Don't Buy MicroStrategy, Inc - Mathematically Going To Zero

How a Leveraged Bitcoin Bet and a Fading Business Have Created a Bubble Destined to Pop - An In-Depth Analysis of MSTR's Strategy, Schemes, Fundamentals, and Outcomes.

"The stock market is the story of cycles and of the human behavior that is responsible for overreactions in both directions." - Seth Klarman

If you want to build a portfolio of unique, high-conviction ideas and gain an edge by understanding the powerful forces shaping global markets, subscribe to The Small Cap Strategist and join a community of discerning investors.

We have already done over 10 company deep-dives using institutional quality research. Today we’re looking at MicroStrategy, Inc.

Executive Summary

MicroStrategy, Inc. (MSTR) is not a viable Bitcoin development company or a healthy proxy for the digital asset. It is a highly levered, speculative vehicle engineered for the perpetual dilution of its common equity. Its complex capital structure, which systematically transfers value from new investors to earlier stakeholders under the guise of "intelligent leverage," is mathematically unsustainable and masks a decaying, unprofitable core software business. Over a long enough time horizon, the crushing weight of its senior obligations (debt and preferred stock) and the inevitable collapse of its speculative premium will destroy the common equity, driving its value toward its intrinsic worth: zero. We will expose Michael Saylor’s narrative, unveil the flawed mechanics of the dilution machine, and show the precise path to this inevitable outcome.

The company's transformation from a struggling enterprise software vendor into a leveraged Bitcoin holding company is presented by its management as a visionary pivot. However, this strategy is not novel but rather a modern replica of financial schemes seen in past speculative bubbles. The core business, far from providing a stable foundation, is in a state of terminal decline, generating insufficient cash flow to support its operations, let alone service the billions in debt and preferred equity raised to acquire Bitcoin. This leaves the company entirely dependent on the capital markets, which will be its detriment when market sentiment turns.

The strategy depends on a mathematical fallacy the company calls "intelligent leverage." By issuing new convertible debt and equity at a significant premium to the underlying value of its assets, MicroStrategy can acquire more Bitcoin and increase its "Bitcoin per share" metric. We will show you that this is not value creation but a direct value transfer from new, incoming investors to existing shareholders. This mechanism requires an ever-increasing stream of new capital at ever-higher valuations to sustain itself, a dynamic that shares the foundational logic of a Ponzi scheme.

This entire structure is presided over by Executive Chairman Michael Saylor, a figure whose past is marked by a major accounting fraud scandal during the dot-com bubble that bears a concerning resemblance to the company's current financial engineering. His masterful use of social media and quasi-philosophical rhetoric has gained a cult-like following, providing the narrative cover necessary to execute this high-risk strategy and sustain the stock's speculative premium.

It should be clear that the common stock of MicroStrategy is nothing more than a deeply out-of-the-money call option on the price of Bitcoin weighed down by the negative carry of operational losses and senior dividend obligations. The forces of competition from superior investment vehicles like spot Bitcoin ETFs, the unsustainable nature of the capital structure, and the eventual reckoning with a mountain of debt will inevitably lead to a collapse of the stock's premium and a wipeout of the common equity. The convergence to zero is not a matter of if, but when.

Studying Michael Saylor

To understand MicroStrategy's trajectory you must first understand Michael Saylor. His personal history, his communication style and his strategic vision. They are the foundation of this speculation. So let's look into how he became a disliked dot-com CEO in 1999 to a BTC celebrity. This will help you understand how to view the company’s present actions and how we decided to predict its future.

A History of Hubris: The Dot-Com Bubble

The current strategy employed by MicroStrategy is not new. Examining the company's actions during the dot-com bubble shows a pattern of behavior and financial reporting that directly parallels its current operations. In 2000, the U.S. Securities and Exchange Commission (SEC) charged MicroStrategy and its top three officers, including then-CEO Michael Saylor, with civil accounting fraud. The charges came from the company's material overstatement of its revenues and earnings for the fiscal years 1997, 1998, and 1999.

The core of the fraud was the premature recognition of revenue from over complicated software and service contracts, a clear violation of Generally Accepted Accounting Principles (GAAP), specifically AICPA Statement of Position 97-2. The SEC found that MicroStrategy would recognize revenue upfront on deals that included significant future service obligations or product deliveries that were not separable from the initial license sale. In some cases, the company recognized revenue on contracts that were not even executed within the same fiscal period. This practice allowed the company to report impressive growth and profits when, in fact, it should have been reporting net losses for the period.

The consequences for shareholders were devastating. On March 20, 2000, upon announcing its intention to restate its financials, MicroStrategy's stock collapsed by 62% in a single day, falling from a high of $333 per share to $120. The event erased an estimated $6 billion of Saylor's personal paper wealth and is widely considered a historical moment that helped burst the dot-com bubble. Ultimately, Saylor and the other executives settled the case with the SEC without admitting or denying wrongdoing. The settlement involved paying a combined total of approximately $11 million in disgorgement (disgorgement refers to the legal action of forcing a person or entity to give up profits they made through illegal or unethical activities, particularly violations of securities laws) and penalties, with Saylor personally disgorging $8.3 million and paying a $350,000 penalty.

