Stock Pitch #6 A Counter-Cyclical Compounder with 10%+ FCF Yield, Academedia AB (OM:ACAD)

High upside, with a highly competent management team and a resilient business model, Academedia offers stability, growth, Strong returns, disciplined growth, and regulatory risks priced in.

Recommendation

Academedia AB (OM:ACAD) presents a compelling investment opportunity for long-term investors. The company's market leadership in Northern Europe, consistent profitability, and strong cash generation are undeniable strengths.

While the share price has been "depressed in the past couple of years" due to "perceived regulatory risk" in its Swedish compulsory and upper secondary education units, the business has consistently delivered "steady profits and growth in the mid-to-high single digits over the past decade". This current market perception, in our view, creates an attractive entry point, offering a substantial "free cash flow yield of more than 10% for the current fiscal year ending June 2025". The market appears to be overlooking the company's operational resilience and long-term growth trajectory.

The explicit mention of "perceived regulatory risk" in an analysis done by Ennismore is particularly instructive. This phrasing suggests a disconnect between the market's current valuation and Academedia's underlying cash generation capabilities. A high free cash flow yield typically indicates that a stock is undervalued relative to its ability to generate cash. The market's reaction, driven by the uncertainty and sentiment surrounding potential regulatory changes, seems to be overshadowing Academedia's consistent profitability and strategic diversification efforts. This overemphasis on short-term regulatory headlines, while neglecting the fundamental operational strengths and long-term prospects, often creates a classic value investing scenario. For patient investors, this "perceived" risk translates into a tangible margin of safety, offering significant upside if regulatory outcomes prove less severe than currently feared, or if the company does strategic international expansion and the inherent stability of its adult education unit.

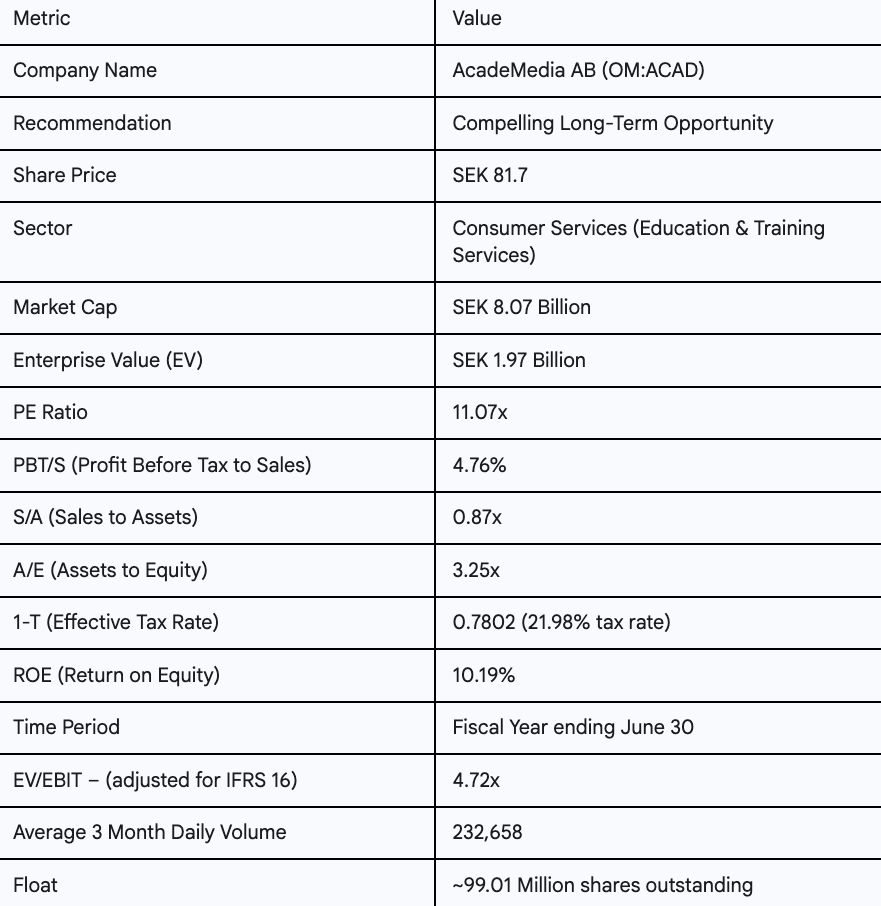

Key Investment Metrics

Investment Case

Academedia's investment narrative is built on a foundation of established strengths, strategic responses to weaknesses, and a clear framework to capitalizing on significant opportunities.

Strengths:

Market Leadership and Scale: Academedia is not merely an education provider; it is the largest independent education operator in Sweden and across Northern Europe. Its network includes over 110,000 students enrolled across 729 schools, with a total of 860 units including pre-, compulsory, and upper secondary schools, as well as adult education centers. This considerable scale provides substantial operational efficiencies, allowing for better resource allocation, procurement advantages, and a stronger brand presence across diverse markets.

Consistent Profitability and Strong Cash Generation: The company has a proven track record, historically generating post-tax returns on invested capital in excess of 10%. For the fiscal year 2024, its Return on Equity (ROE) stood at 10.19%, and Return on Capital Employed (ROCE) was 11.8% in FY2023. The business is notably very cash generative, requiring little upfront capital, evidenced by high Levered Free Cash Flow of $256.6 million in FY2024. This strong cash flow provides financial flexibility for both reinvestment and shareholder returns.

Disciplined Growth Strategy: Academedia's growth has been a blend of organic expansion and disciplined acquisitions. Recent strategic acquisitions, such as Touhula in Finland (adding 113 preschools), Winford College, Yes! Kinderopvang in the Netherlands, and International Schools Potsdam/Erfurt in Germany, demonstrate a clear strategy to expand its footprint and diversify its revenue streams. These acquisitions are not just opportunistic; they are integrated to contribute to the company's overall organic growth figures.

Diversified Operations: The company's operational model is inherently diversified, spanning preschool, compulsory school, upper secondary school, and adult education segments. A key component of this diversification is its adult education unit, which is counter-cyclical and accounts for approximately 10% of total revenues. This segment provides a stable revenue base that often performs well during economic downturns, offering a natural hedge to other parts of the business.

Strategic International Expansion: A significant strategic focus for Academedia is expanding its operations beyond Sweden. The company has set an ambitious goal for 50% of its operations to be outside Swedish schools, with a specific target of operating 200 preschools in Germany and becoming a leading school operator in the region through acquisitions. International operations already contribute a substantial 31% to total sales, demonstrating tangible progress in this strategic shift.

