Why Development Is Dead (And Why That’s Good For You) - America's Senior Care Sector

The "dumb money" burned billions chasing the 2017 demographic curve. In 2026, the real alpha is in the "supply destruction" left behind by 9% rates and $450/sqft hard costs.

“Be fearful when others are greedy, and greedy when others are fearful.”

— Warren Buffett

Let’s get one thing straight before we begin: If you are reading this report looking for a heartwarming narrative about the moral imperative to care for our baby boomers, or some ESG piece about “social infrastructure,” you are in the wrong place.

Close the document. Go read a non-profit brochure.

This is a story about capital flows, demographic inevitability, and the absolute shitshow that is the current state of senior housing supply in the United States.

We are here to talk about making money from the slow-motion collapse of a system that wasn’t built to handle what’s coming.

We are standing at what Marathon Asset Management (the goats of the “Capital Cycle” philosophy) would identify as the absolute sweet spot. For the uninitiated: the Capital Cycle framework holds that the best time to buy into a sector is precisely when capital has fled, supply growth has stalled, and everyone has declared it “uninvestable.”

Returns follow scarcity, not popularity.

The herd has fled. The momentum-chasing allocators who couldn’t build assisted living facilities fast enough in 2018 have been burned, churned, and spat out. They got crushed by COVID, annihilated by interest rates, and regulated into oblivion by staffing mandates. The capital has retreated. The cranes have stopped turning. The regional bank lending windows are slammed shut and bolted.

And precisely because everyone hates this sector right now, precisely because it is “uninvestable” to the tourist capital, it represents one of the most asymmetric opportunities in real estate today.

We will be releasing paid deep dives in the coming weeks of equities we see winning this capital cycle.

Here is what we are covering:

