America Cannot Fight a War

Inside the industrial collapse, the credit crisis, and the most radical economic restructuring since 1946, and what it means for your portfolio.

“The nine most terrifying words in the English language are: I’m from the government, and I’m here to help.”

— Ronald Reagan, 1986

Reagan was joking. The current administration is not.

There is a man at Rabobank named Michael Every who, if you are not reading, you are flying blind. I do not say this lightly. I have spent the better part of these 8 months telling you that consensus macro narratives are, at best, intellectually lazy and, at worst, actively dangerous to your portfolio. Every is one of the few strategists working today who is willing to follow the logic of what is actually happening to its uncomfortable conclusion, rather than retreating to the safety of “tariffs bad, free trade good, next question.”

His framework is called “Reverse Perestroika,” and I believe it is the single most useful mental model for understanding what the Trump administration is actually trying to do, why it might work, why it might fail catastrophically, and (most importantly for us) where the asymmetric investment opportunities sit.

The thesis is deceptively simple. In 1985, Gorbachev inherited an empire that was militarily powerful but economically broken. He traded guns for butter. It destroyed the Soviet Union. The United States in 2025 faces the mirror image: economically dominant but industrially hollowed out, strategically dependent on supply chains it does not control, and unable to produce enough ammunition to sustain a major conflict for more than a week. The administration’s answer, whether by design or by instinct, is to trade butter for guns. Tighten economic controls. Reshore industrial capacity. Rebuild the defence base. Accept short-term pain for long-term resilience.

Whether you think this is visionary or delusional (I genuinely cannot decide, and I suspect that ambiguity is the correct analytical posture), the data increasingly suggest it is what is actually happening.

We went deep on this. Federal Reserve H.8 credit data. DoD industrial base assessments. CSIS war game simulations. BEA foreign direct investment flows. World Gold Council central bank purchasing records. The National Security Strategy itself, all 29 pages of it, which most of Washington treated as boilerplate. It is not.

The picture that emerges is one of the most ambitious (and dangerous) economic restructurings attempted by a major power in the post-war era, with specific, investable implications across two themes we are most confident in.

Here is what we are covering:

The 80/20 Problem. 80% of American bank credit inflates assets. 20% builds things. We pull the Fed’s H.8 data and show you exactly how the financial system is configured against reindustrialisation, and why fixing it means someone loses.

The Ammunition Crisis. The U.S. can sustain Ukraine-intensity combat for approximately three days. Precision-guided munitions run out in under a week. The bottlenecks are almost comically specific, and they sit in the portfolios of companies the sell-side does not cover.

The National Security Strategy. The White House published a 29-page document advocating “regime change” inside allied European nations. We read it so you do not have to.

The Fed: Regime Change, Literally. Warsh’s nomination, Tillis’s block, and why the proposed monetary policy mix is precisely what you would design if your goal were redirecting credit from financial assets toward industrial production.

Panama and the Chokepoints. CK Hutchison’s canal ports ruled unconstitutional. The timing is suggestive. The investment implications are concrete.

Central Bank Gold Buying. 3,220 tonnes in three years. 57% of 2025 purchases deliberately undisclosed. The institutions that manage the world’s monetary reserves are hedging against the very restructuring this report describes.

FDI: The Money Is Already Moving. Manufacturing’s share of new foreign direct investment jumped from 28.8% to 44.9% in a single year. Foreign capital is not stupid.