Competent Management Team: The business is managed by a "highly competent team". Marcus Strömberg, the President & CEO, has a remarkable tenure of 20.4 years, during which he has overseen significant growth, reportedly achieving a 20% growth rate over the years. This long-standing leadership provides stability and deep institutional knowledge.

Weaknesses:

Perceived Regulatory Risk in Sweden: The most prominent weakness, is the "perceived regulatory risk" in its Swedish compulsory and upper secondary education units. This risk is not merely speculative; company statements confirm an ongoing "inquiry on profits in schools" which proposes stricter requirements, including potential bans on profit distribution in the initial years of a school's operation, during ownership changes, or in instances of quality deficiencies. This regulatory uncertainty creates a significant overhang on the share price.

Reliance on State-Funded Vouchers: Academedia's revenue model is primarily dependent on state-funded vouchers for each enrolled student. While this provides a stable and predictable revenue stream, it inherently exposes the company to political decisions, budget allocations, and potential changes in funding mechanisms by the government.

Potential for Grade Inflation Concerns: The public discourse in Sweden includes debates focusing on the role of independent schools in contributing to inequality, segregation, and concerns about "grade inflation". While Academedia asserts its commitment to quality and reports improved quality results, these public perceptions can fuel further regulatory pressure and impact public trust.

Lower School Voucher Increases: Provisional school voucher increases for 2025 in Sweden are notably lower than in previous years, with Swedish preschools seeing approximately 2.5%, compulsory schools 3%, and upper secondary schools around 2.5%. If cost inflation continues or accelerates, these lower increases could put pressure on margins, particularly in segments heavily reliant on Swedish vouchers.

Opportunities:

Growing Demand for Private Education: Independent schools in Sweden have consistently been gaining market share. More broadly, the global private K12 education market is projected to grow at a Compound Annual Growth Rate (CAGR) of 3.79% from 2025 to 2035, with significant projected growth across preschool, primary, and secondary segments. This underlying market expansion provides a strong tailwind for Academedia.

International Market Expansion: The demand for preschool places in Germany remains strong, with Academedia planning to open 10-15 units annually and aiming to reach 200 preschools. The child care services market in Norway is also projected to grow at a 3% CAGR. These international markets offer less saturated environments and potentially more favorable regulatory climates for growth compared to Sweden.

Leveraging Digital Learning Platforms: The global education sector is undergoing a digital transformation, with EdTech, AI, and VR playing increasingly significant roles. Germany's online education market, for instance, is expected to grow at a substantial 12.7% CAGR. Academedia's investment in digital learning platforms like Omniway positions it to capitalize on this trend, enhancing its offerings and operational efficiency.

Vocational Training Needs: Rising unemployment in Sweden, projected to reach 6.9% in 2025, is driving increased demand for higher vocational education. Academedia's programs in this segment are currently operating at full capacity. This counter-cyclical demand provides a good growth avenue, aligning with labor market needs.

Quality Improvement Initiatives: Academedia's proactive focus on enhancing quality, including initiatives in reading literacy, increasing qualified teachers, and improving assessment methods, can strengthen its reputation, attract more students, and potentially mitigate quality-related criticisms from regulators and the public.

Threats:

Stricter Regulatory Changes in Sweden: The most significant threat remains the potential for severe regulatory changes in Sweden. The ongoing inquiry into profits in schools, coupled with public skepticism towards for-profit education providers, could lead to legislation that limits or bans profit distribution, imposes stricter ownership requirements, or reduces voucher funding. Such changes could materially impact profitability and the business model.

Demographic Shifts: While Academedia has reported positive organic growth despite broader demographic trends in Sweden, a more rapid or pronounced decline in birth rates or student populations in specific core Swedish segments could erode the long-term revenue base if not offset by international growth or other segments.

Increased Competition: The Swedish education market is characterized by "robust competitive rivalry". Academedia, as the market leader among independent schools, faces competition not only from less focused municipal schools but also from other independent operators. The increasing number of for-profit schools entering the market intensifies this competitive pressure, leading to a constant "fight for student enrollment".

Economic Downturn Impact: While the adult education segment is counter-cyclical, other segments, particularly preschools with self-pay parental fees, could be sensitive to economic downturns. This is especially relevant in international markets like Norway and Germany, where parental fees constitute a larger portion of revenue.

Integration Challenges: Academedia acknowledges challenges related to integration and managing schools with a high proportion of foreign-born students. Failure to effectively address these complex social and educational issues could impact quality metrics, student outcomes, and public perception, potentially leading to reputational damage or regulatory scrutiny.

Regulatory Risk vs. Operational Reality

The market's reaction is largely driven by the uncertainty and speculation surrounding the severity and implementation of these potential changes. The core risk lies in a potential ban or severe restriction on profit distribution. However, Academedia's proactive stance - welcoming clearer regulation, analyzing risks, and preparing to adapt - demonstrates a strategic approach to managing this environment. The company's strategic shift towards international operations, aiming for 50% of its business to be outside Swedish schools, is a direct and calculated response to mitigate this concentrated Swedish regulatory risk. This diversification strategy aims to reduce reliance on a single, potentially volatile, regulatory environment, thereby de-risking the business model over the long term.

Diversification as a Strategic Hedge: Academedia's expansion into international markets, including Germany, Norway, Finland, Netherlands, Poland, and the UK, coupled with its leading adult education unit, represents a clear strategic imperative. This is not simply a growth strategy; it functions as a critical hedge against the specific regulatory and political risks inherent in the Swedish market. By significantly growing its international revenue streams and expanding its counter-cyclical adult education segment, Academedia actively reduces its dependence on the potentially volatile Swedish K-12 voucher system. This diversification fundamentally improves the company's overall risk profile, making it more resilient to adverse changes in any single market. The "counter-cyclical" nature of adult education is particularly valuable, providing a stable and often growing revenue base even during broader economic downturns, when demand for vocational training typically increases. This multi-pronged approach to growth and risk mitigation is a testament to management's forward-thinking strategy.

