Chile Copper Is Back: The Infrastructure For All Tech (AI, Data Centres, Electricity)

Macro Overview of Chile, Chile's Copper Production and Value Chain, Key Players, Future Trends (Headwinds & Tailwinds), Business Models, & Investment Guidance.

Welcome to The Small Cap Strategist. Our mission is to look past the obvious mega-caps and uncover the high-growth, under-the-radar companies positioned to dominate their niches. Today, we're applying this to Chile's Copper Mining Sector.

We've done multiple Sector Overviews. Our three most recent ones are these:

We have already done over 10 company deep dives in stocks that we believe are significantly undervalued and underappreciated by the market.

Inside this post you will find:

Podcast: Listen to the sector research as we discuss this post.

Executive Summary: A concise overview of Chile's commanding position in the global copper market, highlighting key drivers and risks.

Macro Overview: An analysis of global copper market trends, price dynamics, and the impact of macroeconomic factors and trade policies.

Chile's Copper Production and Value Chain: A deep dive into production trends, the copper value chain from mining to refining, and the critical role of new projects.

Key Players and Competitive Position: Profiles of major state-owned and private players, their strategies, and the competitive landscape of the Chilean copper industry.

Economic Contribution: Value-Added Products: Examination of copper mining's economic impact on Chile, including GDP growth, export revenues, and the focus on value-added products and services.

Chile's Copper Future Trends: Tailwinds and Headwinds: A detailed look at the factors propelling and challenging the sector, from energy transition demand to regulatory burdens and water scarcity.

Business Models in Chilean Copper Production: An exploration of the hybrid business model structure, operational strategies, and the increasing importance of ESG factors.

Investment Guidance and Regional Analysis: Key considerations for investors, including risk assessment, FDI outlook, and Chile's standing in the regional mining sector.

If you want to build a portfolio of unique, high-conviction ideas and gain an edge by understanding the powerful forces shaping global markets, subscribe to The Small Cap Strategist and join a community of discerning investors.

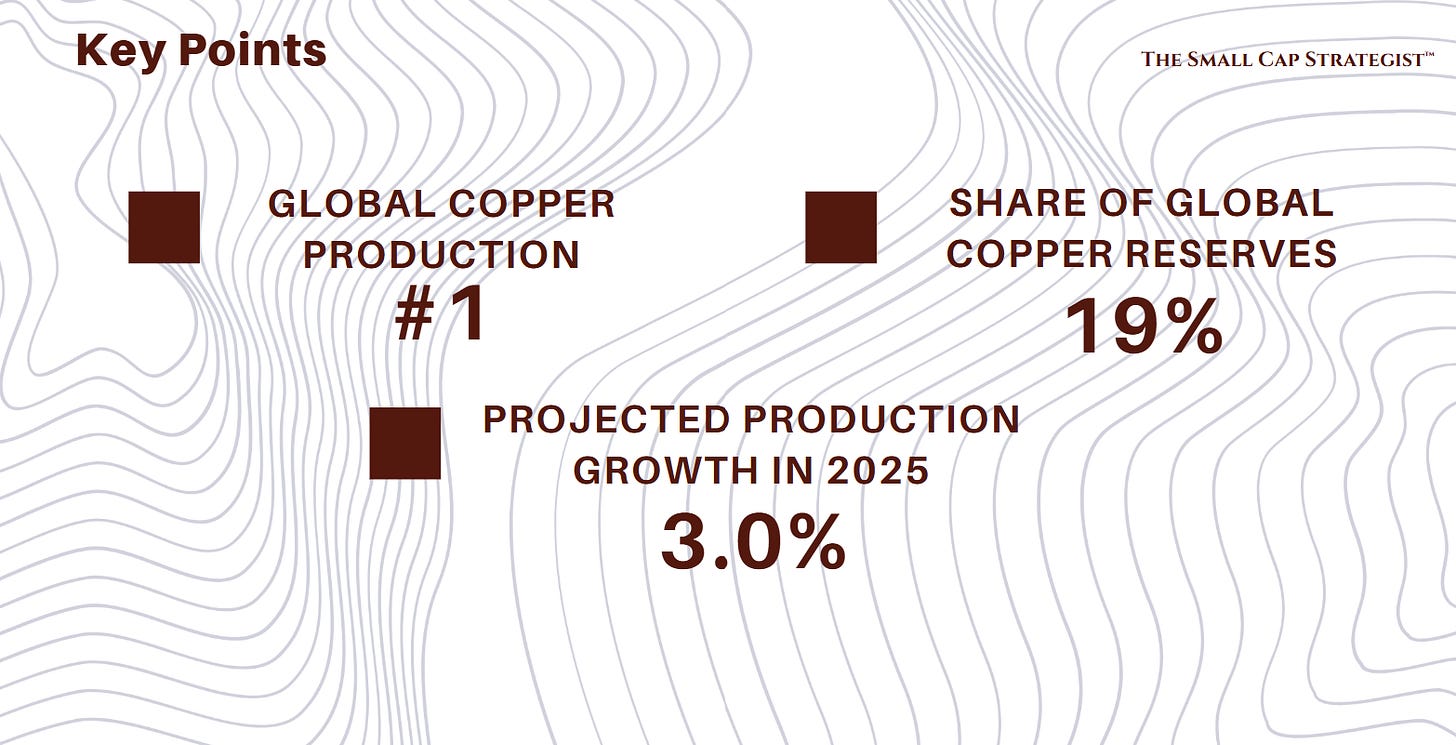

Chile is the world's largest producer and exporter of copper. This sector significantly contributes to its Gross Domestic Product (GDP) and export revenues.

