Weatherford International Inc - Overview & Highlights

An Overview on an Undervalued Energy Services Player Thriving Cyclical Headwinds with Financial Discipline and a Digital Edge

Business Description

Weatherford International is a global energy services company providing equipment and services for the entire lifecycle of oil and natural gas wells. It operates in approximately 75 countries through three main segments.

The company's revenue is geographically diverse, with the Middle East, North Africa & Asia being the largest contributing region (45% of footprint).

Investment Thesis

Upside/Investment Case: The stock appears undervalued with a P/E ratio of 8.61x, below the peer average of ~13x. The consensus analyst price target is $145, implying significant upside. The company is pursuing a high-value strategy focused on digital transformation (e.g., AWS partnership) and specialized technologies to improve margins and competitive positioning.

Margin of Safety/Downside Protection: The balance sheet is strong, with a net leverage ratio of 0.5x. Management is committed to disciplined capital allocation, including a "sacrosanct" dividend, active share buybacks ($152M over the last three quarters), and continued debt reduction. This financial discipline provides a buffer in a cyclical industry.

What would a short case look like?)

A short case would argue that the current valuation is justified due to severe market headwinds. The sharp decline in activity in Mexico (down 60% YoY) and softening in North America and Europe could be more prolonged than anticipated. Despite cost-cutting, the company's cost structure may be too rigid for a rapid market contraction, leading to further margin compression. Its smaller market share (2.19%) limits its competitive power against giants like SLB and Halliburton, especially as it avoids chasing low-value contracts. The long-term threat of an accelerating energy transition could also structurally impair its core business faster than its new energy ventures can compensate.

Drivers, Risks, Scuttlebutt, Porters Five

Key Risks

Commodity Price Volatility: Lower oil and gas prices lead to reduced customer spending, directly impacting revenue and pricing power.

Intense Competition: Faces significant pressure from larger, more established players (SLB, Halliburton, Baker Hughes) with greater scale and financial resources.

Geopolitical Uncertainty: U.S. tariffs and retaliatory actions could disrupt demand, particularly for the Production and Intervention segment.

Scuttlebutt

Analyst Coverage: The consensus recommendation is "Outperform" with an average target price of $145. However, Goldman Sachs downgraded the stock to "Neutral" in December 2024.

Insider Activity: An independent director, Neal P. Goldman, made a significant purchase of over $500,000 in April 2025. Executive sales earlier in the year were reported to be primarily for tax-related purposes.

Competitors & Competitive Advantage

Market position: A smaller player with 2.19% market share in Q1 2025, trailing industry leaders significantly.

Product differentiation: Differentiates through specialized tech (e.g., Managed Pressure Drilling), an integrated service portfolio covering the entire well lifecycle, and a growing suite of digital solutions (ForeSite®, CygNet).

Sources of advantage: Stem from switching costs (integrated service model creates customer stickiness) and intangible assets (proprietary technology and engineering expertise).

Pricing power: Limited due to intense competition and the high bargaining power of customers.

Economic moat: Has a moat built on technology and switching costs, but it's narrower than industry leaders due to competition and the cyclical nature of the industry.

Revenue & Cost

Overall: Highly cyclical. Revenue grew 19% in 2023 but fell 12% YoY in Q1 2025 due to market softening. Full-year 2025 guidance is cautious at $4.6B - $5.0B.

Volume: Lower activity levels in key regions (North America, Mexico, Europe) drove the Q1 2025 revenue decline.

Pricing: Significant pricing pressure exists due to lower commodity prices and competition. Management is focused on defending margins rather than chasing market share.

Mix: Strategically shifting towards higher-value, technology-focused digital solutions and services to improve portfolio quality and margins.

Cost & Margin

Cost structure: Actively managing costs through headcount reductions (over 1,000 since Q3 2024), facility consolidation, and supply chain optimization.