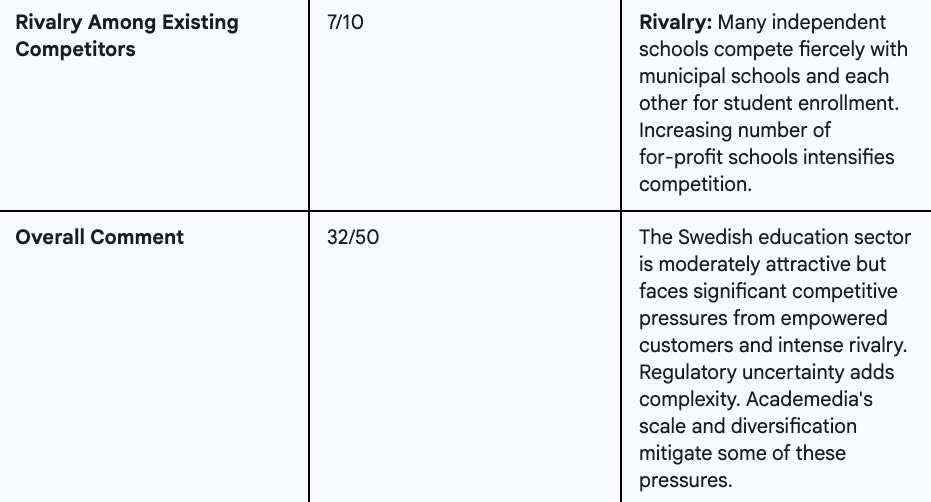

Competition & Porter's Five

Understanding the competitive dynamics within an industry is crucial for assessing a company's long-term viability and profitability. Michael Porter's Five Forces framework provides a structured approach to analyzing these dynamics. Each force is scored out of 10, with a higher score indicating a stronger competitive pressure or a less attractive industry environment.

Table: Porter's Five Forces Analysis for Academedia AB

The power of suppliers in the education sector, particularly for Academedia, is a notable factor. Teachers represent a significant portion of operational costs. While Academedia has made strides in increasing its proportion of qualified teachers, there remains a general shortage of vocational teachers in Sweden. This scarcity grants specialized educators a degree of bargaining power, particularly concerning wages and working conditions. However, Academedia's substantial scale and its focus on fostering employee satisfaction can help mitigate this pressure by making it an attractive employer. For educational materials, the Swedish government's mandate for free resources, effective from July 2024, fundamentally alters the financial dynamics, potentially reducing the direct influence of textbook publishers and other material suppliers over schools' budgets.

Bargaining Power of Customers: 8/10

In the Swedish education system, students and their parents wield considerable influence, making them a powerful force. This power stems directly from the school choice system and the voucher model, where public funding for independent schools is directly tied to student enrollment. This creates a highly competitive environment where schools are acutely dependent on attracting and retaining students. A school's reputation and the perceived quality of its education directly impact enrollment figures. Furthermore, the ongoing political debate surrounding school choice, social segregation, and concerns over grade inflation amplifies customer influence, as public opinion can directly translate into regulatory changes that affect the operational environment for private providers.

Threat of New Entrants: 5/10

The threat of new entrants in the Swedish independent school sector is moderate. While Sweden has a relatively open system that permits for-profit schools and imposes few restrictions on ownership, making entry seemingly straightforward compared to other countries, several barriers exist. The increasing regulatory scrutiny and proposed stricter regulations, including potential bans on profit distribution in early operational years, could significantly raise the hurdle for prospective new entrants. Establishing and scaling a network of schools also requires substantial capital, despite the voucher system reducing some upfront operational capital needs. Moreover, established players like Academedia benefit from strong brands and a proven track record of quality, making it challenging for new, unproven schools to quickly build trust and gain significant market share. Academedia's disciplined acquisition strategy also indicates that larger players can consolidate the market, making it harder for smaller new entrants to gain significant traction.

Threat of Substitutes: 6/10

The threat of substitute products or services in the education sector is notable. Municipal schools serve as the primary substitute, particularly in Sweden. While these public schools often contend with "bloated cost structures", they remain the default choice for many families. Shifts in public perception and concerns about independent schools could potentially drive students back to public options. Beyond traditional schooling, alternative educational paths for upper secondary students include adult education, folk high schools, or direct entry into vocational training or the workforce. Academedia's own adult education segment somewhat mitigates this threat by capturing a portion of this "substitute" market. Furthermore, the rise of online learning platforms, such as Massive Open Online Courses (MOOCs), Learning Management Systems (LMS), and mobile learning apps, presents a growing threat, especially given the rapid growth of the online education market in Germany. Academedia's strategic investments in digital platforms like Omniway are a direct response to this changing sector.

Rivalry Among Existing Competitors: 7/10

The Swedish education market is characterized by competitive rivalry. Academedia, as the market leader among independent schools, faces intense competition from both less focused municipal schools and a growing number of other independent operators. This market is defined by a continuous "fight for student enrollment". The increasing prevalence of for-profit schools within the independent sector further intensifies this rivalry, as more players vie for the same pool of publicly funded students.

Overall Comment: 32/50

The Swedish education sector, while offering significant growth opportunities for independent providers, operates under considerable competitive pressures. The high bargaining power of customers (students and parents) and intense rivalry among existing players are particularly impactful. Regulatory uncertainty adds another layer of complexity, demanding constant adaptation. The threat of substitutes, including public schools and rapidly evolving online learning platforms, is a factor that Academedia must continuously address. While suppliers, particularly qualified teachers, hold some leverage, Academedia's scale and diversified offerings provide a degree of resilience. The overall score reflects an industry that is moderately attractive but requires strong strategic execution and operational efficiency to maintain profitability and market position.

Regulatory Impact on Competitive Dynamics

The ongoing regulatory discussions surrounding profit limits and the existing voucher system are not merely isolated policy debates; they fundamentally shape the competitive nature of this sector. The "perceived regulatory risk" extends beyond Academedia's direct profitability, influencing the attractiveness of the entire independent school sector for new investment and dictating the strategies of existing players. If profit distribution were to be severely restricted, it could deter new for-profit entrants, potentially reducing the threat of new competition. However, it could also disincentivize existing players from expanding or innovating, leading to a less dynamic and potentially stagnant market. Conversely, an overly restrictive regulatory environment might push smaller, less resilient private operators out, inadvertently benefiting larger, more adaptable players like Academedia who possess the resources and compliance frameworks to adjust to such changes. The current system, characterized by strong customer bargaining power due to school choice, inherently compels schools to focus on quality and efficiency, which serves as a competitive advantage for well-run private institutions over what an analyst describes as "less focused municipal schools that tend to have bloated cost structures".

Competitors & Market Position

Academedia operates in a dynamic and fragmented education market, particularly in Sweden, where it holds a dominant position among independent providers. Understanding its key competitors and their respective market shares is crucial for appreciating Academedia's competitive standing.

Competitors

Academedia faces competition from a mix of other independent school operators and, indirectly, from municipal public schools. The most direct competitors in the independent school sector include:

Internationella Engelska Skolan (IES): A prominent independent school operator in Sweden, IES distinguishes itself with a focus on bilingual education and high academic expectations. As of autumn 2024, IES enrolled 31,000 students across 47 compulsory schools and one upper secondary school. IES is notably the largest operator of independent schools within the Swedish compulsory education system.