Pulling future value into the present to create a misleading picture of current financial health is the fundamental mechanism of the 2000 fraud which is conceptually identical to the "intelligent leverage" model the company promotes today. Then, it was unearned revenue; now, it is the unrealized value of a speculative asset financed by diluting future shareholders.

This pattern of questionable conduct has also occurred recently. In June 2024, Saylor agreed to pay a $40 million settlement to the District of Columbia to resolve a tax fraud lawsuit. The suit, brought under the D.C. False Claims Act, accused Saylor of illegally avoiding more than $25 million in income taxes between 2005 and 2021 by falsely claiming to be a resident of lower-tax jurisdictions like Florida and Virginia, while actually living in a Georgetown penthouse and docking his yachts in Washington Harbor. The lawsuit alleged that MicroStrategy collaborated in this scheme by misreporting his address to tax authorities. This recent, major settlement calls to question Saylor's judgment and his adherence to legal and ethical standards.

Saylor’s Antics: Marketing, Memes, and a Cult of Personality

The engine that sustains MicroStrategy's stock premium and allows the dilution scheme to function is a sophisticated and relentless marketing campaign orchestrated by Saylor himself. His communication strategy is central to the investment thesis, as it creates the narrative needed to obscure the company's nonexistent fundamentals. He employs a unique and powerful combination of highly technical, philosophical, and quasi-religious (he’s quite literally made it into a cult following) language to frame Bitcoin as a civilizational paradigm shift.

In interviews and on social media, Saylor describes Bitcoin with evocative and often strange metaphors, calling it "a swarm of cyber hornets serving the goddess of wisdom," "digital energy," and "the apex property of the human race"??? This communication style is deliberately crafted to be, as Doomberg noted:

"Just technical enough to fool the moderately sophisticated."

By wrapping the investment case in complex analogies drawn from physics, thermodynamics, and political philosophy, he creates an aura of unassailable insight that discourages basic and fundamental questions about valuation and risk.

His use of social media, particularly X (formerly Twitter), has been a key in building this persona. With a constant stream of memes, heroic imagery, and grand pronouncements. He has cultivated a loyal and cult-like following. This community functions as a defense mechanism, championing Saylor as a visionary and attacking any logical, evidence-based criticism of the company's strategy as FUD (Fear, Uncertainty, and Doubt) or a fundamental misunderstanding of the Bitcoin revolution. This dynamic was recognized when a 2022 survey named Saylor the "Bitcoin Twitter Personality of the Year".

This strategy effectively goes into a broader cultural trend of "financial nihilism." This mindset, born from economic precarity and a loss of faith in traditional institutions, drives a segment of investors toward high-risk narratives led by charismatic figures. In this environment, the "cause" can become more important than the financial outcome, with some participants expressing a willingness to lose money in service of a larger movement. This phenomenon creates a ground for companies like MicroStrategy, as well as other "meme stocks" such as AMC Entertainment and GameStop, where a powerful, community-driven narrative can temporarily decouple a stock's price from its fundamental reality (note: TEMPORARILY).

The abruptness of Saylor's conversion to this cause further undermines its credibility. In December 2013, he famously tweeted that Bitcoin's "#Bitcoin days are numbered. It seems like just a matter of time before it suffers the same fate as online gambling". From 2014 through mid-2020, his social media feed contained virtually no mentions of Bitcoin. This public skepticism and subsequent silence only ended in August 2020, precisely when MicroStrategy made its first significant Bitcoin purchase. Immediately following this financial commitment, his entire public persona transformed into that of a 24/7 Bitcoin maximalist. This timing strongly suggests that the adoption of the "Bitcoin evangelist" role was not a purely philosophical evolution, but a calculated and opportunistic business decision created to support the new corporate strategy.

The Creation "Intelligent Leverage"

MicroStrategy's investor communications like their quarterly earnings calls to dedicated "Bitcoin for Corporations" events are masterclasses in narrative control. The presentations are meticulously designed to focus attention on a single, custom-crafted metric: "Bitcoin per share." By framing ongoing and massive shareholder dilution as "accretive" on this one metric, the company distracts from traditional measures of corporate performance like revenue growth, profitability, and earnings per share, all of which paint a grim picture.

Saylor's interviews consistently reinforce a worldview in which the existing financial system is fundamentally broken and destined for collapse. He describes fiat currency inflation as a process of "bleeding the free market to death" and presents Bitcoin as the only rational and ethical solution. This messianic framing serves a critical purpose: it elevates the company's strategy from a high-risk corporate treasury decision to a moral and intellectual imperative. It provides the powerful "why" that allows investors to overlook the dangerous and unsustainable "how." The persona of the visionary genius, who sees the future more clearly than the rest of the market, is essential for the perpetual dilution machine to attract the capital it needs to continue justifying these absurd valuations. He has successfully positioned himself as a prophet leading a movement, a role that insulates him from conventional financial scrutiny.

Capital Structure: Indefinite Share Dilution

At the heart of the bearish thesis on MicroStrategy lies its capital structure and the financial mechanism it employs to acquire Bitcoin. The company's narrative of "intelligent leverage" and "accretive" financing hides a mathematical sleight of hand that functions as a perpetual dilution machine. This machine is designed to enrich early shareholders and management at the direct expense of new investors, and its sustainability depends entirely on a constant influx of new capital at ever-increasing valuations.

