Stock Pitch #2, Lectra SA (EPA:LSS) a 40% Upside Story

A Financial Deep-Dive Into Lectra SA, Discovering How This Stock Shows a 40% Upside Driven by Great Financials, Strong Growth Outlook, and Apparent Market Mispricing.

Introduction: The Software Powering Your Wardrobe, Car, and Couch

In an increasingly digital world, the technology that underpins the creation of everyday items often goes unnoticed. Lectra SA, a French technology company with a rich 50-year history, stands as a pivotal, albeit perhaps under-the-radar, enabler for industries that shape our daily lives: fashion, automotive, and furniture. Founded in 1973 and publicly listed since its 1987 Initial Public Offering (IPO) on what is now Euronext Paris, Lectra is observing a significant transformation, steering its clients and its own business model towards the efficiencies and innovations of Industry 4.0.

Using today's Euro to USD exchange rate, we will explore this company, particularly its accelerating transition to a Software-as-a-Service (SaaS) model, and examine how the company is positioning itself to help its clients move through global trade, including the pervasive uncertainties of international tariffs. These dynamics, coupled with a robust product portfolio and strategic acquisitions, present a nuanced and potentially compelling investment case for this mid-cap European technology firm.

Company Snapshot

Lectra's core business revolves around providing industrial intelligence solutions. This consists of a mix of softwares (including Computer-Aided Design/CAM and Product Lifecycle Management - PLM), specialized automated cutting equipment, data analytics, and associated services. The company is a firm proponent and implementer of key Industry 4.0 technologies, embedding Artificial Intelligence, big data analytics, cloud computing, and the Internet of Things (IoT) into its offerings to drive customer success.

With a global footprint spanning over 100 countries, Lectra derives a substantial portion of its revenue from international markets. As of early 2025, the company reported revenues of $569,787 million for the 2024 fiscal year and has a market capitalization of $1,047.3 million and a TEV of $1,110.8 million.

Lectra's solutions have achieved deep penetration in several key global industries. In 2022, the fashion sector accounted for approximately 50% of its revenues, automotive Original Equipment Manufacturers (OEMs) for 25% (primarily for car seats and interiors), and the furniture industry for 12%. Beyond these core areas, Lectra also serves the technical textiles and sign & graphics industries with specialized solutions.

This diversification across major industrial sectors is a noteworthy characteristic. While each of these industries possesses cyclical elements, their economic cycles do not always move in perfect lockstep. For instance, a downturn in new vehicle sales impacting the automotive segment might not directly coincide with a slowdown in the fast-fashion cycle or a lull in home furnishing demand. This multi-sector approach, combined with Lectra's extensive geographic diversification, offers a degree of revenue stability that may not be immediately apparent. The company's Q1 2024 results, which highlighted strong orders from the automotive sector in Asia while other segments and geographies experienced lower demand, serve as a practical example of this inherent portfolio balance.

Furthermore, Lectra's long history as a publicly traded company, dating back to its 1987 IPO, and the remarkably long tenure of its CEO, Daniel Harari, who has guided the company since the early 1990s, suggest a deeply ingrained capacity for long-term strategic thinking and adaptability. The current push towards Industry 4.0 and SaaS is not an abrupt change in direction but rather an evolution built upon decades of experience in industrial automation and software development. This historical context lends credibility to management's ability to execute its ambitious contemporary strategy.

The Business Model

Core Offerings: The Integrated Ecosystem

Lectra's fundamental value proposition lies in enabling its customers to design, develop, produce, and market their products more efficiently, sustainably, and profitably. A tangible example of this is seen in the fashion industry, where Lectra's cutting machinery can help manufacturers reduce material waste by approximately 5%, which can translate into a significant operating margin improvement of around 3% for a typical soft-line manufacturing business operating on otherwise thin margins.

The company's offerings can be broadly categorized into these components:

Hardware (Cutting Solutions): Lectra is renowned for its advanced automated cutting equipment. This includes flagship product lines such as Vector for multi-ply cutting, the acquired Gerber Paragon and Gerber Atria systems, and Versalis for leather cutting. These solutions cater to a diverse range of materials including fabrics, leather, technical textiles, and airbags for the automotive sector. For customers, these machines represent significant capital expenditures, typically with an operational lifespan of 8 to 12 years.

Software (CAD/CAM/PLM):

CAD/CAM: Solutions like Modaris and the acquired Gerber AccuMark are industry standards for 2D/3D pattern making, design, and marker making, optimizing material usage before cutting.

PLM (Product Lifecycle Management): Kubix Link is Lectra's flagship cloud-based PLM platform, primarily for the fashion industry. It facilitates collaboration across design, development, and production teams, manages product data centrally, and accelerates collection launch timelines. Lectra highlights significant benefits for Kubix Link users, such as "360 hours freed up each year by removing non-value-added tasks," achieving "twice the speed to market with automation," and a "20% decrease in production costs".

The Gerber Technology Integration: The acquisition of US-based Gerber Technology in June 2021 for approximately ~€300 million (based on Lectra's share price at the time) was a landmark event.

Strategic Rationale: Gerber was Lectra's largest and, by most accounts, only substantial global competitor. The combination aimed to create an undisputed world leader in Industry 4.0 solutions for the fashion, automotive, and furniture markets.

Impact: The merged entity now commands an estimated 80% global market share in its core segments. Synergies from this acquisition have been a key driver of improved financial fundamentals, such as the 3.5 percentage point increase in gross profit margin reported in 2023. Gerber’s established product lines, including AccuMark CAD software, Paragon and Atria cutting systems, and various spreaders, have been integrated into Lectra’s comprehensive portfolio. Operationally, Lectra now manages three primary production sites for its equipment: its historical base in Bordeaux-Cestas, France, and former Gerber facilities in Tolland, Connecticut (USA), and Suzhou, China.

The Gerber acquisition achieved an 80% global share and the deal also provided Lectra with a significantly larger installed base, creating fertile ground for upselling its newer, high-margin SaaS solutions. It also expanded Lectra's geographic footprint, particularly strengthening its presence in the US market where Gerber had a dominant position. The "strong improvement in the fundamentals of the Group's business model, largely due to synergies arising from the Gerber acquisition" noted in 2023 points towards operational efficiencies, cross-selling achievements, and potentially a more robust R&D pipeline from combined talent and intellectual property, forging an "ultimate Industry 4.0 partner".

The SaaS Pivot: A Game-Changing Transition

Lectra has decisively stated that "All our new software is now available as SaaS", marking a fundamental strategic pivot. The Software-as-a-Service model offers customers cloud-based access, continuous updates, and often a more predictable subscription-based cost structure, while providing Lectra with a growing stream of recurring revenue.