Cedergrenska AB (OM:CEDER): This company is identified as a competitor by various financial analysis platforms. It has a market capitalization of SEK 511.2 million.

Tellusgruppen AB (STO:TELLUS): Also listed among Academedia's competitors, Tellusgruppen has a market capitalization of SEK 94.104 million.

eEducation Albert AB (STO:ALBERT): Another player in the education sector, eEducation Albert AB is cited as a competitor with a market capitalization of SEK 77.9 million.

While other companies like SkiStar, Scandic Hotels Group, and Kambi Group are occasionally listed as competitors, their primary business models are not directly within the education services sector, making them less relevant for a direct competitive analysis of Academedia's core operations.

Market Shares

AcadeMedia:

Academedia maintains its position as the overall market leader within Sweden's independent school sector, holding an approximate market share of 20%.

It is recognized as the largest independent education provider in Northern Europe and stands as the second-largest education provider in Sweden overall, surpassed only by the City of Stockholm.

Specifically, Academedia is the largest independent operator of upper secondary schools in Sweden.

In the adult education segment, Academedia is Sweden's largest provider, commanding an approximate market share of 20%.

Internationally, Academedia has ambitious growth plans. In Germany, it aims to expand its preschool operations to 200 units and become a leading school operator. As of spring 2025, the company inaugurated its 100th preschool in Germany.

In Norway, Academedia holds a leading position in the preschool market through its brand, Espira.

Competitors

IES: As noted, IES is the largest operator of independent schools within the Swedish compulsory education system.

Specific market share figures for other direct competitors in Sweden's independent school sector are not extensively detailed in the provided materials beyond student counts and overall market structure. However, older data from 2019/2020 indicates Academedia held 11% of elementary school students and 37% of high school students among independent schools in Sweden, providing a historical perspective on its relative positioning against peers like IES and Kunskapsskolan (KS).

Table: Key Competitors Comparison

Competitive Analysis

Academedia's ability to maintain its market leadership and consistent profitability in a competitive and regulated environment points to several developing competitive advantages:

Scale and Network Effects: As the largest independent operator in Northern Europe, Academedia benefits significantly from economies of scale. This translates into efficiencies in administration, procurement, and shared resources across its vast network of schools. Its extensive footprint, encompassing 729 schools and 860 units, provides broad geographic coverage and enhances brand recognition, making it a preferred choice for parents and students seeking established and reliable educational options. This broad network can also attract and retain talent, offering diverse career paths within the organization.

Quality Management System: The "AcadeMedia model" serves as a systematic quality assurance framework applied across all its operations. This unwavering focus on quality is explicitly cited as a key driver of growth and improved profitability. In an industry where public trust and educational outcomes are paramount, a demonstrable commitment to quality acts as a powerful differentiator.

Diversified Offerings and Geographic Presence: The breadth of Academedia's educational offerings, from preschool to adult education, combined with its expanding international presence across Sweden, Norway, Germany, Finland, Netherlands, Poland, and the UK, significantly reduces its reliance on any single segment or national market. This diversification provides inherent resilience against localized regulatory changes or demographic shifts, allowing the company to reallocate resources to higher-growth or more stable segments.

Strong Brand Portfolio: Operating under multiple established brands such as Framtidsgymnasiet, Hermods, Pysslingen, Espira, Vittra, and NTI-gymnasiet, Academedia can cater to a wide array of pedagogical needs and market segments. This multi-brand strategy allows for targeted marketing and specialized educational profiles, appealing to diverse student and parent preferences.

Economic Moat

Traditional economic moat factors, often applied to product-based or technology-driven businesses, don’t fully capture the competitive advantages in a sector like education.

The "No Moat" rating from GuruFocus is based on criteria such as market leadership, cost advantages, network effects, customer switching costs, intellectual property, brand strength, regulatory barriers, distribution, pricing power, and innovation. However, in a publicly funded, highly regulated service industry like education, a "moat" is not built on monopolistic pricing power or proprietary technology in the conventional sense, as education is often considered a public good. Instead, a sustainable competitive advantage in this sector is derived from operational excellence, scale, and the ability to cultivate strong relationships with regulators and local communities.

Academedia's competitive advantages: its sophisticated quality management systems, extensive geographic diversification, proven ability to adapt to regulatory environments, and efficient cost structures compared to municipal schools function as a de facto moat. The company's consistent success in attracting students and achieving organic growth within a choice-based system strongly suggests a compelling value proposition that acts as a competitive barrier.

Developing Brand Recognition and Reputation: Academedia's considerable scale and consistent investment in quality initiatives contribute to a growing and positive reputation.

Moderate Economies of Scale: As the largest operator, Academedia benefits from purchasing power and operational efficiencies that smaller, independent schools cannot achieve, particularly in centralized administrative functions and curriculum development.

Mixed Regulatory Barriers: While Sweden's system is open to for-profit entities, the increasing regulatory scrutiny could paradoxically act as a barrier for smaller, less compliant new entrants. This favors larger, established players with the resources to manage complex regulatory frameworks.

Limited but Present Network Effects: While not as pronounced as in digital platforms, a large network of schools can attract a broader pool of teaching talent and offer diverse educational pathways for students within the same system, creating some network benefits.

Operations

Academedia's operational footprint is extensive and diversified, covering a wide spectrum of educational services across multiple geographies. This operational breadth is a cornerstone of its business model and a key factor in its resilience and growth.

Products & Services

Preschool: This segment includes operations in Sweden, Norway, Finland, Germany, and the Netherlands. While primarily state-funded through vouchers, some self-pay parental fees contribute to revenue, with the proportion varying by country.

Compulsory School: Academedia runs compulsory schools (typically K-9 equivalent) and integrated preschools throughout Sweden, operating under various brands.

Upper Secondary School: This segment provides upper secondary education (Gymnasieskola) across Sweden, offering a mix of academic and vocational programs to prepare students for higher education or direct entry into the workforce.

Adult Education: This unit is a significant component, recognized as "counter-cyclical", meaning its demand tends to increase during economic downturns. It accounts for approximately 10% of total revenues and offers a variety of trainings, including Swedish for Immigrants (SFI), Information Technology (IT), marketing, logistics, and higher vocational education, across approximately 150 units in Sweden.

Geographies

Primary Market: Sweden remains Academedia's largest and most established geographical segment.