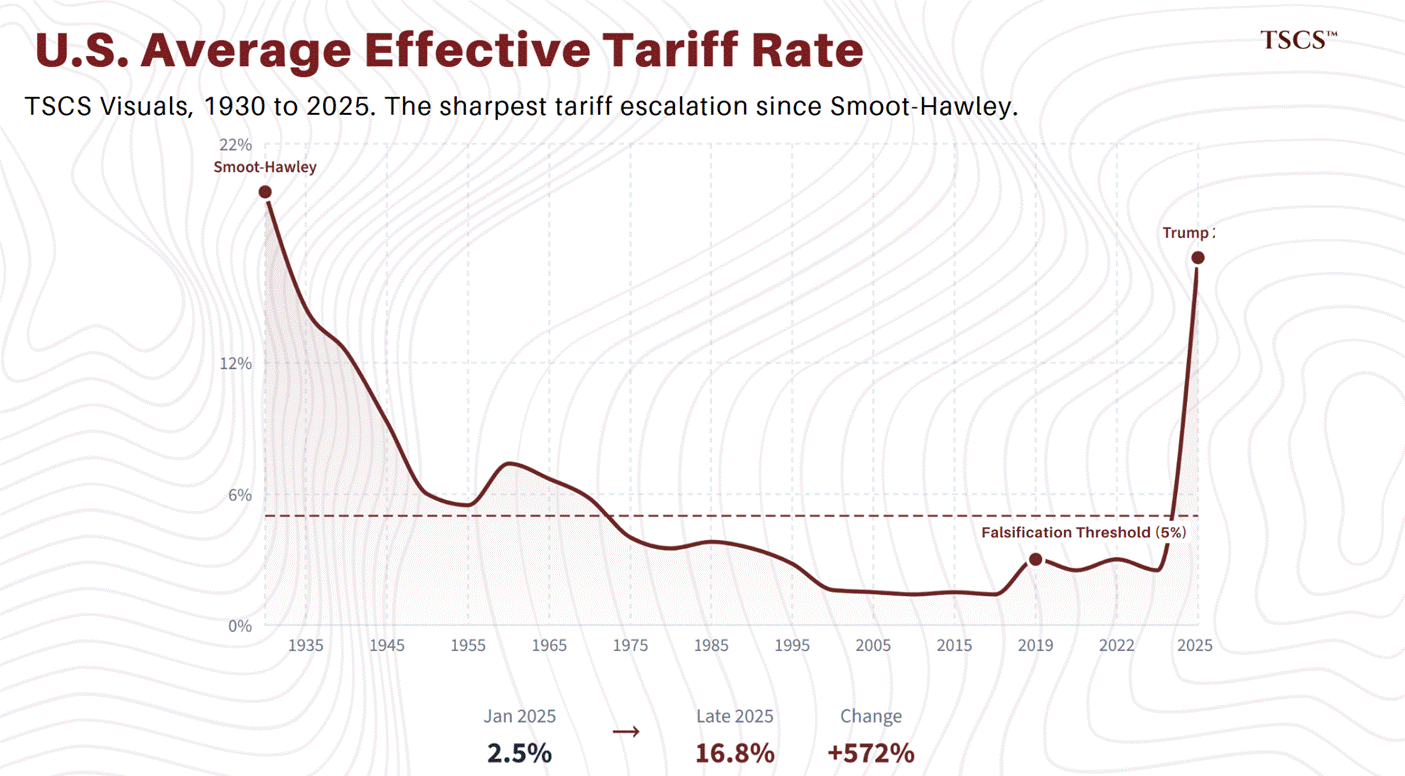

The Tariff Wall. Highest since 1946. The legal status unresolved. The market is not pricing persistence.

Investment Implications. Gold miners priced for $2,500 gold in a $4,850 world. Defence supply chain companies valued for peacetime procurement in a wartime mobilisation cycle. This is where the asymmetric returns sit.

Why You Need to Be Reading TSCS

At TSCS, we have made it our mission to uncover opportunities before the crowd, and to do the work the sell-side cannot or will not do. Our community is built for investors who want institutional-grade analysis without the institutional groupthink.

This is not just research. It is a framework for understanding where markets are actually headed, not where consensus says they should be.

In recent months, we have published:

And ruthless, company-specific analyses:

If you want to understand not only what is happening in global markets, but how to position for the structural shifts that most investors will not see until it is too late, you need to be here.

Let’s get into it.