This transition is rapidly gaining traction:

SaaS revenues surged from $34.58 million (6% of total revenue) in 2023 to $88.09 million (15% of total revenue) in 2024 – a 2.5-fold increase. This 2024 figure was significantly boosted by the inclusion of $46.89 million from the newly acquired Launchmetrics.

Even before the full impact of Launchmetrics, Q1 2024 saw software subscriptions reach $18.78 million, or 13% of total revenue for the quarter.

Lectra has set an ambitious target of achieving over $102 million in SaaS revenues in 2025.

Key SaaS offerings driving this growth include:

Kubix Link (PLM): This cloud-native, highly configurable PLM solution is central to Lectra's fashion offering. It integrates with various enterprise systems like ERP and CMS, as well as design tools such as Adobe Illustrator. Its focus extends to optimizing production processes and supporting sustainability management.

Retviews (Market Intelligence): An AI-powered platform providing real-time competitive intelligence for the fashion industry. It tracks competitor pricing, product assortments, and promotional strategies, enabling brands to make data-driven decisions to optimize their collections.

Launchmetrics (Brand Performance): Acquired in January 2024, Launchmetrics is an AI-powered Brand Performance Cloud catering to the fashion, lifestyle, and beauty sectors. Its suite includes tools for sample management, event organization, media monitoring, and influencer analytics. This acquisition has substantially expanded Lectra’s SaaS portfolio and in-house expertise, with Launchmetrics already exceeding profitability expectations in 2024.

TextileGenesis (Traceability): Following a majority stake acquisition in early 2023, TextileGenesis provides a SaaS platform for the digital traceability of textiles, from fiber to the end consumer. This is crucial for ensuring material authenticity, origin, and supporting sustainability claims.

Valia (Cutting Room 4.0): A newer cloud solution available for fashion, automotive, and furniture, Valia embodies Lectra's Industry 4.0 vision. It employs AI to connect, automate, and streamline the entire production flow from order processing to fabric cutting, with a strong emphasis on optimizing material usage.

Neteven (E-commerce): Acquired in June 2021, Neteven is a SaaS platform that simplifies and automates the distribution of products across major online marketplaces, enhancing brands' direct-to-consumer strategies.

Customer adoption of these SaaS solutions is reportedly strong, with Lectra stating they have been "widely adopted by our customers". New SaaS subscriptions (by annual contract value) grew by 8% in 2024 on the Lectra 2023 scope, and specific solutions like Kubix Link, Launchmetrics, and TextileGenesis booked record levels of new SaaS subscriptions in 2024.

The strategic importance of this SaaS transition cannot be overstated. It marks a shift towards more predictable, high-quality recurring revenue streams. In 2024, recurring revenues (which include SaaS subscriptions and maintenance contracts) accounted for a significant 72% of Lectra's total revenues. Critically, the gross margin generated from these recurring revenues covered nearly all of the company's fixed overhead costs, evidenced by a "security ratio" of 96% in 2024. This significantly improves the resilience and financial stability of Lectra's business model.

This transition to SaaS is not only about adding new product lines; it's about creating an interconnected ecosystem. The integration of PLM (Kubix Link), market intelligence (Retviews), brand performance tools (Launchmetrics), traceability solutions (TextileGenesis), and e-commerce capabilities (Neteven) generates a powerful "flywheel effect." As customers adopt one Lectra SaaS solution, the inherent value and ease of integrating additional Lectra SaaS tools increase, driven by data synergies and streamlined cross-platform workflows. For instance, market trend insights from Retviews can directly inform design and development decisions within the Kubix Link PLM system. Product information housed in Kubix Link can then flow seamlessly to Neteven for efficient marketplace listings and to Launchmetrics for targeted marketing campaigns, while TextileGenesis data can be used to validate sustainability claims communicated via Launchmetrics. This level of integration significantly enhances customer stickiness, reducing churn and creating substantial upselling and cross-selling opportunities. This is a far more potent strategy than merely selling standalone point solutions, as evidenced by the description of Neteven as a "perfect complement" to Kubix Link and Retviews, enabling a "more comprehensive response" to customer needs.

While Lectra does not explicitly disclose gross margins for its SaaS segment alone, the strong emphasis on growing recurring revenues to 72% of the total in 2024 and the impressive "security ratio" of 96% strongly suggest that the SaaS transition is a margin-accretive strategy. The company’s overall gross profit margin improved from 66.61% in FY22 to 69.76% in FY23 and to 71.56% in FY24. SaaS businesses typically command higher gross margins compared to traditional hardware or perpetual license software models once they achieve scale, owing to lower incremental costs for onboarding new users and the efficiencies of centralized cloud infrastructure. Lectra's strategic objective to grow its SaaS business to over $102 million by 2025 shows a deliberate push to enhance overall profitability and revenue predictability, thereby reducing historical reliance on more cyclical hardware sales. The successful integration and performance of Launchmetrics, which "exceeded the Group's profitability expectations" in its first year, further validates this margin-enhancing potential.

Table 1: Lectra SA - Recent Acquisitions Summary

Financial Deep Dive

Recent Performance Analysis

Lectra's recent financial performance reflects a company in transition, during a macroeconomic headwinds and changing their business model towards SaaS and integrating acquisitions.

Fiscal Year 2024 was a year of notable progress, especially in the SaaS domain. Revenues grew by 10.32% year-over-year to $569.787 million, a figure that includes a $46.89 million contribution from the newly consolidated Launchmetrics. The star performer was SaaS revenue, which surged by 150% (2.5 times) to $88.09 million. Recurring revenues, a key indicator of business model stability, rose by 18% and constituted 72% of total revenues. EBITDA before non-recurring items increased by 15% to $103.68 million, yielding an improved EBITDA margin of 17.3% (up 0.8 percentage points). However, net income declined by 9% to $33.69 million, primarily due to $25.84 million in amortization charges related to intangible assets from acquisitions, as well as higher financial expenses. Despite this, free cash flow before non-recurring items showed robust growth, increasing by 59% to $82.06 million. Investment in innovation remained a priority, with R&D expenditure representing 12.8% of revenues (approximately $76.71 million).

Fiscal Year 2023 presented a more mixed picture, heavily influenced by a "severely degraded macroeconomic and geopolitical environment" that led many companies to delay investment decisions. Total revenue for 2023 was $516.496 million, a 6% decrease from $549.862 million in 2022. EBITDA before non-recurring items stood at $89.91 million. Orders for perpetual software licenses and equipment saw a significant 26% decline. Nevertheless, the SaaS segment showed resilience, with new SaaS subscriptions achieving an annual contract value of $12.29 million, up 15% year-over-year. SaaS revenue for 2023 was $34.58 million, accounting for 6% of the total. A bright spot was the gross profit margin, which improved by 3.5 percentage points to 69.8%, partly attributed to synergies from the Gerber acquisition.