International Expansion: The company has a growing international presence, with significant operations in Norway and Germany. Recent strategic acquisitions have expanded its footprint into Finland and the Netherlands. Additionally, Academedia maintains smaller operations in Poland and the UK, indicating a broad European strategy.

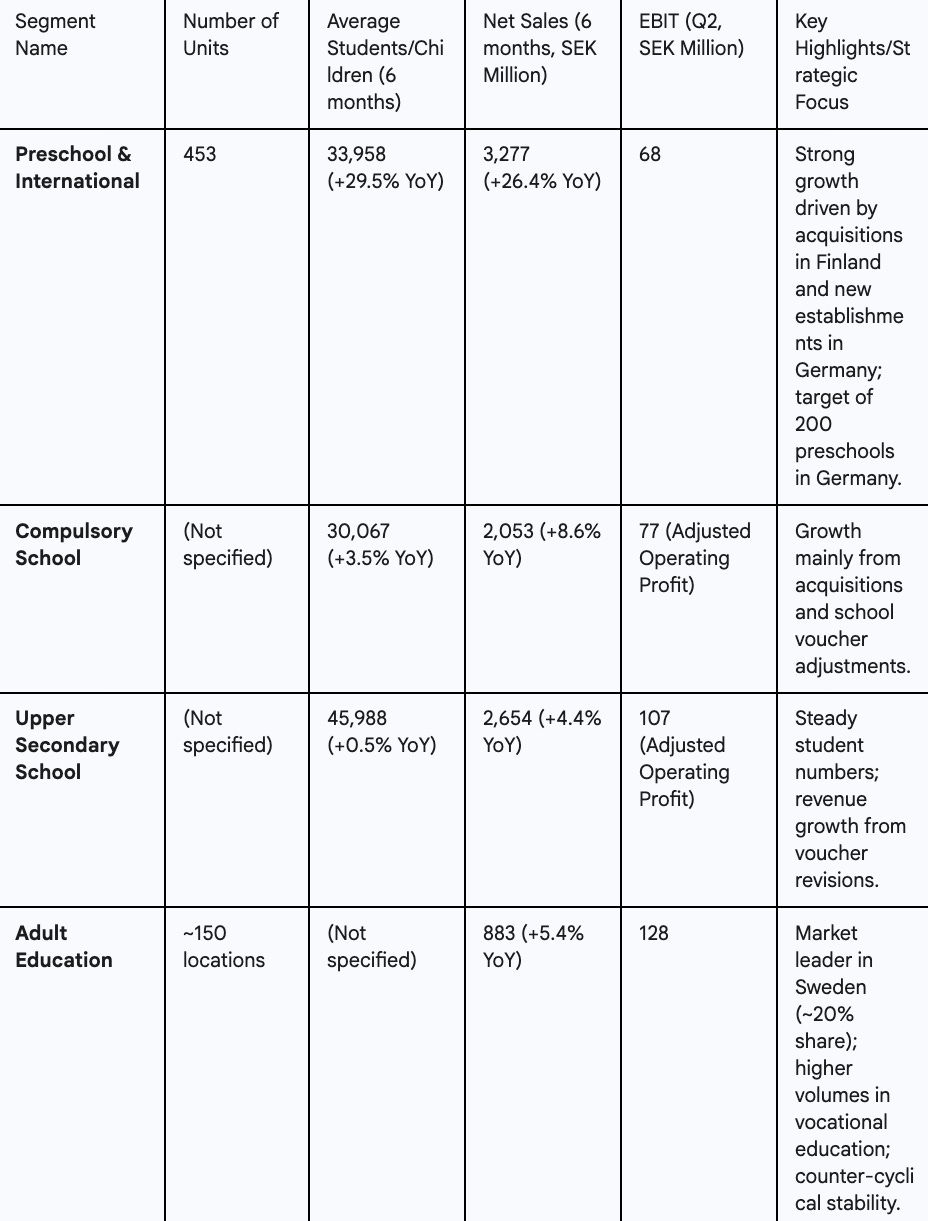

Segments

The operational performance across Academedia's segments for the first six months of the 2024/2025 fiscal year demonstrates continued growth and strategic focus.

Table: Operational Overview by Segment (July-December 2024)

Market Share

Academedia is the overall market leader in Sweden's independent school sector, holding an approximate market share of 20%. It also holds a leading position in the Swedish adult education market, with a similar 20% market share.

Capacity

The company boasts a substantial capacity, serving over 110,000 students enrolled across its 729 pre-, compulsory, and upper secondary schools. Its total operational footprint includes 860 units, supported by a large workforce of 21,000 employees. This extensive capacity allows Academedia to serve a broad student base and offers significant room for future growth, both organically and through acquisitions.

Growth

A clear pattern emerges from Academedia's operational data: while Sweden remains the largest segment, international operations and adult education are demonstrating significant growth and are explicitly identified as strategic focus areas. This indicates a deliberate and active diversification of the company's revenue base. The strong growth in the international preschool segment, evidenced by a 29.5% increase in children and a 26.4% rise in net sales in the first six months of FY2025, alongside the consistent higher volumes in adult education, suggests that these segments are increasingly becoming the primary drivers of overall company performance and profitability. This strategic pivot is crucial for offsetting any potential slowdowns or adverse regulatory impacts within the Swedish K-12 segments, thereby contributing significantly to long-term value creation.

Industry Analysis

The education sector in Sweden and across Europe is undergoing significant transformations, driven by policy shifts, demographic changes, and technological advancements. Understanding these broader trends is essential for evaluating Academedia's operating environment.

Sector Description

Sweden operates a unique system featuring grant-aided independent schools (fristående skolor) that run parallel to traditional municipal schools. This dual system applies across preschool, compulsory school, and upper secondary school levels. Independent schools are publicly funded through a voucher system, receiving funding equivalent to 100% of the per-student allocation provided to average local government schools. Crucially, these independent schools are free of charge for students. The system, introduced in 1992, aimed to foster pluralism and encourage new entrants into the educational sector, notably with few restrictions on ownership, allowing for-profit entities to operate.

Market Structure

The Swedish education market has shifted dramatically from a highly centralized structure to a more market-oriented model. Within this structure, for-profit entities now dominate the independent school sector, including large multi-school corporations. Sweden stands out internationally as one of the few countries with a large, publicly funded for-profit education sector, a distinction it gained particularly after Chile abandoned a similar system in 2015. Independent schools currently account for approximately a fifth of the total education sector and have consistently been gaining market share. In 2023, roughly 16% of compulsory students and 31% of upper secondary students attended private schools, with a significant majority (79%) attending schools operated by for-profit companies.

