Goldman Sachs Downgraded, We Upgraded - Weatherford International Plc (NYSE:WFRD)

Deep Dive into WFRD's Moat, Management, and Market Potential, Looking at Strengths, Risks, and Upside.

Welcome to The Small Cap Strategist. Our mission is to look past the obvious mega-caps and uncover the high-growth, under-the-radar companies dominating their niches. Today, we're applying our philosopy to Weatherford International plc (NYSE: WFRD), a global energy services company positioned for a potential rebound in a dynamic industry.

We've done multiple deep dives into very undervalued companies. Our three most recent ones are these:

Inside this post you will find:

Company Overview: Weatherford's global operations, recent stock performance, and strategic focus on enhancing customer experience, innovation, and lean operations.

Investment Case & Competitive Dynamics: An examination of Weatherford's strengths, weaknesses, opportunities, threats (SWOT), and its market poisition using Porter's Five Forces.

Operational & Industry Insights: Weatherford's products, geographies, customer segments, growth strategies.

Financial Performance & Profitability: An analysis of revenue trends, drivers, margins, and profitability, alongside key financial ratios.

Management & Capital Allocation: Profiles of key management, insights into their capital allocation history, and management ownership.

Valuation & Outlook: Our take on Weatherford's valuation, potential risks (reverse thesis), and the overall investment conclusion.

If you want to build a portfolio of unique, high-conviction ideas and gain an edge by understanding the powerful forces shaping global markets, subscribe to The Small Cap Strategist and join a community of discerning investors.

“I just want a brief summary I don’t have the time to read everything right now:”

Weatherford International plc presents a compelling investment case as a global energy services company operating in a cyclical but essential sector. The company’s core strengths lie in its mixed portfolio of services across the entire well lifecycle, its extensive global operational footprint, and a demonstrated commitment to strengthening its balance sheet and generating free cash flow. Strategic partnerships, such as the one with Amazon Web Services (AWS), position Weatherford for digital transformation and operational efficiencies, aiming to build a sustainable competitive advantage through specialized technological expertise and an integrated service model.

Weatherford has proactively managed its cost structure and pursued portfolio optimization through strategic divestitures. The company's disciplined capital allocation, including debt reduction, consistent dividends, and share buybacks, underscores management’s confidence in its long-term financial stability.

Valuation metrics suggest Weatherford may be undervalued compared to its peers, with analysts projecting significant upside potential.

So what’s the hype of Weatherford?

Weatherford International plc currently holds an "Outperform" consensus recommendation. While specific consensus ratings vary, the average analyst target price is around $145, significantly above recent trading prices. This implies substantial potential upside, with some analysts highlighting the stock as "too cheap to ignore."

Weatherford International plc (WFRD) operates as a global energy services company, providing critical equipment and services across the entire well lifecycle, from drilling to abandonment. The company's operations span approximately 75 countries, reflecting a broad international footprint in the oil and natural gas exploration and production industry, as well as emerging new energy platforms. Over the period from July 23, 2024, to July 1, 2025, Weatherford's stock performance exhibited a significant decline followed by a period of stabilization and modest recovery.

Investment Case: Strengths, Weaknesses, Opportunities, Threats (SWOT)

Strengths

Weatherford International possesses several core strengths that underpin its operational resilience and strategic positioning. The company has a comprehensive portfolio of energy services and equipment, covering the entire well lifecycle from drilling and evaluation to well construction, completions, production, intervention, and responsible abandonment. This breadth of offerings provides diversification across different operational phases within the energy sector. Its global operational footprint, with business conducted in approximately 75 countries and 335 operating locations, including manufacturing, R&D, service, and training facilities, allows it to serve a diverse customer base and mitigate regional market fluctuations.

