Vetoquinol SA (VETO:EPA) - Overview & Highlights

Justifying a 50%+ Upside & a €185m Cash Balance - Vetoquinol SA Investment Screener Summary

Business Description

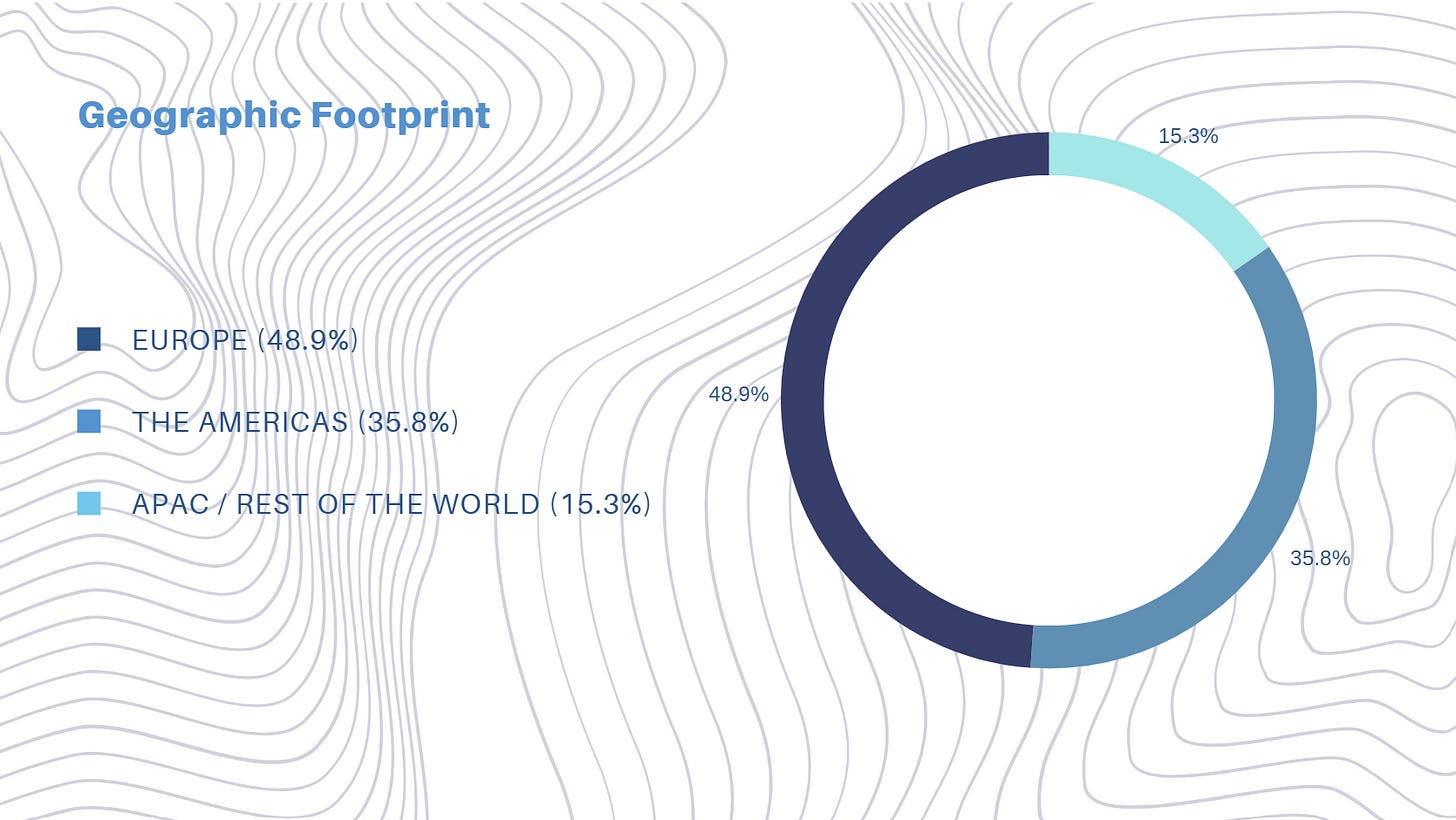

Vetoquinol SA is a French-listed, family-controlled veterinary pharmaceutical company founded in 1933. It develops and commercializes a range of drugs and non-medicinal products for both companion animals (70.1% of 2024 sales) and farm animals (29.9%). The company's core strategy is to focus on its "Essentials" product range—branded, higher-margin products with global potential, such as the anti-parasiticides Drontal and Profender. Vetoquinol makes money by selling these products to veterinarians and distributors across a diversified geographic footprint: Europe (48.9%), the Americas (35.8%, with the USA being the largest single country at 20.8%), and Asia Pacific/Rest of World (15.3%).

Investment Thesis

The investment case rests on the market mispricing a fundamentally sound company due to temporary operational setbacks.

Upside/Margin of Safety: The current valuation is modest (2024 EV/EBITDA of 6.6x, EV/NOPAT of ~12.5x) for a business with high returns on capital and a strong balance sheet. An analyst target price of €91.87 and a target multiple of 15x 2026 OPAT both suggest a potential upside of over 50%.

Downside Protection: The significant net cash position of €185.2M provides a strong financial cushion. The non-discretionary nature of the animal health market offers demand resilience.

Level of Conviction: The analysis presents a high-conviction case, viewing the current share price as a deep value opportunity.

What would a short case look like?

A short case would argue that: 1) The US market issues are not temporary but reflect a permanent loss of market share to larger, better-resourced competitors. 2) The trend of veterinary practice consolidation will accelerate, eroding Vetoquinol's brand loyalty and pricing power faster than anticipated. 3) Management will fail to deploy its large cash balance effectively, leading to continued "cash drag" on returns, or will destroy value through an overpriced acquisition. 4) The "Essentials" strategy will stall as competition intensifies in its niche markets.

Drivers, Risks, and Porters Five

Risks

