Leave Equities For Commodities

Chilean Mining Opportunities, Copper Bullish Drivers, Broader Macro Implications.

As Americans celebrate Independence Day, investors are presented with a unique opportunity to gain independence from conventional market thinking. Adopting a philosophy like Charlie Munger's, our approach at The Small Cap Strategist centers on identifying high-quality businesses at sensible prices, with a strong emphasis on understanding competitive advantages and long-term compounding. As relatively young analysts, we also bring a unique perspective on emerging trends and disruptive forces that can shape the future of agile companies.

This week, our sector research will look into the latest insights from Larry McDonald, editor of the Bear Traps Report, whose macro and commodity expertise gives guidance current market dynamics.

Inside this post you will find:

Macro Outlook & Investment Strategy: A Munger-inspired approach to market analysis, focusing on long-term value and competitive advantages, along with a look at key upcoming economic events.

Chilean Mining Opportunities: An in-depth analysis of the lithium and copper markets in Chile, examining political shifts, supply dynamics, and their implications for major producers.

Copper's Bullish Drivers: A breakdown of the factors propelling copper demand, including AI, infrastructure, and global rebuilding efforts, plus the impact of tariffs and investment strategies.

Energy Sector Deep Dive: Insights into the natural gas and oil services sectors, highlighting supply constraints, growing demand, and the strategic importance of energy independence.

