Buffet's Dream Company - A Huge Bet By Constellation Software: Asseco Poland (WSE:ACP)

Looking into one of the most misunderstood software company which has been invested by one of the most disciplined capital allocators on the planet with a 30% CAGR. An Asseco Poland deep-dive.

Asseco Poland (WSE: ACP) stands as one of the most misunderstood and overlooked investment opportunities within the software sector.

Unlike specula’tive ventures, Asseco's foundation is built on deeply entrenched economic moats, with extremely high switching costs, mission-critical proprietary software (78% of revenue). Nearly 60% of its revenue is recurring, guaranteeing predictable cashflow, while its extensive diversification across numerous sectors (finance, public institutions, ERP, healthcare) and geographies (Poland, Israel, USA, Europe) makes it one of the most risk adverse global software ecosystems in the world.

The recent game changing investment by Topicus, a subsidiary of the legendary Constellation Software, is the catalyst for an imminent and strong re-rating of Asseco’s valuation. Constellation's proven "magnetic hurdle rates" (which we will explain why is so good) and disciplined capital allocation philosophy will drive explosive margin expansion (with EBITDA margins expected to rise from ~15% towards 25%+, mirroring prior successes like Sygnity's 11-percentage-point increase). This strategic alignment is a complete overhaul of Asseco’s fundamentals, designed for relentless profitability.

Current market valuations are blind to this impending shift. They reflect old performance, not the massive embedded value turning the company around. We project a substantial revaluation of Asseco’s shares, offering an almost guaranteed upside for those who see what others miss.

Join The Small Cap Strategist.

Our substack serves as an exclusive community of commercial and private investors, wealth management professionals, and highly intelligent individuals.

Why are they joining us?

Institutional-Grade Research: We deliver insights typically restricted from the public.

Unrivaled Due Diligence: We do the painstaking, creative work no one else dares to touch.

Absolute Edge: In a market obsessed with headlines, our blend of Scuttlebutt and Fundamental research gives you an undeniable advantage over the average investor.

We've completed over a dozen deep dives, with 8 out of 10 of our identified equities generating net gains and consistently beating the S&P 500 since our inception.

If you're ready to build generational wealth and transform your investment strategy, subscribe to The Small Cap Strategist. This isn't just research; it's your blueprint for financial dominance.

Investment Thesis

VMS Moat

The main part of Asseco's success is its extensive knowledge in the Vertical Market Software (VMS) model. Unlike generic tools that serve a broad range of industries, VMS solutions are strictly executed and integrated into the workflows and regulations of niche sectors. This specialization creates great economic moats, providing a significant competitive advantage.

VMS solutions have extremely high switching costs. Once an Asseco system is embedded within a client's operations, the financial and operational burden of transitioning to an alternative provider becomes very expensive. This involves not only the direct cost of new software licenses and implementation but also the tedious re-training of personnel, migration of historical data, and the risks of disrupting mission-critical processes. This strategy typically deters clients from switching, forcing a stickier customer base.

The mission-critical functionality of Asseco's software makes it indispensable. These are the operational software of the organizations they are in. For instance, Asseco's system for Poland's social insurance payments (ZUS) processes over 11% of the country's GDP across 230 modules, serving 2.8 million people. Clients have a huge reliance on Asseco's solutions.

The relatively limited market size of these niche VMS segments, even if it looks like a limiting factor, is in fact a strategic advantage. It acts as a natural deterrent for new entrants, particularly given that much of the market is already served by established incumbents like Asseco. This gives Asseco sustained pricing power and less competition.

Inherent Strengths in VMS

Asseco's VMS characteristics are not just all talk, their operational metrics demonstrate its strength. 78% of its revenues are derived from proprietary software and services. Its clear that the company owns the intellectual property that drives its clients' core operations, rather than simply reselling third-party solutions. Asseco also has control over product development, pricing, and customer relationships.

Furthermore, nearly 60% of Asseco's revenue is recurring. This is a highly desirable trait in the software industry, as it provides predictable cash flows and enhances financial stability. This gives Asseco freedom to invest in research and development and strategic acquisitions.

Asseco also has customer retention rates that consistently exceed 90%. Such high retention reflects strong customer satisfaction and the substantial barriers to exit that clients face.