US Market Risk: Inability to resolve supplier issues and regain market share in its largest single market.

Competitive Pressure: Intense competition from dominant industry players (Zoetis, Merck, etc.) encroaching on its niches.

M&A Execution Risk: Overpaying for acquisitions or facing integration challenges.

Channel Risk: Accelerated consolidation of veterinary practices leading to increased pricing pressure.

Capital Allocation Risk: Failure to deploy the large cash balance in a value-accretive manner.

Porter’s Five Forces

Supplier Power

6/10 (Moderate overall, but high for specialized inputs, as evidenced by the recent US supplier disruption).

Customers (fragmentation etc.)

7/10 (Historically moderate due to vet loyalty, but power is increasing with vet practice consolidation).

Barriers to Entry and Exit

8/10 (High, due to significant R&D costs, lengthy regulatory approvals, and established brand loyalty).

Threat of Substitution

6/10 (Moderate threat from generics post-patent, though mitigated by lifecycle innovation).

Competitive Intensity of Industry

4/10 (High intensity due to an oligopolistic structure with large, dominant competitors).

Overall Comment

The industry structure is attractive due to high barriers to entry, but Vetoquinol's position is challenging as a smaller player, making its niche strategy critical. Overall Score: 31/50.

Competitive Advantage & Competitors

Market position / market share: A small global player with an estimated market share of ~0.9%. It pursues a niche strategy, focusing on segments underserved by larger rivals.

Product differentiation (including brands): Differentiates through its "Essentials" strategy, focusing on branded products (e.g., Drontal, Profender, Felpreva®) to build strong relationships and brand loyalty with veterinarians in specific therapeutic areas.

Sources and trajectory of competitive advantage: The advantage stems from intangible assets (brand recognition within niches, vet relationships) and regulatory expertise. This creates a "narrow" economic moat that is under pressure from industry consolidation.

Evidence of pricing power: Modest. The company was able to implement price increases in 2024, but its smaller scale limits its overall pricing power against industry giants.