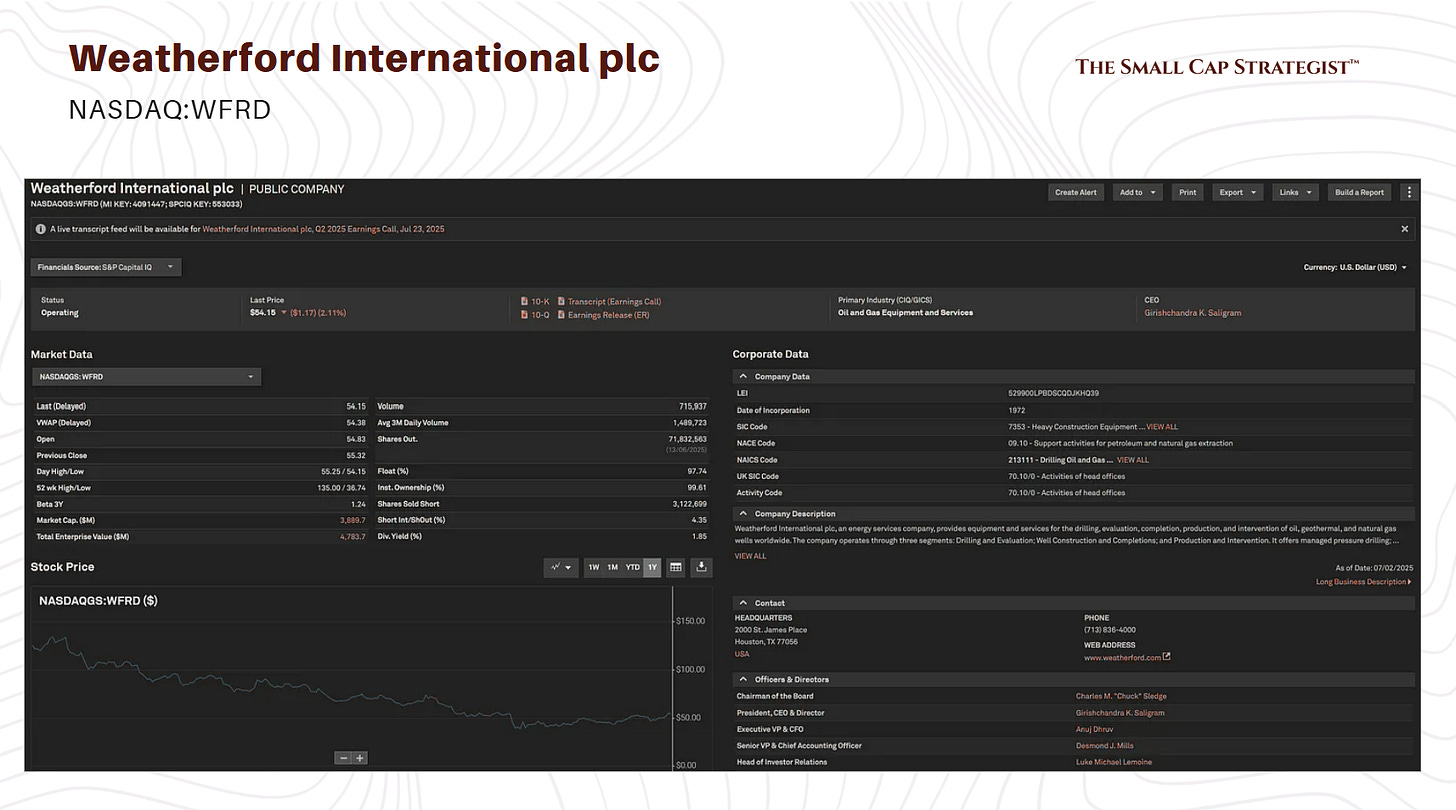

Company Spotlights: Detailed evaluations of Weatherford (WFRD) and Schlumberger (SLB), assessing their financial health, growth prospects, and valuation within the oil services industry.

Broad Macro Implications: Discussions on new US legislation ("Big Beautiful Bill") and its potential to shift market focus, the dynamics of US Treasury issuance and the dollar, and the long-term investment case for hard assets like gold in a financially repressed environment.

If you want to build a portfolio of unique, high-conviction ideas and gain an edge by understanding the powerful forces shaping global markets, subscribe to The Small Cap Strategist and join a community of discerning investors.

Looking ahead, key news to monitor next week includes the FOMC meeting minutes and the much-anticipated July 9th tariff deadline.

“I just want a brief summary I don’t have the time to read everything right now”:

This post offers high-conviction investment ideas, focusing on undervalued commodities and US-centric small-caps. It presents a bullish case for copper, driven by AI and infrastructure, with price targets of $7.50-$9.00 and 200-250% upside for COPX. It then identifies significant opportunities in natural gas (targeting $7-$9) and the oil services sector, highlighting Weatherford (WFRD) as a potential "five or six bagger" and Schlumberger (SLB) as an undervalued blue-chip leader. The analysis concludes with a look at the "Big Beautiful Bill" potentially driving a major shift to Russell 2000 small-caps and the long-term appeal of hard assets like gold in an inflationary environment.

A Technical Look at Lithium's Market Bottom

There is a significant opportunity in lithium, a "double barrel capitulation perfect storm." This scenario was primarily driven by the market's reaction to the perceived victory of a left-wing candidate in Chile and the unexpected surge in market share for hybrid vehicles over pure electric vehicles (EVs). This period of intense selling pressure has led to a cleansing process in the lithium market. A key technical indicator is the monthly Moving Average Convergence Divergence (MACD), which is cited as signaling massive seller exhaustion that historically precedes a market rebound. The MACD indicator, which calculates the difference between two exponential moving averages, serves as a momentum and trend-following tool, with its monthly reading suggesting a significant turning point after prolonged declines.

