DON'T BUY Zeta (NYSE:ZETA)

Zeta started appearing all over the finance community, so we decided to look into the fundamentals to provide an real view into the stock.

Welcome to The Small Cap Strategist. Our mission is to look past the obvious mega-caps and uncover the high-growth, under-the-radar companies poised to dominate their niches. Today, we're applying that lens to Zeta Global Holdings Corp. (NYSE: ZETA), a company building a position in the AI-powered marketing cloud.

We’ve done multiple deep dives in very undervalued companies. Our three most recent ones are these:

You might think this sector is just about global giants like Salesforce Marketing Cloud or Adobe Marketo Engage. But the real story for a strategist lies in the industry's structure. It's a landscape defined by rapid data evolution, the transformative power of Generative AI, and a constant drive for measurable return on investment, the perfect ground for identifying future winners and strategic acquisition targets.

Inside this post you will find:

Company Overview: A deep dive into Zeta's unique Data Cloud, AI Engine, and Omnichannel Engagement model, including its core products: ZMP, ESP, CDP+, DSP, and the Agile Intelligence suite.

Investment Case & Competitive Dynamics: A thorough examination of Zeta's strengths, weaknesses, opportunities, threats, and its position within the competitive marketing technology landscape through the lens of Porter's Five Forces.

Operational & Industry Insights: An overview of Zeta's products, geographies, customer segments, growth strategies, and the broader trends shaping the consumer intelligence and marketing automation industry.

Financial Performance & Profitability: An analysis of revenue trends, drivers, margins, and profitability, alongside key financial ratios.

Management & Capital Allocation: Profiles of key management, insights into their capital allocation history, and management ownership.

Valuation & Outlook: Our take on Zeta's valuation, potential risks (reverse thesis), and the overall investment conclusion.

If you want to build a portfolio of unique, high-conviction ideas and gain an edge by understanding the powerful forces shaping global markets, subscribe to The Small Cap Strategist and join a community of discerning investors.

“I just want a brief summary I don’t have the time to read everything right now”:

Zeta Global Holdings Corp. presents a compelling investment case as an AI-powered marketing cloud company operating in a high-growth, essential sector. The company's core strengths lie in its massive, proprietary data set, sophisticated AI engine, comprehensive omnichannel platform, and robust intellectual property portfolio. These elements collectively form a strong economic moat, characterized by a powerful data advantage, high customer switching costs, and emerging network effects. The consistent and accelerating revenue growth, coupled with a clear trend of improving operating margins (EBITDA and EBIT moving towards positive), suggests that Zeta is on a credible path to sustained profitability, as reflected in its positive Next Twelve Months PE multiple.

Despite the risks, the company's strategic alignment with critical industry trends like AI integration and the shift to first-party data, positions Zeta favorably. The current market price may offer a valuable entry point for investors who believe in the company's ability to execute its growth strategies, continue its path to profitability, and leverage its unique data and AI capabilities to capture a larger share of the digital marketing spend. The company's focus on large, scaled enterprise customers provides a stable revenue base from which to grow. For those willing to accept the inherent risks of a company still scaling to consistent net profitability, Zeta Global Holdings Corp. represents an interesting opportunity in the dynamic MarTech space.