Mathematical Fallacy of "Intelligent Leverage"

MicroStrategy's core financing strategy is presented as a sophisticated form of leverage that creates value for shareholders. The company's own investor presentations highlight how it has managed to increase its total Bitcoin holdings at a much faster rate than its diluted share count, resulting in a rising number of bitcoins per share. This, the company argues, is "accretive" and demonstrates the power of its strategy. However, a simple mathematical deconstruction shows this claim to be a risky fallacy.

The mechanism works as follows:

Initial State: The company has a certain number of bitcoins on its balance sheet and a corresponding number of shares outstanding. This establishes a baseline "Bitcoin per share" value.

Capital Raise: The company issues new securities (typically convertible debt or common and preferred stock) to the public. Crucially, these securities are issued at a price that reflects a significant premium to the net asset value (NAV) of the company's existing holdings.

Bitcoin Purchase: The proceeds from the capital raise are used to purchase additional Bitcoin.

The "Accretion" Illusion: Because the company's Bitcoin holdings increase by a larger percentage than its share count, the calculated metric of "Bitcoin per share" increases. Management presents this as a win for all shareholders.

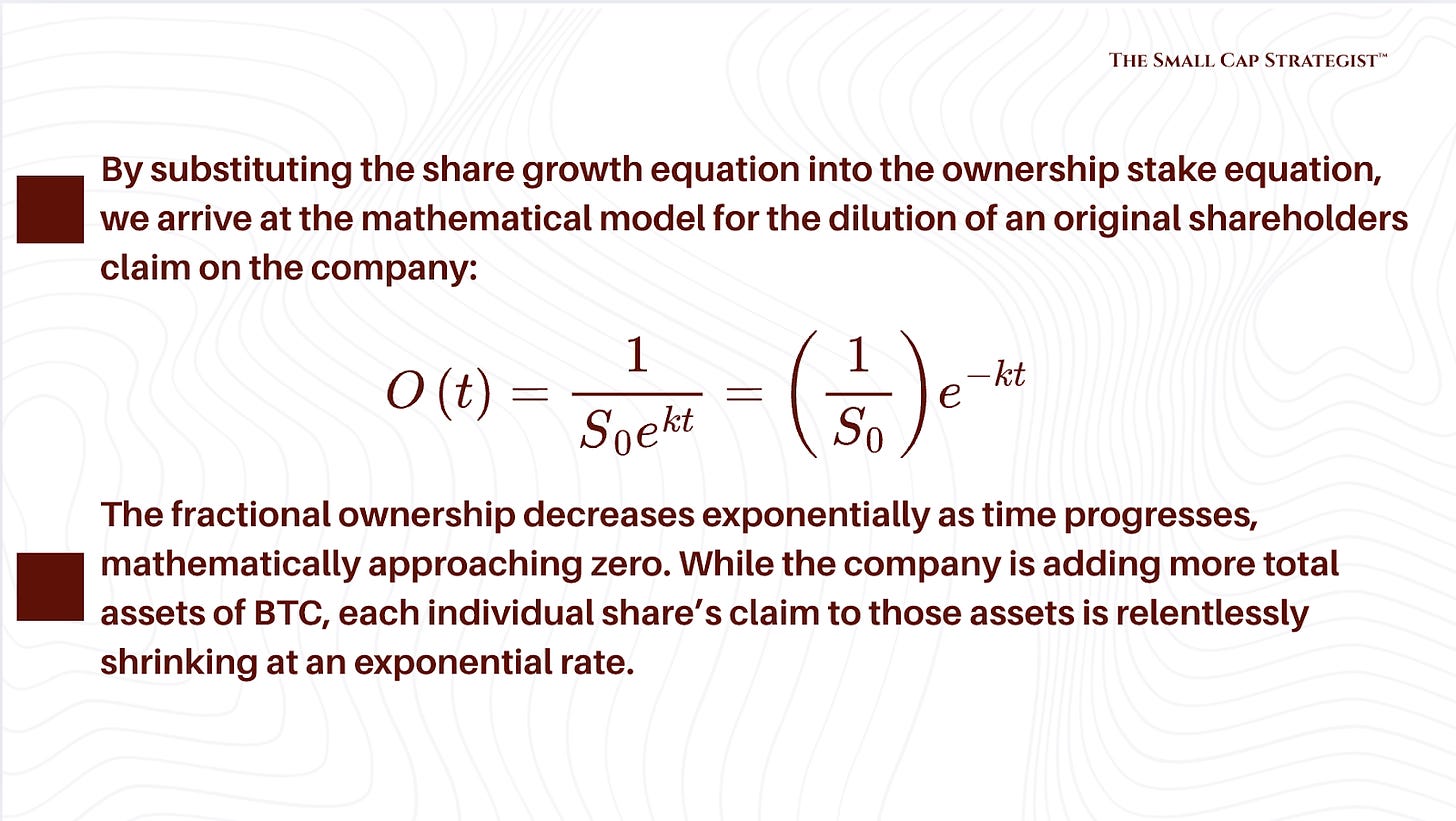

The fundamental flaw in this model is that it ignores who finances this "improvement." The new investors who purchase the newly issued securities are the ones providing 100% of the capital for the new Bitcoin purchases. However, they do not receive a proportional ownership stake in those new assets. Instead, their capital is pooled, and the ownership is diluted across the entire shareholder base, old and new. This results in a direct transfer of value from the new investors to the pre-existing shareholders. This doesn’t really take a genius to see the ‘ponzi scheme’.