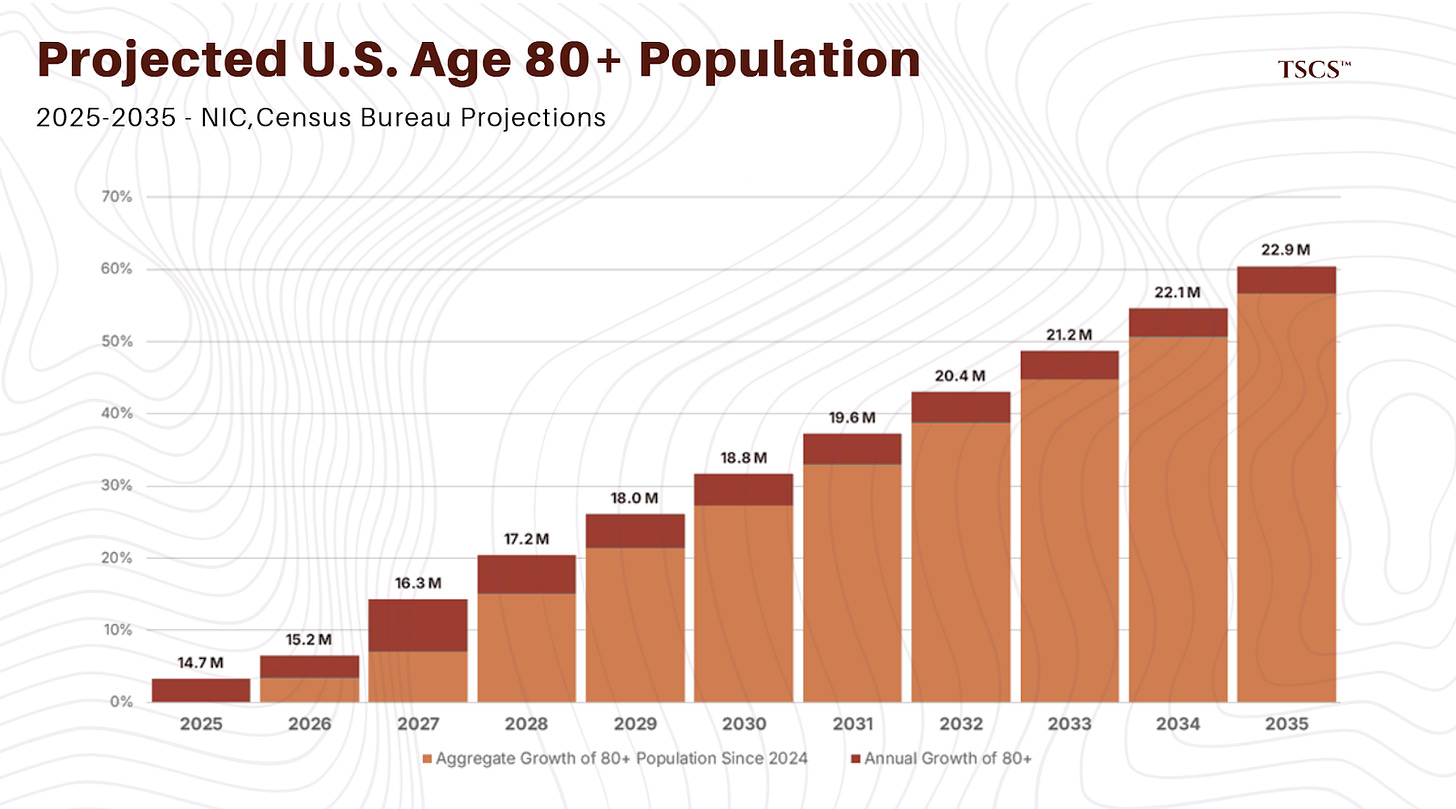

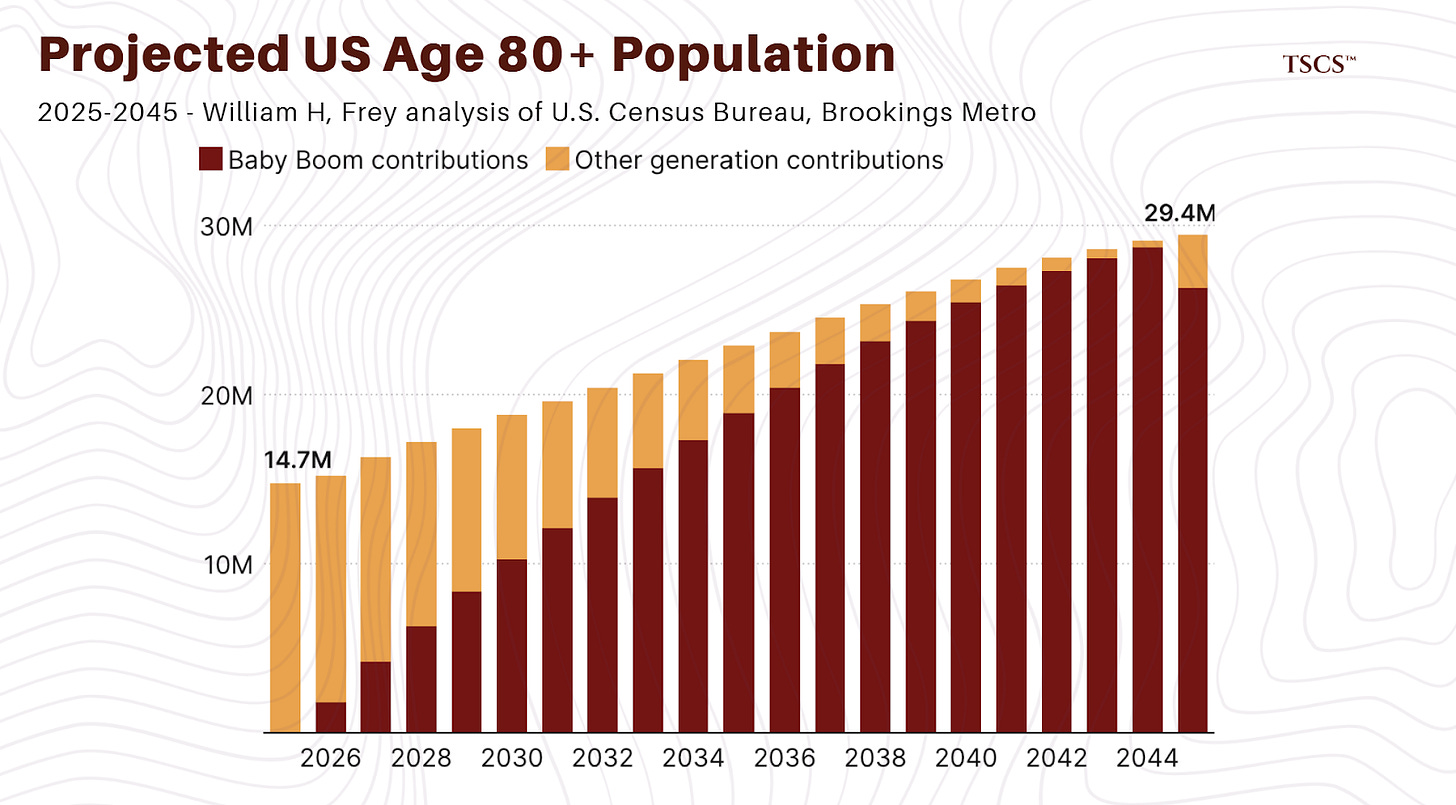

Demographic Inevitability: The 80+ population is exploding. These aren’t tennis-playing 65-year-olds; these are high-acuity, needs-based residents who cannot age in place without turning their living rooms into amateur ICUs.

Supply Vacuum: New construction starts are at historic lows. Hard costs are up 30-40%. Financing is effectively double what it was in the ZIRP era. The replacement cost moat is now so wide you could sail an aircraft carrier through it.

Capital Cycle Mechanics: We will look at some of the winners/losers (Welltower, Ventas, and their peers) to see who is positioned to eat and who is just trying to survive.

Japanese Demographics - U.S. In 15 Years: What happens when a society ages faster than it can build? Japan shows us exactly where this ends.

The Conversions Play: Why failed hotels are becoming memory care units, and why ground-up development is functionally dead.

Senior housing is the physical manifestation of a demographic time bomb that has already detonated. We will show you how to profit from it.

Why You Need to Be Reading TSCS

At TSCS, we’ve made it our mission to uncover hidden opportunities before the crowd. Our community is built for investors who want an edge: institutional-grade analysis, creative frameworks, and a proven record of outperformance.

This isn’t just research, it’s a blueprint for compounding wealth with conviction.

In recent months, we’ve published sector deep-dives such as:

We also provide ruthless stock-specific analyses, highlighting hidden moats and catalysts the market has barely begun to price:

If you want to understand not only where markets are headed, but also how to capture hidden compounding opportunities, you need to be here.

The Theory of “Supply Side” Economics

Most investors are obsessed with demand. They look at a chart of aging Baby Boomers, see the line go up and to the right, and think, “I should buy senior housing.” That is first-level thinking. That is how you lose money. That is how the “dumb money” burned billions in 2017.

Marathon Asset Management taught us that supply is the real driver of long-term returns. It’s a behavioral cycle:

High current returns attract capital.

Capital breeds competition and new supply.

Competition kills returns.

Capital leaves in disgust.

Supply shrinks or stagnates.

Returns rise again because demand (usually) remains constant or grows.

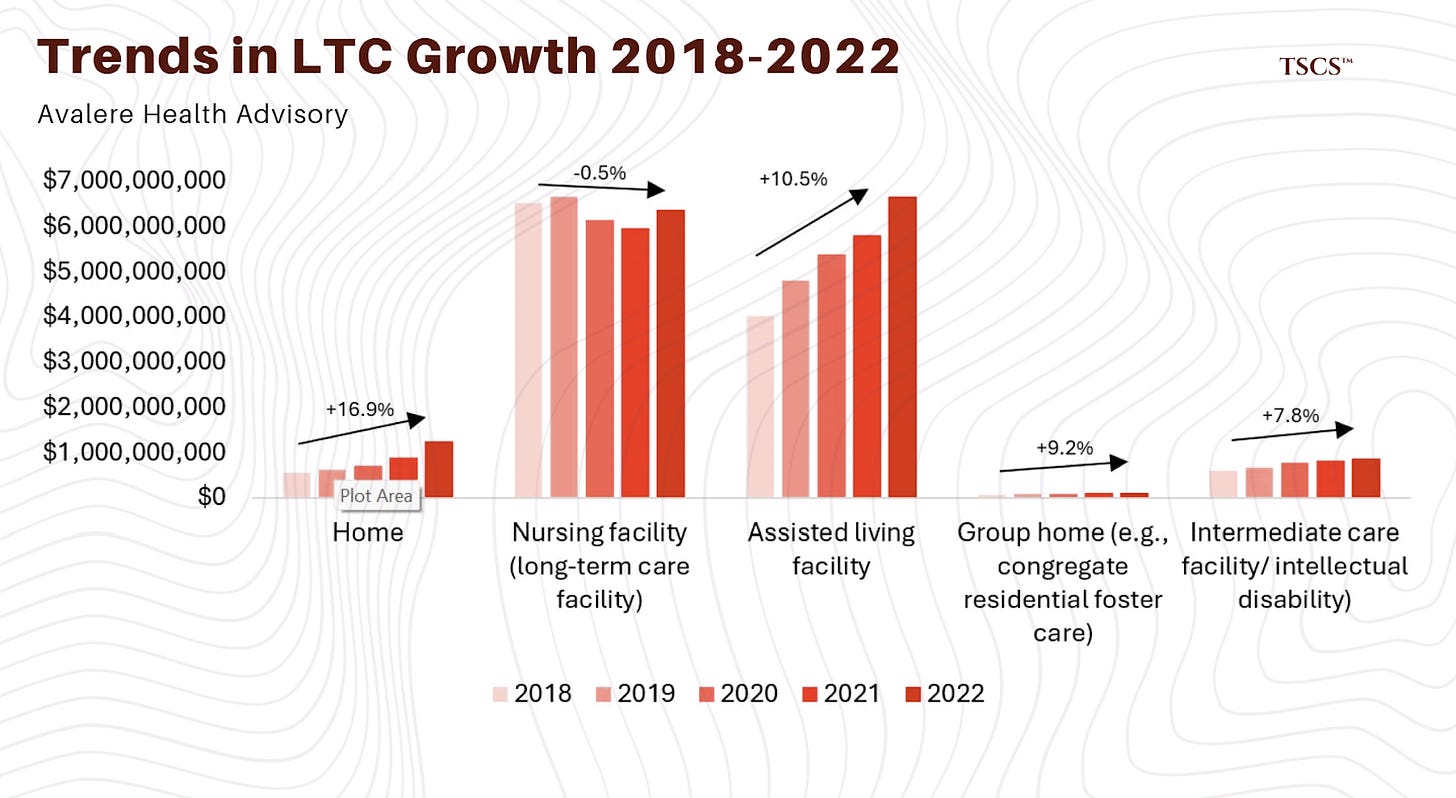

It’s the circle of life, but with money. In the senior housing sector, we saw the “Capital Influx” phase peaking around 2017-2019. Every private equity shop with a cheap credit line was throwing up Assisted Living Facilities (ALF) in secondary markets. They were underwriting perfection, 3% rent growth, 95% occupancy, 30% margins. They ignored the fact that their competitors were building across the street.

Then reality hit. First, it was the oversupply in 2019. Occupancy dipped. Then came COVID, the ultimate exogenous shock. Occupancy didn’t just dip; it cratered. Expenses skyrocketed (PPE, agency labor, hero pay). The “dumb money” that entered late got slaughtered.