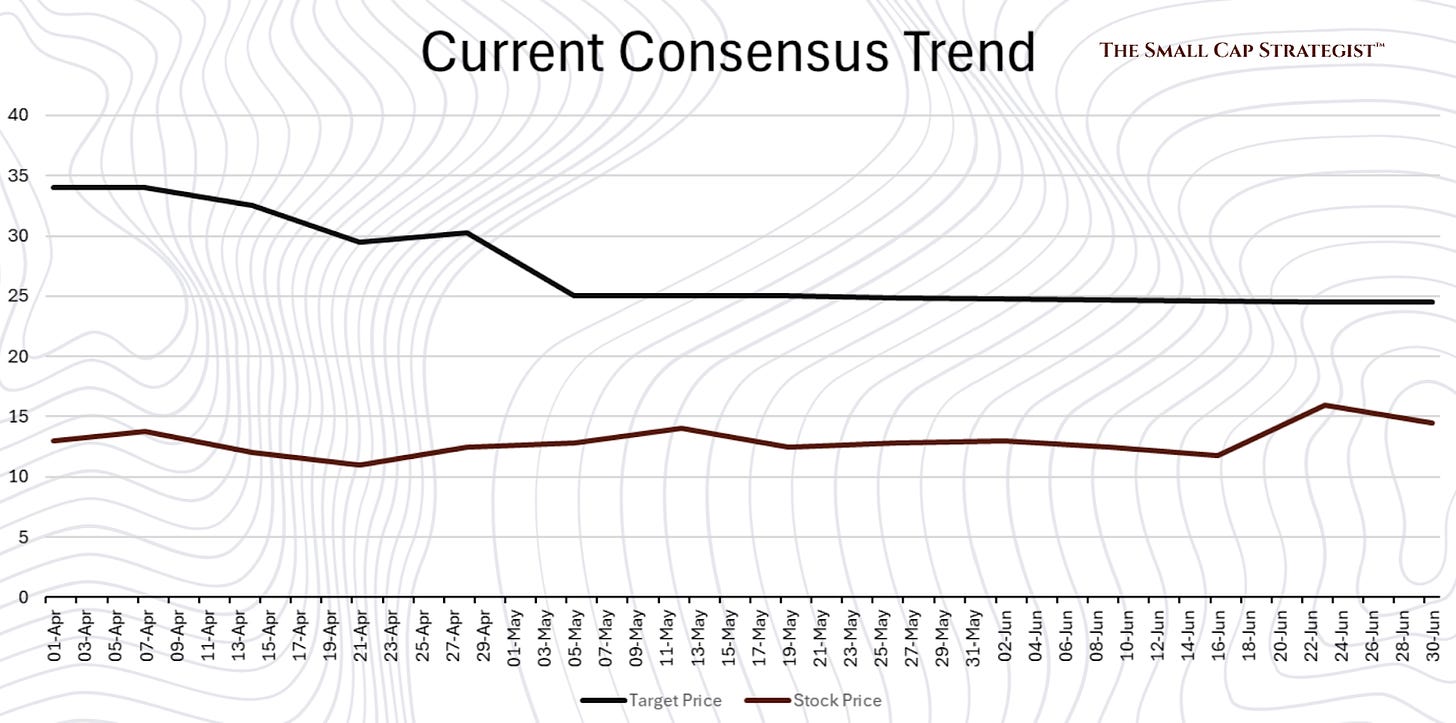

So what’s the hype of Zeta? Zeta Global Holdings Corp. currently holds an "Outperform" consensus recommendation, scoring 1.84 on a scale where 1 signifies a strong Buy. The average analyst target price stands at $25.33, with projections reaching as high as $44.00 and a low of $15.00. This average target price implies a substantial potential upside of 67.66% from the last delayed trading price of $15.58. The broader industry sentiment for the software sector is also notably positive, with a consensus "Buy" rating of 1.00.

A notable divergence exists between the consensus target price and the actual stock performance. The "Current Consensus Trend" chart illustrates that Zeta's stock price has consistently traded below the analyst target price since late April or early May. Furthermore, the stock's 52-week range, spanning from a high of $38.20 to a low of $10.69, shows the current price positioned closer to the lower end of this spectrum. This indicates that while the analytical community maintains a positive long-term view, the market's recent valuation of Zeta has not mirrored this optimism. This warrants a thorough examination of potential weaknesses and threats that might be influencing market sentiment.

Investment Case

Strengths

Zeta Global Holdings Corp. operates an omnichannel, data-driven cloud platform, the Zeta Marketing Platform (ZMP), which is fundamentally powered by artificial intelligence. This platform leverages Generative AI (GenAI), machine learning (ML), natural language processing (NLP), and predictive AI to process billions of structured and unstructured data signals, enabling personalized marketing across diverse channels like email, social media, web, chat, Connected TV (CTV), and video. This deep integration of AI across its offerings is a core competitive advantage.

A significant strength lies in Zeta's proprietary data set, which serves as the foundation for its AI engine. This extensive data set encompasses over 245 million individuals in the U.S. and more than 535 million globally, with an average of over 2,500 attributes per individual. The recent integration of LiveIntent’s identity graph further strengthens this data foundation, enhancing first-party identity resolution and deterministic targeting. The company ingests over one trillion content consumption signals monthly, synthesizing this into hundreds of intent-based audiences, which is a massive scale of data processing. This unparalleled data scale and depth provide a distinct advantage in predicting consumer intent and optimizing marketing outcomes.

The company offers a comprehensive product suite within the ZMP, including Zeta Messaging (ESP), Zeta CDP+, Zeta DSP, and the Agile Intelligence suite. These integrated offerings allow enterprises to manage customer relationships end-to-end, from data management and messaging to paid media activation and real-time intelligence. This integrated approach simplifies marketing operations for customers, incentivizing them to consolidate their marketing spend on Zeta's platform and enter long-term contractual commitments.

Zeta has a strong customer base, working with prominent enterprises across various industry verticals such as consumer & retail, insurance, telecommunications, financial services, and business services. In 2024, 98% of its revenue was derived from "scaled customers," indicating a focus on large, recurring enterprise relationships. This concentration on larger clients suggests stable revenue streams and potential for expansion within existing accounts.