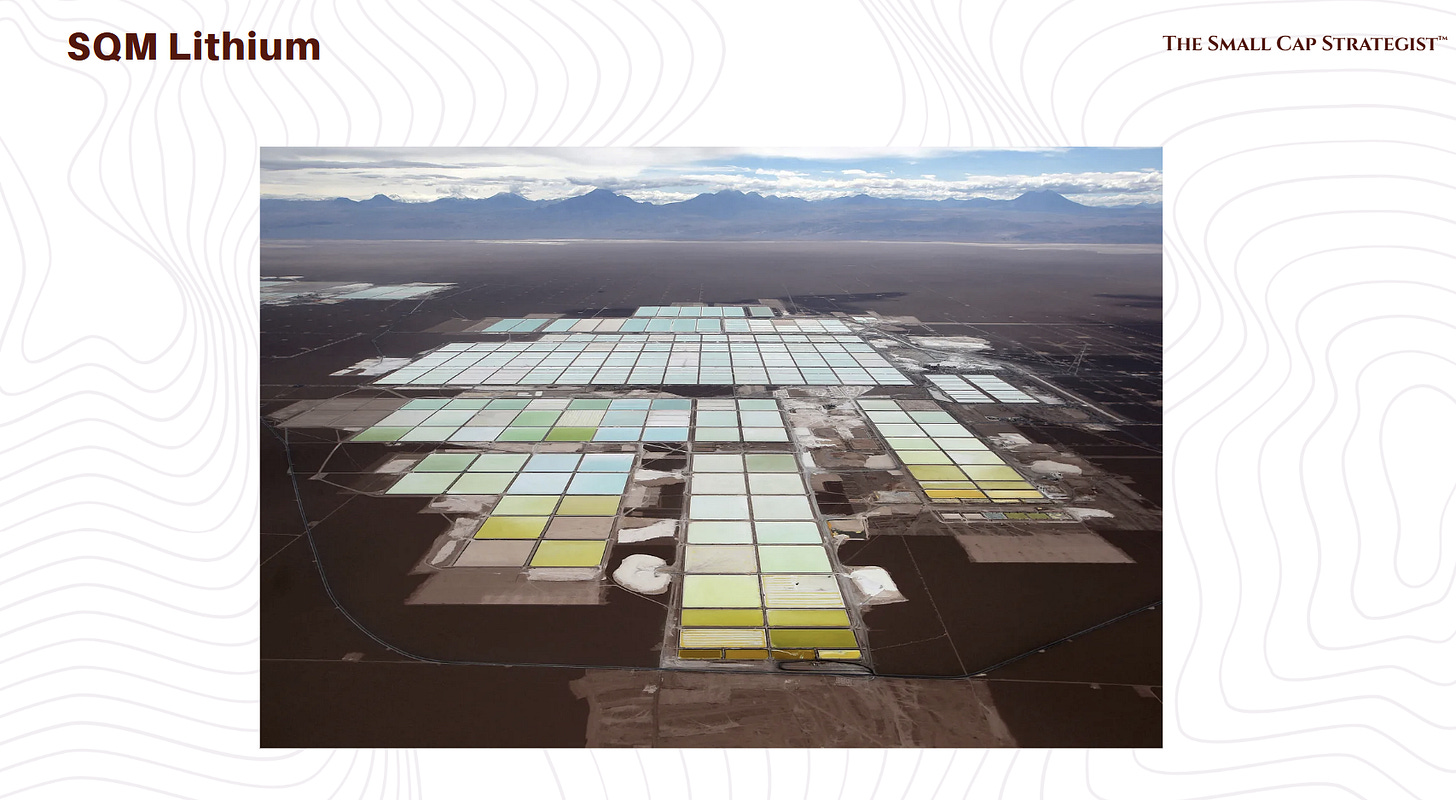

Chile holds a pivotal position in the global lithium supply chain, accounting for a substantial portion of the world's reserves. SQM and Albemarle (ALB) are the two primary lithium producers operating in the country. It is worth noting that while ALB is a Western Australian company, its significant mining operations are located in Chile, showcasing the country's importance to global supply.

While the potential for a political shift to a "market-friendly government" in Chile is presented as a strong bullish catalyst, "spectacular returns" for companies like ALB and SQM present some challenges. The existing "National Lithium Strategy" introduced by President Gabriel Boric in 2023 aims to increase production but also seeks to strengthen state control over lithium resources. This strategy, along with the proposed Codelco-SQM joint venture, faces considerable scrutiny ahead of the November elections. Even if a more capital-market-friendly government comes to power, there will be legal obstacles and slow bureaucratic processes, as well as significant social and environmental concerns. These structural issues like conflicts between lithium production contracts and existing mining concessions are not easily reversed by a change in political leadership.