The global trajectory towards decarbonization and the accelerating energy transition are generating unprecedented demand for copper. Electric vehicles (EVs), the expansion of renewable energy infrastructure, and the development of smart grids all rely heavily on copper, making Chile an attractive place for investment. Copper prices, which averaged $9,412 per metric ton in the first quarter of 2025 reflect this underlying structural demand.

While the demand outlook presents a substantial tailwind for Chile's copper sector, there are clear risks. These include the growing influence of resource nationalism (the new copper royalty and lithium nationalization policies), persistent water scarcity, and the concerns of managing aging mines with declining ore grades. Furthermore, geopolitical tensions, particularly the threat of US tariffs on copper, introduce an element of uncertainty, despite Chile's efforts to diversify its export profile towards markets like China.

Chile has a commanding position as the world's largest copper producer and its significant export relationships with both the United States and China. However, the United States has already imposed a 10% universal tariff on Chile and has explicitly threatened specific tariffs on copper imports. In response, Chile possesses a "diversified export profile," allowing it to potentially increase export volumes to Mainland China to offset any shifts in demand from the US market. But this means that Chile's market leadership, paradoxically, ties it deeply into global geopolitical tensions, making it susceptible not just to direct trade barriers but also to wider market contractions. The nation's economic outlook faces "very high downside risks" from elevated levels of trade and geopolitical tensions.

The high global demand for copper is explicitly linked to the energy transition. This narrative positions copper as a critical mineral for a sustainable future.

Macro Overview

The global copper market in the first quarter of 2025 experienced initial price surges, primarily driven by concerns over tight mine supply. These gains were subsequently reduced by escalating trade tensions, particularly following the US announcement of reciprocal tariffs on April 2. The London Metal Exchange (LME) three-month copper price averaged $9,412 per metric ton in Q1 2025, reflecting a modest 0.97% quarter-on-quarter increase.

Key demand drivers for copper come from the accelerating global energy transition. Copper is necessary for electric vehicles (EVs), their associated charging infrastructure, and the important expansion of smart grids. China's growth in newly installed solar power capacity, which increased by 28% year-on-year in 2024, alongside its higher seasonal EV production in 2025, illustrates this trend.

The impact of macroeconomic trends and trade policies bring considerable volatility into the copper market. The nature of US trade policy under the current administration creates significant uncertainty. The existing 10% universal basic tariff applied to Chile and with threatened tariffs specifically on copper, directly influences market sentiment and export dynamics. This uncertainty has contributed to concerns about a slowing US economy, reflected in a contractionary US manufacturing Purchasing Managers' Index (PMI). The prospect of US tariffs has created a "fear of global slowdown," leading to a decline in investment funds' net long positioning in copper. Overall world GDP growth is projected to slow in 2025-26 amid rising trade tensions. A stronger US dollar, influenced by factors such as anticipated debt ceiling agreements or delays in Federal Reserve interest rate cuts can also exert downward pressure on copper prices.

Despite this, the long-term outlook fundamentally suggests that future copper demand will support prices and prevent significant losses. S&P Global forecasts the copper annual average price to reach $10,000 per metric ton only by 2030, with a tight concentrate market expected to support prices in 2025-26. BMI, another key market intelligence provider, forecasts copper prices at $9,500 per metric ton for 2025.

The current market environment shows a divergence between the long-term demand for copper and the immediate volatility seen in its prices. While multiple sources confirm strong long-term copper demand, short-term copper prices remain highly sensitive to shifts in US trade policy and broader global economic sentiment. This sensitivity is evident in the decline of investment funds' net long positions due to tariff concerns. This situation indicates that the market is currently prioritizing immediate geopolitical and macroeconomic risks over the powerful long-term structural demand story. Such a prioritization may present a potential value opportunity for patient, long-term investors who are capable of absorbing short-term price fluctuations. For copper producers, this underscores the critical importance of implementing robust hedging strategies against trade policy volatility to ensure revenue stability and facilitate project financing, even in the face of strong future demand projections.

