Finding 10x Opportunities in APAC's Trade Re-Route

While macro headwinds and trade wars create noise, we're introducing the small-cap transport stocks quietly positioned for exponential growth.

Macroeconomic Overview

The operating environment for the transportation industry is dictated by the health of the global economy and the flow of goods. Current leading indicators point to a more obscured picture, characterized by subdued growth, a deep manufacturing decline, and significant trade distortions coming from geopolitical policy.

Soft Growth and Manufacturing Drop

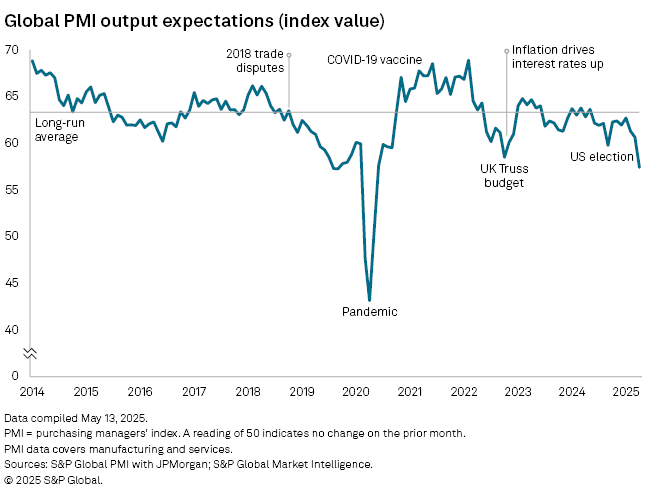

Recent purchasing managers' index (PMI) surveys from S&P Global indicate a lower than expected global recovery. The headline global PMI, which covers both manufacturing and services, rose to 51.2 in May 2025 from a 17-month low of 50.8 in April. While any reading above 50.0 signals expansion, this level is historically consistent with an annualized global GDP growth rate of just 2.0%. This figure stands in contrast to the 3.1% average growth rate the global economy enjoyed in the decade preceding the pandemic, setting a clear tone of weak demand for transportation services.

A critical divergence lies beneath this headline number. The S&P Global report from June 10, 2025, states,

"Global growth was confined to the service sector, as manufacturing experienced a deeper decline."

Global factory output fell in May at the fastest rate since December 2024, a direct consequence of deteriorating order books and a contraction in global goods trade. This manufacturing-specific recession has a direct and immediate impact on the physical movement of goods, pressuring the marine, rail, and road freight sectors that form the backbone of industrial supply chains.

U.S. Tariffs -Disrupting Trade and Demand

The PMI reports consistently identify a primary culprit for the economic stagnation. According to the June 10, 2025, analysis:

"US policy, principally relating to changing tariffs, was cited again as the primary cause of weak demand and subdued global optimism,"

This policy-driven uncertainty has become the central narrative for the logistics sector, creating distortions and disrupting natural trade flows.

One of the most significant distortions is the phenomenon of "tariff front-running." The PMI data reveals that some of the manufacturing growth observed in May across the US, Europe, and parts of Asia "reflected the front-running of tariffs". Companies rushed to ship and receive goods before higher levies took effect, creating an artificial surge in demand for logistics services. This behavior creates a classic bullwhip effect: a short-term spike in shipping volumes and port activity, followed by a potential collapse once deadlines pass. This is validated by the observation that these tariff concerns led to the

"largest US inventory accumulation in the survey's history,"

as firms stockpiled inputs to safeguard against supply shortages and price hikes. Logistics companies involved in warehousing and storage are on the front lines of managing these inventory swells.

The impact on business sentiment has been severe. Global business confidence fell to its lowest level since the pandemic lockdowns of early 2020 in April 2025. The malaise spread beyond goods production:

"Business expectations deteriorated sharply across manufacturing and services globally."

Highlighting how trade uncertainty changes the entire economic ecosystem [Global business confidence falls to lowest level since early 2020].

APAC Divergence - Slow Growth in China & Regional Replacements

The PMI data for May 2025 notes that:

"Emerging markets led the weakness... with mainland China notably declining for the first time in nearly two-and-a-half years due to falling goods production and lower exports."

This slowdown in the region's largest economy represents a major headwind for any transportation company with significant exposure to Chinese trade.

This contrasts with the performance of other regional economies. The April 2025 PMI report highlighted that "India continued to outperform by a wide margin," while Australia recorded modest gains [Global business confidence falls to lowest level since early 2020]. This divergence is critical for investment strategy. The combination of US tariffs on Chinese goods and China's domestic economy weakening is creating an incentive for manufacturers to shift production.