Copper's Friendly Governance

Chile is also a significant global copper exporter. The country has been under left-leaning governments for the past seven years, which have historically pursued policies that "go after the copper, … after lithium, … after companies that produce commodities". A parallel is drawn to Argentina's recent political change to a more capital-market-friendly administration that unlocked substantial returns in emerging market equities.

There is a high probability of a similar political transition in Chile, with the upcoming elections potentially bringing in a market-friendly candidate such as Cass or Matea. This anticipated shift is extremely good news for ALB and SQM and the broader Chilean copper industry.

The political shift will likely alleviate some of the regulatory burdens and improve capital market access for these companies, boosting their production and export capabilities. However, the existing legal obstacles and slow bureaucratic processes are deeply ingrained within Chile's mining sector. Even under a market-friendly government will require considerable time and sustained effort. Therefore, the competitive advantage for Chilean copper producers will not just come from a more favorable political climate but also from their ability to mitigate these current headwinds. For smaller-cap strategists, this means a heightened focus on precise due diligence will be critical determinants of their success.

Bullish Copper: Demand, Tariffs, and Strategic Positioning

Demand Drivers

The long-held perception that $4 per pound represents an upper limit for copper prices is now considered obsolete, as the metal is entering an upper stage of demand.

One significant driver is the high demand from Artificial Intelligence (AI) and data centers. The power requirements and infrastructure associated with AI requires vast quantities of copper for wiring, cooling systems, and power transmission within these facilities.

Another monumental factor is the US power grid rebuild. The existing grid, with some components dating back 50 years and others 30 years, is in dire need of costly maintenance. While an estimate of a $2 trillion rebuild was mentioned, other analyses suggest the cost to entirely replace the US electric grid could be nearly $5 trillion. Even just maintaining what we have will cost hundreds of billions, if not trillions, of dollars over the next decade. This is the largest project and likely most expensive 'project' in U.S. history, with many components requiring a decade or more to build. For small-cap companies involved in grid infrastructure, smart grid components, or specialized copper products, this represents a compounding growth opportunity that could span decades.

Another interesting point is that the global reconstruction efforts following wars and conflicts, such as those in Ukraine, Iran, Gaza, and Israel, are inherently inflationary and need rebuilding, driving demand for copper. The robotics revolution also contributes significantly, with projections indicating the production of millions of robots. Just two million robots would consume approximately a month of global copper production, with forecasts suggesting 50 million robots could be produced within the next decade. This creates a powerful macro picture for copper, which is reflected in copper's performance breaking out versus big tech and the NASDAQ.