The business model exhibits remarkable resilience, particularly given its presence in a fragmented market. This is driven by Asseco's diversification across numerous sectors and geographies. The company's recently disclosed products span a wide array of industries, including finance, public administration, healthcare, ERP, and various other IT solutions. Geographically, Asseco operates across Poland, Israel, the USA, Spain, Czechia, Slovakia, Germany, Serbia, and the UK, among others. The company is not overly reliant on any single market. Another benefit is that the top 10 customers account for less than 10% of the group's total revenue, with the largest customer contributing only about 2%. This significantly de-risks the business, making it less susceptible to single-point failures or concentrated competitive threats. This represents a powerful qualitative advantage that underpins the company's financial stability.

Constellation: The Most Misunderstood Catalyst

The investment community's interest in Asseco was profoundly amplified by the January acquisition of a substantial stake by Topicus, a listed subsidiary of Constellation Software. Constellation Software is widely regarded as one of the most successful capital allocators in the software industry over the past three decades, consistently compounding value at an impressive annualized rate exceeding 35% since its IPO in 2006.

Constellation's distinctive business model is built upon a highly disciplined and decentralized approach to capital deployment. Hundreds of business unit managers are granted significant autonomy to originate and execute deals within a standardized framework. This decentralized structure empowers local teams, which makes them more agile and gives an edge in deep market understanding.

A crucial aspect of Constellation's strategy is its rigorous "hurdle rates" for reinvestment, which typically range from 20% to 30%. These high targets ensure that only the most attractive and high-return opportunities are pursued, preventing capital from being allocated to mediocre projects. Critically, managers are incentivized based on both capital deployed and the return on capital achieved. A significant portion of their after-tax bonuses must be used to purchase Constellation shares on the open market. This creates a strong alignment of interests between management and shareholders, a characteristic that is increasingly rare in the corporate landscape.

"Magnetic Hurdle Rates" Phenomenon: Driving Margin Expansion and High-Return M&A

Mark Leonard, Constellation's founder, famously articulated the concept of "magnetic hurdle rates," observing that "Our performance has been exceptional despite (and perhaps because of) our high hurdle rates". This philosophy challenges the conventional assumption that lower return targets automatically expand the pool of investable opportunities. A lower hurdle, in Mark’s view, merely encourages managers to accept weaker returns.

Asseco is now positioned to benefit from the magnetic attraction of these same rigorous standards. The implications for profitability are significant. Asseco's EBITDA margins currently stand at approximately 15%. A compelling precedent exists in Topicus's prior investment in Sygnity, another Polish VMS firm, where EBITDA margins expanded by an impressive 11 percentage points, reaching 28% within two years. A former Topicus employee confirmed that this level of margin expansion is a typical experience for acquired companies, with the objective often being to increase EBITDA margins from around 8-12% to above 25% within three years.

The market's current valuation of Asseco, with a trailing P/E ratio of 33.00x and an EV/EBIT of 19.9x, may appear to fully price the company. However, this headline multiple only reflects historical performance and existing margin profiles, it fails to capture the magnitude of the transition underway. If Asseco, currently operating at an approximate 15% EBITDA margin, can approach or exceed 25% under Topicus's influence, its earnings power will dramatically increase. The market frequently applies a "Constellation premium" to companies that demonstrate similar operational and capital allocation discipline. Therefore, a significant re-rating of Asseco's valuation multiples is probable, potentially closing the gap with its new strategic partner's valuation. The current multiple is a trailing indicator that does not account for the substantial embedded value creation that could materialize. This forms the core of the argument for Asseco's current undervaluation.

The Constellation investment represents a fundamental cultural and operational restructuring for Asseco. Once regulatory approvals are secured, a systematic integration of Constellation's proven methodologies across Asseco's vast decentralized structure is anticipated. This will likely involve an extremely diligent re-evaluation of every business unit's profitability and capital efficiency.

A historical parallel can be drawn to Berkshire Hathaway's enduring success. While Warren Buffett has never publicly disclosed a specific hurdle rate, his comments on incentive arrangements with Berkshire's operating subsidiaries (where managers are charged 14-20% for capital advances and rewarded for efficiency) suggest a similar philosophy of disciplined capital allocation. Berkshire's remarkable long-term performance, with an 18.7% annualized gain in book value per share over 54 years, aligns remarkably with this implied hurdle rate.