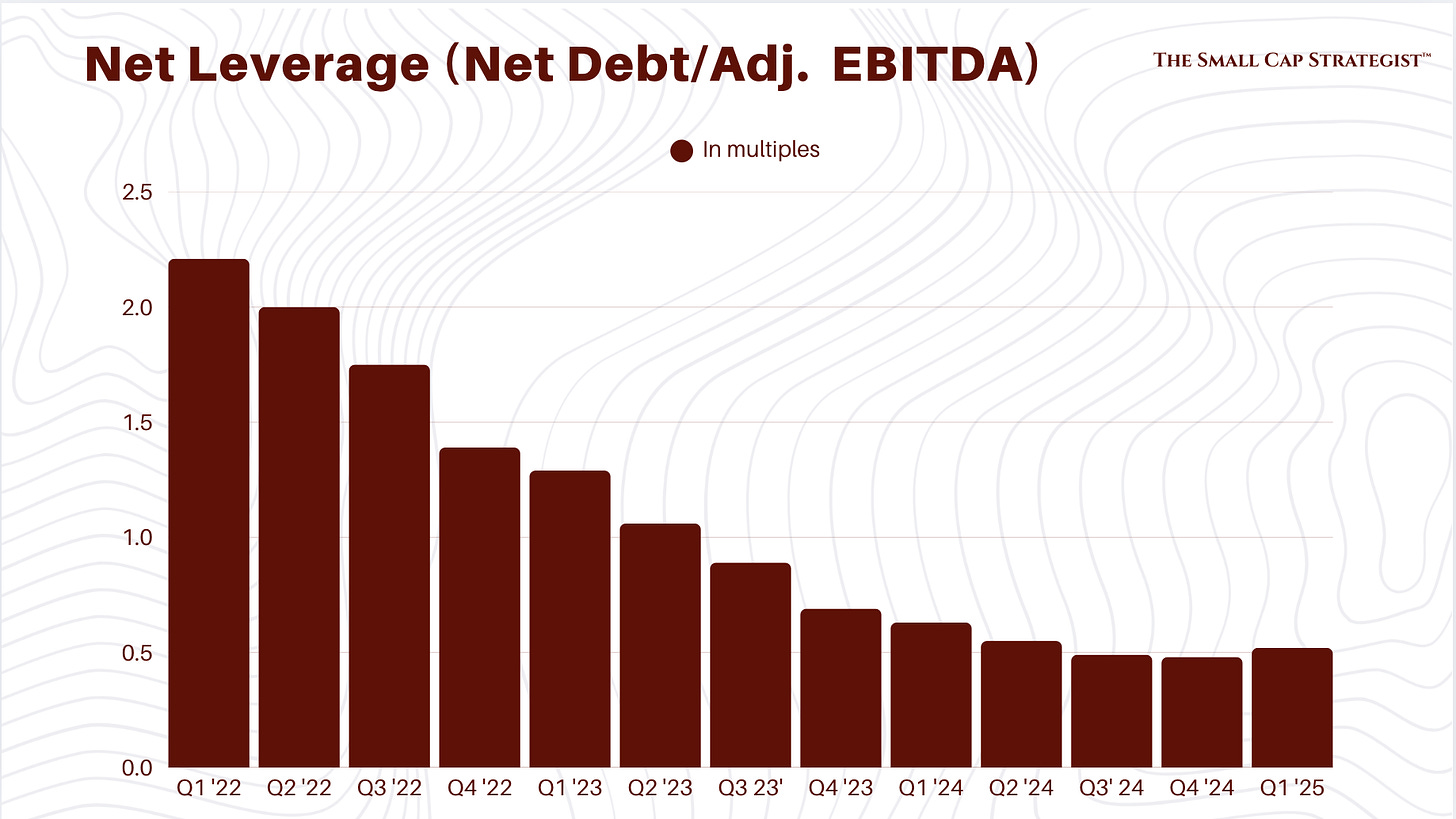

Weatherford has demonstrated a commitment to strengthening its balance sheet, having reduced approximately $6.2 billion of outstanding funded debt post-Chapter 11 restructuring and an additional $1 billion recently. The company's ability to generate adjusted free cash flow, reported at $66 million in Q1 2025 with a 26.1% conversion rate, indicates robust cash management and operational efficiency, even in a challenging revenue environment. Furthermore, Weatherford has established a sustainable dividend, signaling confidence in its long-term financial stability and commitment to shareholder returns. The strategic partnership with Amazon Web Services (AWS) on May 13, 2025, positions Weatherford for enhanced digital transformation, operational efficiencies, and the development of next-generation technologies, which could be a significant competitive differentiator.