Tariffs as a Catalyst

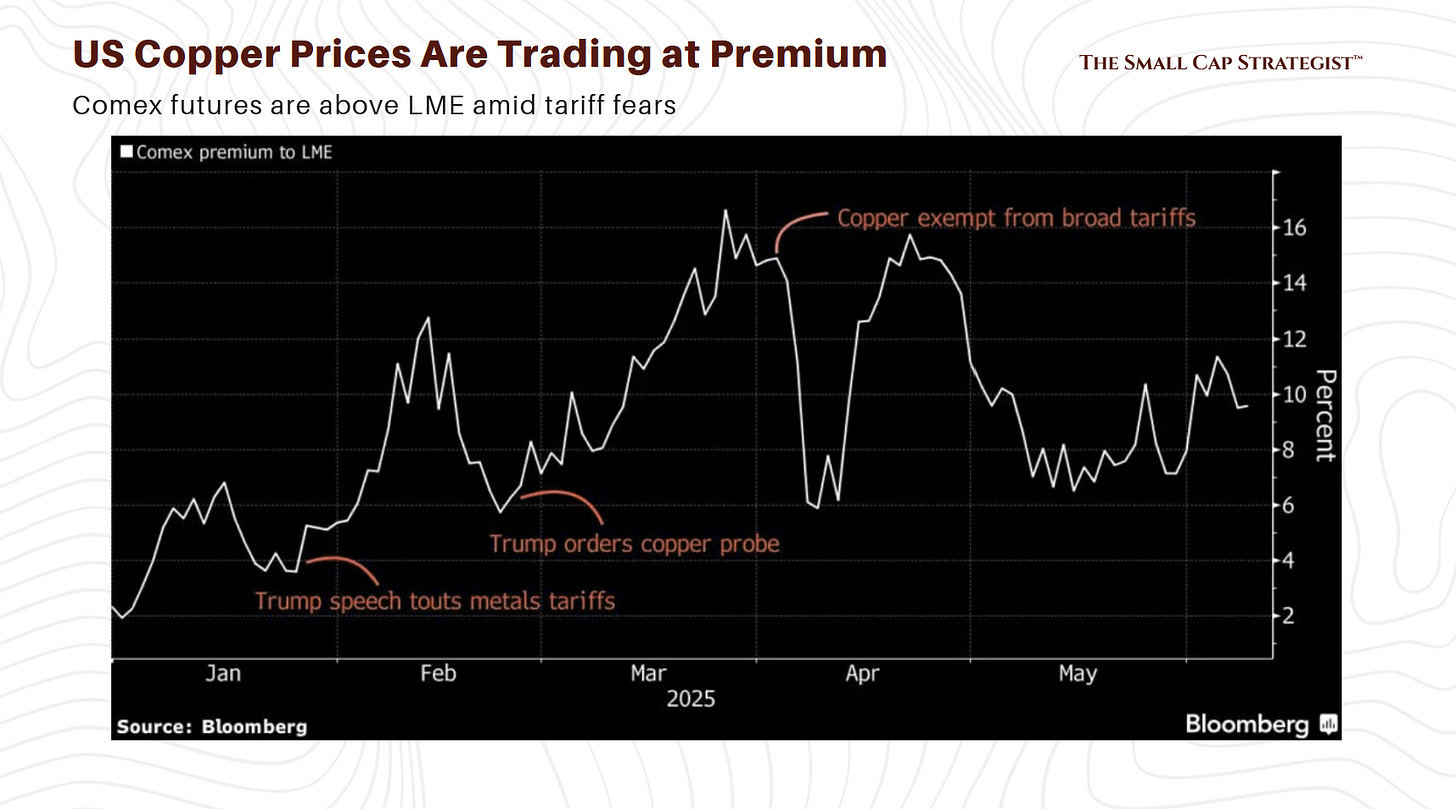

A notable trend shift among institutional investors is their heightened focus on copper and the potential impact of tariffs from Washington. The expectation is for a 25% Section 301 tariff on copper, which is alarming since the U.S. imports 40% of its copper. This anticipated tariff is already being priced into the market as US copper trading at an almost 10% premium compared to copper in London or other parts of the world.

Institutional investors are front running this development and the existing 10% premium on US copper shows the market is indeed anticipating higher domestic prices.

Long-Term Upside with Tactical Entry

While some market participants are already front running the anticipated tariffs, the expectation remains that the 25% tariff on copper is coming. Copper is currently observed to be in a consolidation phase, which can often precede significant price movements.

For investors considering a position, a tactical approach is recommended. You should initiate a small position now and look for pullbacks on news for further entry. The price targets for HG copper are set significantly higher, ranging from $7.50 to $9.00 from its current level of $5.09. The COPX ETF, which tracks copper miners, is projected to have a potential upside of 200-250% over the next five years, with a downside risk estimated at 20-30%. This asymmetric risk/reward profile suggests a compelling long-term opportunity for investors focused on the copper sector.