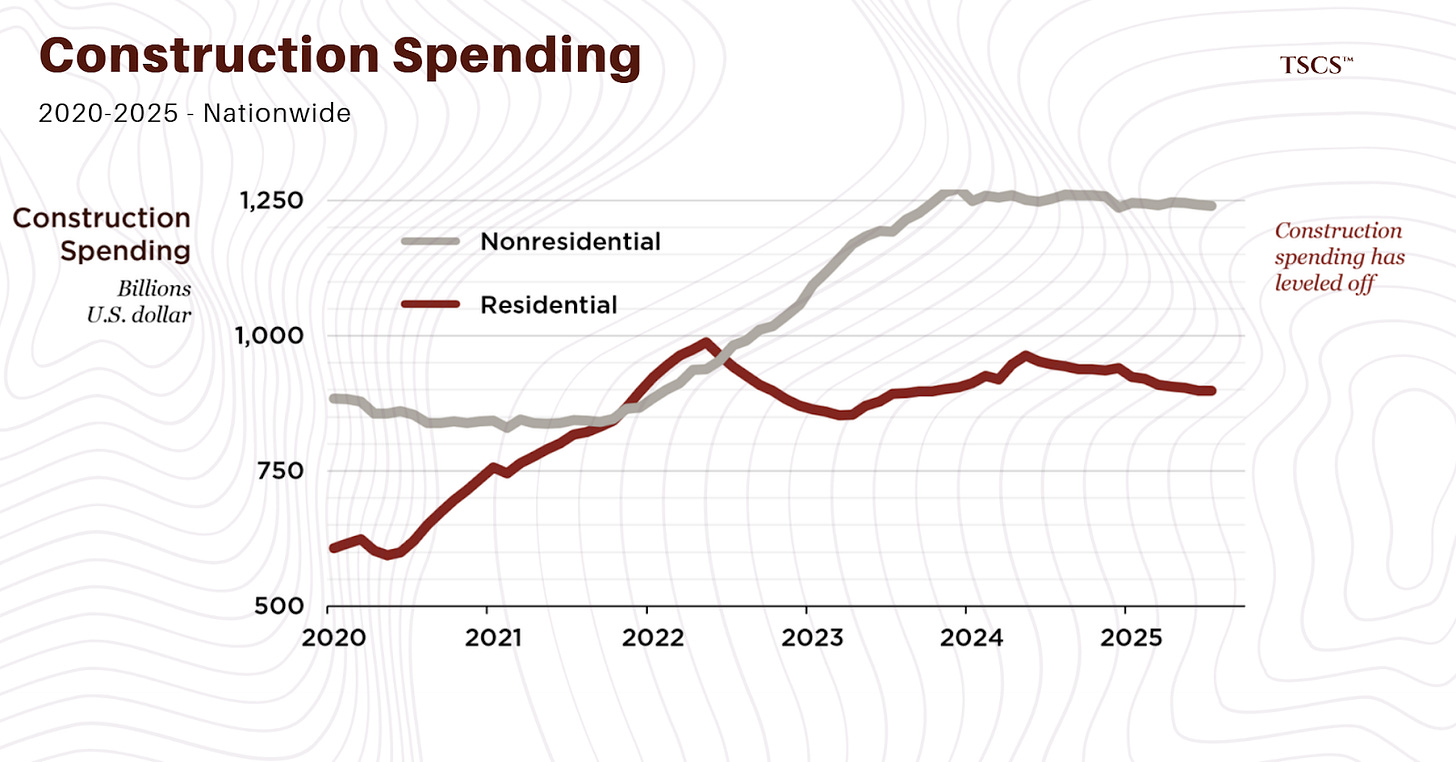

Now, look at 2024-2025. The data confirms we are deep in the “Capital Withdrawal” phase. Construction starts are at historic lows. Banks aren’t lending. The “supply side” has been effectively nuked. This is exactly where you want to be.

The snippet from Morningstar discussing Marathon’s approach notes that “intrinsic pricing power” comes from barriers to entry. Well, try building a new Class A senior living facility in a major MSA today. You have NIMBYs, zoning hell, 9% construction loans, and construction costs that have ballooned to $350-$450 per square foot. The barrier to entry is economically unfeasible.

The beauty of the current cycle is the skepticism. Read the headlines. Everyone is terrified of “labor shortages” and “staffing mandates.” This scares the tourists away. Good. Let them run. When the tourists leave, the operators who actually know how to run these complex businesses (the “operators with a track record” mentioned in Welltower’s strategy) can consolidate market share. We are seeing a bifurcation. The mediocre operators are dying, either going bankrupt or selling at distressed prices. The strong operators, the ones aligned with massive REIT capital like Welltower, are buying these assets for pennies on the dollar.

This is the classic “consolidation” phase of the capital cycle. The weak hands fold. The strong hands accumulate. And because no new supply is coming online to threaten them, the survivors will have pricing power we haven’t seen in decades.

The Demand Wave (Demographics)

The “Silver Tsunami” vs. The “Gray Wave”

I hate the term “Silver Tsunami.” It implies a sudden, destructive event that recedes.

What we are facing is a Gray Wave, a rising tide that is relentless, predictable, and utterly indifferent to whether we have beds for them or not.