Trends

Regulatory Scrutiny in Sweden: A defining trend in Sweden is the increasing public and political scrutiny of independent schools. Public perception has become more critical of school vouchers and for-profit models over the past decade. Debates frequently revolve around concerns of rising inequality, social segregation, and allegations of grade inflation. The Swedish school minister, Lotta Edholm, even declared a "system failure" in 2023, signaling a major shake-up. An ongoing inquiry proposes stricter requirements, including potential bans on profit distribution under certain conditions.

International Regulatory Changes: The regulatory frameworks varies significantly across Academedia's international markets:

Norway: A new law adopted in early 2023 allows the rejection of new independent schools if their establishment is deemed to have a "negative impact on the government schools on offer". This effectively grants counties and municipalities a de facto veto power over independent school establishments, a move viewed as a "step back" for independent education.

Germany: The German education market is characterized by significant investment in digital infrastructure through initiatives like "DigitalPakt Schule," alongside a focus on teacher professionalization and the expansion of all-day programs. The K-12 education market in Germany is projected for strong growth, with an 11.7% CAGR from 2024 to 2030. Demand for preschool places remains consistently high.

Digitalization in Education: Globally, the K12 education market is significantly boosted by digital transformation, encompassing EdTech, Artificial Intelligence (AI), and Virtual Reality (VR) solutions. The online education market in Germany, for instance, is expected to grow substantially at a 12.7% CAGR. This trend presents both opportunities for enhanced learning and operational efficiency, as well as a growing threat from online-only substitutes.

Demographic Changes: While Sweden has experienced a "youth boom" driven by urbanization and immigration, leading to expansion needs, particularly at the upper secondary level, overall demographic trends in Sweden present challenges. Conversely, Germany faces a critical need for new preschool places, described as essential for its development.

Quality Focus: A consistent trend across Academedia's operations is the emphasis on improving quality results, increasing teacher qualifications, and enhancing student and parent satisfaction. This focus is a strategic response to competitive pressures and regulatory demands for accountability.

Increased Vocational Training: There is a growing interest and demand for vocational training programs at the upper secondary level in Sweden. This trend is driven by labor market needs and the recognition of vocational pathways as effective routes to employment.

Divergent Regulatory Paths and Market Opportunities: The regulatory environments in Academedia's key operating geographies are not uniform; Sweden is moving towards tightening regulations on independent schools, while Norway is making it more difficult to establish new ones, and Germany is investing heavily in K-12 and digital infrastructure. This divergence in regulatory approaches means that Academedia cannot apply a singular, "one-size-fits-all" strategy across all its markets. The challenges emerging in Sweden, particularly the regulatory uncertainty, underscore the critical importance of Academedia's international expansion. Germany's high demand for preschools offers a clear and attractive growth runway, providing a counterbalance to potential headwinds in Sweden.

The regulatory "step back" in Norway suggests that aggressive expansion might be challenging there, prompting Academedia to strategically prioritize more favorable regulatory climates like Germany. The overarching global trend towards digitalization in education represents a universal tailwind that Academedia can leverage across all its markets, irrespective of specific local K-12 regulations. This complex and varied regulatory framework highlights the necessity for Academedia to maintain an agile strategy and flexible capital allocation to capitalize on opportunities where they are most promising and mitigate risks where they are most pronounced.

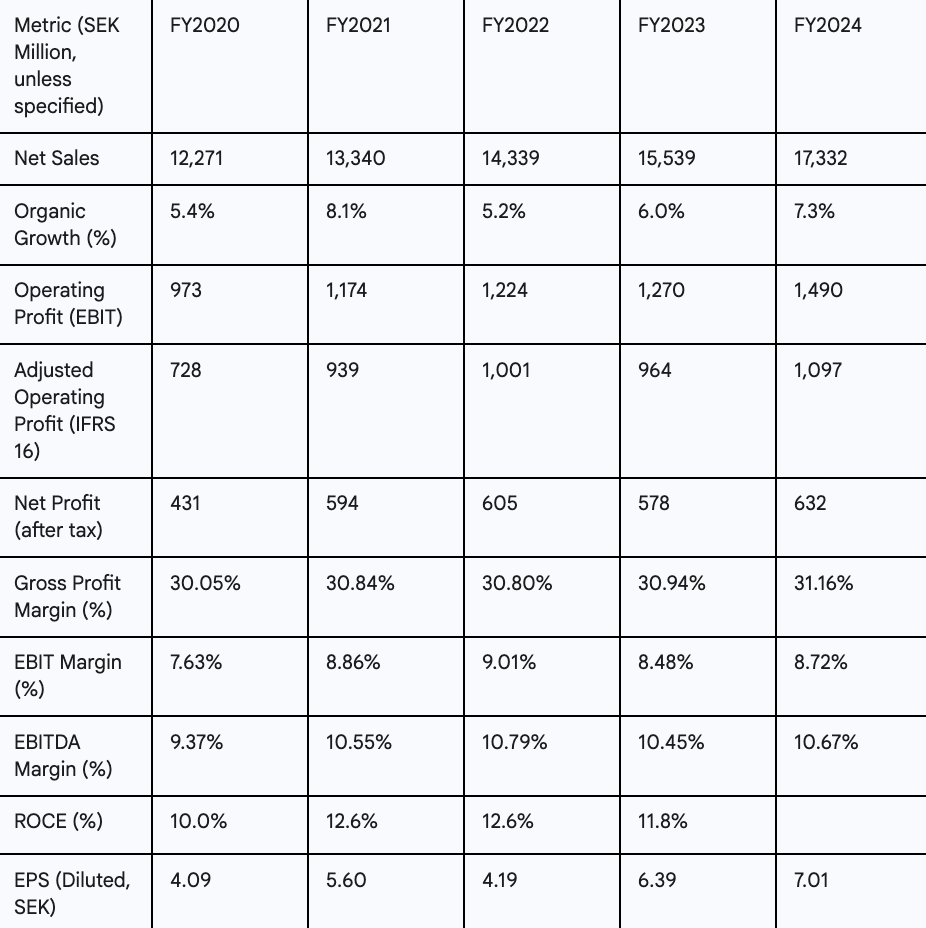

Financial Performance

Revenue Trends & Drivers

Overall Growth: For the fiscal year ending June 30, 2024, Academedia reported a 11.5% increase in net sales, reaching SEK 17,332 million. A significant portion of this growth was organic, including bolt-on acquisitions, contributing 7.3%. This indicates a healthy underlying demand for its services and successful integration of smaller acquisitions.