Natural Gas and Oil Services

Natural Gas Opportunity

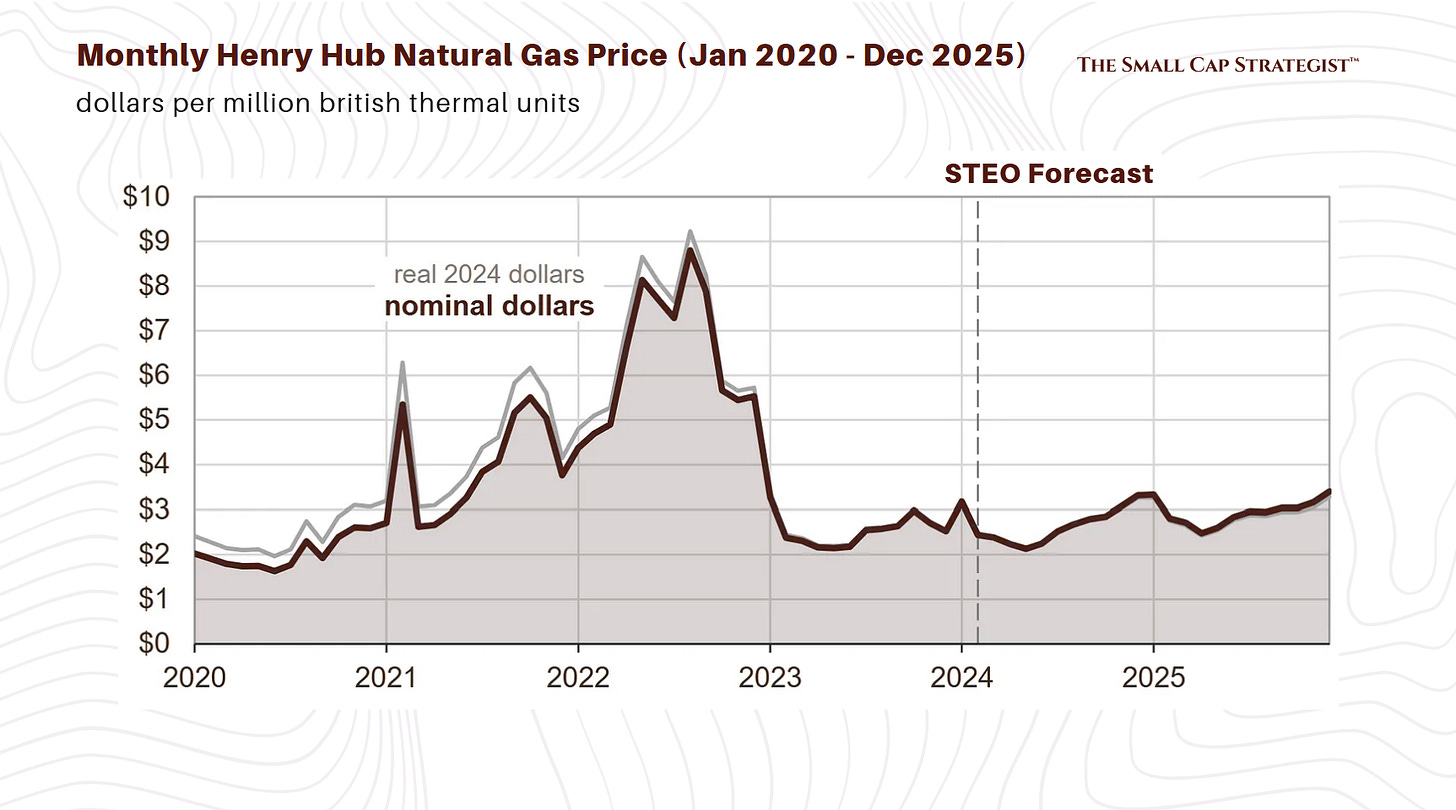

The US shale region is experiencing a point of historical depletion, a fact that is widely recognized within the industry. This supply constraint and strong demand drivers creates a bullish narrative for natural gas. Key demand factors include the high energy requirements of artificial intelligence data centers and the increased demand for liquefied natural gas (LNG) exports to Europe. These combined forces could push natural gas prices into the $7-$9 range.

A clear discrepancy exists between Nvidia and the natural gas equities market. Nvidia has a $3.7 trillion equity valuation. The top three holdings within the FCG ETF are EOG Resources, ConocoPhillips, and Occidental Petroleum Corp. As of recent data, EOG Resources has a market capitalization of approximately $67-71 billion, ConocoPhillips is around $118 billion, and Occidental Petroleum is in the range of $43-45 billion. Which combined is valued around $231-234 billion, showcasing this extreme disparity.