The company has invested significantly in intellectual property, holding a patent portfolio of over 130 U.S. and international patents and applications. This includes 29 granted patents and 34 pending applications specifically covering machine learning and artificial intelligence, focusing on predictive personalization, outcome forecasting, and GenAI. This IP portfolio protects its technological innovations and reinforces its competitive position.

Furthermore, Zeta has dedicated substantial resources to building customer trust by strengthening data privacy, security, and AI governance within its platform. This includes enhanced identity security protocols, AI-driven compliance monitoring, and advanced consent management capabilities, which are crucial in an era of evolving privacy regulations like GDPR and UK GDPR. This proactive approach to compliance and security enhances its appeal to large enterprises.

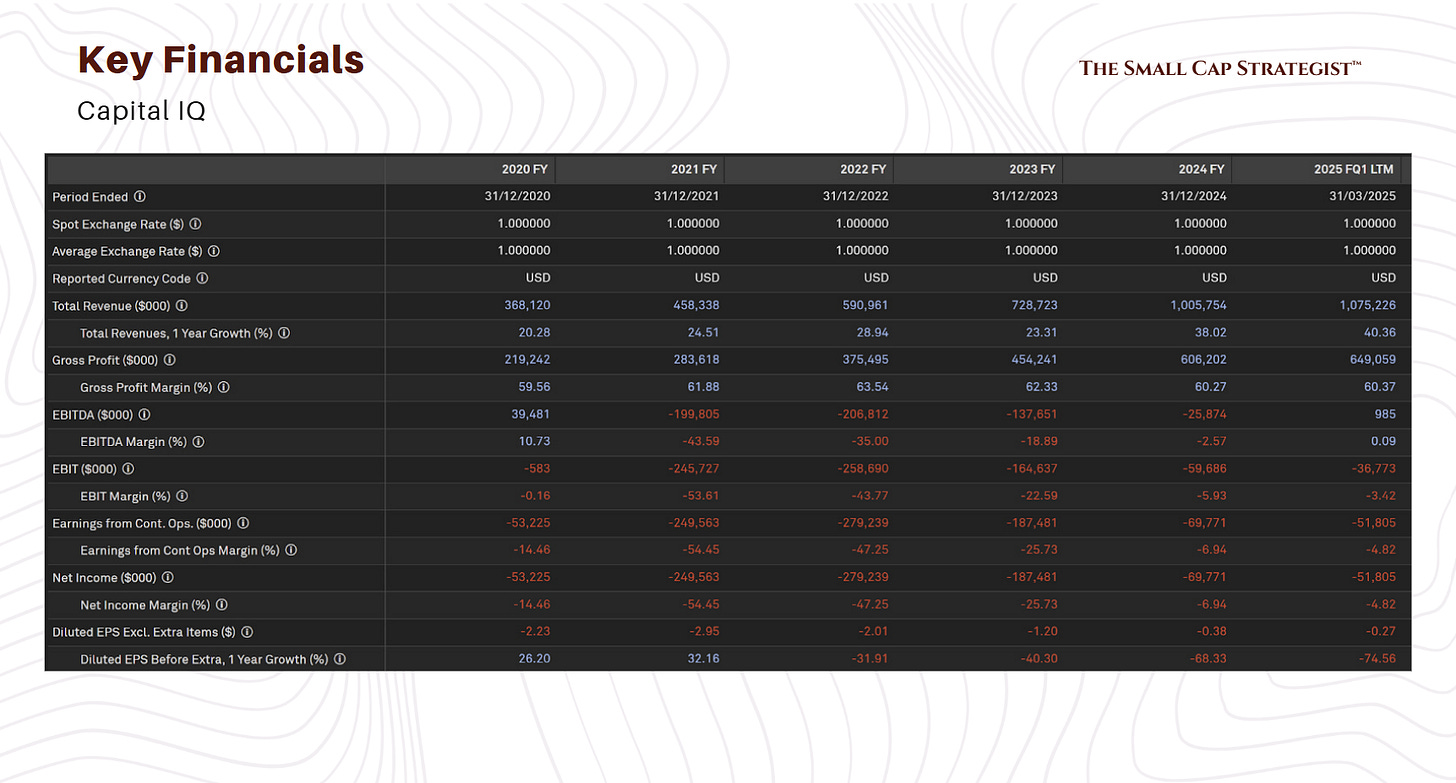

Financially, while the company has historically been unprofitable, it demonstrates a clear trajectory towards profitability. EBITDA, EBIT, and Net Income margins over recent years have been improving. For instance, the EBITDA margin improved from -43.59% in 2021 to 0.09% in the LTM Q1 2025 period, and the Net Income margin improved from -54.95% to -4.87% over the same period. This consistent upward trend in profitability metrics, coupled with consistently high gross margins around 60-63%, indicates strong underlying unit economics and operational leverage as the company scales.