Weaknesses

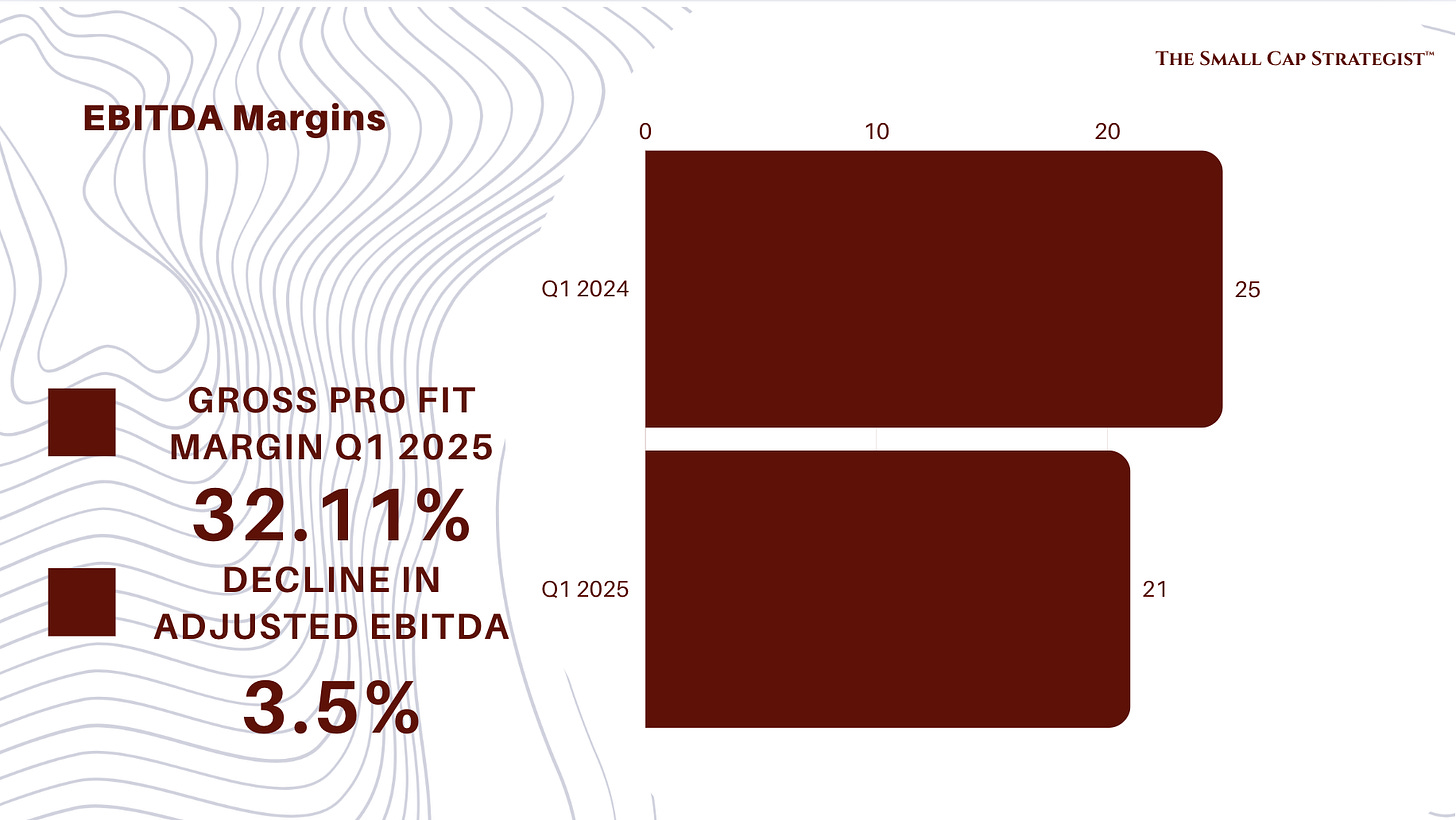

Despite its strengths, Weatherford faces notable weaknesses. The company's revenue in Q1 2025 decreased by 12% year-over-year and 11% sequentially, totaling $1.19 billion, indicating sensitivity to market downturns and a challenging operating environment. Adjusted EBITDA margins also saw a decline, falling to 21.2% in Q1 2025 from 24.7% in Q1 2024, impacted by lower revenues, project startup costs, and under-absorbed headcount. The company's reliance on the cyclical oil and natural gas industry inherently exposes it to commodity price volatility and customer spending cutbacks, as observed in the softening international market and sharp decline in Mexico activity in Q1 2025.

Weatherford's market share, at approximately 2.19% as of Q1 2025, remains significantly smaller compared to industry giants like SLB (15.58%), Baker Hughes (11.79%), and Halliburton (9.94%). This smaller scale can limit its pricing power and ability to absorb market shocks compared to larger, more diversified competitors. The analyst downgrade by Goldman Sachs on December 13, 2024 reflected concerns about limited returns despite deleveraging efforts, which may continue to affect investor sentiment.

Opportunities

Weatherford is well-positioned to capitalize on several emerging opportunities within the energy sector. The global oil and gas industry is expected to see continued demand growth until at least 2030, providing a foundational market for Weatherford's services. The imperative for hydrocarbon companies to maintain and replenish reserves drives traditional exploration and development, particularly in regions like Africa's Atlantic Margin and the Mediterranean, and fuels strategic mergers and acquisitions (M&A). Weatherford's portfolio optimization strategy including divestitures of non-core assets like its Argentina Pressure Pumping and Wireline businesses aligns with the industry's shift towards more focused and efficient operations.

The increasing role of National Oil Companies (NOCs) from the Middle East, China, and other emerging markets, which are expanding internationally and diversifying into low-carbon technologies, presents new avenues for partnerships and growth. Weatherford's emphasis on digital solutions, including its ForeSite® production optimization platform and the CygNet control system offers a significant opportunity to enhance customer efficiency and drive production intensity from existing assets.

Threats

The company faces several external threats that could impede its growth and profitability. The volatility of commodity prices remains a primary concern, as lower prices lead to caution and reduced consumer spending, directly impacting demand for Weatherford's services. The Q1 2025 earnings call highlighted that "the market has taken a turn for the worse" in recent weeks, with a potential broad-based slowdown in the second half of the year if global trade reductions and increased supply necessitate selective CapEx from customers.

Geopolitical factors, such as recent U.S. tariffs and retaliatory tariffs, introduce significant market uncertainty and could lead to short- to mid-term demand destruction, particularly affecting the Production and Intervention segment. Intense competition from larger, more established players like SLB, Halliburton, and Baker Hughes, who possess greater scale and financial resources, creates pricing pressure and limits Weatherford's ability to gain significant market share. The company's commitment to defending margins suggests it will not chase market share without value, which could mean slower growth in a highly competitive environment.