Operational Overview: Global Software

Business Segments & Product Mix

The company strategically diversifies its revenue streams through several core business segments, each catering to distinct market needs:

Solutions for Finance: This segment represents Asseco's largest revenue contributor, generating 31% of total sales in Q1 2025 with over 8% year-over-year growth. It encompasses banking software, insurance management systems, and end-to-end payment solutions covering everything from payment card processing to ATM and point-of-sale (POS) terminal services. Key activities include the transformation of central transactional systems for major Polish banks, supporting Allegro Pay's "Buy Now Pay Later" (BNPL) service in a Software as a Service (SaaS) model, and the ongoing development of the Asseco BooX platform, which serves both commercial and cooperative banks. The company also provides unique services to help banks comply with the Digital Operational Resilience Act (DORA) using an AI-powered application, DORA.ai.

Solutions for Public Institutions: This segment stands out as a significant growth driver, achieving around 20% growth in Q1 2025. It provides specialized software solutions for governmental bodies and public institutions, including local authorities, social security institutions (such as Poland's ZUS system, which processes 11% of the country's GDP), public administration, and the energy sector. Healthcare-specific solutions are also a key offering, optimizing service delivery for over 400 hospitals and thousands of clinics across Poland.

ERP Solutions: Focused on Enterprise Resource Planning (ERP) systems, this segment integrates various applications and modules to streamline business operations. It surpassed 96.23 million EUR in sales in Q1 2025, reflecting an 8% growth rate. A notable entity within this segment is Asseco Enterprise Solutions (Grupa AES), which has seen strong growth in proprietary software and related services, now serving over 70,000 clients.

Other IT Solutions: This category includes software for telecommunications, industrial services, and specialized applications such as electronic signature technology. This segment generated 174.65 million EUR in sales in Q1 2025.

Infrastructure: Revenue in this category is derived from the sale of hardware and ICT infrastructure, excluding components related to comprehensive payment solutions.

Other (Non-IT): This segment captures revenue streams not directly linked to IT solutions, such as training, consulting services, and the outsourcing of non-IT related resources, highlighting the company's diversified business model.

Geographical Markets: Expanding Global Footprint

Asseco Poland operates primarily within Europe, with a strong focus on Poland and other Central and Eastern European countries. However, the company has strategically expanded its presence across various international markets, enhancing its service delivery capabilities and diversifying its revenue base.

The company's geographical reach includes:

Poland: The domestic market remains a core focus, with the Asseco Poland segment generating 174.88 million EUR in Q1 2025, representing a 8.60% increase year-over-year.

Asseco International Segment: This segment covers Central, South-Eastern, Western, and Eastern European markets, contributing 252.90 million EUR in Q1 2025, an 18.94% increase. Notable growth has been observed in Czechia and Slovakia, where the company is "restoring its position" in public sector projects after several years of stagnation.

Formula Systems Segment: This segment primarily serves markets in Israel and North America, with additional presence in Europe, Asia, and Africa. It is the largest contributor to the group's revenue, generating 702.36 million EUR in Q1 2025, a ~9% increase. Key players include Matrix IT in Israel and Sapiens International, a global leader in insurance software.