Weaknesses

Despite the positive trajectory, Zeta Global Holdings Corp. remains unprofitable on a net income basis for the fiscal year 2024. While the company is showing significant progress towards profitability, as indicated by its positive Next Twelve Months (NTM) P/E ratio, the current unprofitability requires continued discipline and scale to achieve sustained positive net earnings.

A significant area of concern for potential investors is the observed pattern of insider selling. Over the last three months, insiders have net sold 4,240,263 shares, and over the past twelve months, this figure expands to 8,925,273 net shares sold. While insider selling can occur for various personal reasons, such as diversification or liquidity, a consistent pattern of substantial net selling by those with the deepest knowledge of the company's operations and prospects is usually interpreted as a signal of a lack of confidence in the stock's near-term appreciation or future outlook. This activity warrants close monitoring.

The disparity between analyst optimism and the stock's actual price performance also represents a weakness. Despite a consensus "Outperform" rating and a significant target price upside, the stock price has consistently traded below analyst targets and is currently near its 52-week low.

Furthermore, while the focus on large enterprise customers is a strength in terms of revenue stability, it also introduces a concentration risk. A significant portion of Zeta's revenue is derived from a relatively small number of scaled and super-scaled customers. The loss of a few key enterprise clients, or a reduction in their marketing spend, could have a disproportionately large impact on Zeta's overall revenue and financial performance.

Opportunities

Zeta Global Holdings Corp. has significant opportunities for continued growth, primarily by further penetrating its existing customer base. The company's platform is designed to create a "flywheel effect," where customer success motivates increased platform usage, leading to accelerated revenue growth. This inherent stickiness and the ability to expand within existing accounts by incentivizing customers to allocate a larger percentage of their marketing budgets to the platform represent a substantial growth avenue.

Acquiring new scaled customers remains a core growth strategy. Given Zeta's proven ability to serve large enterprises across diverse verticals, there is room to onboard additional major clients who are seeking advanced, AI-powered marketing solutions to enhance their consumer engagement and ROI. The company's expansion into the AWS Marketplace, making the Zeta Marketing Platform available to over 300,000 active AWS customers, is a strategic move to broaden its reach and acquire new customers more efficiently.

Continuous innovation and the development of new products are critical for Zeta's long-term success. The ZMP's flexible, service-oriented architecture is designed to support evolving AI-powered marketing use cases and facilitate rapid development of new solutions. This adaptability allows Zeta to stay ahead of market demands and capitalize on emerging trends in digital marketing and AI, ensuring its offerings remain cutting-edge and relevant.

Collaborations, such as the expanded partnership with Amazon Web Services validates Zeta's technology and can lead to co-selling opportunities, boosting market presence.

Threats

The marketing technology industry is characterized by intense competition, posing a significant threat to Zeta Global Holdings Corp.'s market position. The industry includes many firms, from large, integrated marketing cloud providers like Salesforce Marketing Cloud and Adobe Marketo Engage, to specialized solutions such as Mailchimp and HubSpot Marketing Hub. This crowded field means Zeta must continuously innovate and differentiate its offerings to maintain and grow its market share. The competitive pressure can lead to pricing pressures, increased marketing expenses, and challenges in customer acquisition and retention.

Evolving data privacy and security laws represent a substantial and ongoing threat. Regulations such as the General Data Protection Regulation (GDPR) in Europe and the UK GDPR continue to raise questions about their application to third-party marketing technology companies like Zeta. These regulations can restrict the collection, processing, and use of consumer data, which is at the core of Zeta's platform. Non-compliance could result in hefty fines, reputational damage, and a loss of customer trust. While Zeta has invested heavily in compliance and consent management, the dynamic nature of these laws requires constant vigilance and adaptation, potentially increasing operational costs and limiting certain data-driven capabilities.

The rapid pace of technological advancement in AI and machine learning also presents a threat of obsolescence. While Zeta prides itself on its AI engine and patented technologies, the whole AI industry is changing at an unprecedented rate. If new AI models or approaches emerge that significantly outperform Zeta's proprietary algorithms, or if competitors develop more advanced solutions, Zeta could face challenges in maintaining its technological edge and delivering superior customer outcomes.

Future acquisitions, while potentially offering growth, will continue to carry the typical integration risks.