Student Numbers: The growth in revenue is directly correlated with an increasing student base. The average number of children and students (excluding the Adult Education segment) grew by 6.2% in FY2024, reaching 103,994. Preliminary student numbers for autumn 2024 further indicate continued momentum, with an approximate 8% growth to around 109,000 students.

Acquisitions: Strategic acquisitions have been a key driver of top-line growth. For instance, acquisitions including Touhula, Winford College, and FAWZ collectively contributed 4.4% to net sales growth in FY2024. The completion of strategically important acquisitions in Finland and the Netherlands further underscores this growth avenue.

International Operations: International operations are increasingly contributing to the revenue mix, accounting for 31% of total sales in FY2024, up from 24% previously. Notably, the proportion of revenue not reliant on Swedish school vouchers has grown to 40%, indicating successful diversification away from its primary domestic funding source.

Adult Education: The adult education segment has consistently shown positive contributions, driven by higher volumes, particularly in higher vocational education and municipal adult education programs. This segment's counter-cyclical nature provides a stable revenue stream.

Overall Trends

Academedia has a decade-long track record of delivering "steady profits and growth in the mid-to-high single digits". This consistency was maintained in FY2024, which saw not only an 11.5% revenue increase but also a 9.3% rise in net profit.

Student enrollment volumes reflect the company's growth trajectory. The average number of students across preschool, compulsory, and upper secondary schools increased by 6.2% in FY2024 to 103,994. More recent data shows a continued upward trend, with an 8.5% increase in Q1 2024/25 and a 9.3% increase in Q2 2024/25. Notably, Academedia's preschools in Germany experienced a nearly 15% increase in children in Q1 2024/25, highlighting the strong demand in this international market.

Product/Services & Pricing

The revenue mix is diversified, with adult education contributing approximately 10% of total revenues. International operations now comprise 31% of total sales. The business primarily generates revenue through state-funded vouchers for each enrolled student.

Revenue generation is largely dependent on state-funded vouchers. While self-pay parental fees exist within the preschool segment, they vary significantly by country, ranging from less than 4% of the total amount in Sweden to over 10% in Norway and Germany. Preliminary school voucher increases for 2025 in Sweden are projected to be lower than previous years (approximately 2.5% for preschools, 3% for compulsory schools, and 2.5% for upper secondary schools). In contrast, Norway's school voucher funding is expected to increase by around 4.5%, and German school voucher levels are showing positive adjustments, contributing to improved profitability in that market.

Margins

Summary of Cost Structure: Personnel costs represent a significant portion of Academedia's operational expenses. The company has focused on stabilizing staff turnover and managing wage inflation. In FY2024, group overhead expenses increased due to a reduction in vacancies and the strengthening of various staff functions. Conversely, lower energy costs provided a positive impact on profitability during the year.

COGS & Gross Margins: Academedia maintained a healthy Gross Profit Margin of 31.16% for FY2024. The Gross Profit for the same period amounted to SEK 5,530 million.

OPEX & Operating Margin

Operating Income (EBIT) saw a substantial 17.3% increase, reaching SEK 1,490 million in FY2024.

The EBIT Margin for FY2024 was 8.72%.

Adjusted Operating Profit (EBIT, adjusted for IFRS 16) also demonstrated strong growth, increasing by 13.8% to SEK 1,097 million in FY2024, with an Adjusted EBIT margin of 6.3%.

The EBITDA Margin for FY2024 stood at 10.67%.

Profitability generally improved across all segments in FY2024, with the notable exception of the Upper Secondary School segment, where school voucher increases did not fully offset inflation-driven cost increases. Conversely, international operations experienced improved profitability, largely due to favorable adjustments in school vouchers.

ROCE (Return on Capital Employed): Academedia's Return on Capital Employed (ROCE) was 11.8% for FY2023. This aligns with the company's historical performance of generating "post-tax returns on invested capital in excess of 10%".

Table: Historical Financial Highlights (FY2020-FY2024)

Margin Pressure and International Offset: The financial data reveals that while the state-funded voucher system provides a stable revenue foundation, it does not always keep pace with cost inflation, particularly evident in the lower school voucher increases for 2025 in Sweden and the resulting margin pressure in the Upper Secondary School segment in FY2024. This indicates a potential for margin compression in its core Swedish K-12 operations. However, this pressure is significantly offset by the improved profitability in international operations, driven by adjusted school vouchers (e.g., in Germany), and by higher volumes and improved capacity utilization within the adult education segment. This dynamic reinforces the strategic importance of Academedia's diversification efforts. International growth and the adult education segment are not merely contributing to revenue expansion; they are actively bolstering margin resilience and overall profitability, effectively mitigating the localized market pressures in Sweden. This strategic execution is crucial for maintaining the company's strong financial performance.

Good Insights

Beyond the core financial and operational data, several other aspects provide valuable context for understanding Academedia's long-term prospects.

Management

Academedia is led by an experienced management team.

Marcus Strömberg (President & CEO): Appointed in January 2005, Mr. Strömberg boasts an impressive tenure of 20.4 years. His leadership has been instrumental in the company's development, overseeing a reported 20% growth over the years. His total yearly compensation is SEK 11.72 million.

Petter Sylvan (Chief Financial Officer): Mr. Sylvan assumed the CFO position on March 4, 2024. He brings extensive financial leadership experience, having previously served as CFO at Avonova and for 15 years at Profoto, where he played a key role in taking the company public in 2021. He holds a Master's degree in Automation Technology and an Executive MBA.

Katarina Wilson (Deputy CEO & COO): A key member of the executive team.

Other Key Leadership: The management team also includes Hanna Clausen (Head of Group Accounting & IR), Jimmy Kjellstrom (Director of Administration & Head of Upper Secondary School Segment), Jonas Nordstrom (Chief Legal Officer), Lisa Oldmark (Head of HR & AcadeMedia Academy), Christer Hammar (Head of Adult Education Segment), Kristofer Hammar (Director of Business Development & Acting Head of Preschool Segment), Ingela Gullberg (Head of Quality), Lotta Krus (Head of Compulsory School Segment), and Sara Lindberg (Head of Swedish Preschools).

Board of Directors: The Board is chaired by Håkan Sörman (Independent Chairman) and includes Johan Andersson, Anna Lundmark Boman (Employee Representative), Mikael Helmerson, Pernilla Larsson (Deputy Employee Representative), Marie Osberg, and Ann-Marie Begler (Independent Director).

Capital Allocation

Academedia's capital allocation strategy reflects a balanced approach between growth and shareholder returns.