Porter's Five Forces, Competition, and Competitive Advantage

Porter and Competitive Industry Position

Suppliers: 6/10 (Moderate Bargaining Power)

Suppliers to the oilfield services industry, particularly those providing specialized equipment, advanced materials, and critical components, can exert moderate bargaining power. While Weatherford's global scale and diversified operations allow for some negotiation leverage, the highly technical and often proprietary nature of certain inputs means that switching costs or limited alternative suppliers can grant suppliers a degree of influence over pricing and terms.Customers: 8/10 (High Bargaining Power)

Weatherford's customer base primarily consists of large national oil companies, international oil companies, and independent exploration and production firms. These customers are sophisticated, often operate on massive scales, and possess significant purchasing power. In periods of lower commodity prices or reduced capital expenditure, customers can demand more favorable terms, intensifying price competition among service providers. The trend towards shorter, spot-based LNG contracts further amplifies customer flexibility and bargaining strength.Barriers to Entry and Exit: 8/10 (High Barriers)

The oilfield services sector demands substantial capital investment in specialized equipment, advanced technology, and extensive research and development. Establishing a global operational network, building a skilled workforce, and complex regulatory environments create formidable barriers for new entrants. Furthermore, the specialized nature of assets and long-term contractual obligations can result in high exit barriers, making it difficult for companies to scale down or leave the market without significant costs.Competition: 9/10 (Very High Intensity)

The industry is dominated by a few large, integrated players such as SLB, Halliburton, and Baker Hughes, alongside numerous smaller, specialized firms. This creates a highly competitive environment where rivalry is intense, particularly during market downturns. Price competition is prevalent, and companies continuously invest in technology and operational efficiency to differentiate themselves. Weatherford's market share of approximately 2.19% in Q1 2025 shows its position as a smaller player relative to the market leaders, intensifying the competitive pressure it faces.Overall Comment: 31/50

The oil and gas equipment and services industry is mature and highly competitive, characterized by powerful customers and significant barriers to entry. This structure inherently limits the profitability potential for service providers and places consistent pressure on margins. Weatherford operates within this necessitating a sharp focus on operational efficiency, technological differentiation, and disciplined capital allocation to maintain and improve its competitive standing.

Key Competitors

Weatherford International operates in a highly competitive landscape. Its principal competitors include:

Market Shares

The oilfield services market is fragmented, with a few dominant players and numerous smaller participants. Weatherford holds a relatively modest share compared to the industry leaders.

Competitive Analysis of the Company

Weatherford's competitive strategy centers on its suite of services and its commitment to technological innovation and operational efficiency. While it does not command the market share of its larger rivals, its global presence across 75 countries and 335 operating locations provides a broad operational base. The company differentiates itself through specialized offerings like Managed Pressure Drilling, advanced wireline services, and a robust Well Construction and Completions portfolio, which are crucial for optimizing reservoir access and ensuring well integrity.

The strategic partnership with AWS is a significant move to enhance its digital capabilities aiming to modernize its software and hardware suite and improve operational efficiency for customers through data-driven decision-making. This digital transformation effort, including the development of its Unified Data Model and the WFRD Software Launchpad, positions Weatherford to offer more integrated and intelligent solutions. The company's focus on lean operations and cost optimization, evidenced by headcount reductions and working capital efficiency improvements, is essential for maintaining profitability in a cyclical market.

Sustainable Competitive Advantage

Weatherford's sustainable competitive advantage comes from its specialized technological expertise and its integrated service model. The company's ability to offer a full spectrum of services across the entire well lifecycle, from initial drilling to responsible abandonment, creates a degree of stickiness with customers who prefer comprehensive solutions over fragmented offerings. Its investments in proprietary technologies, such as advanced managed pressure drilling systems and digital solutions like ForeSite® and CygNet, provide capabilities that are difficult for smaller competitors to replicate and offer tangible value to operators through improved efficiency and production optimization.

The global operating footprint, built over decades, represents a significant barrier to entry for new players, as establishing such a network requires immense capital, logistical complexity, and local market understanding. While not as large as its top-tier competitors, Weatherford's scale still allows for economies of scope and some operational efficiencies that smaller, niche players cannot achieve. The ongoing digital transformation, particularly the AWS partnership, suggests a forward-looking approach to leverage data and cloud infrastructure, potentially creating a more agile and innovative service delivery model that could enhance its competitive edge over time.

Evaluation of Economic Moat

Weatherford's economic moat is primarily derived from switching costs and intangible assets (technology and intellectual property). The integrated nature of its services means that once an operator engages Weatherford for a phase of well development, switching to another provider for subsequent phases can involve significant disruption, compatibility issues, and retraining costs. This creates a degree of customer lock-in. The company's specialized tools and digital platforms, such as ForeSite® and CygNet, are embedded into customer workflows, further increasing the friction associated with switching.

The proprietary technologies and engineering expertise developed over decades constitute valuable intangible assets. These innovations, particularly in areas like managed pressure drilling and production optimization, are the result of substantial R&D investment and provide performance advantages that are not easily replicated. However, the moat is somewhat constrained by the intense competition within the oilfield services sector, where larger players also possess significant technological capabilities and global reach. While Weatherford's restructuring efforts have improved its financial health, the cyclical nature of the industry and the bargaining power of major customers mean that its moat, while present, is not as wide or impenetrable as those of some market leaders. The company's ability to maintain and expand this moat will depend on its continued investment in differentiated technology and its disciplined approach to operational efficiency.