If we think of a simplified example, it illustrates the point clearly. Imagine a company with 10 bitcoins and 1,000 shares, meaning each share represents 0.01 bitcoins. The company then raises capital by issuing 20 new shares and uses the proceeds to buy 10 more bitcoins. The company now has 20 bitcoins and 1,020 shares. The new "Bitcoin per share" metric is approximately 0.0196 (20/1,020), an apparent 96% increase for the original shareholders. However, the 20 new shares, which financed the purchase of 10 bitcoins, now only represent a claim on a tiny fraction of them. The value they contributed was immediately diluted to the benefit of the incumbents.

This is not a theoretical exercise. As of late 2023, an investor could have purchased one Bitcoin directly on the market for approximately $90,000. Alternatively, they could have spent the same $90,000 to purchase shares of MicroStrategy, which would have given them an economic exposure equivalent to only 0.29 Bitcoin. This demonstrates that new shareholders are paying a massive premium for indirect, and inferior, exposure to the asset.

While not a Ponzi scheme in the strict legal definition (as the shares are publicly traded and not redeemed by the company), the model shares a critical structural dynamic: it is fundamentally dependent on a continuous and ever-larger stream of new money coming in at inflated valuations to pay off earlier investors (in the form of stock price appreciation). As one analysis based on limit theory concludes, "a little bit of dilution over time means you have an infinite amount of dilution in a long-enough time horizon, and one divided by infinity is zero". The model only works as long as new participants are willing to enter at progressively worse terms. When that stream of capital falters, the entire structure is poised for collapse.

Huge Obligations: Debt and Preferred Equity Analysis

To fund this Bitcoin acquisition strategy, MicroStrategy has constructed a massive and increasingly complicated tower of liabilities that stands senior to the common equity. Since pivoting in 2020, the company has abandoned traditional capital allocation principles and has instead become a consumer of capital, stating its purpose is to “use cashflows as well as proceeds from equity and debt financings to accumulate bitcoin". As of mid-2024, this has resulted in a debt load exceeding $8 billion, supplemented by an expanding class of high-yield preferred stock.

The following table illustrates the scale of the liabilities that have a priority claim on the company's assets over common shareholders.

A particularly ominous development for common shareholders is the company's increasing reliance on perpetual preferred stock. The issuance of these securities, such as the 8% STRK and 10% STRD series, creates a permanent and significant cash outflow obligation. With an unprofitable core business, the hundreds of millions of dollars required annually to service these dividends can only be funded through one mechanism: issuing and selling more common stock.

This creates a direct and unavoidable conflict of interest at the heart of the capital structure. To satisfy the contractual obligations to the senior preferred shareholders, management must continuously dilute the junior common shareholders. This establishes a perpetual dilution machine that can't ever be stopped. The preferred shares are senior to the common stock in the capital stack, meaning in any scenario of financial distress, the common equity will be diluted to zero to satisfy the liquidation preference and accrued dividends of the preferreds. This structure ensures a guaranteed, long-term transfer of value from the bottom of the capital stack to the middle, meaning eventually over time those preferred will own all the Bitcoin.

Furthermore, the debt maturity schedule creates a clear refinancing wall between 2027 and 2032, a period during which billions of dollars in principal will come due. MicroStrategy has no operational cash flow to repay this debt. Its only options will be to (a) sell a significant portion of its Bitcoin holdings, undermining its entire "HODL" narrative; (b) issue a massive amount of new equity; or (c) issue new debt to refinance the old. The viability of the latter two options is entirely dependent on the market price of Bitcoin and the MSTR stock premium at that specific future time. A crypto bear market or a collapse in the stock's speculative premium during this window would make refinancing prohibitively expensive or impossible, creating a direct path to default and a restructuring that would leave common shareholders with nothing.

Weak Financials

The legacy software operation is not only unprofitable but is also shrinking, incapable of generating the cash flow needed to support the company's ambitious and costly Bitcoin strategy. Looking at the company's segmented financials and capital allocation history, MicroStrategy is not a software company that buys Bitcoin, but rather a leveraged Bitcoin fund with a costly and deteriorating legacy asset attached.