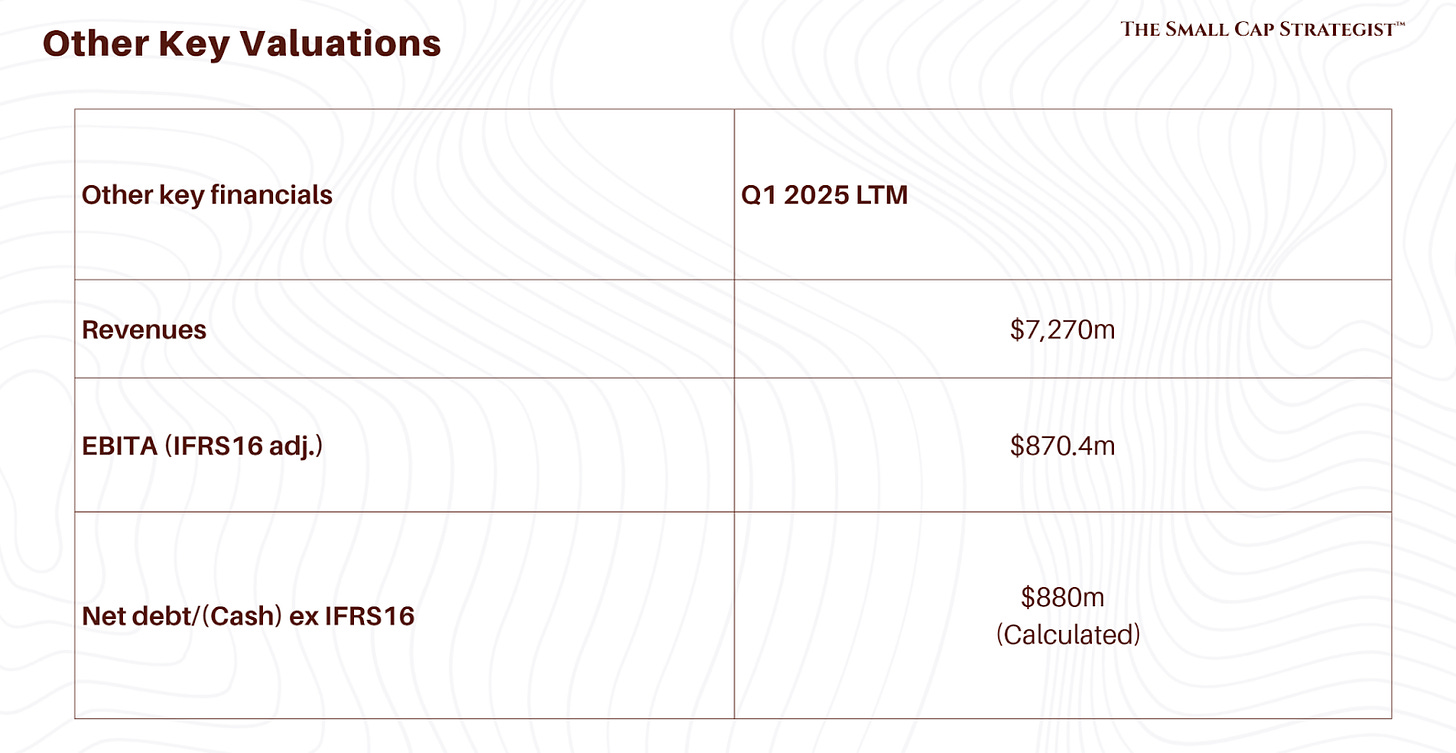

Gross margin: Q1 2025 LTM Gross Profit Margin was 32.11%.

Operating margin: Q1 2025 LTM Operating Margin was 16.22%. Adjusted EBITDA margin declined to 21.2% in Q1 2025 from 24.7% in Q1 2024 due to lower revenue.

Returns on capital: ROE was 23.94% for Q1 2025 LTM. Calculated adjusted ROCE is approximately 19.5%.

Allocation of Capital

WFRD demonstrates a disciplined framework prioritizing balance sheet strength and shareholder returns.

Debt Reduction: Paid down ~$7.2 billion in debt since restructuring.

Dividends: Maintains a consistent quarterly dividend, which management views as "sacrosanct".

Share Buybacks: Actively repurchasing shares under a $500M authorization.

Portfolio Optimization: Uses strategic divestitures (e.g., Argentina assets) and bolt-on acquisitions (e.g., Datagration Solutions) to high-grade its service portfolio.

Things to consider on the Balance Sheet

The balance sheet has been significantly de-risked since the 2019 bankruptcy. Net leverage stands at a healthy 0.5x. The company expanded its credit facility to $680 million, enhancing liquidity. No significant off-balance sheet items or pension issues were noted in the text.

Things to consider on Cash Flow

Strong focus on free cash flow (FCF) generation. Reported adjusted FCF of $66 million in Q1 2025 with a 26.1% conversion rate. The company is committed to increasing its FCF conversion for the full year 2025.

Valuation

The stock appears undervalued based on multiple metrics. Its P/E of 8.61x is below the peer average. A 2-Stage FCF to Equity model cited in the text projected a fair value of $127. The average analyst price target of $145 suggests substantial upside, providing a significant margin of safety against the current price. Downside is partially mitigated by the strong balance sheet and commitment to shareholder returns.

Management & Analyst Coverage

CEO (Girishchandra K. Saligram): Appointed in 2020. Emphasizes balance sheet strength and shareholder returns.

CFO (Anuj Dhruv): Joined in 2023 with extensive experience in global finance and strategy.

Board (Charles M. Sledge, Chairman): Chairman since 2020, previously CFO of Cameron International.

Individual insiders own approximately 2.12% of the company's stock.

The consensus is "Outperform" with a $145 average price target. Goldman Sachs is more conservative, with a "Neutral" rating and a $98 target as of December 2024.

Relevant History

The most significant event was the company's Chapter 11 bankruptcy filing in July 2019 and emergence in December 2019. This event reset its capital structure, creating a new financial foundation. More recently, a strategic partnership with AWS was announced in May 2025.

Industry Overview

The oilfield services sector is capital-intensive, cyclical, and dominated by a few large integrated players (SLB, Halliburton, Baker Hughes) and numerous smaller firms. Key trends include a moderating pace of energy transition, a focus on reserve replenishment (driving M&A), a resurgence of National Oil Companies (NOCs), and the globalization of the LNG market.

Operational Overview

Weatherford operates globally via its DRE, WCC, and PRI segments. Geographically, it has a strong presence in the Middle East & Asia, which has shown resilience, while facing headwinds in Mexico, North America, and Europe. The company is proactively managing capacity by reducing headcount in response to lower activity levels. It holds a small market share (2.19%) but differentiates through technology and a broad service portfolio.

If you’d like a full analysis with our Institutional-Grade Research, we did one here:

Thank you for reading The Small Cap Strategist, if you enjoyed this post consider subscribing.

This post is for informational and educational purposes only and should not be considered investment advice. The author is not a financial advisor. All investment decisions carry risk, and readers should consult with a qualified financial professional before making any investment choices. The author may or may not hold positions in the securities discussed.