Q1 2024 continued the narrative of growth amidst challenges. Total revenue reached $140.66 million, a 5% increase year-over-year, with Launchmetrics contributing $9.45 million. Recurring revenues comprised 70% of this total at $103.34 million (representing a 5% increase on the Lectra 2023 scope). Revenue from new systems, however, was $44.05 million (30% of total), a 12% decrease on the Lectra 2023 scope, reflecting the pull-forward effect of a high order intake in Q4 2022. Software subscriptions accounted for $18.78 million (13% of total Q1 revenue). EBITDA before non-recurring items grew by 7% to $24.01 million, with the margin slightly up at 16.3%. Net income for the quarter was $7.63 million, down 9%, again impacted by $5.92 million in amortization charges from acquisitions. Free cash flow before non-recurring items was particularly strong at $25.04 million, more than doubling year-over-year. The order book in Q1 2024 showed a mixed performance: high demand in the Asian automotive market but lower levels in other sectors and geographies. New SaaS subscription orders amounted to $2.73 million, a slight decrease of $0.23 million year-over-year on a like-for-like basis.

More recently, Lectra indicated a "business slowdown due to unprecedented environment" in its Q1 2025 announcement, though detailed figures are not available at the time of this analysis.

The financial data clearly demonstrates Lectra's ability to handle global economic headwinds by growing its key strategic metrics, particularly SaaS and total recurring revenue, alongside free cash flow. This resilience, especially the capacity to improve gross and EBITDA margins in such conditions, points to sound operational execution and the tangible benefits of its evolving business model, which includes the successful integration of acquisitions like Gerber and a disciplined approach to costs. The "security ratio," where recurring revenue gross margin covers 96% of fixed overheads, is a good addition to this enhanced stability.

A crucial aspect for investors to understand is the divergence between net income and cash flow trends. The reported declines in net income in FY2024 and Q1 2024, despite top-line and EBITDA growth, are predominantly due to non-cash accounting charges, specifically the amortization of intangible assets arising from its active M&A strategy. In contrast, free cash flow has shown significant improvement. This is important because GAAP net income can sometimes obscure the true underlying cash-generating capability of a business, especially following substantial acquisitions. The strong FCF growth suggests that the core business and recent acquisitions are performing well from a cash generation perspective. This makes FCF-based valuation approaches potentially more insightful for Lectra than relying solely on P/E ratios based on reported net income. Analysts often make adjustments for these non-cash items when assessing profitability, calculating metrics like Net Operating Profit After Tax (NOPAT) and Return on Capital Employed (ROCE) by excluding such non-cash or one-off items to get a clearer view of sustainable operational performance. While Lectra's specific definitions for "underlying NOPAT" or "adjusted ROCE" are not detailed in the provided materials, an "underlying NOPAT of $74,33 million" and a "post-tax return on capital of around 35% adjusted for acquisition related intangible assets" (as mentioned in the initial query, reflecting potential analyst views) would indicate very healthy underlying profitability and capital efficiency.

Table 2: Lectra SA - Key Financial & Operational Metrics Summary

Note: Some historical figures like SaaS revenue for FY2022 were not explicitly detailed in the same way as recent periods.

Key Metrics & Valuation

As of late May 2025, Lectra's shares (trading under tickers LSS on Euronext Paris) are priced at $27.37 as of June 3rd 2025. This gives the company a market capitalization of approximately $1,047.3 billion.

Key valuation metrics present a mixed but intriguing picture:

P/E Ratio (TTM): 30.0x. This variation likely reflects different calculation dates and treatment of earnings.

P/E Ratio (Forward): More consistently cited around 17.66x, based on analyst forecasts.

PEG Ratio (Forward): A compelling 0.66, based on a forward P/E of 17.66 and forecasted EPS growth of 36.46%.

TEV/LTM Total Revenue (TTM): 2.03.

TEV to EBITDA (TTM): Approximately 12.02.

Dividend Yield (Forward): Forecasts range from 1.3% to 2.27%. The company proposed a $0.Fi43 dividend for FY2024.

Analyst Consensus: Generally "Buy". Analyst target prices suggest significant upside, with Gilbert Dupont and TPICAP Midcap (Capital IQ sources) with a target price of $34.31 implying an upside of 27%, but we expect it to go higher than 40%.

The forward PEG ratio of 0.66 is particularly noteworthy. A PEG ratio below 1.0 is often considered an indicator that a stock may be undervalued relative to its expected earnings growth. If Lectra can achieve the forecasted EPS growth of over 36%, driven by its successful SaaS transition, synergies from acquisitions, and the underlying demand from Industry 4.0 adoption, then current valuation levels could indeed represent an attractive entry point. The "Falling Star" classification by Stockopedia, which reflects recent negative price momentum, might be overlooking these improving fundamental prospects, potentially creating a value opportunity if the company continues to execute its strategic plan effectively.

Table 3: Lectra SA - Valuation Snapshot (as of late May 2025)

Balance Sheet & Cash Flow

Lectra maintains what it describes as a "particularly robust balance sheet". As of the end of Q1 2024, shareholders' equity stood at $368.541 million, which increased to $387.566 million by the end of FY2024. Net financial debt was a modest $21.38 (€18.8) million at the end of Q1 2024, even after the initial payment for the Launchmetrics acquisition. This net debt figure was further managed down to $23.43 (€20.6) million by December 31, 2024. The company's cash position in Q1 2024 included $108.405 million in cash and cash equivalents against $135.70 (€119.3) million in financial debt. IFRS 16 lease liabilities, accounted for as debt, amounted to $36.59 (€32.165) million at the end of 2024 and are included in total financial liabilities; the associated depreciation of right-of-use assets ($12.13 (€10.663) million in 2024) reduces EBIT.

Free cash flow generation is a strong point. The company generated $25.02 million in free cash flow (before non-recurring items: total unlevered FCF was $57.627 million) in Q1 2024 alone, and an impressive $95.546 million for the full year 2024. Historical data from 2022 also mentioned a free cash flow conversion rate exceeding 120%, indicating efficient conversion of profits into cash.

Future Outlook & Guidance

Looking ahead, and prior to the Q1 2025 slowdown announcement, Lectra had outlined ambitious goals as part of its 2023-2025 strategic roadmap, which aims to solidify its position as a key Industry 4.0 player.

For 2024, the initial guidance for the Lectra 2023 scope (excluding Launchmetrics) projected revenues between $545.97 million and $602.85 million, with EBITDA before non-recurring items between $96.69 million and $121.72 million. Launchmetrics itself was projected to contribute $47.78-52.33 million in revenue with an EBITDA margin above 15% for 2024. (Actual 2024 results for Launchmetrics were $46.87 million in revenue and a 16.9% EBITDA margin 27).