Acquisitions: The company has a consistent strategy of growth through "disciplined acquisitions". Recent significant deals include Touhula in Finland, Winford College, Yes! Kinderopvang in the Netherlands, and International Schools Potsdam/Erfurt in Germany. These acquisitions are integrated to contribute to organic growth. The company has also secured new loan agreements to finance these and future acquisitions.

Dividends: Academedia has a history of returning capital to shareholders, with a proposed ordinary dividend of SEK 1.75 per share for FY2024, resulting in a dividend yield of 2.17%.

Share Redemption Programs: The Board has proposed a voluntary share redemption program with a maximum amount of SEK 300 million. A previous program, which concluded in March 2024, resulted in a reduction of 4,095,867 shares, demonstrating a commitment to enhancing shareholder value through share buybacks.

Ownership

CEO Marcus Strömberg directly holds 0.15% of the company's shares, aligning his personal financial interests with those of the shareholders. Recent director dealings (March-May 2025) show a mix of buy transactions (e.g., Christer Hammar, Petter Sylvan) and sell transactions (e.g., Marcus Strömberg, Lise-Lotte Oldmark, Petter Sylvan, Mellby Gard AB, Nordea Funds Ltd). While Mellby Gard AB, a main shareholder, executed a significant sell transaction in March 2025 (SEK 72.8 million), it also made a large buy in February 2025 (SEK 5.27 million). The main shareholders also include Marvin Holding Ltd and Nordea Funds Ltd. A notable development is the acquisition of Mellby Gård's total holding in Academedia by Akelius Foundation, signaling a significant ownership change and the entry of a new long-term institutional investor, which can be interpreted as a vote of confidence in the company's future.

Academedia went public on June 15, 2016, and has since returned to Nasdaq Stockholm.

Alignment of Interests and Strategic Capital Deployment: The long tenure of CEO Marcus Strömberg, spanning over two decades, indicates deep industry knowledge, consistent leadership, and a strong commitment to Academedia's long-term vision. His personal ownership stake in the company further ensures a direct alignment of his interests with those of the shareholders. The company's capital allocation strategy, characterized by a consistent pursuit of acquisitions for growth and the implementation of share redemption programs for shareholder returns, demonstrates a balanced and active approach to capital management. This dual focus aims to achieve both strategic expansion and improved shareholder value through increased efficiency and potential earnings per share accretion. The mixed pattern of insider dealings, while including some selling, also features buying activity, which, when viewed in the context of significant institutional ownership changes like the Akelius Foundation's acquisition of Mellby Gård's stake, suggests a dynamic but not necessarily negative signal regarding confidence in the company's future.

Valuation, Risks, and Conclusion

Valuation & Margin of Safety

Academedia currently trades at a Price-to-Earnings (P/E) ratio of 11.07x on a trailing twelve-month basis. Its Enterprise Value to Earnings Before Interest and Taxes (EV/EBIT), adjusted for IFRS 16, stands at 4.72x on a next twelve months (NTM) basis, according to peer comparison data. When compared to its peers, Academedia's NTM P/E of 11.53x is slightly below the median of 12.03x, and its NTM TEV/EBIT of 4.72x is also below the peer median of 7.40x. This suggests a relative undervaluation compared to its industry counterparts.

The high free cash flow yield of 10% is a strong indicator of a significant margin of safety, implying that the market is valuing the company at a discount relative to its good cash generation capabilities. This discount is largely attributable to the "perceived regulatory risk" in Sweden. If these regulatory risks do not materialize as severely as feared, or if Academedia successfully handles and mitigates them through its ongoing diversification strategy, there is substantial upside potential for a re-rating of the stock.

Key risks

Severe Regulatory Intervention: The most critical threat is a drastic and unfavorable change in Swedish regulations. This could involve a complete ban on profit distribution for independent schools, a significant reduction in state-funded vouchers, or highly restrictive operational mandates that severely impact profitability and cash flow. While Academedia is actively diversifying its revenue streams, a fundamental overhaul of the Swedish system would undoubtedly pose a major challenge.

Failure of International Expansion: The company's strategic pivot towards international markets, particularly Germany, is a key growth driver and risk mitigation strategy. If this international expansion fails to meet its ambitious targets, or if these new markets present unexpected regulatory hurdles or competitive pressures, the diversification strategy would be undermined, leaving the company more exposed to its domestic market.

Accelerated Demographic Decline: While Academedia has demonstrated positive organic growth despite broader demographic trends in Sweden, a more rapid or severe decline in student numbers within its core Swedish segments than currently anticipated could significantly erode its revenue base over the long term, impacting profitability.

Increased Competition/Quality Erosion: A failure to consistently maintain high-quality educational standards or to effectively differentiate its offerings against both municipal and other independent schools could lead to a loss of market share and student enrollment. In a choice-based system, a decline in perceived quality directly impacts the ability to attract and retain students.

Conclusion

Academedia AB represents a compelling opportunity for investors seeking exposure to the stable, yet evolving, education sector. The company's established market leadership in Northern Europe, its consistent ability to generate profits and strong cash flow, and its proactive international expansion strategy collectively position it well to work on the "perceived regulatory headwinds" in its home market.

The ongoing debate surrounding Swedish regulations, particularly concerning profit distribution, remains a key factor to monitor. However, management's strategic pivot towards international growth, especially in high-demand markets like Germany, and the inherent stability provided by the counter-cyclical adult education segment, collectively offer a hedge against these domestic uncertainties. The current valuation, particularly its attractive free cash flow yield, suggests that the market may be overly discounting the company's proven operational resilience and its future growth potential. The market's reaction is likely driven by the negative sentiment and headlines surrounding "for-profit schools" in Sweden, rather than a fundamental assessment of Academedia's operational strength, cash generation, or its proactive diversification strategy. The market often struggles to price in nuanced regulatory risks, leading to a blanket discount. This creates a classic value investment scenario: if the regulatory changes are less severe than feared, or if Academedia successfully adapts and grows its international and adult education segments, the market's "perception" could shift, leading to a re-rating of the stock. The high FCF yield provides a strong return base even if the multiple expansion is slow. This is a bet on management's execution and the market eventually recognizing the underlying value.

For investors with a long-term horizon, Academedia offers a unique blend of stability, growth, and the potential for a significant re-rating as its diversification strategy matures and greater regulatory clarity emerges. The company's disciplined management, strategic acquisitions, and focus on quality further strengthen its investment case.

Thank you for reading The Small Cap Strategist, if you’ve enjoyed this post please consider subscribing.

Disclaimer: This post is for informational and educational purposes only and should not be considered investment advice. The author is not a financial advisor. All investment decisions carry risk, and readers should consult with a qualified financial professional before making any investment choices. The author may or may not hold positions in the securities discussed.