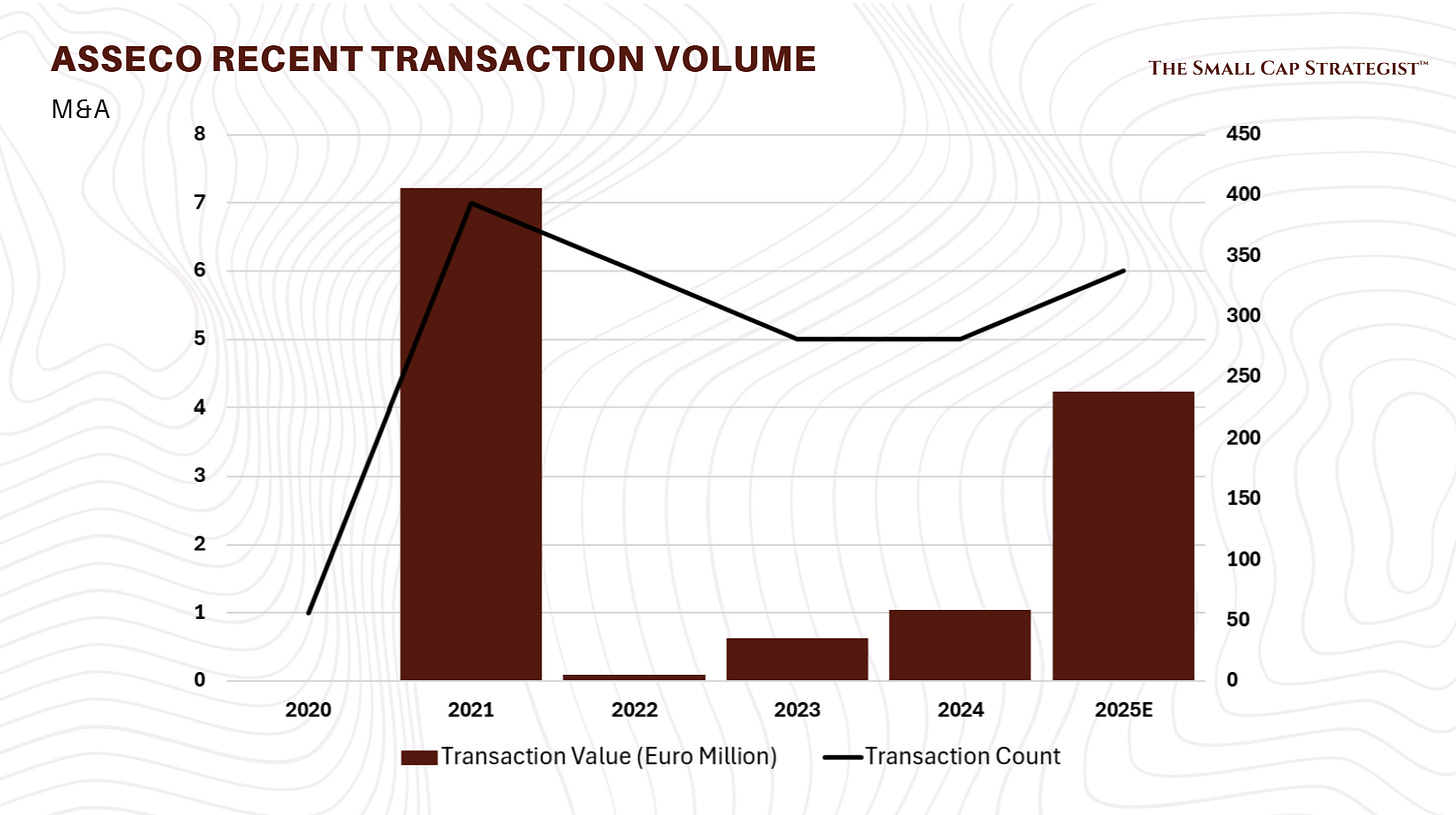

Recent acquisitions have played a crucial role in Asseco's offerings and market presence, particularly in sectors aligned with its strategic objectives. In Q1 2025 alone, 8 new organizations joined the group, including companies in Israel, Poland, Spain, Egypt, the U.S., and India, with further acquisition activity planned.

Business Strategy & Innovation: Digital Transformation

Asseco's business strategy leverages technological advancements to create innovative solutions that address the unique challenges faced by its clients. The company's focus on developing and maintaining differentiated proprietary products gives them a competitive advantage through continuous innovation and adaptation.

Significant investments are made in Research and Development (R&D) to maintain a leadership position in the IT sector. This commitment enables the creation of a portfolio of flexible, user-friendly applications that integrate seamlessly with existing client processes, enhancing user experiences, driving efficiency, and supporting digital transformation initiatives.

Furthermore, the company prioritizes building strategic partnerships with other technology providers and industry stakeholders to foster collaborative innovation. This approach allows Asseco to broaden its technological capabilities and enter new markets more effectively. Digital transformation remains a pivotal focus area, with the company actively capitalizing on emerging technologies such as artificial intelligence (AI), cloud computing, and data analytics. By aligning its product offerings with these digitalization trends, Asseco aims to position itself as a forward-thinking IT provider capable of meeting the evolving needs of enterprises.

Customer Base & Sales Channels

Asseco serves a broad and diverse range of customers across multiple categories, including financial institutions, government entities, healthcare organizations, and various other business sectors. This diversified client base, comprising hundreds of organizations, reduces dependency on any single customer, as evidenced by the fact that the top 10 customers account for less than 10% of the group's revenues, and the largest customer generates only about 2%. The company is committed to nurturing long-lasting relationships with its customers, fostering loyalty and responsiveness to their evolving needs.