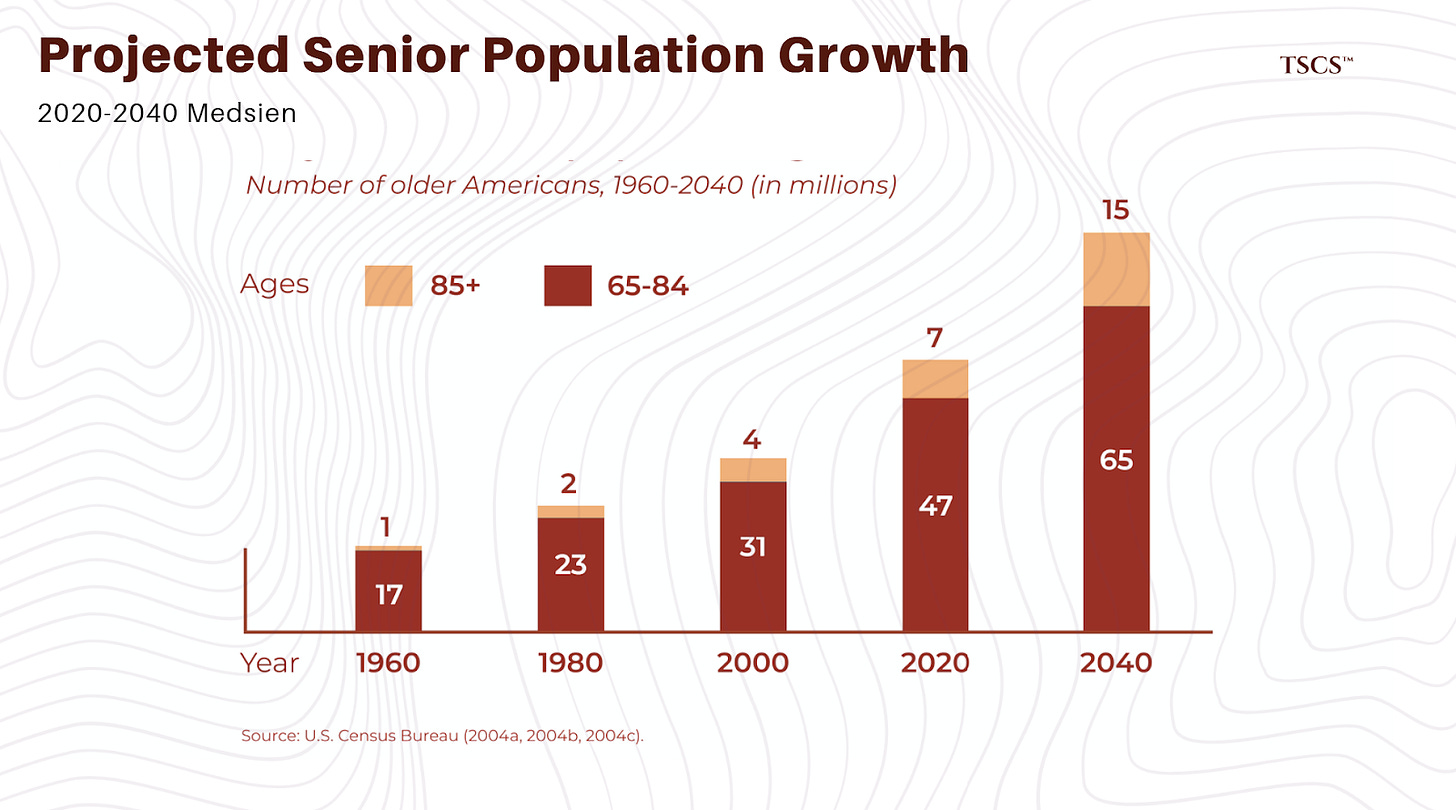

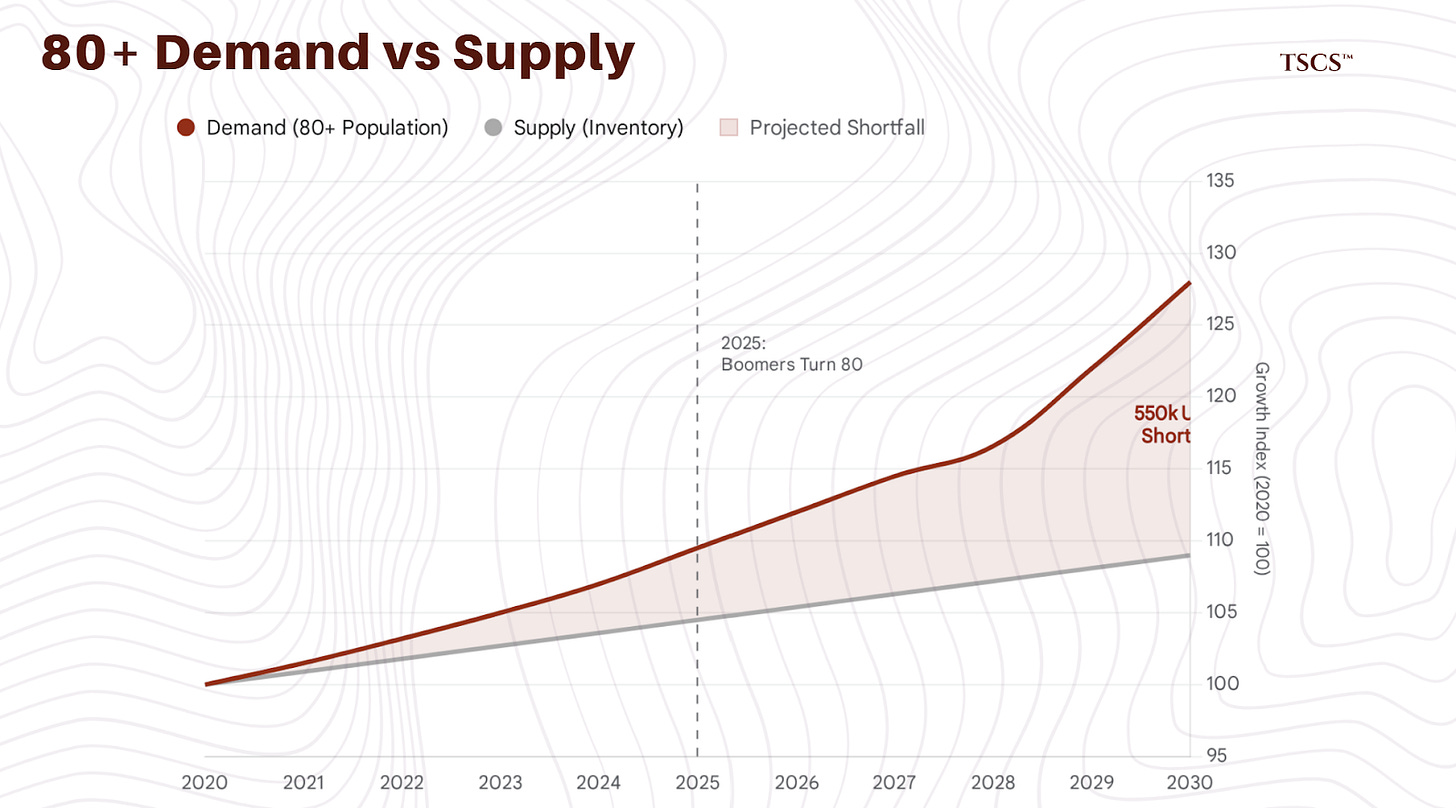

Let’s look at the numbers from the Census Bureau and NIC MAP. The first Baby Boomers turned 80 in 2025. The 80+ population (the prime demographic for senior housing) is projected to grow by 50% by 2030. We need 806,000 additional units by 2030 just to maintain current penetration rates.

We aren’t building anywhere near that. We are building maybe 26,000 units a year. Do the math. We are driving 100 miles an hour toward a cliff, and the construction industry has taken its foot off the gas. To bridge the deficit in the next five years, the industry would need more than a 3.5-fold increase in its current development pace. That is physically impossible given the constraints on labor and capital.

Acuity Creep: 85 is the New 75

Here is the nuance the generic reports miss: It’s about acuity (not just age).

“85 is the new 75.”

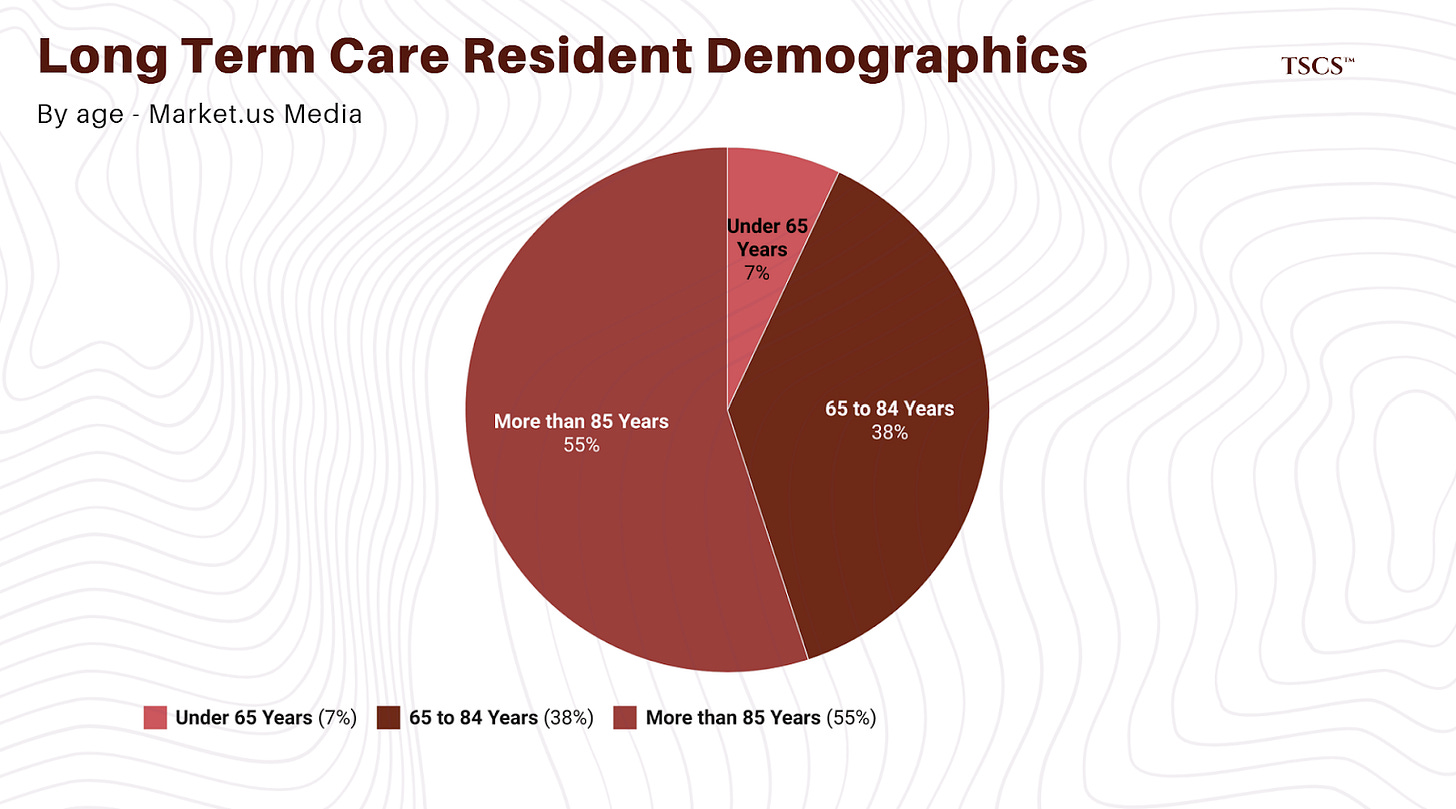

People are moving into senior housing later and sicker. The “lifestyle” independent living resident is staying home longer (thanks to technology and home health), so when they finally do move in, they are frail. They have multiple chronic conditions. 53% of assisted living residents are now 85+, and 4 in 10 have dementia.