Porter, Competition, and Competitive Advantage

Competitive Analysis of the Company

Sustainable Competitive Advantage

Zeta Global's sustainable competitive advantage is primarily rooted in three interconnected pillars: its proprietary data set, its advanced AI engine, and its omnichannel integration capabilities, all reinforced by a strong intellectual property portfolio.

The company's proprietary data set is a valuable asset. With profiles for over 245 million individuals in the U.S. and more than 535 million globally, enriched by over 2,500 attributes per individual. The continuous ingestion of over one trillion content consumption signals monthly, synthesized into hundreds of intent-based audiences, creates a dynamic and self-improving data asset. The acquisition and integration of LiveIntent’s authenticated identity graph further solidifies this foundation, enabling superior first-party identity resolution and deterministic targeting in a privacy-compliant manner. This continuously updated and proprietary data set is exceedingly difficult and costly for competitors to replicate.

Zeta's AI engine is intrinsically linked to and powered by this unique data. The extensive application of Generative AI, machine learning, natural language processing, and predictive AI allows the ZMP to seamlessly collect and analyze vast amounts of structured and unstructured data, predict consumer intent, personalize content, and optimize marketing performance across all channels. The ability to create GenAI agents and workflows for automation, and to use GenAI for campaign creation and analytics, demonstrates a sophisticated and forward-looking approach to AI integration.

The omnichannel engagement capability, allowing integrated access to a wide range of inventory and data sources and third-party services within a single platform, ensures that customers can deploy targeted marketing programs across all addressable channels. This single-platform approach for cross-channel marketing is a key differentiator, enabling brands to connect with modern consumers across multiple devices and platforms.

Zeta's intellectual property portfolio, comprising over 130 patents and applications, with a strong focus on AI and machine learning, provides legal protection for its innovations. These patents cover critical aspects like predictive personalization and GenAI applications, making it harder for competitors to directly imitate its core functionalities.

Evaluation of Economic Moat

Zeta Global Holdings appears to possess a Wide Economic Moat, primarily driven by its Data Moat and High Switching Costs, supported by Intangible Assets and emerging Network Effects.

The Data Moat is exceptionally strong. The sheer scale and proprietary nature of Zeta’s data set, combined with its continuous ingestion of trillions of signals and the integration of LiveIntent’s identity graph, creates a powerful competitive barrier. It is nearly impossible for new entrants or even many established competitors to amass and effectively leverage a comparable data asset.

High Switching Costs are evident in Zeta's enterprise-focused model. The ZMP acts as a "system of record" for customer data and integrates deeply into their marketing workflows. Adapting to custom data schemas, providing end-to-end omnichannel capabilities, and offering long-term contractual commitments mean that migrating from Zeta's platform would be time-consuming and costly for enterprises, leading to significant operational disruption and potential data loss. This inherent stickiness ensures customer retention and recurring revenue.

Patents protect core technological innovations, preventing competitors from easily replicating its proprietary algorithms for personalization, forecasting, and GenAI applications. The company's focus on data privacy and AI governance also contributes to its brand reputation and trust among enterprise clients, which is an intangible asset in a privacy-sensitive market.

While not as pronounced as the data moat, Network Effects are emerging, particularly with the LiveIntent integration. Expanding Zeta's identity graph and publisher network through LiveIntent enhances the value proposition for all users, as more data sources and channels lead to improved targeting precision and campaign performance. This creates a positive feedback loop where increased adoption by publishers and advertisers makes the platform more valuable for everyone.

Operational Overview

Zeta Global Holdings Corp. operates an omnichannel data-driven cloud platform, the Zeta Marketing Platform (ZMP), designed to help enterprises acquire, grow, and retain consumer relationships.

Products, Geographies, Segments, Market Share, Capacity

Products: The ZMP is the core offering, built on four pillars: Zeta’s Data Set, AI Engine, Omnichannel Engagement, and Performance Optimization. It comprises three core products with modular capabilities:

Messaging (ESP): Zeta Messaging provides AI-powered omnichannel messaging, enabling segmentation, campaign automation, and individualized experiences across email, mobile, and social channels. It uses intelligence tools to expand customer knowledge with purchase behavior, preferences, and predictive intent.

Data Management (CDP+): Zeta CDP+ serves as a system of record for all consumer information, delivering a single, actionable view of customers and prospects. Enhanced by LiveIntent’s identity graph, it improves identity resolution and activates individualized experiences across channels, unifying deterministic and probabilistic identity matching.

Activation (DSP): Zeta’s DSP maximizes paid media effectiveness by engaging audiences with precision and efficiency. It incorporates LiveIntent’s publisher network, minimizing reliance on third-party cookies, and provides AI-driven attribution and real-time media optimization across desktop, mobile, CTV, and social channels.