Oil Services: Powering Energy Independence

A notable shift in the energy sector involves the increased capital allocation discipline among Chief Financial Officers (CFOs). Learning from past periods of extremely high capex in oil a decade ago, energy companies are now exhibiting more disciplined investment strategies. This discipline gives a quicker and more efficient reduction in production and rig counts in response to lower oil or natural gas prices, providing greater support for commodity prices than in previous cycles.

The Strategic Petroleum Reserve (SPR) has experienced significant drawdowns, with reports indicating damage that could impede its refilling. In parallel, the current administration is actively pursuing increased energy independence for the United States. A key component of this strategy involves increasing US offshore drilling, aiming to increase its contribution to total US production from the current 14% to 20%. This will position oil services companies, such as those within the OIH ETF, along with individual players like Schlumberger (SLB) and Weatherford (WFRD), for substantial growth. These companies are projected to have a 300% upside as they benefit from the anticipated increase in drilling activity.

Spotlight on Value: Weatherford (WFRD)

Weatherford (WFRD) is an incredible value proposition within the oil services sector. This assessment is strengthened by the fact that renowned value investor David Einhorn of Greenlight Capital has been accumulating shares in the company in recent years.

Weatherford's financial health appears significantly stronger than during previous energy market regimes. The company boasts a strong balance sheet, with approximately $900 million in cash and a reduced debt level of around $1.7 billion. This improved financial structure gives a solid foundation for future growth.

Looking ahead, Weatherford is projected to generate between $500 million and $520 million in free cash flow (FCF) in 2026, translating to an impressive 15-16% FCF yield relative to its equity market cap. For context, the company reported adjusted FCF of $66 million in Q1 2025, indicating that the 2026 projection implies a substantial ramp-up in cash generation, likely tied to the anticipated increase in offshore drilling activity. Weatherford trades at only two to three times its projected EBITDA of $1.2 billion to $1.3 billion next year. This aligns with its 2024 EBITDA of $1.28 billion. Given that the S&P 500 is currently trading at 22 times earnings, Weatherford's valuation is significantly undervalued. This positions Weatherford as a potential five or six bagger on the upside from its current levels.

Schlumberger (SLB): The Industry Bellwether

Schlumberger (SLB) is referred to as the Google of this space due to its dominant market position and innovative use of artificial intelligence to enhance its operations. SLB has a market capitalization of approximately $47 billion, significantly larger than its peers.

The company is expected to achieve a free cash flow yield of almost 10% and projected EBITDA close to $9 billion next year. Despite a 3% year-over-year decline in total revenues in the first quarter of 2025, SLB managed to expand its adjusted EBITDA margin by 18 basis points to 23.8%, demonstrating disciplined cost control. The company's commitment to returning at least $4 billion to shareholders in 2025 reflects confidence in its cash flow generation capabilities. While SLB is a much larger and generally safer investment compared to Weatherford, its valuation metrics, such as trading at less than 12 times 2025 earnings with over 20% EPS growth on the horizon, still suggest it is undervalued within its peer group. This makes SLB a compelling choice for investors seeking exposure to the oil services sector through a more established, blue-chip company.

Broader Macro Themes and Investment Implications

The "Big Beautiful Bill" and Market Rotation

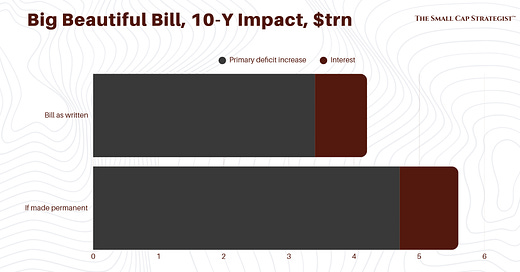

New legislation currently on Capitol Hill, named by Trump as the "Big Beautiful Bill," carries massive macro implications. This bill’s idea is to generate substantial growth and potentially reignite inflation. A critical aspect of this legislation is its focus on impacting US companies versus international companies. The S&P 500 and NASDAQ indices have high exposure to international sales.