The company has set clear objectives for 2025: to achieve recurring revenues of over $455.03 million, which includes $102.38 million from SaaS offerings. Overall revenues are targeted to be between $625.67 million and $682.55 million, with an EBITDA margin before non-recurring items approaching 20%. A key operational goal is to maintain a high "security ratio," ensuring that the gross margin from recurring revenues continues to cover a substantial portion of fixed overhead costs (this ratio was 96% in 2024).

Tariffs and Trade

Changes in Global Trade

The global manufacturing landscape is increasingly shaped by geopolitical tensions, particularly between the US and China, and the persistent threat of new or increased tariffs. Discussions around potential tariffs of 10% on EU imports, 25% on automobiles, and even higher rates on Chinese goods create a climate of uncertainty for industries reliant on global supply chains.

This environment directly impacts Lectra's core customer base in fashion, automotive, and furniture:

Increased Costs: Tariffs on essential components like steel, aluminum, electronics (including semiconductors), and on finished goods, inevitably inflate production costs for manufacturers.

Supply Chain Disruption & Relocation: The pressure to mitigate tariff impacts is forcing companies to fundamentally rethink their manufacturing footprints and sourcing strategies. This often involves complex and costly initiatives such as reshoring production to domestic markets, nearshoring to adjacent low-cost countries (like Mexico for the US market, or Eastern Europe for Western Europe), or diversifying sourcing away from high-tariff regions such as China to alternatives like Vietnam or India which is easier said than done.

Impact on Investment Decisions: The prevailing uncertainty can lead manufacturers to adopt a cautious stance, often delaying or deferring major capital investments until the trade policy outlook becomes clearer. Consumer confidence, which can be rattled by economic uncertainty and rising prices, also plays a significant role in investment sentiment within these consumer-facing industries.

Specific Sector Impacts:

Automotive: The automotive sector, with its deeply interconnected global supply chains, is particularly vulnerable. Tariffs on imported parts can add thousands of dollars to the production cost of a single vehicle, potentially eroding the competitiveness of electric vehicles and disrupting established component flows.

Fashion & Furniture: For fashion and furniture, especially in the luxury segment, tariff policies can create unexpected transparency challenges. Brands that have historically marketed products with European origin labels while relying on Chinese manufacturing may face consumer backlash if these supply chain realities are exposed through tariff-related scrutiny. This could accelerate a push towards more transparent, traceable, and potentially regionalized supply chains.

Lectra's Strategy to Mitigate Headwinds

Lectra’s Industry 4.0 solutions - encompassing automation, digitalization, and data analytics - offer tangible ways for manufacturers to mitigate tariff impacts by:

Improve operational efficiency to absorb or offset increased costs.

Building more agile, resilient, and responsive supply chains.

Facilitating the establishment or optimization of production in new, diversified, or regionalized locations.

Several of Lectra's specific offerings are particularly relevant in this context:

Retviews (AI Market Intelligence): This SaaS solution provides fashion brands with real-time visibility into competitor pricing, product assortments, sourcing patterns, and discounting strategies. In a market where tariffs can abruptly alter cost structures, such intelligence is invaluable. It allows brands to make informed, data-driven pricing adjustments to protect margins without unduly alienating consumers. Retviews also helps optimize product assortments for specific regional markets, ensuring relevance and reducing waste.

Valia (Cloud-based Cutting Room 4.0): This platform, designed for the fashion, automotive, and furniture industries, supports the trend towards regional manufacturing hubs and enables more agile, on-demand production models. This flexibility is key for companies needing to adapt quickly to shifting trade dynamics.

Kubix Link (PLM) & TextileGenesis (Traceability): These solutions enhance supply chain visibility and management. Kubix Link streamlines collaboration and data flow across dispersed design and production teams, while TextileGenesis provides the tools for robust material traceability. This is critical not only for sustainability initiatives but also for complying with complex rules of origin that often accompany tariff regimes and for addressing increased consumer demand for supply chain transparency.

Lectra is also actively pursuing geographic expansion as part of its strategy. The company's initiatives to grow its presence in markets like Mexico and Brazil, leveraging platforms such as Valia Fashion, are clear indicators of its intent to capitalize on the shift towards regional manufacturing and to serve customers looking to reduce their reliance on traditionally dominant, but now potentially high-tariff, manufacturing centers like China. India is another market where Lectra sees significant growth potential, aligning with global trends of supply chain diversification.

Investment Opportunity from Tariff Uncertainties

The core assertion is that these challenges will accelerate the adoption of automation and digitalization among manufacturers. As companies are forced to reconfigure their supply chains, find new efficiencies to combat tariff-induced cost inflation, or establish production in new territories, the demand for Lectra's integrated suite of solutions - from automated cutters and CAD/CAM software to PLM systems and AI-driven market intelligence - is likely to increase.

This perspective is echoed by some market commentators who see Lectra's strong Industry 4.0 focus and its strategic expansion into untaxed or less-tariff-affected regions as positioning the company as a "disruptor in automation" that offers "tariff resilience". This process can lock in long-term customer relationships for Lectra.

The impact of tariffs can be seen as an external catalyst, compelling manufacturers, particularly small and medium-sized enterprises (SMEs) that might have previously hesitated due to cost or inertia, to finally embrace the transformative potential of Industry 4.0. Tariffs fundamentally alter the return-on-investment calculation for digitization projects. The urgent need to rapidly shift production locations, manage intricate new supply networks, or extract every possible efficiency to absorb new costs elevates advanced software, automation, and data analytics from "nice-to-have" luxuries to "must-have" necessities. This external shock can overcome internal resistance to change, potentially accelerating a multi-year adoption cycle for Lectra's comprehensive suite of solutions.

In a world where tariffs can cause rapid shifts in input costs and competitive pricing, data becomes an exceptionally valuable commodity. Solutions like Retviews, which provide real-time market intelligence, are critical. Without accurate, timely data, businesses operate in the dark, risking either overpricing products and losing market share, or underpricing them and damaging profitability. Retviews offers the necessary visibility for informed decision-making on pricing, assortment planning, and even sourcing strategies, directly addressing the pain points created by tariff volatility. This capability elevates Lectra from being merely an equipment and software vendor to a strategic data and insights partner for its clients.