Intelligence (Agile Intelligence): This suite synthesizes behavioral signals into intent-based scores, accessible through five product modules: MarketPulse, CustomerPulse, DMAPulse, AudiencePulse, and CompetitorPulse. These modules provide real-time, actionable insights for market, customer, prospect, competitor, and location intelligence, aiding in growth strategies. The Agile Intelligence suite is offered for a licensing fee and/or an incremental fee based on ZMP utilization.

Geographies: Zeta Global operates in the United States and internationally. Its headquarters are in New York City, with 15 offices worldwide across 11 countries, including key locations like Silicon Valley, London, Chennai, and Hyderabad in India.

Segments: The company works with large enterprises across a diverse range of industry verticals. For the year ended December 31, 2024, its revenue breakdown by segment was: consumer & retail (22%), insurance (10%), telecommunications (9%), financial services (8%), and business services (7%). This diversification across industries reduces concentration risk from any single sector.

Capacity: Zeta's platform is designed for enterprise scale, processing over one trillion content consumption signals per month globally. The ZMP is hosted in the Zeta Hybrid Cloud, a combination of public cloud (AWS/Google/Azure) and self-hosted private cloud resources (VMware/Docker/Kubernetes). This hybrid architecture is designed for cost-effectiveness, high performance, and efficient workload management, ensuring the platform can handle the growing complexity of marketing requirements and evolving AI-powered use cases.

Industry Overview

Sector description, market structure, trends

Zeta Global Holdings Corp. operates within the Marketing Technology (MarTech) sector, specifically focusing on consumer intelligence and marketing automation software. This sector aims to empower enterprises to target, connect, and engage consumers across all addressable channels.

The market structure of the MarTech industry is highly competitive and fragmented. Zeta's ZMP positions it as an integrated platform provider, competing with both niche players and larger, more established technology giants.

Trends:

AI and Generative AI Integration: This is perhaps the most significant trend. Zeta is at the forefront of this trend, leveraging GenAI, machine learning, natural language processing, and predictive AI to process data, predict intent, and automate marketing workflows. The industry is moving towards AI-driven solutions that can personalize experiences at scale and optimize marketing spend for improved ROI.

Shift to First-Party Data: With increasing privacy concerns and the impending deprecation of third-party cookies, the emphasis on first-party data has intensified. Companies are seeking solutions that allow them to collect, manage, and activate their own customer data effectively. Zeta's strengthened CDP+ offering, enhanced by LiveIntent’s identity graph, directly addresses this need by improving identity resolution and enabling authenticated, people-based marketing with minimal reliance on third-party cookies.

Omnichannel Engagement: Modern consumers interact with brands across a multitude of devices and platforms. Marketers require integrated platforms that can orchestrate consistent, personalized experiences across all these touchpoints. Zeta's ZMP provides integrated access to a wide range of omnichannel inventory and data sources.

Data Privacy and Security: Regulatory environments, such as GDPR in Europe and various state-level privacy laws in the U.S., are becoming more stringent. Companies operating in this space must demonstrate robust data privacy, security, and AI governance capabilities. Zeta's significant investments in enhanced identity security protocols, AI-driven compliance monitoring, and advanced consent management capabilities align directly with this critical industry requirement, building customer trust.

Focus on Measurable ROI: Enterprises are increasingly demanding clear, measurable returns on their marketing investments. Marketing technology platforms are expected to provide real-time analytics and optimization recommendations to demonstrate tangible business impact. Zeta's performance optimization pillar directly addresses this demand.

Revenue Trends & Drivers, Margins, and Profitability

Revenue Trends

Overall Trends: The company's total revenue has shown robust year-over-year increases.

In fiscal year 2020, total revenue was $388.12 million.

This grew to $458.34 million in 2021, representing a 20.28% increase.

By 2022, revenue reached $590.96 million, marking a 28.94% growth.

In 2023, revenue climbed to $728.72 million, a 23.31% increase.

Most notably, for the fiscal year ended December 31, 2024, Zeta achieved $1,005.75 million in revenue, a significant 38.02% growth from the previous year.

The latest available data for the LTM (Last Twelve Months) as of Q1 2025 shows total revenue at $1,075.23 million, reflecting a continued strong growth rate of 40.38%.

This consistent and accelerating growth underscores the increasing demand for data-driven marketing solutions and Zeta's ability to capture a larger share of this market. The company has also publicly stated its aim to achieve over $1 billion in revenue by 2025, a target it has already surpassed in 2024.Volumes: The growth in revenue is directly linked to the increasing utilization of Zeta's platform by its customers. The company ingests over one trillion content consumption signals per month on a global basis, which are then synthesized into intent-based audiences for marketing programs. This massive data processing capacity supports the scale required for its enterprise clients.