The company employs a multi-channel marketing strategy to engage clients and promote its products and services. This includes a combination of direct sales, partnerships with resellers, and online marketing strategies to reach a wide audience across different segments. Distribution of its solutions is often facilitated through established strategic partnerships, which enhance market penetration and support client acquisition efforts. Asseco also focuses on leveraging thought leadership and industry presence to strengthen brand recognition and establish itself as a trusted provider in the IT sector.

Financial Performance

Key Financial Highlights (Q1 2025)

For the first quarter of 2025, Asseco Poland S.A. reported strong financial results across key metrics:

Revenue: EUR 1093.7 million, marking a 11.2% increase compared to the previous year. Notably, EUR 864.5 million of this revenue was derived from proprietary software and services, which showed a 13.3% Compound Annual Growth Rate (CAGR).

Non-IFRS Operating Profit: This metric increased by 16.3% to EUR 135.03 million, with the non-IFRS operating profit margin improving by 0.5 percentage points.

Non-IFRS Net Profit: Saw a 17.7% increase, reaching EUR 37.28 million.

Reported Net Profit: Stood at EUR 32.50 million, a 12.1% increase compared to Q1 of the previous year.

Non-IFRS EBITDA: Reached EUR 170.15 million, with the EBITDA margin increasing by 0.4 percentage points.

The company's profit growth was a result of both organic expansion and strategic acquisitions. Organic growth contributed EUR 11.23 million to profit, while acquisitions added EUR 10.51 million. It is important to note that no one-time transactions impacted the non-IFRS profit in this quarter.

The enhancement in profitability for Asseco Poland was broad-based, observed across all major segments: banking and finance, public sectors, and enterprises. This improvement is attributed to a "catch-up effect" stemming from costs incurred in the previous year due to regulatory changes and long-term agreements, where revenues were initially postponed. In Q1 2025, these previously recognized costs aligned with current revenues, leading to a notable increase in profitability. Additionally, costs did not grow as dynamically as revenues, partly due to an improved labor market situation and successful revenue indexation with customers. In the International segment, profitability also improved as several previously burdensome contracts either expired or were finalized, transitioning into a more profitable maintenance phase.

Margins and Profitability Analysis

Asseco has demonstrated an impressive ability to maintain its margins. The Group's gross profit margin from sales improved to 22.8% in Q1 2025, an increase of 1.4 percentage points from 21.4% in Q1 2024. This indicates effective cost management at the production level,

Operating profitability also saw notable improvements. The Group's EBITDA margin increased by 0.2 percentage points to 14.9%, and the EBIT margin rose by 0.4 percentage points to 10.3%. When adjusted for non-IFRS metrics (excluding PPA amortization, SBP costs, and M&A-related items), the EBITDA margin improved by 0.4 percentage points to 15.6%, and the EBIT margin by 0.5 percentage points to 12.3%.

Segment-specific analysis reveals that Asseco Poland, the domestic segment, was a key driver of this margin expansion. Its EBIT margin improved by 2.2 percentage points to 19.1%, and its EBITDA margin increased by 2.1 percentage points to 23.9%. This suggests strong operational leverage and efficiency within the core Polish market.

Summary of Cost Structure

The company's cost structure reflects its human capital-intensive nature. Employee benefits expense for the entire group amounted to 558.3 million EUR in Q1 2025, representing a 13.63% year-over-year increase. This category includes salaries, social insurance costs, pension costs, and share-based payment transaction costs. External services costs, including human resources outsourcing and subcontractors, were 138.36 million EUR in Q1 2025. Other operating costs primarily consisted of property and company car maintenance, and business travel expenses.

Despite the increase in absolute costs, the company has effectively managed its cost base relative to revenue growth. Management noted that costs are not growing as dynamically as revenues, attributing this to an improved situation in the labor market, which has resulted in slightly lower remuneration rates. This indicates a favorable environment for managing personnel expenses.

Cash Conversion Rates

Asseco demonstrates strong cash generation capabilities. The Group's cash flow from operations before tax (CFO BT) increased by 16.5% year-over-year to 121.38 million EUR in Q1 2025. While cash flow from investing activities (CFI) showed a significant outflow of 62.7 million EUR, this was primarily due to increased acquisition activity in the Matrix and Sapiens groups. Cash flow from financing activities (CFF) saw a reduced outflow of 62.67 million EUR, partly due to increased loan and credit inflows in the Matrix and Magic groups.