Furthermore, the heightened scrutiny on global supply chains resulting from trade tensions can also amplify the importance of sustainability and traceability, areas where Lectra is strengthening its offerings with solutions like TextileGenesis. Companies may increasingly need to provide verifiable proof of the origin of their goods to comply with complex international trade regulations or to satisfy consumers who are wary of products sourced from certain regions or under questionable conditions. Tariffs often come with intricate rules of origin, making robust material traceability a critical compliance tool. As highlighted by recent trends where trade tensions have led to consumer questioning of product origins, strong traceability capabilities can become a significant competitive advantage and a means of de-risking supply chains, thereby indirectly bolstering the investment case for solutions like TextileGenesis.

Porter's Five Forces Analysis

An analysis using Porter's Five Forces framework provides insight into the competitive dynamics of the markets Lectra operates in and the sources of its strategic advantages.

Intensity of Rivalry: (Moderate Post-Gerber Acquisition)

The competitive landscape was dramatically reshaped by Lectra's 2021 acquisition of Gerber Technology, its most significant and, by many accounts, only substantial global competitor. This consolidation has resulted in the combined entity holding an estimated 80% market share in their core segments globally. "Legacy" Lectra has historically positioned itself as a premium provider, with prices often 20-50% higher than competitors, justified by superior technology, throughput, and efficiency leading to a lower total cost of ownership over the equipment's lifespan. CEO Daniel Harari has consistently emphasized this value proposition. The remaining ~20% of the market is fragmented among a variety of smaller, often private, companies. In specific niches, key competitors include: Fabric Cutting Machines: Bullmer, Eastman Machine Company, and Zünd Systemtechnik AG are notable names. Fashion PLM/CAD Software: The software space sees competition from larger, diversified players like Dassault Systèmes, PTC, and Autodesk, as well as specialized PLM providers such as Arena PLM & QMS, and design software firms like EFI Optitex, Browzwear, and Assyst. The overall markets Lectra serves, such as PLM in Fashion (projected CAGR of 12.5%), Fabric Cutting Machines (projected CAGR of 4.63%), and Automotive Software (projected CAGR of 7.8%), are experiencing healthy growth. This expansion of the total addressable market can somewhat mitigate direct, aggressive rivalry for existing market share, as companies can also grow by capturing new demand. The rapid adoption of SaaS solutions further fuels this growth dynamic.

Threat of New Entrants: (Moderate to Low)

Several factors create significant barriers to entry for potential new competitors: High Capital Costs & R&D Investment: Developing and manufacturing industrial-grade cutting equipment and sophisticated enterprise software (CAD, CAM, PLM with AI capabilities) requires substantial upfront capital investment and sustained, significant R&D expenditure. Lectra, for example, invested 12.8% of its revenue in R&D in 2024. Established Customer Relationships & Brand Equity: Lectra has cultivated long-standing relationships with major global brands in fashion, automotive, and furniture over decades. Brand reputation and trust are hard-earned and difficult for newcomers to replicate quickly. High Switching Costs for Customers: As detailed later, the costs and complexities for customers to switch from Lectra's (or Gerber's) established platforms are substantial. Integration Complexity & Data Security Concerns: Integrating new PLM or CAD systems with a customer's existing legacy IT infrastructure is a complex, time-consuming, and often costly undertaking. Data security is also a paramount concern for enterprises adopting these solutions. Economies of Scale: Lectra's global operational scale, extensive sales and service network, and large installed base provide significant economies of scale in R&D, manufacturing, distribution, and customer support, which new entrants would struggle to match.

Bargaining Power of Suppliers: (Moderate)

Lectra, like many technology hardware manufacturers, faces dependencies on its supplier base: Component Dependency: The company relies on external suppliers for key components, particularly electronic parts such as semiconductors, which are critical for its automated cutting equipment and other hardware. The global semiconductor shortages of recent years have underscored the potential vulnerabilities in this part of the supply chain, impacting industries from automotive to industrial automation. Lectra's Mitigation Strategies: Lectra actively manages these risks through a multi-faceted approach. This includes rigorous technological, industrial, and financial assessments of its suppliers; implementation of specific supply security plans for high-risk vendors; and requiring adherence to a responsible purchasing charter. The company also prioritizes local sourcing where feasible (e.g., 94% of components for its Bordeaux-Cestas production site are sourced from European suppliers), maintains significant inventories of sensitive parts, pursues multiple sourcing strategies for critical components when possible, makes advance purchases of components nearing end-of-life, and continuously evolves its product designs (e.g., modular and programmable electronic controls) to allow for easier component replacement and mitigate obsolescence risks. Concentration in Certain Supply Markets: The semiconductor industry itself is characterized by geographic concentration of manufacturing (primarily East Asia) and a limited number of advanced foundry options, which can amplify supply risks.

Bargaining Power of Buyers (Customers): (Moderate to Low)

Several factors limit the bargaining power of Lectra's customers: High Switching Costs: This is arguably the most significant factor. Lectra's solutions are deeply embedded into its customers' core design and manufacturing workflows. The software requires substantial training, with users often needing "a month of classes to even start to master" the systems. Consequently, retraining staff on a new, unfamiliar system from a different provider would be both expensive and highly disruptive to operations. Furthermore, migrating extensive historical design and production data to a new platform is a complex process fraught with potential for errors and inconsistencies ("rounding errors") that can take considerable time and effort to resolve. Reflecting these high switching costs, Lectra has historically maintained very high customer continuity, recently highlighted by a 96% security ratio. This means most of Lectra's revenue comes from recurring subscriptions and contracts, showing strong customer loyalty. Market Concentration (Lectra/Gerber Dominance): With an estimated 80% global market share following the Gerber acquisition, customers have relatively few viable alternatives if they are seeking comprehensive, integrated, and industry-proven solutions at a similar scale. Strong Value Proposition: Lectra's solutions deliver demonstrable ROI to customers through material savings, waste reduction, increased efficiency, and faster time-to-market. If the perceived value is high, customers may be less inclined to exert strong pressure on pricing. Customer Size and Sophistication: While large, sophisticated customers (such as major automotive OEMs or global fashion conglomerates like GAP, Inditex, and Prada) inherently possess more bargaining leverage than smaller firms, the overall structural factors of high switching costs and market concentration tend to temper this power. It is worth noting, however, that within specific industries like automotive, buyers (the auto manufacturers) generally wield high bargaining power over their suppliers due to the availability of numerous brands and extensive online information.

Threat of Substitute Products or Services: (Low to Moderate)

The primary "substitute" for Lectra's automated solutions is often manual processes. However, in most of the industries Lectra serves, manual labor is increasingly uncompetitive due to higher costs, lower efficiency, quality inconsistencies, and the inability to scale rapidly, particularly in high-wage economies or for applications requiring high precision. Automation also helps address skilled labor shortages. Developing comparable sophisticated software (CAD/CAM/PLM) and precision hardware (automated cutters) in-house is a prohibitively expensive and complex undertaking for the vast majority of Lectra's customers. While specific technologies within the automation sphere will continue to evolve (e.g., new cutting methods, advancements in AI algorithms), the fundamental need for integrated design-to-production solutions is unlikely to diminish. The competitive threat in this context is more about customers choosing a competitor's specific technological approach over Lectra's, rather than abandoning automation altogether. The impact of automation on labor, often substituting low-skilled roles while creating demand for high-skilled roles to manage and operate the new systems, actually reinforces the need for sophisticated, integrated solutions like those offered by Lectra.