Chile's Copper Production and Value Chain

Chile's copper mine production is projected at 3.0% growth in 2025, building upon a notable 4.9% year-on-year increase observed in 2024. This recovery is particularly important given that it follows five consecutive years of production contractions. In the first four months of 2025, copper mine production increased by 3.5% year-on-year, reaching 1,752 kilotons (kt), largely propelled by higher output from Codelco's mines and BHP's Escondida mine. Long-term projections indicate that Chile is expected to maintain its position as the largest copper producer globally through to 2034, with production forecast to reach 6,612.06 kt by that year.

The production chain for copper in Chile begins primarily in large open-pit mines, although some underground operations also contribute. Following extraction, the ore undergoes concentration, a process of crushing and grinding to liberate copper minerals from waste rock, resulting in copper concentrate. This stage is notably water-intensive. The copper concentrate is then subjected to smelting, where it is heated to high temperatures to remove impurities, producing blister copper. The final stage is refining, involving further purification of blister copper through electrolysis to produce high-grade copper cathodes, which are the primary form of copper traded globally for industrial applications.

The upstream segment, encompassing mining and concentration, is dominated by large-scale operations. This segment is highly capital-intensive and directly exposed to operational risks such as labor disputes, water availability, and ore quality, as well as changing regulatory frameworks like new taxes and environmental approvals. The midstream segment, involving smelting and refining, is influenced by the global market for concentrate, which has recently been characterized by tightness, leading to negative treatment charges (TCs). This situation impacts the profitability of smelters and can influence the integrated value chain by making it less attractive to sell raw concentrate. In the downstream segment, Chile primarily exports refined copper and copper concentrates. Its network of free-trade agreements (FTAs) with major economic blocs like the EU and China, alongside historical trade ties with the US, facilitates global distribution. However, the sector remains vulnerable to trade protectionism, such as potential US tariffs.