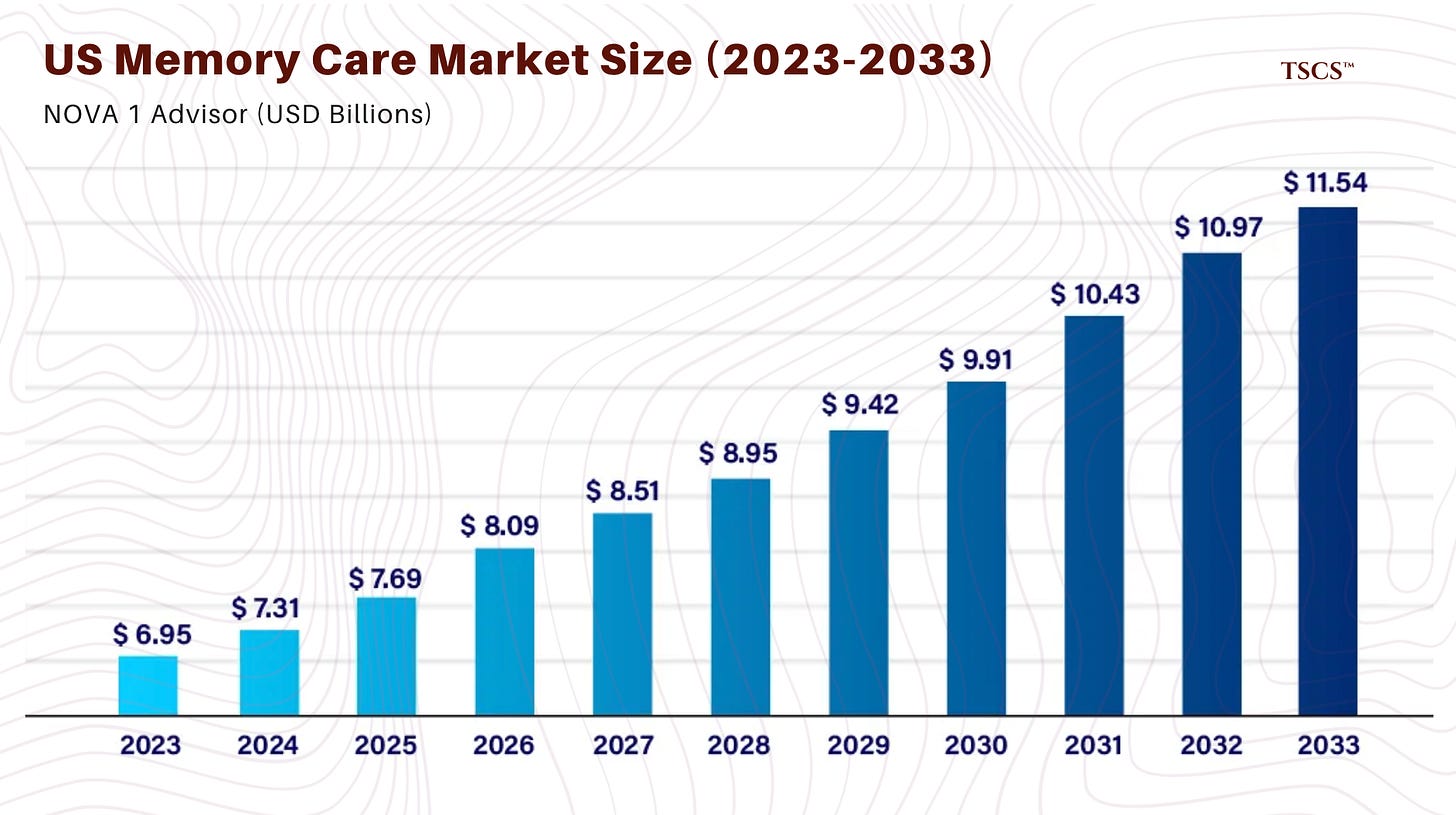

This shifts the business model fundamentally. It is no longer a “hospitality” play where you sell bingo nights and decent food. It is a “healthcare” play where you are managing medication, fall risks, and cognitive decline. This increases the operational intensity (a term Welltower loves). It also increases the moat. Any developer can build an apartment complex with handrails and call it “Active Adult.” Very few can build and operate a high-acuity memory care facility that doesn’t get shut down by the state.

The Wealth Transfer and “Ability to Pay”

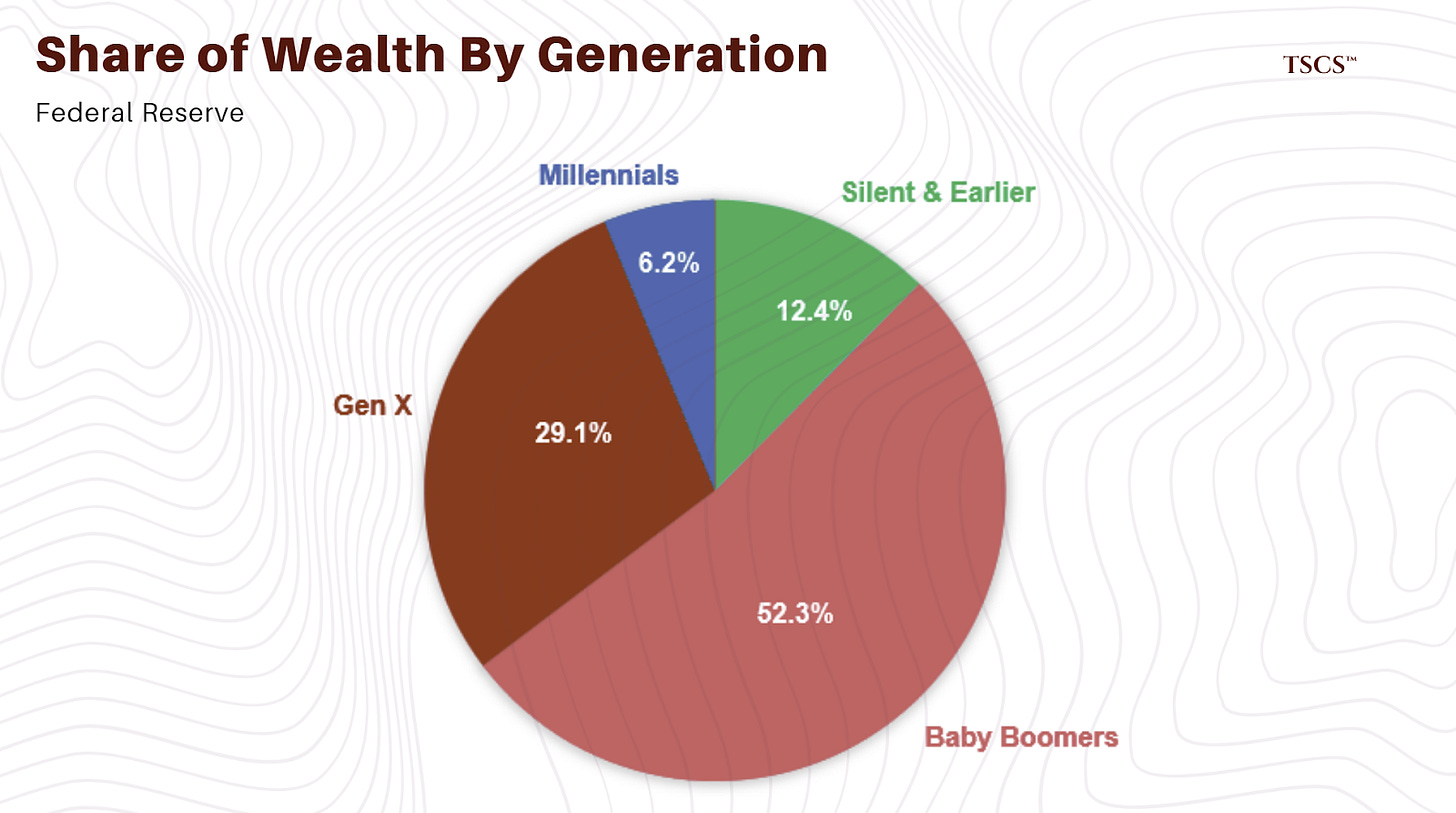

Critics will say, “Sure, there are old people, but can they afford $8,000 a month for memory care?”