Dying Software Business

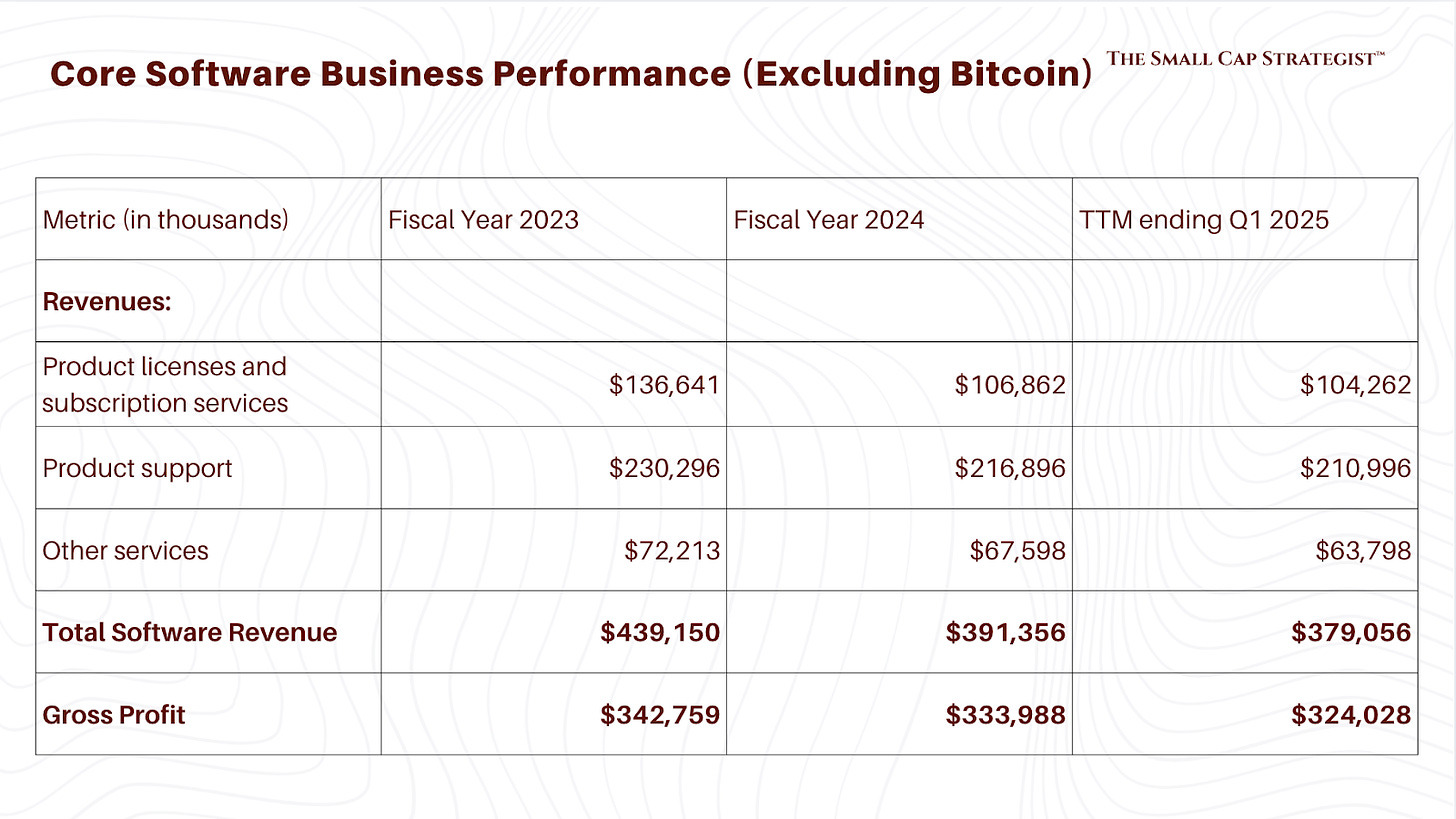

A close examination of MicroStrategy's financial statements confirms that its foundational software business is in a state of secular decline. Consolidated results are heavily distorted by massive, non-cash digital asset impairment losses (and, more recently, unrealized fair value adjustments), making them difficult to interpret. However when we isolate the segment data for the software business a clear picture of decay is seen.

Annual revenues from the software business have been consistently falling for several years. For the fiscal year 2024, total revenues were $463.5 million, a 6.6% decline from $496.3 million in 2023, which itself was a decline from the prior year. This trend reflects a fundamental shift in the company's market and product relevance.

The composition of this shrinking revenue base is also deteriorating. The company is experiencing a decline in its high-margin, upfront product license revenues, which are being partially offset by growth in recurring subscription services revenues as it transitions customers to the cloud. While a shift to a subscription model can be a healthy long-term strategy for a software company, in MicroStrategy's case, it is happening against a backdrop of falling total revenue. In 2024, product license revenues fell 35.5%, while the more strategically important subscription services revenues grew by 31.5%. This pattern continued into the first quarter of 2025, where subscription services revenue grew an impressive 61.6% year-over-year to $37.1 million, but this was overshadowed by a 16.2% decline in the much larger product support revenue stream.

Most critically, the software business is fundamentally unprofitable on a cash-generating basis. While the company reports a gross profit, this figure does not cover the substantial operating expenses of the business, including sales and marketing, research and development, and general administrative costs. For the full fiscal year 2024, the company reported a staggering net loss of $1.167 billion, and for Q1 2025, a net loss of $4.22 billion, both figures dominated by Bitcoin-related accounting. Even if one were to ignore these non-cash charges, the underlying software operations do not generate sufficient cash to fund the company's interest payments and preferred dividend obligations, let alone finance further Bitcoin acquisitions.