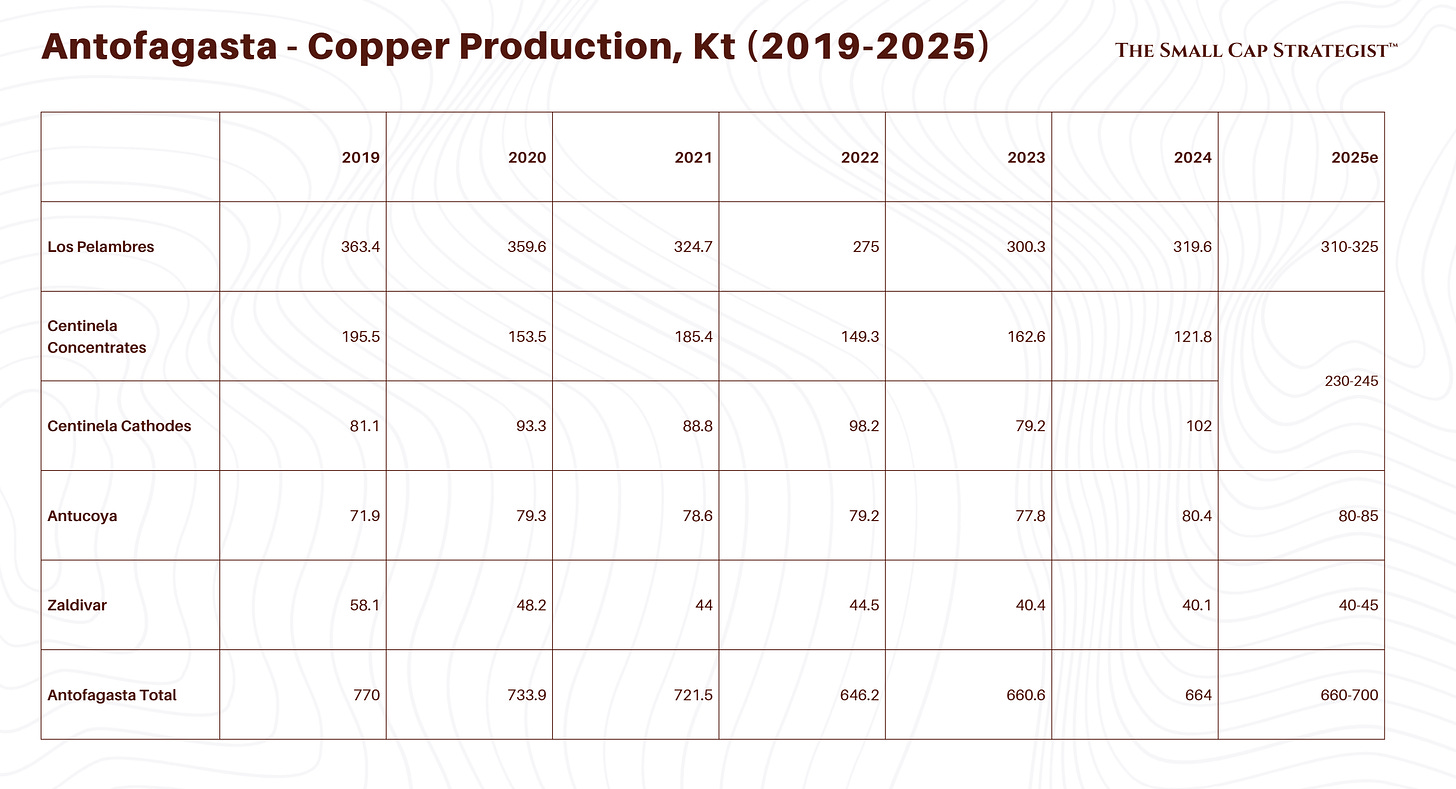

The "strong new copper project pipeline" is a critical driver of future growth in Chile. Important examples include Teck Resources' Quebrada Blanca Phase 2 (QB2), which is a primary contributor to Chile's production rebound, with significant ramp-up expected to reach 230-270kt in 2025 and further increasing to 280-310kt in 2026-2027. QB2 is pioneering the large-scale use of desalinated seawater, directly addressing the critical challenge of water scarcity. Antofagasta's Centinela Second Concentrator, which has received environmental approval, is set to increase capacity by 170kt, with production commencing by 2027. Antofagasta is also investing in its Los Pelambres desalination plant to enhance water security. Furthermore, to offset anticipated long-term production declines from fiscal year 2027, BHP plans to launch four new projects at its Escondida mine between 2027 and 2032.

Chile's aging copper mines are experiencing declining ore grades, which means that larger volumes of ore must be processed to yield the same amount of copper. This increased processing is highly water-intensive. In response, miners are compelled to invest heavily in costly solutions such as desalination plants and advanced processing technologies. This creates a feedback loop where environmental and geological challenges directly drive up capital and operational expenditures. This represents a fundamental shift in the economics of Chilean copper mining, potentially impacting its global competitiveness. Such substantial investments are typically only feasible for large, well-capitalized players, which could lead to further market consolidation and higher barriers to entry for new participants.

Chile produces both copper concentrate and refined copper. The global market for concentrate is currently tight, resulting in negative treatment charges (TCs) for smelters. This economic condition implies that the value captured from selling raw concentrate is diminished, potentially even costing miners to process their concentrate. A strategic opportunity therefore exists for Chile to invest further in domestic smelting and refining capacity, enabling it to process a larger proportion of its own concentrate into higher-value refined copper. This vertical integration would allow Chile to capture a greater share of the overall copper value chain, reducing its vulnerability to volatile concentrate market dynamics. It also offers a strategic hedge against potential tariffs on raw materials versus refined products, thereby enhancing the resilience of its export profile and maximizing economic benefits within the country.