This structural shift will require the creation and strengthening of new logistics and transport corridors. A supply chain that goes from Shanghai to Los Angeles might now involve shipping raw materials from Australia to Vietnam for assembly, followed by trucking finished goods to a port for export to the US. This creates new, durable demand for intra-Asia shipping, cross-border trucking within ASEAN, and enhanced domestic logistics capabilities within these new manufacturing hubs. We think investors should look for logistics companies that are strategically positioned to capitalize on these emerging trade routes, albeit rather than those solely dependent on the increasingly volatile and politically sensitive traditional China-US lanes.

Marine & Ports - Volatility and Congestion

Currently, there is very high volatility in the APAC marine shipping and port sectors. Tariff-driven demand swings have led to fluctuating freight rates and a large increase in cargo has created congestion at key hubs, testing the strength of the supply chain.

Freight Rates and Throughput

The practice of front-loading shipments to avoid tariffs has had a direct and measurable effect on ocean freight. A sharp rebound in Transpacific import demand overwhelmed carrier capacity in the lead-up to June 2025. In response, carriers announced General Rate Increases (GRIs) effective June 1, with post-GRI estimates reaching $6,000–$6,500 to the U.S. West Coast and $7,000–$7,500 to the U.S. East Coast.

This volatility is reflected in major freight indices. The Drewry World Container Index (WCI) remained relatively stable in mid-June 2025 at $3,543 per 40ft container, but this masked significant underlying movement on key lanes. Rates from Shanghai to New York rose 2% to $7,285, and spot rates to Los Angeles had increased 89% in the four weeks prior. Similarly, the China Containerized Freight Index (CCFI) registered a composite increase of 7.6% in a single week in mid-June, with the Mediterranean and South America routes showing double-digit percentage growth. This high level of fluctuation is the new operational reality for shippers and carriers.

Port throughput data tells a similar story of front-loading. Singapore, a critical transshipment hub, handled 6.1% more containers in the first four months of 2025 compared to the prior year, a surge its Transport Minister directly attributed to companies trying to ship ahead of tariff implementation. The Port of Shanghai also saw a significant increase in cargo throughput in early 2025, handling a record 5 million TEUs in January alone. However, this surge is likely temporary. Analysts forecast a potential slowdown in the second half of the year as the front-loading effect dissipates and the underlying weak demand reasserts itself.

Port Infrastructure - Critical Bottleneck and Investment Hub

Major APAC ports have become both beneficiaries and victims of this trade volatility. While they handle increased volumes, they also face intense operational pressure. Congestion at hubs like Shanghai, Singapore, and Port Klang has become a risk, with vessel waiting times extending to three days or more in some cases.

In response, significant capital is being deployed to enhance port capacity and efficiency. Recent Transactions of the industry from June 2025 shows PSA International, one of the world's largest port operators, filing a massive $5 billion shelf registration, signaling a long-term commitment to infrastructure investment. The same list shows M&A activity even in smaller markets, such as Fijian Holdings Limited's acquisition of a minority stake in Port Denarau Marina. The aggregate transaction value in the Marine Ports and Services sector shows a significant spike since March 2025, post fluctuations, indicating that capital continues to flow into the sector despite macroeconomic uncertainty.

A look at key listed port operators show a better financial picture.

PSA International (Private): This company’s performance leads the industry. For the year ending December 31, 2024, PSA handled a record 100.2 million TEUs, a 5.6% increase from 2023. However, its net profit fell 25.2% to S$1.1 billion, a clear sign of margin compression from higher operating and finance costs despite volume growth.

Xiamen Port Development Co., Ltd. (SZSE:000905): This key Chinese port operator provides a more regional view. Its 2024 annual report summary showed a 20.1% decline in revenue to RMB 366.7 billion, reflecting the economic slowdown in China. However, net profit attributable to shareholders decreased by a more modest 9.9% to RMB 1.4 billion, suggesting some operational resilience or cost control. The company's business extends beyond simple port operations into integrated logistics and supply chain services. More encouragingly, its report for the first quarter of 2025 showed a 24.9% year-over-year increase in net profit, pointing to a potential recovery.

Small/Mid-Cap WATCH LIST: Marine & Ports

In a market defined by high volatility and macroeconomic uncertainty, investors can find opportunities in niche players with distinct geographic advantages, specialized cargo focus, and strong balance sheets. These smaller, more agile companies can sometimes adapt more quickly than global giants.