Evaluation of business franchise / “economic moat”: Possesses a moderate but narrow economic moat. While effective in its niches, it lacks the scale and R&D budget of its major competitors, and its operational resilience has been shown to be vulnerable.

Competitors

Zoetis: Market leader with $8.5B in 2023 revenue.

Merck Animal Health: Strong in livestock, with $5.6B in 2023 revenue.

Boehringer Ingelheim Animal Health: Private company with €4.7B in 2023 revenue.

Elanco Animal Health: Diversified player with ~$4.4B in derived FY23 revenue.

Revenue & Cost

Overall: Modest recent growth (+1.9% in 2024), impacted by US challenges and planned product rationalization. Q1 2025 revenue declined by 2.3%.

Mix: The key positive trend is the strategic shift towards higher-margin "Essential" products, which grew 4.6% in 2024 and now represent 61% of total sales (up from 49% in 2018).

Costs

Cost structure: Asset-light operational model. Key expenses in 2024 were Personnel (31.1% of sales) and R&D (8.1% of sales), with R&D spend increasing to fuel innovation.

Margins: Gross margin was 55.5% in 2024. The reported EBIT margin improved to 14.1% from 13.5% in 2023. EBITDA margin was 19.3%.

Returns on capital: Strong returns demonstrate capital efficiency. Post-tax ROCE was ~17%, while post-tax return on net operating assets (excluding acquisition intangibles) exceeded an impressive 35%.

Allocation of Capital

Management has a disciplined history, prioritizing strategic M&A, followed by modest dividends (~1.2% yield), and share buybacks. The last major acquisition (Drontal/Profender) was in 2020/2021. The current focus is on deploying the substantial net cash balance, with a stated intention to pursue acquisitions, particularly in the US.

Balance Sheet & Cashflow

The key feature is its fortress-like balance sheet: debt-free with a net cash position of €185.2M at the end of 2024. Leverage is very low, with an Assets-to-Equity ratio of 1.292. The balance sheet carries substantial goodwill and intangible assets from past acquisitions.

The company is a strong and consistent cash generator. Cash flow from operations was €85.8 million in 2024.

Valuation & Margin of Safety

Valuation appears low on multiple metrics: LTM P/E of 14.6x, 2024 EV/EBITDA of 6.6x, and a 2024 EV/OPAT of ~12.5x. This is considered cheap for a company with its quality and stability. The margin of safety is provided by this low valuation, the large net cash position, and resilient industry fundamentals. A re-rating to a 15x EV/OPAT multiple is considered plausible, implying >50% upside.

Management & Ownership

CEO: Matthieu Frechin, a member of the founding family, has been CEO since 2010. He provides a long-term strategic vision.

CFO: Régis Vimal du Monteil has been in his role since 2010.