The "Big Beautiful Bill" is designed to deliver the largest middle- and working-class tax cut in US history, providing over $10,000 per year back to typical hardworking families. It also aims to drive a "Blue-Collar BOOM" through tax relief for workers, support for small businesses, and investments in American manufacturing. Analyses suggest this bill could increase long-run GDP by 1.2% and create 892,000 full-time equivalent jobs. While it is projected to reduce federal tax revenue by trillions over the next decade and increase federal budget deficits, the economic growth stimulated by the tax cuts is expected to offset a portion of these revenue reductions.

As the US growth expectations increase over the next couple of years due to this legislation, particularly as tax cuts flow into the economy, a colossal shift is expected back towards the IWM (Russell 2000) relative to the S&P names, technology names, or QQQs. This trade, which has not performed well recently, is expected to gain significant traction as the Trump administration progresses into its second year and towards the midterms. This suggests that domestically focused small-cap companies, which constitute a larger portion of the Russell 2000, stand to benefit disproportionately from legislation designed to boost US economic activity and support American workers and businesses.

The Dollar and Treasury Issuance Showdown

A critical macro development revolves around US Treasury issuance. There has been no net new issuance from the United States government since January. As the debt ceiling approaches and is expected to be raised in the next two to three weeks, it is calculated that the Treasury will need to sell an astounding $1.7 trillion of treasuries between August and the end of the year to catch up.

The Treasury General Account (TGA), which serves as the US Treasury's checking account, is currently being drained due to the lack of net issuance. The Congressional Budget Office (CBO) estimates that the government's ability to borrow using extraordinary measures will likely be exhausted in August or September 2025 if the debt limit remains unchanged. This situation sets the stage for a significant showdown, particularly if the "Big Beautiful Bill" gets tied up in the House, as anticipated, given the differing versions from the House and Senate. The narrow Republican majority in the House and the Freedom Caucus and external pressure from figures like Elon Musk, could lead to high drama and increased market volatility surrounding the debt ceiling.

This massive influx of issuance, potentially $1.5 to $1.7 trillion, with an estimated $600-700 billion more than last year over the same period, will dramatically drive up T-bill rates. This will widen the spread between US treasuries and those of other global economies, attracting capital back to the dollar. Given that the dollar experienced its worst first half since the 1970s, the probability of a meaningful counter-trend rally in the dollar between now and November is considered very high. This creates an absolutely incredible setup for macro investors over the next six months.

Gold and Hard Assets in a Financial Repression Era

Gold has demonstrated strength, with every dip to its 50-day moving average proving to be a buying opportunity. However, gold may face a challenging third quarter as the anticipated surge in Treasury issuance picks up and the dollar experiences its counter-trend rally.

This reminds us of financial repression, which involves policies designed to keep interest rates artificially low, often below the rate of inflation, to allow governments and companies to access cheap loans and reduce the burden of debt repayments. This strategy can be particularly effective at liquidating government debt denominated in domestic currency. The need to sell massive amounts of bonds will lead to a stagflationary environment.

In such a regime of financial repression, hard assets and commodities are expected to perform exceptionally well. This environment is

"extremely bullish for commodities and hard assets".

Over the next five to ten years, the strategic allocation should favor hard assets, including gold, silver, and platinum, over financial assets, which are essentially paper certificates like stocks and bonds. This long-term outlook emphasizes the importance of tangible assets in a world grappling with significant debt burdens and policies aimed at devaluing that debt through inflation.

If you enjoyed this post, consider subscribing to The Small Cap Strategist.

Disclaimer: This post is for informational and educational purposes only and should not be considered investment advice. The author is not a financial advisor. All investment decisions carry risk, and readers should consult with a qualified financial professional before making any investment choices. The author may or may not hold positions in the securities discussed.