Table 1: Comparative Analysis of APAC Small/Mid-Cap Marine & Port Operators

Deep Dive Profile 1: PT Habco Trans Maritima Tbk (HATM.JK)

Business Model: PT Habco Trans Maritima is an Indonesian shipping company specializing in bulk carrier services. It is a part of the larger Habco Group, which has operated in Indonesia's marine logistics sector since 1991. HATM's core business involves transporting bulk commodities, particularly coal, to serve the needs of domestic steam power plants. The company operates a fleet of bulk carriers, tugs, and barges of various sizes.

Financials: HATM is a small-cap with a market capitalization of approximately IDR 1.86 trillion (about $115 million USD). It trades at an attractive P/E ratio of around 11.6x. Recent financial news indicates a company in growth mode; in February 2023, it secured a Rp 150 billion facility to procure new vessels, and its Q3 2023 performance was stable, supported by this fleet expansion.

Investment Thesis (The Commodity Specialist): HATM's business model presents a compelling case. Its focus on transporting bulk commodities for Indonesia's domestic energy sector largely insulates it from the volatility of trans-Pacific container trade and the associated tariff disputes. Its growth is tied to a more stable driver: Indonesia's internal energy demand. The recent financing and fleet expansion signal both management confidence and access to capital for growth. This makes HATM a potential value play on a domestic industrial champion in a key emerging market.

Deep Dive Profile 2: Sunsky Logistics Limited (Pre-IPO)

Business Model: Sunsky Logistics is an Indian logistics company that has filed for an IPO on the BSE SME platform. The company provides road freight and related logistics services within India.

Financials: The company's pre-IPO financials, as detailed in its Draft Red Herring Prospectus, are impressive. Between the financial years ending March 31, 2024, and March 31, 2025, revenue increased by 50% and profit after tax (PAT) surged by 107%. It boasts a very high Return on Equity (RoE) of 79.4% and a manageable debt-to-equity ratio of 0.45. The proceeds from its IPO are earmarked for tangible growth initiatives: the purchase of flatbed trailers and the repayment of some existing debt.

Investment Thesis (Geographic Growth): Sunsky represents a ground-floor opportunity to invest in the expanding Indian logistics market, a direct beneficiary of the "China+1" manufacturing shift and strong domestic economic growth. India is projected to have the highest CAGR in e-commerce logistics in the APAC region through 2030. The company's outstanding growth and profitability metrics, coupled with a clear use of IPO funds for asset expansion, make its upcoming listing one to watch closely. Its focus on road transport plugs it directly into the domestic supply chain, shielding it from international port congestion and freight rate volatility.

Rail & Road – Intra-Regional & Domestic Trade

While marine transport is experiencing global headwinds, rail and road logistics are benefiting from powerful secular trends, including supply chain regionalization, booming e-commerce, and massive government infrastructure investment.