Product/Services Mix: Revenue generation is driven by the core Zeta Marketing Platform (ZMP), which includes its Messaging (ESP), Data Management (CDP+), and Activation (DSP) products. Additionally, the Agile Intelligence suite contributes through licensing fees and incremental fees based on customer utilization. The modular nature of the ZMP allows customers to activate specific components based on their business needs, incentivizing them to allocate an increasing percentage of their marketing budgets to the platform.

Pricing: Zeta's revenue model is primarily based on subscription agreements, which are typically structured on a quarterly or annual basis. This recurring revenue model provides a degree of predictability and stability to the company's financial outlook.

Margins and ROCE analysis

Summary of Cost Structure: The company's primary operating expenses include cost of revenues (excluding depreciation and amortization), general and administrative expenses, selling and marketing expenses, and research and development expenses. These categories reflect the significant investment required to maintain and expand its technology platform, data assets, and customer acquisition efforts.

COGS & Gross Margins: Zeta maintains consistently high gross margins, indicating strong unit economics.

Gross Profit Margin has hovered around 60-63% over the past five fiscal years: 59.58% (2020), 61.88% (2021), 63.54% (2022), 62.33% (2023), and 60.27% (2024). The latest LTM Q1 2025 figure is 60.37%. This high gross profitability suggests that the core service delivery is efficient and scalable, providing a solid foundation for achieving overall profitability as the company scales its operations and leverages its fixed costs.

OPEX & Operating Margin: While gross margins are strong, operating expenses have historically led to negative operating margins. However, a significant trend of improvement is evident:

EBITDA Margin: Improved from -43.59% in 2021 to -2.57% in 2024, turning positive at 0.09% in the LTM Q1 2025 period. This progression towards positive EBITDA indicates that the company is nearing operational cash flow breakeven before accounting for non-cash expenses like depreciation and amortization, and financing costs.

EBIT Margin: Similarly, the EBIT margin has improved from -53.61% in 2021 to -5.93% in 2024, and further to -3.42% in the LTM Q1 2025 period. This continuous improvement demonstrates the company's progress in controlling its operating expenses relative to its revenue growth, moving closer to operating profitability.

ROCE (Return on Capital Employed): For FY2024, Zeta’s ROCE is calculated at -8.79% (EBIT of -$59,686k / Capital Employed of $679,030k, where Capital Employed is Total Assets less Current Liabilities as of Q1 2025 LTM). A negative ROCE indicates that the company is not yet efficiently generating operating profit from the capital it employs. This is consistent with its negative EBIT. However, the improving trend in EBIT suggests that as the company continues to scale and its operating margins turn positive, its capital efficiency and ROCE are likely to improve, demonstrating a better return on its invested capital. The company's projected positive NTM PE also supports the expectation of future profitability and improved capital utilization.

Miscellaneous

Management

Profiles:

Zeta Global Holdings Corp. is led by an experienced executive team. David A. Steinberg serves as the Co-Founder, Chairman of the Board, and Chief Executive Officer. He co-founded the company in 2007, initially under the name 'XL Marketing'. Steven H. Gerber holds the position of President, while Christopher E. Greiner is the Chief Financial Officer. Matthew Mobley serves as the Chief Operating Officer. John Sculley, former CEO of Apple Inc., was a co-founder of Zeta Global and recently retired. This leadership team brings a blend of entrepreneurial vision and operational expertise to steer the company's growth in the dynamic marketing technology landscape.

Capital Allocation History:

Zeta Global has a history of strategic acquisitions as a core component of its growth and platform development. Since its founding, the company has actively pursued mergers and acquisitions to expand its capabilities and data assets. Notable acquisitions include:

Adchemy Actions division (2013): Incorporated a machine learning-based advertising platform.

Clicksquared (2014): Added a SaaS-based, cross-channel campaign management platform.

Acxiom Impact (2016): Enhanced marketing automation tools.

Boomtrain (2017): Integrated machine learning, decisioning, and marketing automation into its cloud.

Disqus (2017): Acquired a prominent commenting platform.

Temnos (2019): A Silicon Valley AI company, enhancing its ability to analyze internet intent.

Sizmek (2019): Integrated a programmatic ad buying platform.

Rocket Fuel's data management platform, IgnitionOne's demand side platform, and PlaceIQ's managed media business: Further expanded its marketing tech stack.

LiveIntent (recent integration): Significantly strengthened its identity graph and publisher network, enhancing its first-party data foundation.