The Group's cash conversion rate (Free Cash Flow / EBIT non-IFRS) stood at 66% in Q1 2025, an improvement from 63% in Q1 2024. More impressively, the cash conversion rate over the last 12 months was 102%, indicating a robust ability to convert operating profit into cash over a longer period. Segment-specific cash conversion rates were also strong: Asseco Poland achieved 67% (a significant 51 percentage point improvement), Asseco International 91%, and Formula Systems 55%. These figures highlight the company's overall financial discipline and efficiency in cash management.

Balance Sheet Health

Asseco's balance sheet remains robust and liquid. As of March 31, 2025, the company held 735.05 million EUR in cash and deposits. Management has characterized the debt situation as stable and optimal.

Working capital, defined as current assets minus current liabilities, was 569.56 million EUR as of March 31, 2025. Liquidity ratios indicate a healthy financial position: the current ratio was 1.3, the quick ratio 1.2, and the immediate ratio 0.5, all considered stable and safe. Debt ratios also reflect prudence, with a total debt ratio of 52.4% and a debt-to-equity ratio of 39.2%, both well within safe limits.

Management & Governance

The leadership and governance structure of Asseco Poland are critical components of its long-term success, characterized by founder-led vision, a proven capital allocation strategy, and strong alignment with shareholder interests.

Profiles

Asseco Poland is led by a seasoned management team. Adam Goral, the company's founder, remains the Chief Executive Officer and the largest shareholder. His continued leadership provides stability and a long-term strategic perspective. The management board also includes key executives such as Zbigniew Pomianek (Vice President of Management Board), Karolina Rzonca-Bajorek (Vice President of the Management Board & CFO), and Marek Pawel Panek (Vice President of the Management Board). This experienced team has been instrumental in navigating the company's growth and strategic direction.

Capital Allocation History

Asseco boasts an impressive and consistent capital allocation history, primarily driven by a strong M&A strategy. Since its 2004 IPO, the company has executed over 150 acquisitions, which have been a significant driver of its remarkable growth, with revenue expanding 158-fold and operating profit increasing 103-fold.

The company maintains an active M&A pipeline, demonstrating its commitment to inorganic growth. In Q1 2025 alone, 8 new companies were integrated into the group, with further acquisitions actively being pursued. This continuous acquisition activity is a core element of its strategy, aimed at strengthening its market position and expanding its technological capabilities.

A key aspect of Asseco's capital allocation philosophy is its discipline in capital management. The company has achieved a cash conversion rate of over 100% for the last 12 months for the entire group, indicating efficient conversion of earnings into cash. This strong cash generation capability supports its M&A endeavors without compromising financial stability.

Management Ownership and Director Dealings

The significant ownership stake held by founder and CEO Adam Goral ensures a strong alignment of interests between management and shareholders. This founder-led structure often translates into a long-term strategic horizon and a deep commitment to value creation.

The recent investment by Topicus, a Constellation Software subsidiary, is expected to further reinforce this alignment. Constellation's model, which mandates that a majority of after-tax bonuses for managers be used to purchase company shares on the open market, is a powerful incentive for performance and shareholder value creation. While the full integration of this model into Asseco is subject to regulatory approvals, the philosophical alignment is clear and promises to enhance the existing strong governance framework.

Porter, Competition, and Competitive Advantage

Asseco Poland operates within an industry structure that is highly favorable to incumbents, primarily due to the inherent defensibility of its Vertical Market Software (VMS) model. A Porter's Five Forces analysis highlights the strength of its competitive position.

Porter and Competitive Industry Position

Suppliers: 8/10 The company's VMS model, with 78% of its revenue derived from proprietary software, suggests a moderate reliance on generic software components or hardware suppliers. This focus on proprietary solutions reduces dependence on external vendors for core intellectual property. While the availability of highly skilled IT talent is a critical input, the company has noted an "improved situation on the labor market," which has helped manage remuneration rates and reduce previous challenges. This indicates a relatively strong position vis-à-vis its labor suppliers.

Customers: 9/10 Asseco holds significant power over its customers, primarily due to the high switching costs and the mission-critical nature of its software solutions. Customer retention rates exceeding 90% are a testament to this strong leverage. Furthermore, the company's diversified customer base, with no single client accounting for more than 2% of total revenue and the top 10 customers contributing less than 10%, mitigates the risk of any single customer exerting undue pressure.