Key Players and Competitive Position in Chilean Copper Mining

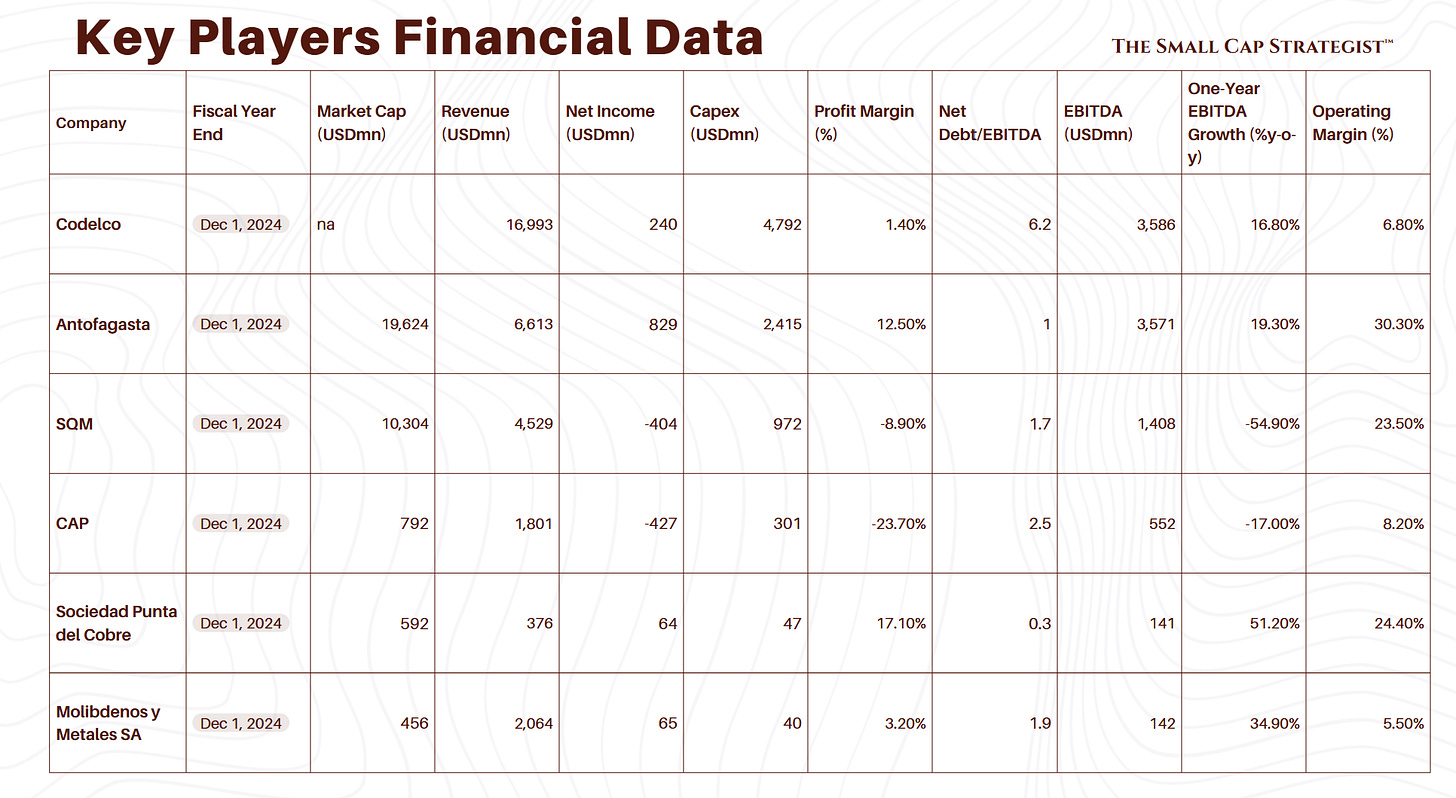

Chile's state-owned Codelco remains the cornerstone of the national copper industry, accounting for approximately 25% of Chile's total copper output and a significant portion of its molybdenum production. Despite its historical importance, Codelco faces substantial challenges from aging operations and declining ore grades, which contributed to its output falling to its lowest level in a quarter-century in 2023, reaching 1.3 million metric tons (mnt). Codelco's strategy is heavily focused on "structural projects" designed to extend mine life and boost output to 1.7 mnt by 2030. As a state miner, it benefits from favorable access to credit markets, a crucial advantage for funding these massive investments. Codelco has also been tasked with managing Chile's national lithium strategy, entering into joint ventures for lithium extraction, further expanding its strategic role.

Several major private and multinational players also contribute significantly to Chile's copper production. Antofagasta, a prominent global copper miner, produced 664 kt in 2024. Its operations are strategically concentrated in Chile, benefiting from the country's relative political and operational stability. Antofagasta is actively pursuing expansion with the Centinela Second Concentrator project and investing in critical infrastructure such as desalination plants at Los Pelambres to mitigate water scarcity. The company reported an impressive 19.6% year-on-year rise in copper production in Q1 2025. BHP, through its Escondida mine, stands as the world's largest copper mine and a key contributor to Chile's national output. Escondida reported a strong 20% year-on-year increase in copper production over the first nine months of fiscal year 2025. To counteract anticipated long-term production declines from FY2027, BHP plans to launch four new projects at Escondida between 2027 and 2032. Anglo American, while a diversified global miner, holds significant copper operations in Chile, including Los Bronces and Collahuasi. Its Q1 2025 copper production in Chile, however, saw a disappointing 29% year-on-year decline, primarily due to lower ore grades at Collahuasi and reduced throughput at Los Bronces. Anglo American's global strategy focuses on divesting non-core assets to concentrate on "future-enabling commodities" like copper. Lastly, Teck Resources' Quebrada Blanca Phase 2 (QB2) project is a major driver of Chile's recent copper production rebound, with substantial ramp-up expected to continue through 2027. This project is particularly known for its pioneering large-scale use of desalinated seawater for mining in the Tarapaca Region, setting a precedent for sustainable water management in the industry.

The Chilean copper sector is characterized by a hybrid structure, featuring a few dominant state-owned and multinational players. This market concentration benefits from established infrastructure, deep expertise, and economies of scale. However, it also presents challenges related to resource nationalism and regulatory changes, which can disproportionately affect large-scale operations. Despite these pressures, the market generally encourages foreign direct investment (FDI), ranking favorably in competitive landscape scores.

Codelco, as a state-owned entity, benefits from direct government backing and favorable access to credit markets. However, Codelco faces significant challenges with aging assets and declining ore grades, which have contributed to recent production dips. Furthermore, the government has expanded Codelco's mandate, assigning it the responsibility of managing the national lithium strategy, including forming joint ventures for lithium extraction. This dual role creates tension. While Codelco provides a stabilizing force and national control over key resources, its operational inefficiencies and expanded mandates could potentially dilute its focus and resources, thereby hindering optimal performance in both copper and lithium. This suggests that the state's involvement, while ensuring national benefit, might come at the cost of pure commercial agility and efficiency, potentially impacting the overall sector's growth potential.