Operational Overview

Products, Geographies, Segments, Market Share, Capacity

Reportable Segments:

Drilling and Evaluation (DRE): This segment provides services such as managed pressure drilling, drilling services (directional drilling, logging while drilling, measurement while drilling, rotary-steerable systems), wireline services, and drilling fluids. DRE focuses on optimizing reservoir access and productivity from early well planning to reservoir management. In Q1 2025, the DRE segment's adjusted EBITDA was $74 million, a decrease of 43% year-over-year, primarily due to lower activity, though partly offset by higher Drilling Services activity in the Middle East/North Africa/Asia region.

Well Construction and Completions (WCC): This segment offers products and services for well integrity assurance throughout the well's lifecycle. Key offerings include tubular running services, cementation products, completions tools (safety valves, production packers, multistage fracturing systems), liner hangers, and well services. WCC aims for safe and efficient services during the well construction phase. WCC revenue in Q1 2025 was $441 million, a decrease of 4% year-over-year and 13% sequentially, mainly due to lower activity in North America, Latin America, and Europe/Sub-Sahara Africa/Russia, partially offset by increased activity in the Middle East/North Africa/Asia.

Production and Intervention (PRI): PRI focuses on production optimization technologies, ranging from boosting productivity to responsible well abandonment. Its primary offerings include intervention services & drilling tools, artificial lift systems (reciprocating rod lift, gas-lift, hydraulic-lift), digital solutions (software, automation, flow measurement), sub-sea intervention, and pressure pumping services in select markets. This segment is particularly sensitive to U.S. tariffs and retaliatory tariffs, which could cause short- to mid-term demand destruction, especially for artificial lift products.

Geographies:

Weatherford conducts business in approximately 75 countries, with 335 operating locations. The company's geographical revenue breakdown indicates that the Middle East/North Africa/Asia region was the largest contributor to revenue in the last fiscal year (likely 2024), bringing in $1.57 billion. Recent market conditions have shown significant regional variations:

Mexico: Activity levels declined sharply in Q1 2025, expected to be down around 60% year-over-year, worse than previous forecasts. However, the company anticipates activity to stabilize or potentially uptick later in the year or into 2026.

North America: Continued a downward trend, down 4% sequentially in Q1 2025.

Europe: Softened in Q1 2025 due to operator cutbacks in the U.K. amidst an unfavorable policy environment.

Middle East & Asia: Demonstrated resilience and stability, showing year-on-year growth in Q1 2025, validating the company's confidence in these regions. Countries like Thailand, Malaysia, Indonesia, and India are driving activity based on domestic needs.

Deepwater Brazil: Weatherford successfully installed its first OptiROSS RFID Multi-Cycle Sliding Sleeve Valve for Petrobras, highlighting success in complex deepwater operations.

Offshore: The company sees significant positivity in the offshore segment looking into 2026 and 2027.

Market Share:

As indicated in the "Market Shares" table, Weatherford holds a relatively small market share (2.19% in Q1 2025) compared to major competitors in the broader oilfield services sector.

Capacity:

While specific capacity utilization rates are not detailed, the company's Q1 2025 earnings call highlighted efforts to adapt its cost structure and reduce headcount (over 1,000 since Q3 2024) in response to lower activity levels and to minimize decrementals. This suggests a proactive approach to align operational capacity with prevailing market demand. Weatherford's expanded credit facility to $680 million in Q1 2024, with $371 million of borrowing capacity, provides financial flexibility to manage operations and potential investments.

Industry Overview

Sector Description:

The sector provides specialized equipment, technology, and services essential for the exploration, drilling, completion, production, and abandonment of oil and natural gas wells. This includes everything from advanced drilling tools and managed pressure systems to production optimization software and well intervention services. The industry is capital-intensive and highly reliant on the capital expenditure cycles of oil and gas producers.

Market Structure:

The market structure is characterized by a few large, integrated service providers (e.g., SLB, Halliburton, Baker Hughes) with global reach and a broad portfolio, alongside numerous smaller, specialized companies. Weatherford falls into the latter category, albeit with a significant global footprint. The industry's customers, primarily national oil companies (NOCs), international oil companies, and independent producers, wield considerable bargaining power due to their scale and the commoditized nature of some services.

Trends:

Moderating Energy Transition: While the long-term shift towards cleaner energy continues, there is a growing acknowledgment of the enduring importance of oil and gas. Major industry players like BP and Equinor have publicly adjusted their strategies, scaling back previous ambitions in renewables to refocus on traditional oil and gas production. The International Energy Agency (IEA) forecasts continued global oil and gas demand growth until at least 2030, followed by a prolonged period of only modest decline. This indicates a more pragmatic, extended role for hydrocarbons than previously anticipated by some.