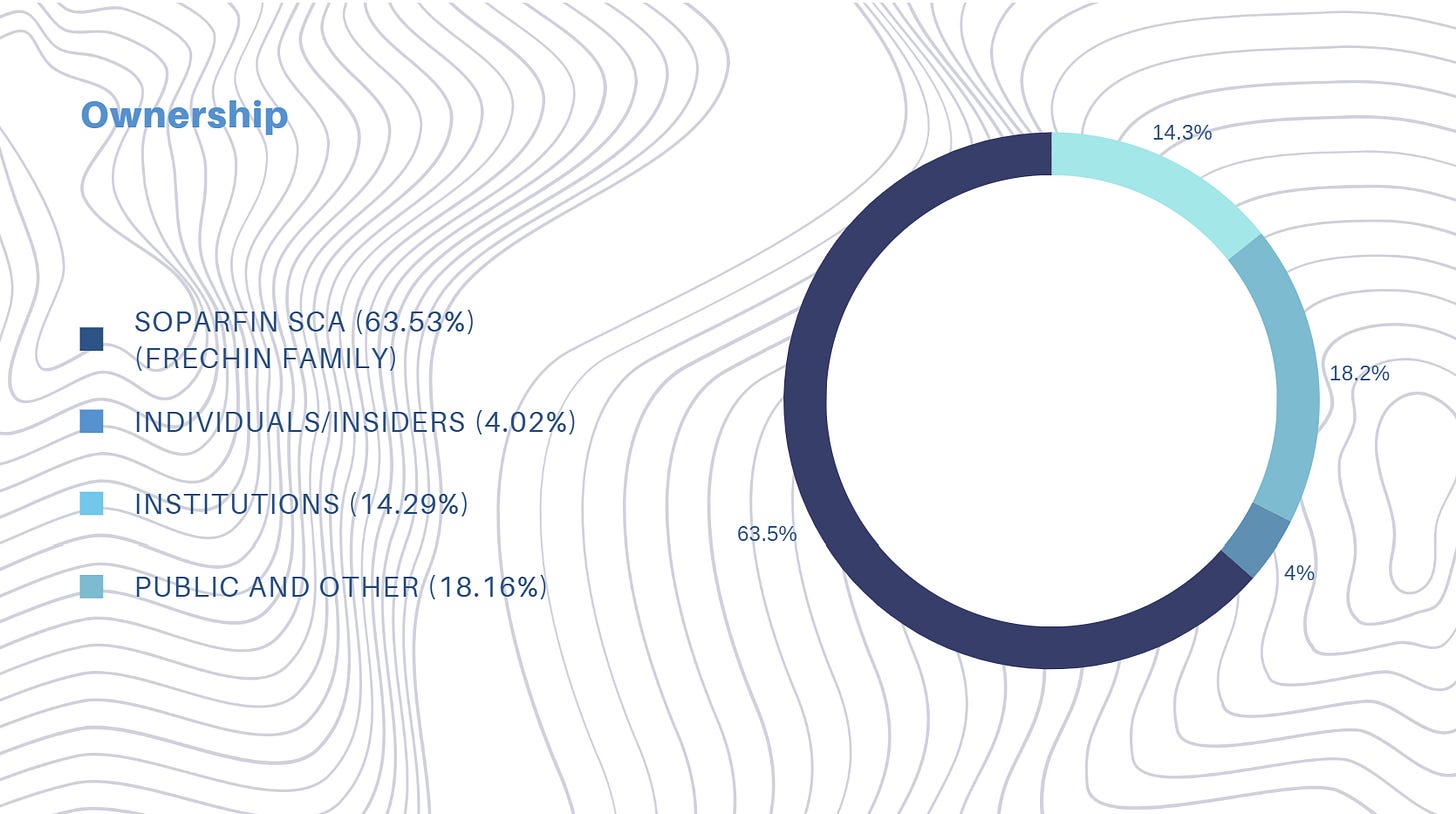

Assessment: The management team is experienced and stable, with a disciplined approach to operations and capital. The family's significant ownership aligns their interests with long-term value creation.

The company is majority-controlled by the founding Frechin family, which holds a 67% equity stake through its holding company, Soparfin SCA. This results in a limited publicly traded float of 32.45%.

Analyst Coverage & Company History

5 Analysts covering with a stated 1-year consensus target price of €91.87.

Founded in 1933, listed on Euronext Paris in 2006. The most significant recent corporate action was the acquisition of the Drontal and Profender product families from Elanco (originally Bayer) in 2020-2021, which was a key step in bolstering its "Essentials" portfolio.

Industry & Operations

The global animal health market (~$63B in 2024) is an oligopoly dominated by four major players. The industry benefits from strong, secular growth drivers, including the "humanization of pets," an aging pet population, and increased spending on advanced medical care. Product life cycles are generally longer than in human health.

Thank you for reading The Small Cap Strategist. If you like this post consider subscribing.

Disclaimer: This post is for informational and educational purposes only and should not be considered investment advice. The author is not a financial advisor. All investment decisions carry risk, and readers should consult with a qualified financial professional before making any investment choices. The author may or may not hold positions in the securities discussed.