The Gerber acquisition significantly deepened Lectra's economic moat. Beyond merely eliminating its primary competitor, the deal substantially increased switching costs for a much larger combined customer base and solidified its status as the "market standard". This enhanced market dominance makes it even more challenging for new entrants or smaller competitors to displace Lectra, as customers are generally less inclined to switch away from a de facto industry standard due to network effects (e.g., easier availability of trained personnel, better interoperability within the broader industry ecosystem). This dominant position, coupled with the inherently high switching costs, should afford Lectra a degree of pricing power and contribute to a more stable and predictable revenue base over the long term.

Furthermore, Lectra's strategic shift towards a SaaS model acts as an additional competitive advantage. Cloud-based delivery, the promise of continuous updates and innovation, and the potential for deeper data integration across platforms make SaaS offerings inherently "stickier" than traditional on-premise perpetual license software. SaaS models typically foster more ongoing engagement with customers, often through dedicated customer success teams (which Lectra is reinforcing). The ability to collect and analyze anonymized usage data can also create a powerful feedback loop, driving continuous product improvement and innovation in a way that standalone software vendors might find difficult to replicate. This dynamic further entrenches Lectra within its customer base and makes its full value proposition harder for competitors to match quickly.

Finally, Lectra's proactive and diligent approach to managing its supplier risks, particularly concerning critical components like semiconductors, represents an often-underappreciated operational strength. In an era increasingly characterized by supply chain volatility and disruptions, this level of operational foresight can translate into a tangible competitive advantage. If Lectra can consistently ensure product availability and maintain stable production for its customers when competitors might be struggling due to component shortages, it enhances its reputation for reliability and can potentially lead to market share gains. Strategies such as prioritizing local sourcing where practical and maintaining significant inventories of sensitive parts, while potentially impacting working capital metrics in the short term, effectively function as an insurance policy against costly disruptions.

Leadership & Ownership: Who's at the Helm?

Management & Board of Directors:

Lectra is led by Daniel Harari, who serves as both Chairman and Chief Executive Officer. A graduate of the prestigious École Polytechnique and holding an MBA from HEC Paris, Mr. Harari has an exceptionally long tenure with the company. He effectively took the helm in 1991 after his venture capital firm, Compagnie Financière du Scribe, acquired Lectra, and was formally re-appointed CEO in May 2002. This continuity of leadership for over three decades is a defining characteristic of the company. Mr. Harari maintains a significant personal stake in Lectra, holding 12.7% of the company's capital. His total annual compensation was reported at €562,040.80

The Executive Committee comprises a team of experienced leaders overseeing key functional and regional areas. Notable members include Olivier du Chesnay (Chief Financial Officer since September 2017), Maximilien Abadie (Chief Strategy & Product Officer), Thierry Caye (Chief Technology Officer), Maria Modrono (Chief Marketing & Communications Officer), Laurence Jacquot (Chief Customer Success Officer), and Javier Garcia (Chief Customer Officer). Reflecting the strategic importance of recent acquisitions, Michael Jaïs, CEO & Co-founder of Launchmetrics, joined the Executive Committee in January 2024. Regional leadership is represented by Presidents for the Americas (Leonard Marano), EMEA (Antonella Capelli), and Asia-Pacific (Frédéric Morel).

The Board of Directors, as of April 25, 2025, consists of seven members, with a balanced gender representation of four women and three men. Five of the seven board members are independent, underscoring a commitment to good governance practices. Daniel Harari chairs the Board. Nathalie Rossiensky serves as the Lead Independent Director. Other independent directors include Céline Abecassis-Moedas, Karine Calvet, Pierre-Yves Roussel, and Hélène Viot Poirier. Jérôme Viala, a former long-serving Executive Vice President at Lectra, joined the Board as a non-independent director following his retirement from executive duties. The Board is supported by several specialized committees, including Audit, Strategic, Sustainability, Compensation, Nominations, and notably, an ad hoc Committee specifically tasked with overseeing the succession plan for the Chief Executive Officer.

Shareholder Structure:

Daniel Harari is the largest individual shareholder with 12.7% of the capital and 12.6% of the voting rights. The majority of Lectra's free float, which is over 85%, is held by institutional investors. According to Fintel, 44 institutional owners had filed 13F forms or 13D/G with the SEC, with prominent names including Brown Capital Management (BCSFX), Artisan International Small-Mid Fund (ARTJX), various Fidelity funds (FSTSX, FIGSX, FSCOX, FIGFX), T. Rowe Price International Discovery Fund (PRIDX), and Invesco Oppenheimer Global Opportunities Fund. Lectra's 2024 Annual Report also confirms that Brown Capital Management, FMR LLC (Fidelity), Kempen Oranje Participaties (The Netherlands), and Alantra EQMC Asset Management (Spain) each held more than 5% but less than 10% of the company's share capital and voting rights.

Lectra also promotes employee share ownership; management (excluding Daniel Harari, who holds no stock options) and 411 key employees collectively held 3.3% of the diluted capital through stock option programs.

A significant recent development in Lectra's corporate governance was the elimination of double voting rights, effective from April 2025. Previously, certain shares carried disproportionate voting power. This change, approved at a special shareholder meeting, democratizes the decision-making process by ensuring that all shares now carry equal weight. This move aligns Lectra with best practices in corporate governance, potentially reducing the perceived governance risk for investors and making the stock more attractive to a broader range of institutional funds, particularly those with stringent ESG (Environmental, Social, and Governance) screening criteria. The market reportedly reacted positively to this overhaul, with Lectra's stock outperforming the CAC 40 index by +8.2% in the period immediately following the announcement (as of May 10, 2025).