Reserve Replenishment and M&A: A critical challenge for hydrocarbon companies in 2025 is maintaining and replenishing reserves. This drives both traditional exploration in regions like Africa’s Atlantic Margin and the Mediterranean, and an increasing reliance on mergers and acquisitions (M&A) as a strategic shortcut due to the high costs and risks of exploration. The M&A landscape is shifting towards smaller, more strategic acquisitions, particularly in the mid-market, as companies seek scale and portfolio optimization. US independent companies are increasingly looking beyond North America to South America, the Middle East, and Africa for growth opportunities. Significant Gulf of Mexico projects commencing production in 2025 could also stimulate regional M&A activity.

Access to Capital: Access to traditional forms of financing, such as public equity markets and reserve-based lending, remains challenging for many companies in the sector. This has led to a diversification of funding sources, with private credit institutions, family offices, and hedge funds becoming progressively more influential. Banks in the Middle East and Africa are also stepping into the traditional lending space previously dominated by Western banks.

Resurgence of National Oil Companies (NOCs): NOCs, particularly from the Middle East, China, and other emerging markets, are experiencing a renaissance. They are expanding internationally, pursuing acquisitions and strategic partnerships to boost reserves and market influence. Beyond traditional oil and gas projects, NOCs are also diversifying into low-carbon technologies like renewables and carbon capture and storage.

Strategic Joint Ventures: Incorporated joint ventures are becoming a common strategy for companies to optimize portfolios, share risks, and unlock value from non-core assets. This trend extends to smaller, more localized joint ventures in domestic markets, and innovative structures like 'co-buyer' arrangements to reduce upfront costs.

LNG Market Globalization: Rising demand from Asia, Europe, and other regions is globalizing the LNG market. US LNG exports are crucial, and LNG continues to be viewed as a cleaner alternative. Companies are seeking greater flexibility in contracts, with short-term, spot-based sales agreements increasingly replacing long-term commitments. Floating LNG technologies are gaining traction, and countries like Guyana, Suriname, and Argentina are emerging as key players.

Shale Expansion: Shale oil and gas production is expanding into new regions beyond North America, including Saudi Arabia’s Jafurah Basin, Australia (Beetaloo/McArthur Basin), Argentina (Vaca Muerta), and Algeria, attracting international investment.

US Regulatory Environment: A potential new US administration advocating for 'drill, baby, drill' policies could lead to fewer regulatory restrictions and faster approvals for infrastructure projects, benefiting the domestic oil and gas industry. However, a more nationalistic 'America First' agenda could complicate the investment landscape for international companies.

Revenue Trends & Drivers, Margins, and Profitability

Revenue Trends

Overall Trends:

Weatherford's revenue trends reflect the cyclical nature of the oil and gas industry and the company's efforts to navigate market fluctuations. Full-year revenue for 2023 was $5,135 million, a 19% increase from 2022, driven by a 26% international revenue growth. However, the Q1 2025 results indicated a significant downturn, with revenue of $1,193 million, a decrease of 12% year-over-year and 11% sequentially. This decline was attributed to a softening international market, a sharp drop in activity in Mexico (down approximately 60% year-over-year), a continued downtrend in North America (down 4% sequentially), and softening in Europe due to operator cutbacks. Despite these headwinds, the Middle East and Asia regions showed resilience and year-on-year growth. The company anticipates full-year 2025 revenues to be in the range of $4.6 billion to $5 billion, reflecting a scaled-back outlook due to market expectations and recent divestments.

Volumes:

While specific volume data is not provided, the revenue declines in Q1 2025 directly correlate with lower activity levels in key regions. The company's Q1 2025 earnings call explicitly mentioned "lower revenues, project startup costs and a partially under-absorbed headcount" as factors impacting margins, indicating that reduced activity volumes were a primary driver. The divestment of the Argentina Pressure Pumping and Wireline businesses in Q1 2025 also contributes to a reduction in overall activity and revenue volumes, aligning with a strategy to focus on differentiated product lines and improve portfolio quality.

Product/Services Mix:

Weatherford's revenue is generated across its three segments: Drilling and Evaluation (DRE), Well Construction and Completions (WCC), and Production and Intervention (PRI). In Q1 2025, WCC revenue was $441 million, experiencing a decline across most geographies, while DRE adjusted EBITDA decreased significantly due to lower activity. The company's strategic focus on digital solutions, particularly in production optimization, and P&A services suggests a deliberate shift towards less capital-intensive, technology-focused offerings that are expected to yield higher returns and provide growth prospects even in challenging markets. This portfolio optimization aims to enhance the overall product mix towards higher-value, differentiated services.

Pricing:

Lower commodity prices have led to caution and a slowdown in customer spending, which typically translates into increased pricing pressure within the oilfield services sector. The company's Q1 2025 earnings call emphasized that it "will not chase market share without value," indicating a commitment to defending its margins even if it means sacrificing some top-line growth. This suggests a disciplined approach to pricing, prioritizing profitability over market share gains in a competitive environment.