All major copper miners in Chile (Codelco, Antofagasta, BHP, Anglo American, and Teck Resources) confront a common set of challenges, including declining ore grades, persistent water scarcity, labor disputes, and changing regulations. However, their strategies to address these headwinds differ significantly. Codelco is focusing on large-scale "structural projects" to modernize its aging infrastructure and boost output. Antofagasta is investing heavily in desalination plants and expanding concentrator capacity. BHP is planning new projects at Escondida specifically to offset anticipated future production declines from its existing operations. Meanwhile, Anglo American is pursuing a strategy of global portfolio optimization and divestment of non-core assets to concentrate on its most promising commodities, including copper. This divergence in approaches indicates that there is no single, universally effective solution to Chile's complex mining challenges. The success of the Chilean copper sector will therefore depend on the collective adaptability of these varied corporate strategies. For investors, this implies that a deeper assessment of each company's specific capital expenditure plans, technological investments, and risk mitigation approaches is crucial to evaluate their true resilience and long-term growth prospects, rather than relying solely on broad sector trends.

Economic Contribution: Value-Added Products

Copper mining is clearly the foundation of the Chilean economy. Real GDP growth in Chile is supported by expanding mining activity and investment. The sector significantly supports national fiscal accounts through substantial copper revenue, further amplified by the recently implemented copper mining royalty. Exports of goods Free On Board (fob) are projected to rise steadily from US 93.0 billion in 2023 to US 105.4 billion in 2025 and an impressive US $118.6 billion by 2029, with copper being the primary driver of this export growth.

Beyond raw material extraction, Chile is increasingly focusing on value-added products and services within the copper sector. While Chile is a dominant producer of copper concentrate, it also prioritizes the production of higher-value refined copper cathodes. The sophisticated nature of Chilean mining operations, particularly in addressing complex challenges like declining ore grades and water scarcity, fosters a robust ecosystem of specialized mining services, engineering, and technology development. The industry's increasing drive to power mining operations with renewable energy sources, such as solar power in the northern desert regions, creates significant opportunities for growth in Chile's domestic renewable energy sector, adding value beyond the direct mining output and contributing to national energy independence. The necessity for desalination plants, exemplified by projects like Teck QB2 and Antofagasta Los Pelambres, drives substantial investment in water infrastructure development and related technologies.

The mining sector is a major direct and indirect employer, supporting a large workforce across various skill levels. Investment in new projects and expansions stimulates significant regional economic development, particularly in the northern mining regions.

Chile's Copper Future Trends: Tailwinds and Headwinds

Tailwinds

The most significant tailwind is the global demand stemming from the energy transition. The accelerating global change towards a green economy is generating immense and sustained demand for copper. Copper is indispensable for electric vehicles (EVs), renewable energy generation infrastructure (solar, wind), and the expansion of smart grids. This structural demand is expected to provide a fundamental floor for prices and support long-term growth, preventing significant losses. Furthermore, government initiatives and efforts to attract Foreign Direct Investment (FDI) remain a positive factor. Despite some resource nationalist policies, the Chilean government is actively working to attract foreign investment, particularly in critical minerals. Efforts to ease regulatory approval processes, which have seen approval times increase significantly in recent years (from 559 days in 2014 to 1,433 days in 2023), and maintain a relatively stable business environment (ranking 8.0 in overall business environment for 2025) are significant positive signals. Strategic partnerships, such as the EU's Memorandum of Understanding (MoU) with Chile on raw materials value chains, further strengthening investment prospects and secure supply chains. Chile also benefits from a strong project pipeline.

A substantial pipeline of new and expansion copper projects, including major developments like Teck Resources' QB2, Antofagasta's Centinela Second Concentrator, and BHP's planned Escondida projects, are poised to significantly contribute to future production growth. Finally, fiscal consolidation and stable macroeconomics provide a supportive backdrop. The incoming administration's anticipated focus on fiscal consolidation, aiming to reduce the fiscal deficit to 0.8% of GDP by 2029, and a projected strengthening of the peso after 2026, driven by easing election uncertainty and pro-market reforms, contribute to a stable macroeconomic environment conducive to attracting investment.

Headwinds

Several headwinds challenge the Chilean copper sector. Resource nationalism and increased government intervention are prominent concerns. The nationalization of lithium reserves in April 2023 and the introduction of a new copper mining royalty in January 2024 signal a growing trend of state involvement. While the copper royalty was modified from its initial proposal, it still raises concerns among industry leaders about deterring future investment and increasing operational costs.

Regulatory burdens also pose a significant challenge. Strict environmental and social regulations, particularly concerning water extraction and lengthy project approval processes, significantly hinder competitiveness and can cause substantial project delays. The increasing propensity for legal action by environmental regulators against mining firms further weakens investor sentiment.

Water scarcity is a critical and escalating operational challenge, especially in the arid northern mining regions. This necessitates costly investments in desalination plants, increasing operational expenses and potentially limiting the scope of new project development. As Chile's copper mines age, declining ore grades become a factor. This means that larger volumes of ore must be processed to yield the same amount of metal, which increases production costs and exacerbates water consumption.