Barriers to Entry and Exit: 9/10 The VMS industry is characterized by very high barriers to entry. These include the necessity for specialized domain knowledge, long and complex development cycles for tailored solutions, substantial integration costs for new clients, and the intricate regulatory complexities prevalent in sectors like finance and public administration. Additionally, the presence of established incumbents like Asseco, with deeply embedded systems and long-standing relationships, makes it exceedingly difficult for new players to gain traction.

Threat of Substitution: 7/10 The threat of substitution for Asseco's Vertical Market Software (VMS) solutions is moderate. While the mission-critical nature and high customization of VMS create significant switching costs, potential substitutes can emerge from adjacent technology areas. Customers might consider adopting highly customized generic software platforms (e.g., advanced ERP or CRM systems) with extensive vertical-specific configuration, or in some instances, develop highly specialized in-house solutions. Emerging disruptive technologies, such as advanced AI-driven automation or evolving low-code/no-code platforms, could also represent longer-term, indirect substitutes by offering alternative ways to achieve similar business outcomes. However, the deep integration and specialized functionality of Asseco's VMS, particularly in regulated sectors, mitigate an immediate widespread threat.

Competition: 7/10 While the niche nature of VMS segments deters a broad influx of new competitors, competition still exists from other established VMS providers and larger, diversified IT service companies. However, Asseco's deep entrenchment across multiple vertical markets and its diversified portfolio provide a significant buffer against intense competitive pressures. The market remains fragmented, allowing Asseco to maintain its strong position.

Overall Comment: 40/50 Asseco operates within an industry structure that is highly favorable to established players. The inherent defensibility of the VMS model, combined with Asseco's extensive and diversified portfolio, significantly strengthens its competitive standing. The moderate threat of substitution is effectively managed by high switching costs and the specialized nature of its solutions.

Key Competitors

Market Shares

Poland: The company is a leader in the Polish capital market, serves over 80% of cooperative banks, collaborates with over 450 hospitals, and its solutions are used in 9,200 medical locations, representing approximately 40% of that market. Its AUMS Billing & CIS system generates over 65% of energy bills in Poland.

Czech Republic: Asseco Solutions holds a 25% market share in ERP solutions for small and medium-sized enterprises.

Slovakia: Asseco Solutions commands approximately 17% of the ERP market.

Africa and Portugal: Asseco PST's solutions are utilized by approximately 80% of banks in Angola, 50% in Cape Verde, 30% in Namibia, and 25% in Portugal and Mozambique, and 20% in East Timor and São Tomé and Príncipe.

Israel: Matrix IT is recognized as a leading IT firm in Israel.

Digital Marketplaces: ZAP Group manages a leading Israeli marketplace, featuring over 400 stores and more than 70,000 products.

Competitive Analysis of the Company

Sustainable Competitive Advantage:

Asseco's sustainable competitive advantage stems from several deeply entrenched characteristics. Its high proportion of proprietary software (78% of revenue) ensures control over its intellectual property and product roadmap. The high switching costs associated with its VMS solutions create significant customer stickiness, leading to predictable, recurring revenue (nearly 60% of total revenue). The company's deep domain expertise, cultivated across multiple regulated sectors (finance, public administration, healthcare, energy), allows it to develop highly specialized and indispensable solutions. Furthermore, its vast and diversified customer base, with no single client dependency, provides stability and reduces vulnerability to individual market fluctuations. Finally, Asseco's proven and active M&A engine serves as a powerful mechanism for inorganic growth, allowing it to acquire niche expertise and expand market reach.

Evaluation of Economic Moat:

The company possesses a wide economic moat, primarily driven by the inherent defensibility of its VMS business model. The high switching costs and the mission-critical nature of its software create a powerful barrier against competition. This foundational moat is further strengthened by Asseco's extensive geographical and sectoral diversification, which reduces reliance on any single market or industry and provides a robust buffer against localized downturns. The strategic acquisition approach, particularly under the influence of Constellation Software, is expected to deepen this moat by instilling even more rigorous capital allocation practices and driving operational efficiency across its acquired entities. This combination of intrinsic VMS advantages and disciplined strategic execution positions Asseco with a durable competitive edge.