The following table isolates the performance of the core software business to provide a clear view of its trajectory, stripped of the distorting effects of the Bitcoin treasury.

The data clearly shows a business whose revenue and gross profit are eroding. This operational decay proves that the company has no internal engine of value creation. It is entirely dependent on external capital markets for its survival and to fund its strategy.

Capital Allocation: Feeding the Machine

MicroStrategy's capital allocation policy is a radical departure from the practices of any conventional public company. Its use of cash has a singular, all-consuming focus: the acquisition of Bitcoin. All available capital from its meager operational cash flows and the billions raised through debt and equity issuance is channeled into this one activity.

The company does not pay a dividend to its common shareholders and has not engaged in any significant share buyback programs to return capital to them. Investment in the core software business, particularly in R&D, appears to be at a maintenance level rather than a growth-oriented one. The company has effectively ceased to operate as a software company and now functions solely as a capital acquisition vehicle for its Bitcoin treasury. This fixated focus on a single, albeit speculative asset, funded by an ever-expanding pyramid of liabilities and shareholder dilution, is the defining feature of its financial strategy.

SWOT Analysis

Strengths:

First-Mover Advantage: MicroStrategy was a pioneer in adopting a corporate Bitcoin treasury strategy that has given it significant brand recognition and a leadership position within the crypto community.

Large Bitcoin Holdings: The company has amassed one of the largest corporate Bitcoin treasuries in the world, holding over 597,000 BTC as of mid-2024. This scale provides it with a certain gravitas in the market.

Weaknesses:

Unprofitable Core Business: As detailed above, the legacy software business is in decline and does not generate profits, making the company entirely reliant on external financing.

Extreme Concentration Risk: The company's fate is tied almost exclusively to the price of a single, highly volatile asset, with no meaningful diversification.

Unsustainable Capital Structure: The strategy is built on a foundation of perpetual dilution and a growing mountain of debt and preferred equity that is hostile to common shareholders.

Management Credibility: The CEO's history includes a major SEC accounting fraud charge and a recent $40 million tax fraud settlement, raising significant questions about leadership and governance.

Opportunities:

Bitcoin Price Appreciation: The primary bull case rests on the potential for a massive increase in the price of Bitcoin, which would increase the value of the company's assets. However, this analysis contends that due to the senior claims of debt and preferred stock, much of this upside would not accrue to common shareholders in a crisis.

Threats:

Bitcoin Price Collapse: A significant and sustained drop in the price of Bitcoin is the most obvious and acute threat, which could trigger margin calls (on any secured debt), make refinancing impossible, and lead to insolvency.

Collapse of the Stock Premium: The emergence of spot Bitcoin ETFs provides a cheaper, more direct, and less risky alternative for investors seeking Bitcoin exposure. This competition poses an existential threat to the MSTR stock premium, the collapse of which would break the "flywheel" of the dilution machine.

Regulatory Scrutiny: The company's unique and aggressive financial engineering could attract adverse attention from regulators, particularly given management's history.

Loss of Narrative Control: The entire model is held together by the Saylor narrative. A crisis of faith in his leadership or a shift in market sentiment could dry up the flow of new capital, causing the system to seize up.

Valuation and Endgame: Negative Margin of Safety

The endgame for common shareholders is predetermined by the company's capital structure and the laws of finance, which dictate that such a speculative premium cannot last forever.

The Premium Fails: Quantifying the Speculation

The most obvious anomaly in MicroStrategy's valuation is the massive and persistent premium at which its common stock trades relative to its Net Asset Value (NAV) (the market value of its Bitcoin holdings plus a nominal value for its decaying software business, minus its liabilities). As of March 2025 this premium to be an astonishing +112%.

This premium is the "crypto reactor" that powers the entire enterprise. It is a tangible measure of the market's speculative fever and its belief in the Saylor narrative. The premium exists for several reasons, all of which are eroding:

Expectation of Future Purchases: Investors bid up the stock in anticipation that the company will continue to use its "intelligent leverage" to acquire more Bitcoin, further increasing the "Bitcoin per share" metric.

Leveraged Bet: MSTR is seen as a leveraged play on Bitcoin. Because it uses debt to acquire the asset, its stock price can be more volatile, offering higher potential returns (and losses) than holding Bitcoin directly.

The Proxy Vehicle: Historically, for many institutional and retail investors, MSTR was one of the only convenient, regulated ways to gain exposure to Bitcoin through a traditional brokerage account. It served as an imperfect but accessible proxy.

The launch of numerous spot Bitcoin ETFs in the United States in early 2024 fundamentally changes the key driver and poses an existential threat to the MSTR premium. These ETFs offer investors what MSTR cannot: direct, unleveraged, and low-cost exposure to the price of Bitcoin without the added layers of corporate governance risk, operational business decay, and a complex, hostile capital structure.