Labor disputes are another persistent issue; frequent labor tensions and strikes over wage disputes, working conditions, and job security pose continuous risks to mining production and the progress of new projects. Major mines like BHP's Escondida and Codelco's Chuquicamata have experienced significant disruptions.

Geopolitical tensions and trade protectionism create significant uncertainty for Chile's export-oriented sector. The threat of US tariffs on copper imports and the broader specter of a global trade war, particularly between the US and China, could lead to weaker demand and increased price volatility for copper. Lastly, the growing footprint of organized crime, particularly affecting business operations in northern Chile, poses a notable downside risk to political stability and operational security.

The Chilean government is facing a challenging policy balancing act, aiming to balance resource nationalism with the imperative of attracting foreign investment. On one hand, the government is pursuing resource nationalist policies, such as the copper royalty and lithium nationalization, with the objective of securing greater revenues and control over strategic resources. On the other hand, it simultaneously aims to attract foreign direct investment and ease regulatory burdens to boost overall economic growth. This creates a fundamental tension in policy. While the state seeks to maximize its share of the mineral wealth, overly aggressive resource nationalism or burdensome taxation risks undermining the very investment climate that has historically made Chile attractive. The long-term success of Chile's mining sector therefore hinges on its ability to find a sustainable equilibrium that satisfies nationalistic aspirations without deterring the massive capital investments required for new projects and the sustained operation of existing ones. This policy unpredictability represents a critical risk for long-term investors, as it can significantly impact project viability.

A paradoxical situation emerges when considering the relationship between climate change and copper production in Chile. The global energy transition, driven by climate change mitigation efforts, is the primary demand driver for copper. However, within Chile, climate-related challenges, such as chronic water scarcity, and increasingly strict environmental regulations, are significant operational constraints for copper miners. This highlights a paradox where the global solution (climate action) creates localized operational and cost problems for the very industry producing the raw materials essential for that solution. The implication is that any "green premium" for copper might be partially offset by the increased costs and complexities of environmentally compliant mining, directly impacting profitability and project timelines. Furthermore, the risk of "critical mineral investment stymied by weakening US leadership on climate change efforts" suggests that even if global demand falters due to political shifts, local environmental pressures and their associated costs will likely persist, creating a dual and persistent challenge for the industry.

Business Models in Chilean Copper Production

The Chilean copper mining sector operates under a hybrid business model structure, reflecting its unique blend of state control and private enterprise. The State-Owned Enterprise (SOE) model is exemplified by Codelco, which serves as the national champion. Codelco benefits from direct state backing and favorable access to credit markets, which is crucial for funding its massive, long-term "structural projects" aimed at modernizing its aging infrastructure and boosting output. However, as an SOE, it is also subject to government mandates, including managing strategic resources like lithium, and can face operational challenges inherent in large, aging state assets.

Alongside Codelco, Private Multinational Corporations such as BHP, Anglo American, and Teck Resources operate large-scale, technologically advanced mines. Their business models emphasize global portfolio optimization, operational efficiency, and leveraging economies of scale. These companies are vital conduits for foreign direct investment (FDI) and introduce cutting-edge technological expertise into the Chilean mining landscape. Lastly, Chilean Private Companies like Antofagasta, while publicly listed in London, maintain a strong operational focus within Chile. Their business model centers on maximizing output and profitability from their Chilean assets through continuous investment, cost reduction, and technological upgrades.

Several key characteristics define the operational strategies across these business models. The capital-intensive nature of copper mining necessitates massive capital expenditure for exploration, development, and ongoing operations. Codelco's capital expenditure, for instance, reached $4.792 billion in 2024, while Antofagasta′s stood at $2.415 billion. There is a growing emphasis on technological adoption to address persistent challenges. This includes the increasing integration of advanced technologies to process declining ore grades and manage water scarcity, such as Direct Lithium Extraction (DLE) in the lithium sector and large-scale desalination plants for copper operations.

Sustainability imperatives are also becoming central to business models, with a growing focus on Environmental, Social, and Governance (ESG) factors. Codelco has set ambitious targets, aiming for a 70% reduction in greenhouse gas emissions by 2030 and net-zero Scope 1 and 2 emissions by 2050. Anglo American also has significant carbon neutrality targets. Notably, ESG bonds are becoming a growing component of Chile's sovereign debt, reflecting a broader commitment to sustainable finance. Finally, robust risk management strategies are crucial for mitigating labor disputes, navigating intense environmental scrutiny, and adapting to geopolitical trade risks. Diversification of export markets is a key approach employed by these companies to enhance resilience.

Business models are continuously adapting to the evolving environment. In response to increasing resource nationalism, private firms are forming partnerships with state entities, as exemplified by the joint venture between SQM and Codelco for lithium extraction. To address pervasive water scarcity, widespread investment in desalination plants is becoming a standard operational component, marking a significant shift from traditional freshwater sources. Furthermore, continuous research and development and investment in advanced processing technologies are crucial for optimizing ore processing and maintaining profitability amidst declining ore grades.