Margins and ROCE analysis

Summary of Cost Structure:

Weatherford has been actively managing its cost structure to adapt to market conditions. The company has implemented a multi-year cost optimization program focused on sustainable productivity gains through technology and lean processes, beyond mere headcount adjustments. Since Q3 2024, headcount has been reduced by over 1,000, leading to annualized personnel expenses being down by over $100 million. The company's modernized fulfillment network, consolidated facilities, and nimble supply chain contribute to a more scalable cost structure.

COGS & Gross Margins:

While specific COGS figures are not provided in detail, the overall profitability metrics indicate pressure on gross margins. Gross profit margin for 2025 FQ1 LTM was 32.11%. The decline in adjusted EBITDA margins in Q1 2025 (to 21.2% from 24.7% year-over-year) was directly impacted by lower revenues, project startup costs, and partially under-absorbed headcount, which suggests that the cost of goods sold and direct operational expenses were not able to scale down proportionally with the revenue decline.

OPEX & Operating Margin:

Operating income in Q1 2025 was $142 million, a significant decrease of 39% year-over-year and 28% sequentially. This indicates that operating expenses, while being managed through cost optimization programs, still faced challenges in a rapidly declining revenue environment. The company's stated goal is to minimize decrementals, which implies a strong focus on controlling operating expenses as revenues fall. Operating margin for 2025 FQ1 LTM was 16.22%.

Miscellaneous

Management

Profiles:

Girishchandra K. Saligram (President and CEO): Appointed in October 2020. Prior to Weatherford, he served as COO and President for Global Services of Exterran Corporation. His background includes 12 years with GE Healthcare in engineering, services, operations, and commercial roles. He emphasizes maintaining a strong balance sheet and ensuring sufficient liquidity, with the dividend being "sacrosanct".

Charles M. Sledge (Chairman of the Board): Has been Chairman since June 2020 and a Director since December 2019. He previously served as CFO of Cameron International Corporation.

Anuj Dhruv (Executive Vice President and Chief Financial Officer): Welcomed in January 2023, bringing over two decades of experience in global finance, strategy, and transformation across technology, energy, and chemicals industries.

Desmond J. Mills (Senior VP & Chief Accounting Officer): Senior VP and Chief Accounting Officer since 2021.

Scott C. Weatherholt (Executive VP, General Counsel & Chief Compliance Officer): Executive VP, General Counsel, and Chief Compliance Officer since 2020.

Capital Allocation History:

Weatherford has demonstrated a disciplined approach to capital allocation, particularly since its emergence from Chapter 11 bankruptcy.

Debt Reduction: The company significantly reduced its outstanding funded debt by approximately $6.2 billion after its Chapter 11 restructuring in 2019. More recently, it reduced gross debt by an additional $1 billion. In Q1 2025, it repurchased $34 million of its 8.625% Senior Notes due 2030, and in earlier quarters, it repurchased significant amounts of its 6.5% Senior Secured Notes ($75 million in Q4 2023 and $151 million in January 2024, $167 million in Q1 2024).

Dividends: Weatherford has consistently paid quarterly dividends of $0.25 per share, with an annualized dividend of $1.00. Management views the dividend as sustainable, even in a down-market.

Share Buybacks: The company has actively engaged in share repurchases, buying back approximately $152 million worth of shares over the past three quarters, including about $53 million in Q1 2025. It operates under a $500 million authorization for buybacks.

Credit Facilities: The credit facility was expanded to $680 million in Q1 2024, with $371 million in borrowing capacity, providing enhanced liquidity and financial flexibility.

Divestitures: In Q1 2025, Weatherford divested its Argentina Pressure Pumping and Argentina Wireline businesses. These divestitures are part of a broader portfolio optimization strategy to focus on differentiated product lines and improve portfolio quality, with proceeds potentially used to high-grade the portfolio or return cash to shareholders.

Acquisitions: The company acquired Datagration Solutions Inc. on September 3, 2024, indicating a strategic focus on integrating advanced digital solutions.

Management Ownership and Director Dealings:

Individual insiders hold approximately 2.12% of Weatherford's stock. Over the past three months, insider activity has shown net buying, suggesting a positive outlook from within the company. Notably, Independent Director Neal P. Goldman made significant share purchases on April 24, 2025, totaling over $500,000. Conversely, several executives, including the CFO, Chief Accounting Officer, and CEO, engaged in sell transactions in January and February 2025, primarily for tax-related purposes or option/award related, rather than indicating a lack of confidence in the company's prospects. For example, CEO Girish Saligram sold substantial amounts in early 2025 due to tax-related reasons.

IPO

Weatherford International plc was incorporated in 1972. However, the company underwent a significant financial restructuring, filing for Chapter 11 bankruptcy in July 2019 and emerging in December 2019. This event effectively reset its capital structure and share base. The stock performance history prior to this restructuring showed a dramatic decline, with shares trading at cents before the bankruptcy. Post-emergence, the company's shares traded at significantly higher levels, reflecting a new financial foundation with reduced debt and improved liquidity. Therefore, while not a traditional IPO, the emergence from Chapter 11 served as a re-listing with a fundamentally altered financial profile.