Terrestrial Corridors

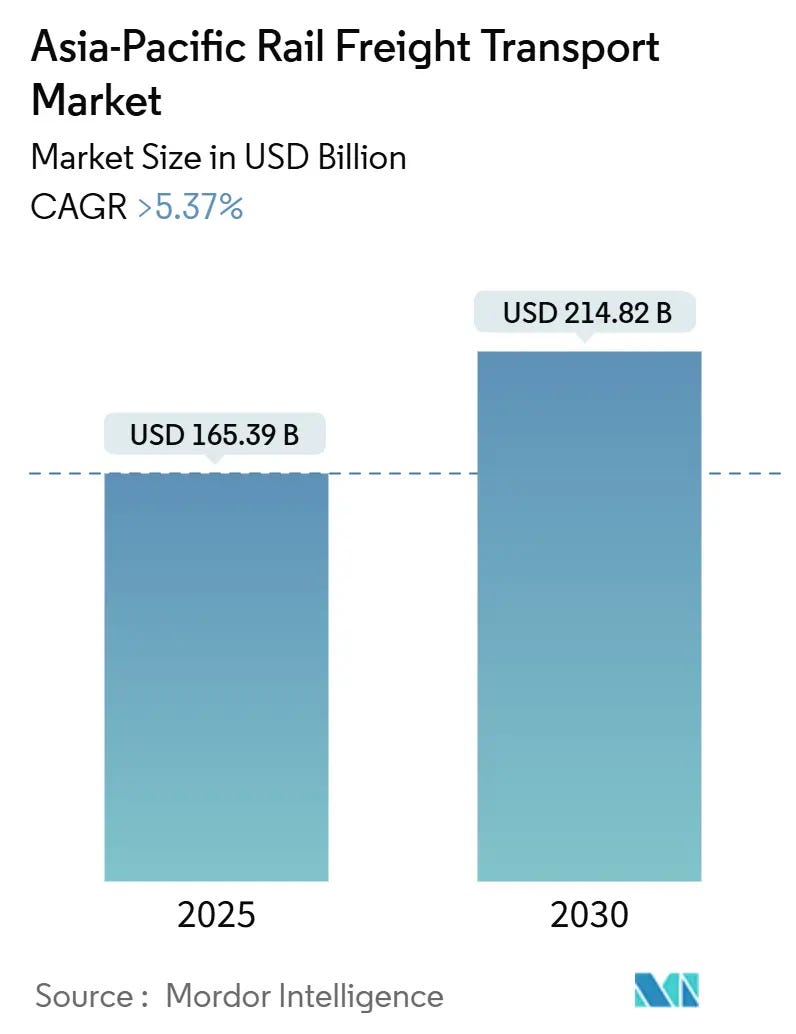

The Asia-Pacific rail freight market was valued at approximately $165.4 billion in 2025 and is projected to grow at a compound annual growth rate (CAGR) of 5.4% to reach $214.8 billion by 2030. Key drivers include rising intra-Asia merchandise trade and the explosion of cross-border e-commerce. As an alternative to volatile and time-consuming ocean freight, rail is becoming increasingly attractive. The launch of a new rail service from Hanoi, Vietnam, to Europe, for instance, cuts transit time by about 18 days compared to sea routes.

The road freight market is experiencing similar, if not stronger, tailwinds. The overall APAC logistics market, of which road transport is the largest component, is forecast to expand from $4.56 trillion in 2024 to $8.28 trillion by 2034, a CAGR of 6.1%. This growth is heavily driven by the expansion of e-commerce and the corresponding need for efficient last-mile delivery services.

Infrastructure Investment - BRI and Others

This growth is supported by large amounts of investment in infrastructure. China's Belt and Road Initiative (BRI) has been a significant driver, financing over 10,000 kilometers of railways and nearly 100,000 kilometers of highways. While the transport sector's share of new BRI engagement fell to a historical low of 12% in 2024, specific strategic projects continue to advance. A notable recent project is a 19.5-kilometer cross-border rail line connecting Mongolia and China, designed to increase coal export capacity.

Beyond the BRI, national and regional initiatives are adding momentum. India's Gati Shakti National Master Plan and Japan's Smart Logistics Strategy are aimed at enhancing logistics efficiency and reducing transit times. ASEAN is also stepping up efforts to develop and fund a pipeline of regional infrastructure projects to improve connectivity. The scale of investment required is immense, with one estimate suggesting the APAC region needs to invest $43 trillion between 2020 and 2035, with nearly 40% of that dedicated to rail, ports, airports, and urban transit.

This massive, long-term spending on infrastructure creates a distinct investment opportunity. While investing in a single toll road or rail line carries project-specific risks, investing in the companies that supply the essential materials, equipment, and services for all such projects offers a more diversified approach. These are the "picks and shovels" of the infrastructure boom. Companies that provide the steel, cement, rolling stock, and construction services are positioned to benefit from sustained government stimulus and long-term national development goals, regardless of the success or failure of any individual project. Their performance becomes a proxy for the health of the entire infrastructure construction ecosystem.

We will start focusing on the small/mid cap companies that will benefit the most from this trend in the coming weeks and months.

This one of the few opportunities which won’t grab headlines, but will 10x your portfolio.

Small/Mid-Cap Idea Generation: Rail & Road

The terrestrial logistics space offers a diverse range of business models, from materials suppliers and urban metro operators to specialized freight haulers and toll road concessionaires.

Table 2: Comparative Analysis of APAC Small/Mid-Cap Rail & Road Logistics Firms

Deep Dive Profile 1: China Railway Materials Company Limited (000927.SZ)

Business Model: China Railway Materials (CRM) is a foundational supplier to China's colossal railway industry. Its deep state ties are evident in its history, with its predecessor being part of the People's Liberation Army's logistics department. Today, it is a core subsidiary of the state-owned China Railway Construction Corporation. CRM provides comprehensive railway services, bulk commodity trading, and engineering contracting, making it an indispensable part of China's rail infrastructure development.