Valid question. But we are talking about the Baby Boomers. This is the wealthiest generation in human history. They are sitting on trillions in housing equity. They aren’t broke. And even if they are cash-poor, they are asset-rich. The sale of a paid-off home in a coastal market funds a lot of months in a senior living facility.

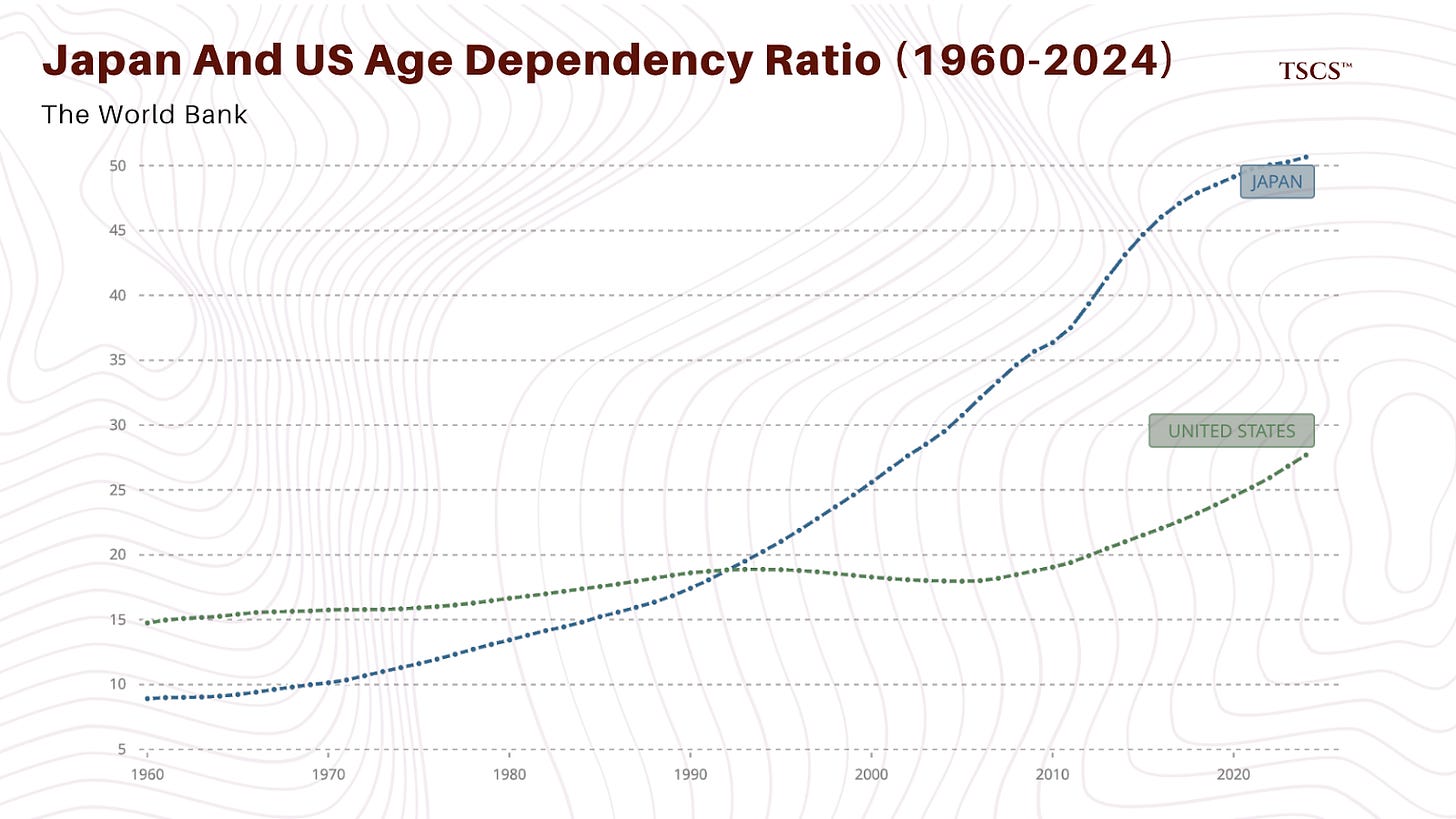

Furthermore, looking at the Japanese model, we see that when the private market fails, the government has to step in with insurance schemes (LTCI). While the US is allergic to “socialized medicine,” the sheer political weight of 70 million angry Boomers will force some form of subsidy or coverage expansion eventually. But for now, the “private pay” market is good enough for the top 10% of the income bracket, which is exactly where the REITs like Welltower and Ventas play.

Part III: The Supply Drought

Why We Can’t Just “Build More”

If demand is so high, why isn’t every developer breaking ground? The answer lies in the mechanics of the “Sticks” lag and the high cost of capital.