A rational investor seeking Bitcoin exposure now has a superior alternative. Why pay a 100% premium to own Bitcoin indirectly through MSTR, subject to the claims of bondholders and preferred shareholders, when you can own it directly through an ETF with a management fee of less than 0.30%? The MSTR premium is now a glaring arbitrage opportunity. As capital flows from overpriced proxies like MSTR to fairly priced ETFs, the premium is destined to compress. The collapse of this premium would be fatal to MicroStrategy's feedback loop. Without the ability to sell its stock at inflated prices, the "infinite money glitch" ceases to function. The company would no longer be able to issue equity to acquire assets in a way that appears "accretive," and the entire model would grind to a halt.

The justification of this trade is straightforward:

Strange Premium: Their premium has historical average of around 1.3x, suggesting a significant reversion to the mean is likely. Using an implied price of $177,0000 per bitcoin within MSTR’s stock, the premium is a multiple of 2.6x.

No More Scarcity: Historical justification for MSTR’s premium, being unique and regulated vehicle for BTC exposure, has been nullified by the new low-fee spot BTC ETFs (investors can get cheaper and less risky exposure to the same thing).

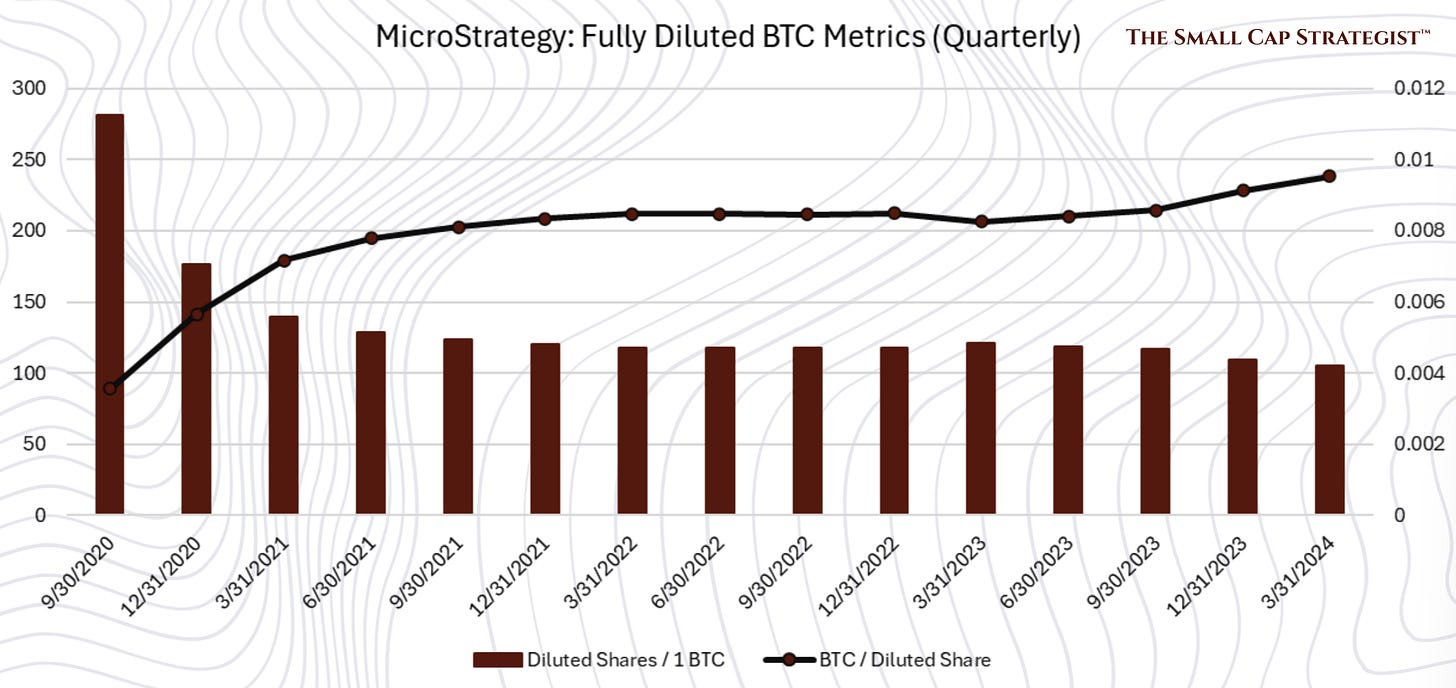

Flawed Accertion Narrative: Arguing that MSTR creates value through intelligent leverage is misleading. The amount of BTC per share has remained virtually unchanged in recent years, with shareholder value being driven almost entirely by BTC’s price appreciation, not a superior strategy.

This distortion between price and NAV creates an arbitrage opportunity for investors. The strategy could be a pairs trade, by going long in a spot BTC ETF like IBIT or FBTC and short in MSTR. This does not bet against BTC but rather the unsustainable premium on MSTR. This hedges the position against a rise in Bitcoins Price. If BTC goes up, the gains on long ETF offset losses in MSTR. The trade profits if MSTR’s premium collapses relative to the price of bitcoin.

A reversion from its 2.6x premium to its historical average of 1.3x would imply a return of 50% on the trade. Obviously, risks apply. Shorting a ‘meme stock’ like MSTR is notoriously dangerous due to the high cost of borrowing shares and the threat of a short squeeze. The stock's extreme volatility makes timing the trade difficult.

Pathways to Collapse

The destruction of MicroStrategy's common equity can occur through several distinct but related scenarios.