This aggressive acquisition strategy has been instrumental in building Zeta's comprehensive platform, expanding its proprietary data set, and integrating advanced AI capabilities, thereby forming a key part of its competitive moat. The company has historically raised capital, including $125 million from Blackstone's GSO Capital Partners in 2015, to fund these acquisitions.

Management Ownership and Director Dealings

Insider ownership in Zeta Global Holdings Corp. is substantial, with company insiders collectively owning 20% of the company, valued at approximately US$673 million. This level of insider ownership is generally viewed as a positive indicator, as it aligns the interests of management and directors directly with those of common shareholders, incentivizing them to maximize long-term shareholder value. The significant stake suggests confidence from those closest to the company's operations.

Over the past three months, the number of shares sold by insiders significantly outweighed shares bought, resulting in a net activity of (4,240,263) shares sold. This trend extends over the past twelve months, with a net total of (8,925,273) shares sold by insiders. While insider selling can be attributed to various factors such as personal financial planning, diversification, or tax considerations, a consistent pattern of substantial net selling by company executives and directors can be a point of concern for investors. It may suggest that those with the most intimate knowledge of the company's near-term prospects are reducing their exposure, which could be interpreted as a less bullish outlook than the public consensus. This activity contrasts with the overall "Outperform" analyst recommendation and the projected upside, warranting careful consideration by potential investors.

IPO

Zeta Global Holdings Corp. went public on the New York Stock Exchange (NYSE) on June 10, 2021. The company debuted at a valuation of US$1.7 billion at the time of its IPO. Its shares are traded under the ticker symbol ZETA.

Valuation, Reverse Thesis, and Conclusion

Valuation & Margin of Safety

Zeta Global Holdings Corp. currently trades at $15.58 per share. The mean analyst target price is $25.33, indicating a potential upside of 67.66% from the current price. This significant difference between the current trading price and the consensus target price suggests a substantial margin of safety, implying that the market may be undervaluing Zeta's future growth and profitability potential.

From a multiples perspective, Zeta's Next Twelve Months (NTM) Price-to-Earnings (PE) ratio stands at 22.17. This is a critical valuation point, as the company's historical PE for FY2024 was negative (-52.04, -50.21), reflecting its unprofitability in the past year. The transition to a positive NTM PE indicates that analysts and the market are anticipating a shift to profitability within the next twelve months, which aligns with the improving trend in EBITDA and EBIT margins.

The NTM Enterprise Value (EV) to EBITDA multiple is 12.85, and the NTM Market Cap to Revenue multiple is 2.77. These multiples provide context for how the market values Zeta relative to its future earnings and revenue generation. The market's current valuation, when compared to the analyst target price, suggests a strong belief in the company's ability to execute its growth strategies and achieve sustained profitability. The 53% decline in stock price over the past six months, despite analyst optimism, further underscores the potential for a rebound if the company meets or exceeds its projected financial performance.

Reverse Thesis

A reverse thesis for Zeta Global Holdings Corp. would argue that the company's stock may not deliver the anticipated returns, or could even decline further, due to several factors.

Despite the improving margin trends, Zeta might fail to achieve consistent net profitability. The company has operated at a net loss for several years, and persistent high operating expenses, particularly in selling, marketing, and R&D, could continue to outpace revenue growth, preventing the realization of positive net income. This would invalidate the positive forward-looking PE multiple and disappoint market expectations.

New disruptive technologies or more aggressive strategies from established competitors like Salesforce, Adobe, or HubSpot could diminish the uniqueness or effectiveness of Zeta's AI and data capabilities.

Stricter interpretations or new laws, particularly outside the U.S., could severely restrict Zeta's ability to collect, process, and leverage consumer data, which is fundamental to its platform. This could cripple its core offerings, increase compliance costs, and damage its reputation, leading to a loss of enterprise customers.

The consistent pattern of significant insider selling observed over the past 3 and 12 months could be a more accurate indicator of the company's true prospects than the public analyst consensus. If insiders, who possess the most intimate knowledge of the company, are systematically divesting their shares, it might signal underlying operational challenges or a less optimistic future outlook that is not yet fully transparent to the broader market. This could lead to continued stock underperformance, regardless of the company's stated strategic goals or improving financial trends.

Thank you for reading The Small Cap Strategist, if you enjoyed this post consider subscribing.

Disclaimer: This post is for informational and educational purposes only and should not be considered investment advice. The author is not a financial advisor. All investment decisions carry risk, and readers should consult with a qualified financial professional before making any investment choices. The author may or may not hold positions in the securities discussed.

Interesting. I'll add this to the backlog of companies to analyze with the Diligent Hand series, but it appears it may not make it past the knockout phase.