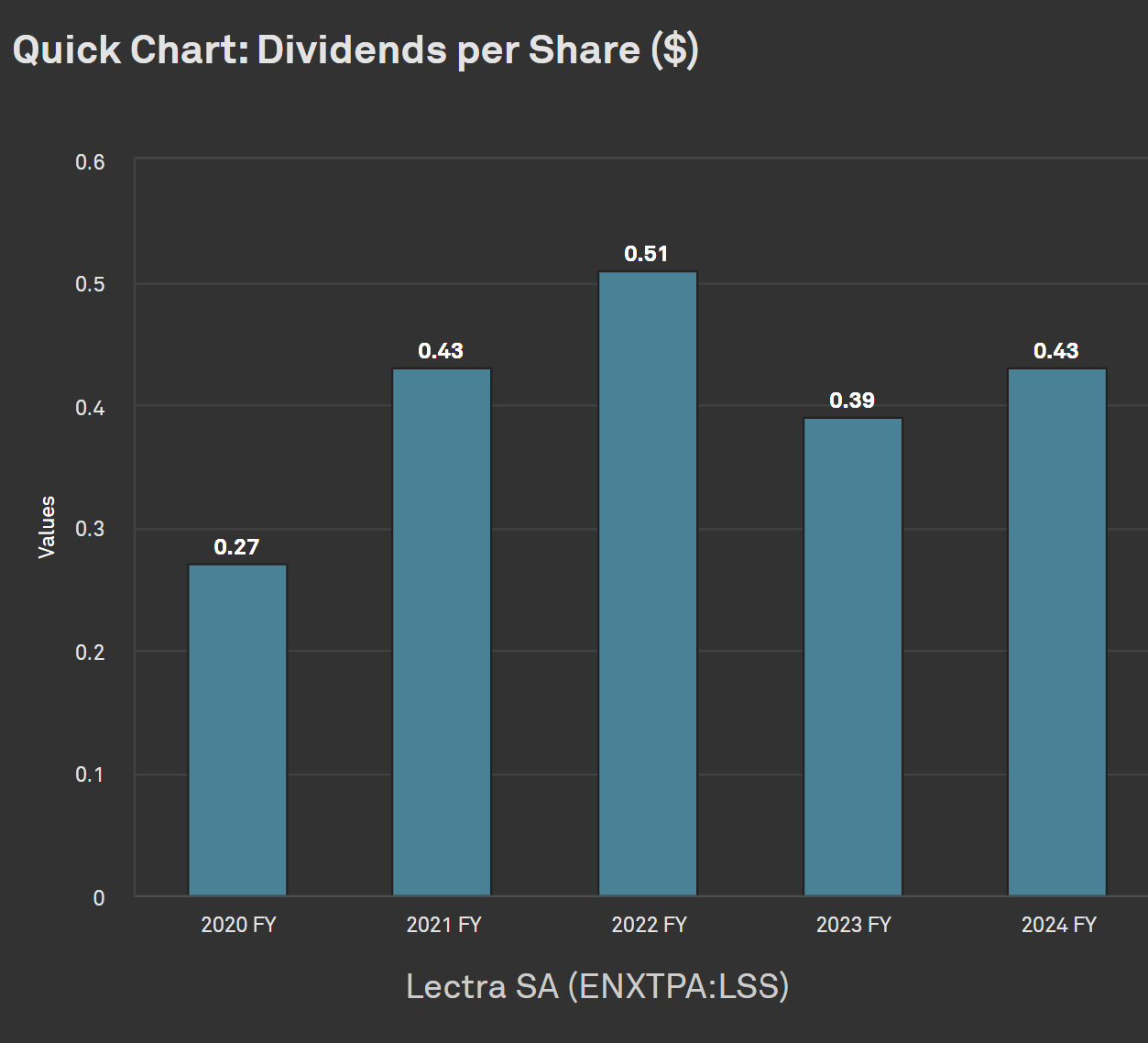

Dividend Policy & History:

Lectra has demonstrated a commitment to returning capital to its shareholders. The company's dividend policy has recently seen an enhancement; the payout ratio was approximately 40% of net income for the 2023 fiscal year, and due to strong free cash flow generation in 2024, the company decided to increase the payout ratio to 50% of net income for the 2024 fiscal year.

Recent dividend per share payments and proposals include:

For FY 2024 (proposed for payment in 2025): $0.43 per share, representing an 10.26% increase year-over-year. The ex-dividend date was April 30, 2025, with the payment date on May 05, 2025.

For FY 2023 (paid in 2024): $39 per share.

For FY 2022 (paid in 2023): 0.51

Graph 4: Lectra SA - Dividend Per Share History

The long and consistent leadership of CEO Daniel Harari, coupled with his substantial personal investment in the company, provides a strong alignment of interests with shareholders and a clear strategic vision. However, such a long tenure naturally brings the question of succession planning to the forefront for long-term investors. The establishment of an "ad hoc Committee in charge of the succession of the Chief Executive Officer" is a crucial and positive governance step, indicating that the Board is proactively addressing this key person risk. This should offer some reassurance to investors concerned about leadership continuity.

The recent elimination of the double voting rights structure is a significant enhancement to Lectra's governance profile. Dual-class share structures are often viewed unfavorably by governance-focused institutional investors as they can entrench existing management or disproportionately favor certain shareholder groups. By moving to a "one share, one vote" principle, Lectra not only aligns itself with modern governance best practices but also potentially broadens its appeal to a wider universe of institutional capital. This could, over time, lead to increased demand for its shares and potentially a lower cost of equity. The positive market reaction cited suggests investors have welcomed this change.

Finally, Lectra's dividend policy, particularly the recent increase in the payout ratio to 50% for FY2024, signals management's confidence in the company's future cash-generating capabilities. This confidence is likely underpinned by the growing proportion of predictable, high-quality recurring revenues from its expanding SaaS business. As SaaS revenues become a more dominant part of the mix, future cash flows become more foreseeable, giving the Board greater assurance in committing to a more generous dividend payout. This evolution in dividend policy could also make Lectra's stock increasingly attractive to income-oriented investors, thereby diversifying its shareholder base.

Investment Perspective & Concluding Thoughts

Recap of the Bull Case

Lectra SA presents a compelling investment narrative centered on several key strengths and strategic initiatives:

Successful and Accelerating SaaS Transition: The company is rapidly growing its Software-as-a-Service revenue, which reached $88.04 million in 2024 (15% of total) and is targeted to exceed $102.37 million in 2025. This shift is creating a higher-quality, more predictable recurring revenue stream (72% of total revenue in 2024) and has the potential to enhance overall profit margins.

Leadership in Industry 4.0: Lectra boasts a strong, integrated portfolio of solutions encompassing CAD/CAM software, PLM systems, advanced automated cutting equipment, and data analytics services. This positions the company effectively to capitalize on the ongoing digitalization and automation megatrends within its core industries of fashion, automotive, and furniture.

Tariffs as a Demand Catalyst: In an era of heightened global trade tensions and tariff uncertainties, Lectra's solutions (particularly AI-driven market intelligence like Retviews and agile manufacturing platforms like Valia) can empower its customers to adapt their supply chains, optimize pricing, and mitigate risks. This macroeconomic headwind for manufacturers could paradoxically translate into a business opportunity and demand driver for Lectra.