Scenario 1: The Bitcoin Crash. The most straightforward path to ruin is a severe and prolonged bear market in Bitcoin. A 50% or greater decline in price, which has occurred multiple times in the asset's history, would have catastrophic consequences. It would cut the value of the company's assets, potentially triggering covenants on any secured debt and blowing a massive hole in its balance sheet. The company's ability to service its debt and preferred dividends would be crippled, and its access to capital markets to roll over debt or raise new funds would evaporate. This would almost certainly force a restructuring or bankruptcy, where the common equity would be wiped out.

Scenario 2: The Premium Collapse. This scenario does not require a Bitcoin crash. Even if Bitcoin's price remains stable or rises modestly, a loss of faith in the Saylor narrative or the continued migration of capital to superior Bitcoin ETFs could cause the MSTR-to-NAV premium to vanish. As explained above, this would break the company's financing model. Unable to issue new equity at inflated prices, the perpetual dilution machine would stop. The company would be left with a decaying software business, massive debt obligations, and no mechanism to fund its operations or growth, leading to a slow but inevitable decline toward insolvency.

Scenario 3: The Refinancing Wall. This is the ticking time bomb on the balance sheet. Between 2027 and 2032, the company faces a wall of maturing debt totaling billions of dollars. It has no plausible path to repay this principal from operational cash flow. Therefore, it must refinance. If either Scenario 1 or Scenario 2 is in effect during this period, refinancing will be impossible. Lenders will not extend new credit to a company with a collapsing asset base and a broken business model. This would trigger a default, forcing a liquidation or restructuring where common shareholders are last in line.

Capital Stack Waterfall

In any scenario of financial distress, bankruptcy, or liquidation, the claims on a company's assets are settled according to a strict hierarchy known as the absolute priority rule. This rule dictates the "waterfall" of payments, and for MicroStrategy, it seals the fate of the common stock.

The capital stack is ordered as follows:

Creditors (Debt Holders): The holders of the company's ~$8.2 billion in convertible senior notes have the first claim on the company's assets. They must be paid in full before any value can flow down to equity holders.

Preferred Shareholders: Next in line are the holders of the perpetual preferred stock (STRK, STRD, STRF). They have a claim equal to their liquidation preference (typically $100 per share) plus any accrued and unpaid dividends. This represents a multi-billion dollar claim senior to the common stock.

Common Shareholders: At the very bottom of the waterfall are the common stockholders. They are the residual claimants, entitled only to whatever value is left after all senior obligations to creditors and preferred shareholders have been satisfied in full.

Given the more than $13 billion in debt and preferred stock obligations that stand senior to the common equity, any scenario that sees the market value of the company's assets (which are almost entirely composed of Bitcoin) fall below this threshold will result in a total and permanent loss for common shareholders. The margin of safety for the common stock is not just zero; it is deeply negative. The structure is designed in such a way that in a crisis, the common equity acts as a disposable cushion to absorb losses for the benefit of the more senior tranches of the capital structure.

Conclusion

The story of MicroStrategy is not a story about the transformative potential of Bitcoin. It is a story about Saylor and his team’s deceptive financial engineering, narrative control, and the exploitation of speculative mania in an era of unprecedented market conditions. It stands as a direct echo of the dot-com bubble, led by the very same protagonist and employing a conceptually identical method of leveraging a compelling new technology narrative to mask fundamental weakness and execute a massive transfer of wealth.

The company's structure is not designed for sustainable, long-term value creation for all stakeholders. It is designed for value transfer, siphoning capital from new investors to the benefit of earlier stakeholders, all under the guise of a visionary corporate strategy. The common stock of MicroStrategy is not an investment in a growing business nor is it a prudent proxy for a digital asset. It is a deeply flawed financial instrument: an unhedged, highly leveraged, out-of-the-money call option on the price of a single volatile asset. This option is burdened by the negative carry of an unprofitable core business and the perpetual drain of senior dividend obligations, and its effective strike price is relentlessly pushed higher by the very mechanism of dilution required to keep it alive.

Like all such speculative instruments built on a foundation of leverage and hope rather than cash flow and fundamentals, it is mathematically destined to expire worthless. The forces of financial gravity like the eventual compression of its speculative premium in the face of superior alternatives, the crushing weight of its debt and preferred equity obligations, and its vulnerability to a downturn in its single underlying asset. The convergence of MicroStrategy's common stock to its true intrinsic value of zero is not a matter of if, but when.

If you enjoyed this post, consider subscribing to The Small Cap Strategist.

This post is for informational and educational purposes only and should not be considered investment advice. The author is not a financial advisor. All investment decisions carry risk, and readers should consult with a qualified financial professional before making any investment choices. The author may or may not hold positions in the securities discussed. This post may not be an accurate reflection of MSTR.

you failed to mention they have more real capital than anyone in the world. they will be the most valuable company in the world in a decade. most of their debt is not callable and they could tolerate a prolonged btc decline to 15,000 without issue.

i will continue to build generational wealth alongside him.

Kudos! You nailed it.

I hope people read and share what you have written and wake up before they are financially harmed.

And let’s hope the company never joins the S & P 500 as some have speculated as well.