Valuation, Reverse Thesis, and Conclusion

Valuation & Margin of Safety

Weatherford International's valuation metrics suggest the stock may be trading below its intrinsic value. As of Q1 2025 LTM, the company's P/E ratio stands at 8.61x, which is notably lower than the average P/E ratio of 13.3x for its peers, as indicated by some analyses. This disparity suggests a potential undervaluation relative to its direct competitors. Another perspective indicated a projected fair value of $127 based on a 2-Stage Free Cash Flow to Equity model, suggesting the stock was potentially 29% undervalued relative to its then-current share price of $89.70.

The average analyst price target for WFRD is around $145, which is significantly above the current share price and even above some fair value estimates, implying substantial upside potential. The company's strong adjusted free cash flow generation of $66 million in Q1 2025 and its commitment to increasing free cash flow conversion for the full year 2025 provide a solid foundation for future valuation. The net leverage ratio of 0.5 times also points to a healthy balance sheet, reducing financial risk and potentially supporting a higher valuation multiple. While the Goldman Sachs downgrade in December 2024 to Neutral with a target of $98 (down from $132) introduced caution, it also acknowledged the potential for "value accretion to the equity from the continued pay down of debt". This suggests that even with a more conservative view, there remains a recognized path for value creation. The collective sentiment from multiple analysts highlighting the stock as "too cheap to ignore" reinforces the argument for a margin of safety at current levels.

Reverse Thesis

A reverse thesis for Weatherford International would posit that the stock's current valuation accurately reflects, or even overstates, its true potential, and that any perceived undervaluation is a mirage. This argument would rest on several points:

First, the continued softening of the international oil and gas market, particularly the sharp declines in Mexico and Europe, coupled with persistent downtrends in North America, could lead to further revenue and margin compression beyond current expectations. The company's own scaled-back outlook for 2025 revenues ($4.6 billion to $5 billion) and the cautious tone from management regarding a potential "broad-based slowdown in the second half of the year" if global trade reductions and increased supply persist, suggest that the industry headwinds are more severe or prolonged than some bullish analysts anticipate.

Second, while Weatherford has made significant strides in deleveraging, the cyclical nature of the energy services sector means that financial stability can quickly erode during prolonged downturns. The restructuring and severance charge taken in Q1 2025, alongside the impact on adjusted EBITDA margins from lower revenues and under-absorbed headcount, indicates that cost structures, despite optimization efforts, may still be too rigid to fully adapt to rapid market contractions. The company's relatively smaller market share compared to industry giants could also limit its ability to compete effectively on price or secure large, long-term contracts in a highly competitive environment, particularly if it maintains its stance of not chasing market share without value.

Finally, the long-term threat of the energy transition, even if its pace is moderating, could eventually lead to structural declines in demand for traditional oilfield services. While Weatherford is investing in digital solutions and new energy platforms, the transition might accelerate unexpectedly, or the returns from these new ventures may not materialize quickly enough to offset declines in its core business. The stock's performance from July 2024 to April 2025, showing a significant decline, could be interpreted as the market correctly pricing in these fundamental challenges, and the subsequent modest recovery as merely a technical rebound or a temporary overreaction to positive news like the AWS partnership, rather than a sustained shift in underlying value.

Conclusion

Weatherford International plc is navigating a complex and challenging period within the global energy services sector. The company's stock performance from July 2024 to July 2025 reflects a significant downturn driven by softening market conditions and an analyst downgrade in late 2024. However, the subsequent stabilization and modest recovery from April 2025 onwards point to a re-evaluation of its investment potential, fueled by disciplined financial management, strategic digital initiatives, and a growing sentiment of undervaluation among some market observers.

Weatherford's core strengths lie in its comprehensive service portfolio, extensive global footprint, and a demonstrable commitment to financial deleveraging and free cash flow generation. The strategic partnership with AWS represents a forward-looking step towards enhancing operational efficiency and technological differentiation, which is crucial for long-term competitiveness. While the company faces persistent weaknesses from market cyclicality and intense competition, its proactive cost optimization programs and focus on higher-value offerings like digital solutions and P&A services position it to capitalize on emerging opportunities.

The valuation analysis suggests that Weatherford may indeed be trading at a discount relative to its peers and intrinsic value estimates, offering a potential margin of safety for investors. However, the prevailing market headwinds, including lower commodity prices and regional activity slowdowns, present real risks that could temper the pace of recovery. The industry's evolving landscape, marked by the ongoing energy transition and shifts in capital access, demands continuous adaptation and strategic agility.

Given the mixed signals—a strong balance sheet and strategic vision juxtaposed with a challenging operating environment—Weatherford International warrants close monitoring. The company's ability to execute its strategic priorities, particularly in expanding its digital footprint and maintaining cost discipline amidst market volatility, will be critical in determining its trajectory. For investors with a long-term horizon and a tolerance for the cyclical nature of the energy sector, Weatherford could offer a compelling opportunity as market conditions stabilize and its strategic initiatives bear fruit.

If you enjoyed this post, consider subscribing to the Small Cap Strategist.

Disclaimer: This post is for informational and educational purposes only and should not be considered investment advice. The author is not a financial advisor. All investment decisions carry risk, and readers should consult with a qualified financial professional before making any investment choices. The author may or may not hold positions in the securities discussed.