1. The Cost of Capital:

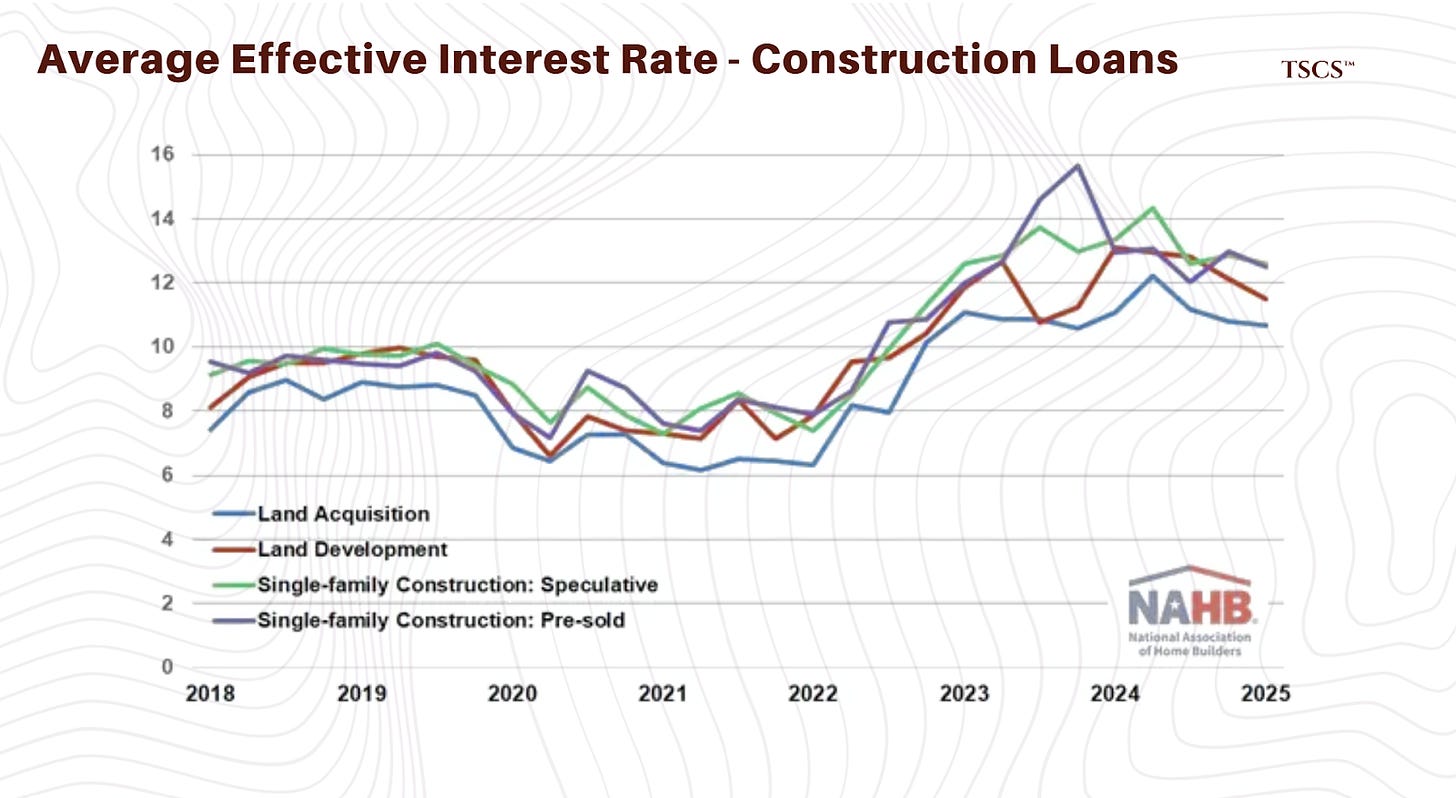

Go try to get a construction loan right now. I dare you. Regional banks, the traditional lifeblood of real estate development, are scared stiff. They are dealing with their own balance sheet holes from office real estate. Banks are “returning,” but let’s be real, they are returning for acquisitions of cash-flowing assets, not speculative construction. Rates are 6.25% to 9.75%. That kills the pro-forma. A project that pencils at 4% interest is a bankruptcy filing at 9%.

2. Hard Costs:

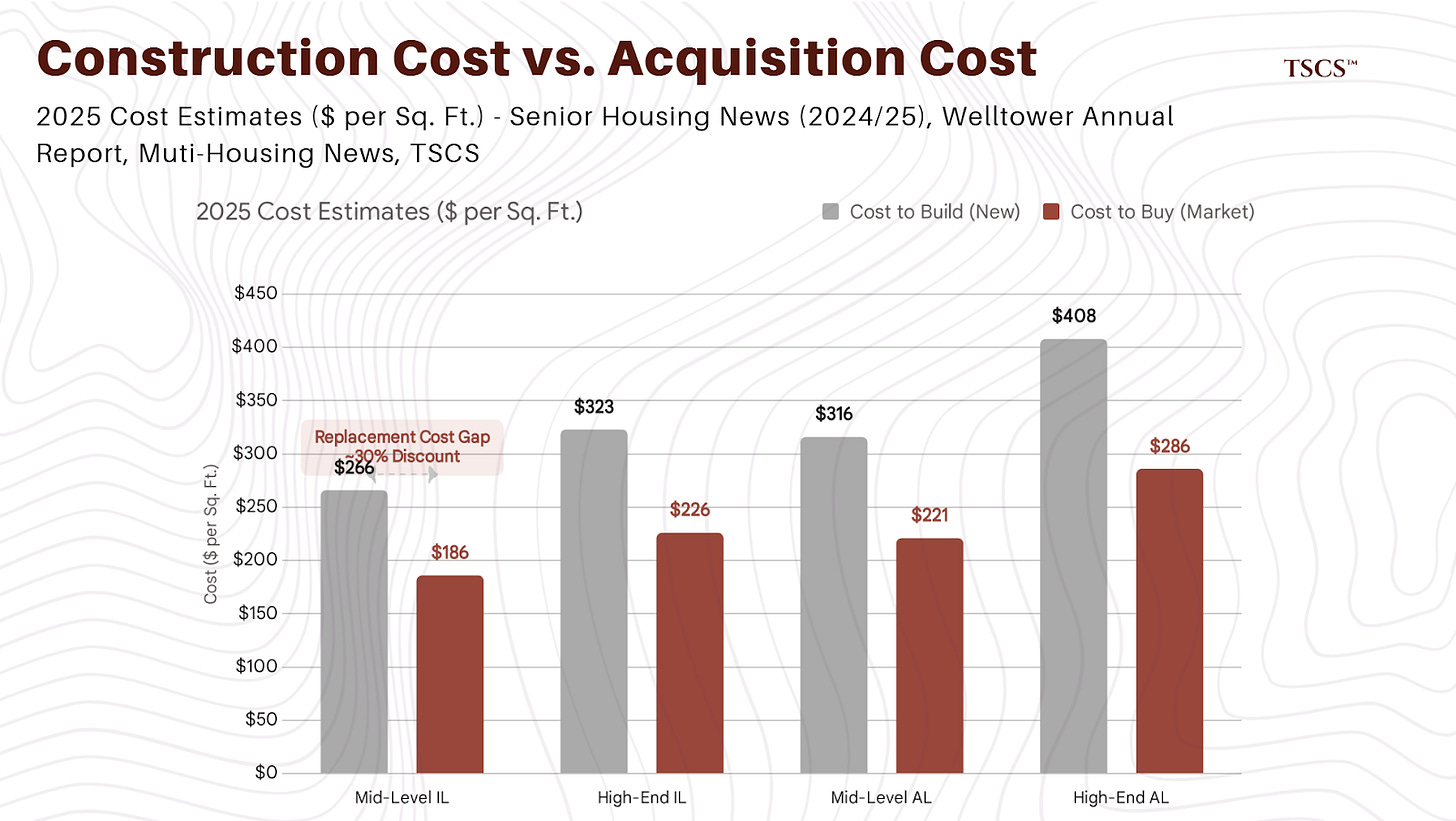

Construction costs haven’t come down. They’ve stabilized at a high plateau. We see mid-level assisted living construction at $274-$349 per square foot. That’s just the building. Add land, soft costs, FF&E (Furniture, Fixtures, and Equipment), and carry costs. You are looking at $350k-$450k per unit to build new.

The Breakdown of the Cost Stack:

Hard Costs: $185.6/SF (approx. 88% of total)

Contingency: $18.6/SF

Financing: $12.5/SF

Soft Costs: $7.1/SF

FF&E: $4.5/SF

When you sum this up, the price tag is high. And remember, “soft costs” and “financing” are the killers when delays happen. If you get stuck in permitting for 12 months (standard in blue states), your carry cost eats your entire developer fee.

3. Replacement Cost Discrepancy:

This is the holy grail of value investing. You can buy existing, stabilized Class A assets for $250k-$300k per unit. Why would you build for $400k when you can buy for $300k?

Welltower explicitly states this in their strategy: they are acquiring assets at a “30%+ discount to replacement cost.” As long as this gap exists, new supply will remain muted. No rational actor builds when they can buy cheaper.

The “Sticks in the Ground” Lag

Even if rates dropped to zero tomorrow (they won’t), and every banker suddenly decided they loved senior living construction (they don’t), we would still see a supply gap for 24-36 months. That’s how long it takes to entitle, permit, and build these things.

The “sticks” (”more twigs than sticks in ‘26”) aren’t going into the ground. This guarantees that the supply shortage is locked in through at least 2027. We have a clear runway of rising occupancy and rising rents. It is the most predictable macro setup I have seen in my career.