Financials: CRM has a market capitalization of approximately $2.19 billion USD (CNY 15.6 billion) and trades at a P/E ratio of about 32.7x. Its 2024 financial results reflected the broader economic slowdown in China, with revenue declining 15.4% and earnings falling 19.6%.

Investment Thesis (The "Picks and Shovels" Play): While its recent financial performance has been hampered by the weak economic climate, CRM is a direct, strategic play on China's long-term commitment to expanding and upgrading its rail network, both for domestic use and as part of the Belt and Road Initiative. The company is a prime beneficiary of any government stimulus directed towards infrastructure spending. As one of the world's largest logistics providers and a dominant railway material supplier in China, it represents a state-backed champion essential to achieving national transportation goals.

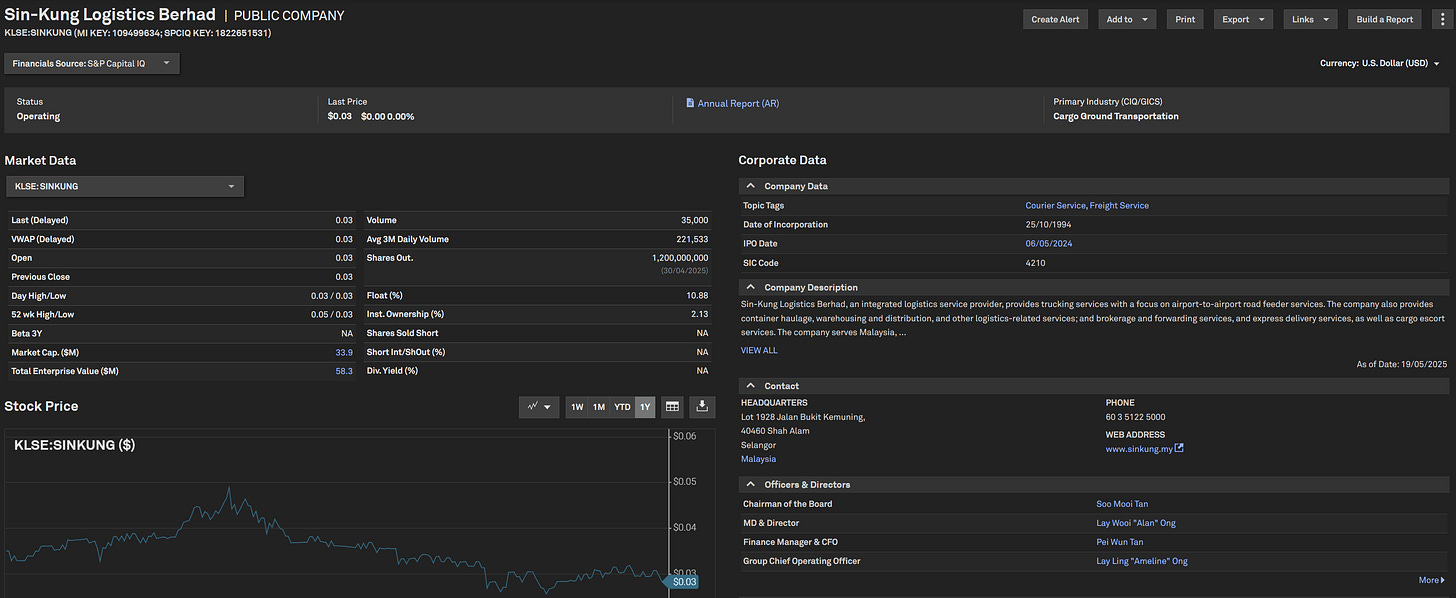

Deep Dive Profile 2: Sin-Kung Logistics Berhad (SINKUNG.KL)

Business Model: Sin-Kung Logistics is a Malaysian small-cap integrated logistics provider. Its operations are centered on trucking services, with a specialized focus on airport-to-airport road feeder services. It also engages in container haulage and warehousing, serving a diverse international client base across Asia, Europe, and the US.

Financials: With a market capitalization of just MYR 144 million (around $30 million USD), Sin-Kung is firmly in the small-cap category. Recent financials have been challenging; the company reported a net loss of MYR 1.2 million on revenue of MYR 12.7 million for the first quarter of 2025. The stock has been under pressure, trading near its 52-week lows.