Dominant Market Position: Following the strategic acquisition of Gerber Technology, its primary global competitor, Lectra now commands an estimated 80% market share in its key segments. This dominant position creates a formidable economic moat, characterized by high customer switching costs and significant barriers to entry for new competitors.

Strategic and Accretive M&A: Lectra has a proven track record of strategic acquisitions (Gerber, Launchmetrics, Kubix Link, Retviews, TextileGenesis) that are enhancing its technological capabilities, accelerating its SaaS growth, expanding its coverage of the customer value chain, and appear to be integrating successfully.

Strong Financial Profile: The company has shown resilience in challenging macroeconomic conditions, with improving underlying fundamentals (evidenced by the 96% "security ratio"), robust free cash flow generation ($95.546 million in FY2024), and a healthy balance sheet with manageable net debt.

Potentially Attractive Valuation: Current valuation metrics, particularly a forward PEG ratio of 0.66, suggest potential undervaluation if the company achieves its growth forecasts. Analyst consensus is generally "Buy," with price targets indicating considerable upside potential.

Experienced Leadership and Improved Governance: The company benefits from a long-tenured and significantly invested CEO, Daniel Harari. Recent positive governance changes, such as the elimination of double voting rights, enhance its appeal to institutional investors.

Key Risks & Investor Considerations

Despite the positive attributes, investors should consider several risks:

Macroeconomic Headwinds and Customer Investment Cycles: Lectra serves industries (fashion, automotive, furniture) that are inherently cyclical and sensitive to overall economic conditions and consumer sentiment. During periods of economic downturn or heightened uncertainty, customers may delay or reduce capital expenditures and software investments, as seen in the "degraded environment" of 2023 and the "business slowdown" noted for Q1 2025.

Execution on M&A Integration: While the integration of Launchmetrics is reported as successful, the ongoing successful integration of multiple acquired technologies, platforms, and teams remains crucial for realizing full synergies and avoiding operational disruptions. Non-cash amortization charges related to these acquisitions will continue to impact GAAP net income in the near term.

Competitive Pressures: Although Lectra is the market leader, it still faces competition from specialized niche players in specific segments and from large, diversified software companies that offer PLM or CAD solutions. Continuous innovation and investment in R&D are essential to maintain its competitive edge.

Supply Chain Vulnerabilities: Despite proactive mitigation efforts, Lectra remains dependent on certain suppliers, particularly for electronic components like semiconductors. Global shortages or disruptions in these supply chains could impact production and delivery capabilities.

Geographic Concentration of Performance: Recent growth in some segments has been notably reliant on specific regions, such as Asia for automotive orders in Q1 2024. A slowdown in these key growth regions could impact overall performance.

Recent Share Price Underperformance: Stockopedia classified Lectra as a "Falling Star", reflecting that its share price has been trading below its 52-week high and key moving averages, with negative relative strength against the broader market. This indicates recent market sentiment has been cautious, and the stock needs catalysts to reverse this trend.

Valuation Summary & Potential

Lectra's valuation is contrasting. On one hand, metrics like a forward P/E of around 17.66x and a PEG ratio of 0.66 suggest that the stock may not fully reflect its growth potential, especially when considering analyst EPS growth forecasts in the range of 36%. Analyst price targets generally point to substantial upside from current levels.

On the other hand, the recent share price underperformance and the Q1 2025 "business slowdown" warning indicate that the market is factoring in current macroeconomic uncertainties. The key to unlocking valuation potential lies in Lectra's ability to continue executing its SaaS transition, successfully integrate its acquisitions to drive synergistic growth, and demonstrate that it can indeed help its customers navigate (and benefit from) the evolving global trade landscape. If the company can deliver on its 2025 financial objectives, particularly the $102.37 million SaaS revenue target and an overall EBITDA margin approaching 20%, a significant re-rating of the stock could occur.

The divergence between reported GAAP net income (depressed by non-cash amortization from acquisitions) and strong free cash flow generation is a critical factor. An investor focus on FCF-based metrics or adjusted profitability measures (like an underlying NOPAT, which analysts might estimate around $73.93 million, and a post-tax ROCE adjusted for acquisition intangibles, potentially around 35%, as alluded to in the initial query) would likely reveal a more favorable view of Lectra's intrinsic value and profitability than P/E ratios based on unadjusted net income.

Final Take

Lectra SA appears to be at an inflection point. The "Falling Star" stock market classification seems to be at odds with a business that is fundamentally strengthening its model through a decisive SaaS pivot, strategic acquisitions, and a dominant market position. This disconnect may represent the core of the investment opportunity. The market might be overly focused on near-term macroeconomic headwinds affecting customer investment sentiment or the temporary impact on GAAP net income from acquisition-related accounting. However, if Lectra successfully continues to execute its strategic plan—growing its high-margin SaaS revenues, realizing synergies from its acquisitions, and capitalizing on the broader Industry 4.0 adoption trends (which could be accelerated by tariff-induced supply chain reconfigurations)—a positive shift in market sentiment and a corresponding share price recovery seem plausible. The low forward PEG ratio lends quantitative support to this potential.

Beyond the immediate impact of specific tariffs, Lectra is well-positioned as a "picks and shovels" provider for the multi-decade secular trend of de-globalization, supply chain regionalization, and the broad pursuit of operational resilience. Companies across Lectra's core sectors—fashion, automotive, and furniture—will increasingly require the agility, data-driven insights, and automation capabilities that Lectra's integrated suite of solutions provides to navigate a more fragmented and uncertain global trade environment. This positions Lectra as a potential long-term beneficiary of these structural shifts, irrespective of the precise tariff policies enacted at any given moment.

Furthermore, the increasing volume of data processed by Lectra's expanding network of SaaS platforms (Kubix Link, Retviews, Launchmetrics, TextileGenesis, Valia) represents a significant, though currently unquantified, asset. In the future, aggregated and anonymized industry-specific data could unlock new revenue streams or significantly enhance the AI capabilities of its existing product portfolio, adding another layer to its long-term growth potential beyond direct software and equipment sales.

For investors with a medium to long-term horizon, Lectra offers exposure to the durable Industry 4.0 transformation, a compelling SaaS growth story, and a degree of counter-cyclical opportunity tied to global trade restructuring. While near-term volatility related to customer investment cycles is a risk, the underlying strategic direction and market positioning appear robust.

Thanks for reading The Small Cap Strategist, if you like our research please consider subscribing.

Disclaimer: This post is for informational and educational purposes only and should not be considered investment advice. The author is not a financial advisor. All investment decisions carry risk, and readers should consult with a qualified financial professional before making any investment choices. The author may or may not hold positions in the securities discussed.