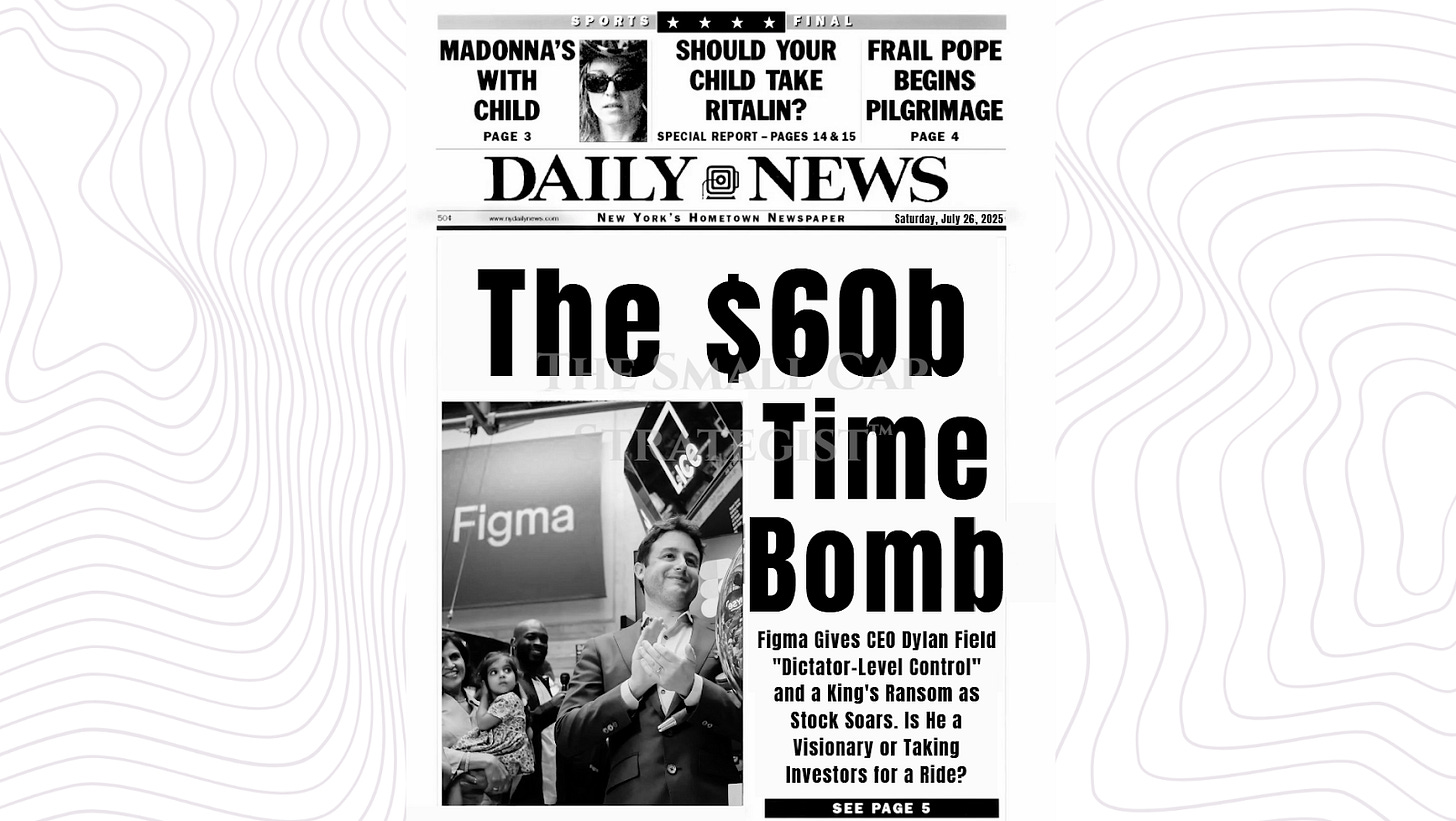

Figma: Down 40%, A Reality Check

Figma's business is world-class. Its valuation, however, could be a setup for failure. Here's the reality check Wall Street is ignoring. A Figma ($FIG) Stock Analysis

"The most dangerous thing is to buy something at the peak of its popularity. At that point, all of the optimism and positive belief about the future is already reflected in the price." - Howard Marks

Figma, Inc. may not be the generational investment opportunity the market believes it to be. This is the classic spectacular business attached to a dangerously overvalued stock, a speculative instrument whose price has become fundamentally decoupled from its underlying financial reality. The company’s quality is the narrative used to justify a valuation that is mathematically detached from any sane projection of future cash flows. Over a long enough time horizon, the immense weight of market expectations, combined with undeniable existential threats, could crush the stock’s speculative premium, leading to a catastrophic destruction of capital for anyone buying at these levels. We look into the controversial logic propping up this valuation and the specific risks that may trigger a collapse.

The narrative is seductive. Figma has built a phenomenal, near-monopolistic product that has become the new staple of digital design. Its business model is brilliant, its growth metrics are top tier, and its leadership is visionary. This is the quality that has fueled a speculative frenzy, allowing the market to price the company not for the success it has achieved, but for a flawless, multi-decade reign of uninterrupted, hyper-growth execution, a future that might not even materialise.

This strategy is entirely dependent on ignoring three critical threats. The first is AI disruption. The company’s core value proposition (a platform for human-led, iterative design) will face intense competition with generative AI models that promise to render that entire process obsolete. Figma’s bet that it can pivot to own the new AI-driven workflow is a high-stakes gamble against technological forces that could vaporize its primary market. The second is the threat of bundling from established giants. A behemoth like Microsoft or Google could easily integrate a "good enough" competitor into its existing enterprise suite, offering it for free to hundreds of millions of users and effectively suffocating Figma's primary growth vector.

Finally, the valuation itself is the greatest risk. Priced beyond perfection, the stock is a house of cards. Any perceived stumble, a growth deceleration, a delayed product, a macroeconomic headwind, will not be forgiven. Our analysis concludes that Figma is a world-class business trading at a price that leaves no margin for error and no outcome other than disappointment. An investment today is not a bet on a great company; that is self-evident. It is a wager that this great company can defy the laws of financial gravity. We believe that gravity usually always wins.

Investment Thesis

Keep reading with a 7-day free trial

Subscribe to The Small Cap Strategist to keep reading this post and get 7 days of free access to the full post archives.