Investment Thesis (The Niche Air-to-Road Connector): Sin-Kung's value lies in its specialized niche. The global air freight market has remained relatively strong, supported by e-commerce and the need for faster shipping alternatives. By providing the critical road link between airports, Sin-Kung acts as an essential component of the air cargo supply chain. This focus could insulate it from the extreme volatility seen in ocean freight. While its current financial performance is weak, its strategic position within a resilient sub-sector makes it a potential turnaround candidate. As manufacturing and supply chains continue to reconfigure throughout Southeast Asia, demand for such specialized, cross-border logistics services is likely to grow. This is a high-risk, high-reward name to watch for signs of operational improvement.

Investment Theses – Identifying Actionable Themes

The analysis of the APAC transportation sector clearly shows that the US tariff policy has caused a manufacturing slowdown in China and widespread trade flow distortion. This has led to high volatility in ocean freight and congestion at major ports. In response, a strategic diversification of supply chains toward India and ASEAN nations is accelerating. This, in turn, is increasing the attractiveness of alternative transport modes like air and rail and fueling growth in new geographic corridors. This dynamic means a simple "buy transportation" strategy is insufficient. The sector has a collection of distinct niches experiencing vastly different pressures and opportunities.

We will aim to create a specialized portfolio of the best “invest and forget” stocks in this industry that will benefit the most from this exceptional trend.

Key Investment Themes for the APAC Transportation Sector

Three primary themes emerge from this analysis for investors looking at small-to-mid-cap opportunities:

Theme 1: Supply Chain Diversification. This theme focuses on logistics companies located in ASEAN and India that are the direct beneficiaries of manufacturing and sourcing relocation away from China. As global firms build out their "China+1" strategies, these companies will provide the essential trucking, warehousing, and multimodal services needed to support new factories and trade routes.

Examples: Sunsky Logistics (Pre-IPO) and Neptune Logitek (Pre-IPO) in India are pure-play opportunities to invest in the build-out of new logistics capacity in a high-growth region. Their strong pre-IPO growth metrics and clear use of funds for asset acquisition are positive indicators.

Theme 2: Commodity Niche Specialists. This theme involves identifying companies focused on transporting essential bulk commodities such as energy, minerals, and agricultural products. These goods often have more inelastic demand curves and are less exposed to tariffs on finished consumer products. Their performance is more closely tied to industrial and domestic demand within their home countries than to global consumer sentiment.

Examples: PT Habco Trans Maritima (HATM.JK), which transports coal for Indonesia's domestic power grid, is a prime example.

PT Dana Brata Luhur (TEBE.JK) is similarly focused on Indonesian mining infrastructure.

Jushen Logistics Group (001202.SZ) offers a contrarian play on this theme within China; while currently facing headwinds, it is a key logistics provider for the country's vast non-ferrous metals industry and would benefit from an eventual industrial recovery.

Theme 3: The Infrastructure Enabler ("Selling Shovels in the Gold Rush"). This theme advocates for investing in companies that supply the foundational materials, equipment, and services for long-term, state-backed infrastructure projects. This approach diversifies risk away from the success of any single project and instead bets on the overarching government commitment to improving transport networks.

Example: China Railway Materials Company Limited (000927.SZ) is the quintessential "picks and shovels" play. As a key supplier to China's state-owned railway builders, its fortunes are tied to the country's massive and ongoing infrastructure budget.

Concluding Checklist for Subscribers

When evaluating small-to-mid-cap transportation companies in the current APAC environment, a disciplined approach is essential. Investors should consider the following factors:

Geographic Exposure: Does the company primarily serve the volatile China-US trade lane, or does it benefit from the structural shift to India and ASEAN?

Niche Focus: Does the company operate in a defensible and resilient niche (e.g., bulk commodities, air freight support, domestic e-commerce), or is it a generalist exposed to all macroeconomic headwinds?

Balance Sheet Strength: In a volatile and capital-intensive industry, a strong balance sheet is paramount. Screen for companies with manageable debt-to-equity ratios and positive operating cash flow.

Capital Allocation: Is the company investing prudently for future growth? Look for clear and logical use of proceeds in IPOs and capital raises, such as acquiring revenue-generating assets (ships, trailers) rather than simply funding operational losses.

Valuation: Is the company priced attractively relative to its peers and its growth prospects? Use comparative tables and metrics like P/E, P/B, and EV/EBITDA to identify potential mispricing in the market.

Thank you for reading The Small Cap Strategist. If you enjoyed this post, please consider subscribing.