Investment Guidance and Regional Analysis

Chile maintains a strong and comparatively stable business environment, ranking as the second lowest in country risk within Latin America and 13th globally in the Mining Risk/Reward Index. This favorable position is underpinned by robust investor protections and extensive access to global markets through a network of free-trade agreements. Real GDP in Chile is forecast to grow firmly by 2.8% in 2025, a trajectory significantly supported by expanding mining activity and investment. The incoming government, expected to take office in March 2026, is anticipated to prioritize fiscal consolidation and a reduction in regulatory burdens, further enhancing the investment climate.

In the broader regional context, Chile's standing in the Americas Mining Risk/Reward Index is notable. It ranks 3rd regionally out of 17 markets and 13th globally out of 62 markets, with an overall score of 35.4. This strong position is attributed to its substantial mining sector size and a promising investment outlook. Specifically, Chile's Industry Rewards score of 26.2 (out of 100) surpasses the regional average, driven by the sheer scale of its mining sector. Its Country Rewards score of 39.1 also stands ahead of the regional average of 49.8, supported by high electrification rates (28.7) and competitive labor costs (36.1). However, Chile's Industry Risks score of 57.9 is higher than the regional average of 51.0, primarily due to its vulnerability to commodity price volatility and increased government intervention. Despite this, the nation performs strongly in Country Risks, scoring 25.1 compared to the regional average of 52.6, largely owing to its political stability, reflected in a political risk score of 16.4.

For investors considering the Chilean copper sector, several key considerations are important. A primary focus should be on critical minerals, particularly copper and lithium, given their central role in the global energy transition and Chile's vast reserves. While the government's national lithium strategy is statist, it still allows for private majority stakes in many salt flats and actively encourages joint ventures, offering avenues for private participation. Investors must acknowledge the inherent long-term demand fundamentals versus short-term volatility. While the structural demand for copper is strong, investors should be prepared for short-term price volatility driven by US trade policy and broader global macroeconomic uncertainty.

Investors must factor in changing regulation, including the new copper royalty and lithium nationalization. While these policies increase costs and state intervention, the overall environment remains comparatively stable. The upcoming 2025 general election introduces a degree of political uncertainty that merits attention. Furthermore, thorough due diligence on operational challenges is essential. This includes assessing water management strategies (e.g., investments in desalination), mitigation plans for declining ore grades, and the state of labor relations, all of which are critical for evaluating project viability and long-term profitability. Finally, for miners, diversification and strategic partnerships are key to mitigating risks and accessing opportunities. Diversifying export destinations beyond the US and forming strategic partnerships, especially with state-owned Codelco for lithium projects, can enhance resilience and unlock new ventures.

Despite the identified challenges, the outlook for Foreign Direct Investment (FDI) remains positive. Firm prices for critical minerals and a more benign business environment, anticipated after the 2025 election, are expected to encourage FDI and boost exports. Chile's access to market finance is strong, supported by strong environmental, social, and governance (ESG) indicators and substantial sovereign wealth funds.

Conclusions

Chile's copper sector is uniquely positioned by its worldclass natural deposits and the strong global demand for copper, particularly driven by the accelerating energy transition. Yet, this advantageous position is balanced against increasing domestic and international issues.

A core tension lies in the government's imperative to maximize national benefit from its vast resources, as evidenced by the new copper royalty and lithium nationalization policies, versus the critical need to attract and retain massive foreign investment. Such investment is indispensable for technological advancement, the development of new projects, and the sustained growth of production. The long-term health of the sector will depend on the government's ability to manage this, ensuring that policies designed to capture greater national wealth do not inadvertently deter the capital and expertise essential for the industry's future.

Furthermore, the very force driving copper demand also imposes significant operational and cost burdens within Chile. Climate-related challenges, most notably chronic water scarcity in arid mining regions, and increasingly stringent environmental regulations require large-scale and expensive investments in new technologies and infrastructure, such as desalination plants.

The varied and evolving business models and operational strategies employed by the major players (like state-owned Codelco's focus on structural projects to private multinationals' investments in desalination and new ventures) emphasise the difficulty of the challenges. The success of the Chilean copper sector will hinge on addressing common headwinds.

In conclusion, despite the headwinds of resource nationalism, regulatory burdens, and operational complexities, Chile's fundamental strengths like its immense copper reserves, relatively stable institutions, and a strong pipeline of new projects, suggest continued attractiveness for strategic, long-term investors. The sector's resilience and future growth will ultimately depend on a delicate and continuously managed balance between state aspirations for resource control and the market realities of attracting and sustaining the necessary capital and innovation.

If you enjoyed this post, consider subscribing to The Small Cap Strategist.

Disclaimer: This post is for informational and educational purposes only and should not be considered investment advice. The author is not a financial advisor. All investment decisions carry risk, and readers should consult with a qualified financial professional before making any investment choices. The author may or may not hold positions in the securities discussed.

the new format is excellent