Valuation, Reverse Thesis, and Conclusion

Valuation & Margin of Safety

Asseco Poland's current valuation, reflected in a trailing 2024 earnings multiple of 33x, might initially appear strong. However, this headline multiple is widely considered to reflect the company's historical performance and existing margin profile, potentially underestimating the significant transition currently underway. The valuation is viewed as reflecting trailing margins and underutilized capital.

The core of the undervaluation argument rests on the future potential unlocked by the "magnetic hurdle rates" and the influence of Constellation Software. Should Asseco's EBITDA margins rise meaningfully towards the 25%+ levels seen in other Constellation-influenced entities (such as Sygnity's 28% after Topicus's involvement), and if its reinvestment performance improves in line with Constellation's disciplined approach, the embedded value creation could be substantial. The 2025 FY E EV/EBIT multiple of 9.87x, a forward-looking metric, suggests a more reasonable valuation when considering future earnings potential. This fundamental shift in capital efficiency and profitability is expected to justify a significantly higher valuation multiple, driving a re-rating of the stock.

Reverse Thesis

While the investment case for Asseco Poland is compelling, it is crucial to consider potential counter-arguments and risks that could impede the realization of its full potential.

One primary risk lies in the regulatory hurdles associated with the full integration of Topicus's strategic influence. Asseco management has indicated that strategic changes are currently constrained by ongoing regulatory approvals for the Topicus transaction, implying that the full benefits of Constellation's playbook may be delayed or, in a worst-case scenario, partially hindered if approvals are not secured or are subject to onerous conditions.

Another significant challenge could be the effective implementation of Constellation's operational discipline. While the blueprint is proven, transplanting such a rigorous philosophy across Asseco's vast, decentralized structure, which includes over 150 acquisitions, is a complex undertaking. Failure to integrate these practices effectively could limit the anticipated margin expansion and capital efficiency improvements.

Integration risks of numerous acquisitions are also a perennial concern for a company with such an active M&A strategy. While Asseco has a strong track record, each new acquisition carries the potential for integration challenges that could divert management attention and resources.

Geopolitical instability, particularly in regions where Asseco has significant operations, such as Ukraine and Israel, poses an ongoing risk. Although the company has stated that these situations have not had a material impact on Q1 2025 results, a deterioration could affect operations, customer demand, or supply chains.

Furthermore, intense competition from global players in various IT segments, coupled with the potential inability to maintain pricing power in certain markets, could pressure margins. While the VMS model offers defensibility, aggressive competition could still erode profitability. Finally, despite an observed improvement in the labor market and a reduction in remuneration rate challenges, talent retention remains a critical factor in the IT sector. A resurgence of talent shortages or wage inflation could increase operating costs and impact project delivery.

Conclusion

Asseco Poland, a deeply entrenched leader in the Vertical Market Software (VMS) space, stands at an important juncture. Its strong business model, characterized by high switching costs, mission-critical proprietary software, and a significant recurring revenue base, provides a strong foundation for sustained performance. The company's extensive diversification across numerous sectors and geographies further de-risks its operations, creating a resilient global software ecosystem.

The recent strategic investment by Topicus, a subsidiary of the legendary Constellation Software, represents a profound catalyst for Asseco. Constellation's disciplined capital allocation philosophy, particularly its "magnetic hurdle rates" and strong management alignment, is poised to instigate a fundamental transformation in Asseco's financial profile. This is expected to drive significant margin expansion, drawing parallels to the impressive operational improvements seen in other Constellation-influenced acquisitions.

The current market valuation, while seemingly full, largely reflects trailing performance and historical capital utilization. It does not yet fully capture the magnitude of the impending operational and capital allocation shifts. Asseco's ability to approach Constellation-like profitability and reinvestment standards could unlock substantial embedded value, leading to a significant re-rating of its shares.

For patient, long-term investors, Asseco Poland represents a compelling opportunity to invest in a deeply entrenched software leader that is poised for accelerated compounding and a fundamental revaluation as it integrates the proven methodologies of one of the world's most successful software acquirers.

If you enjoyed this post, consider subscribing to The Small Cap Strategist.

Disclaimer: This post is for informational and educational purposes only and should not be considered investment advice. The author is not a financial advisor. All investment decisions carry risk, and readers should consult with a qualified financial professional before making any investment choices. The author may or may not hold positions in the securities discussed. This post may not be an accurate reflection of Asseco Poland or its related companies.