Part IV: The Japan Proxy

The Ghost of Christmas Future

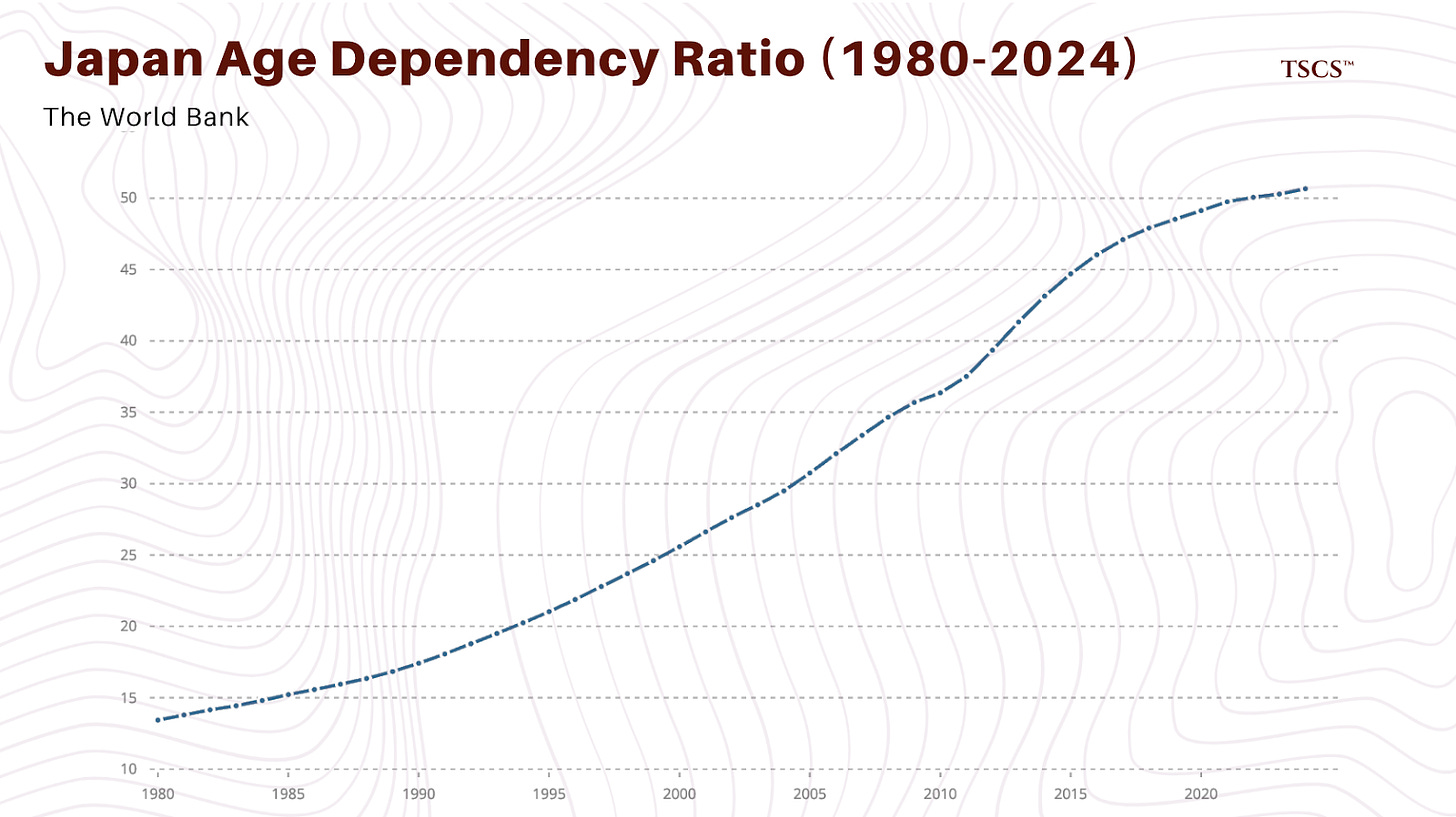

If you want to know what happens to the US in 2035, look at Japan today. Japan is the laboratory for extreme aging. They are about 10-15 years ahead of us on the demographic curve.

1. The Failure of Family Care:

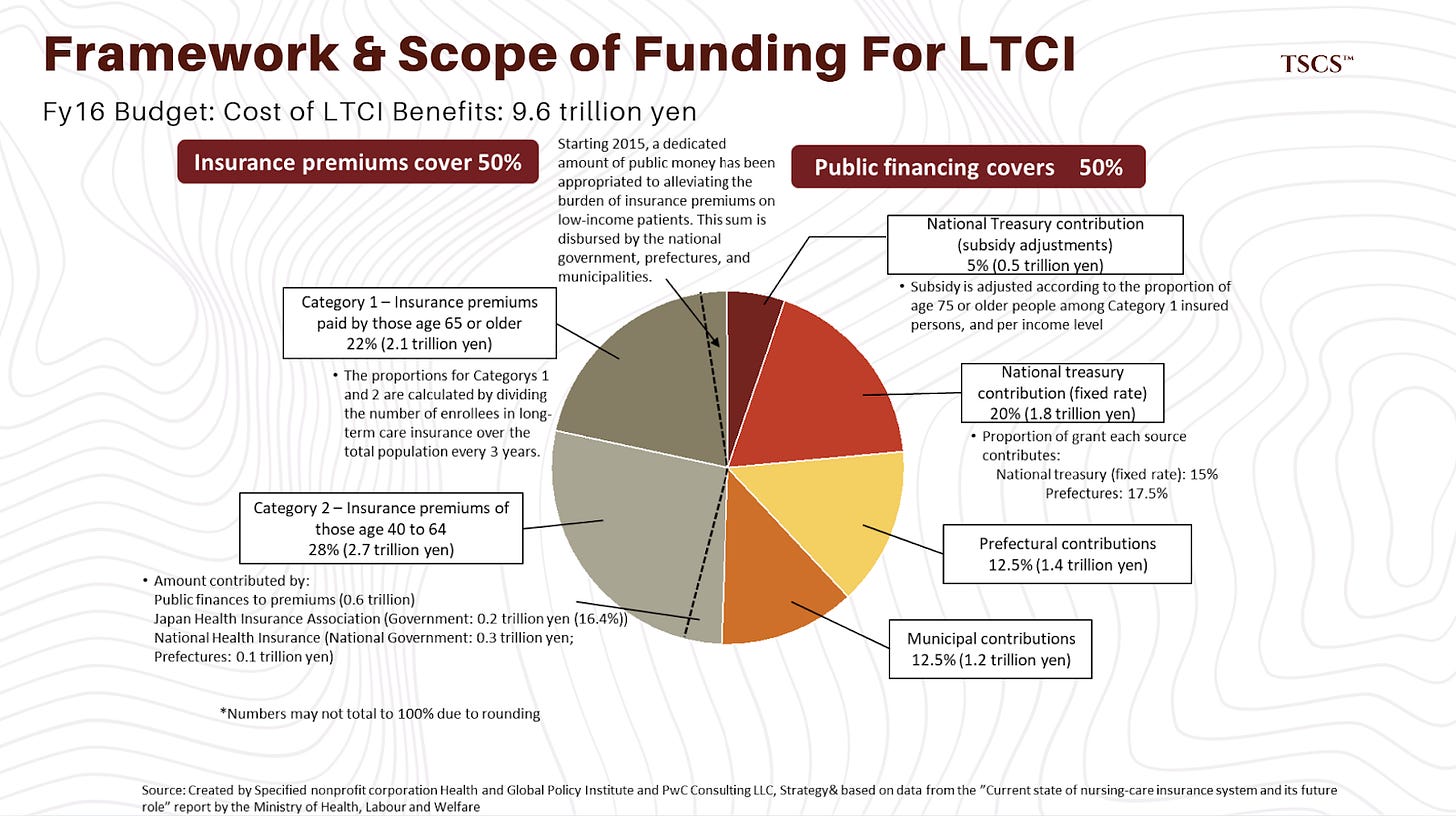

Japan historically relied on “Confucian ethics”, the idea that the eldest son’s wife would take care of the aging parents. That model collapsed. Women entered the workforce. Households shrank. The “Old Age Dependency Ratio” skyrocketed. The government had to intervene with the Long-Term Care Insurance (LTCI) system in 2000. They realized that leaving elder care to the “family” was economically disastrous because it pulled prime-age workers out of the labor force to care for grandma.

2. Social Hospitalization:

Before LTCI, Japan had a massive problem with “social hospitalization”. Elderly people were clogging up expensive acute-care hospital beds because they had nowhere else to go. It was fiscal insanity. The government had to build intermediate care facilities and incentivize private operators to build senior housing to offload these patients.

The US is seeing early signs of this. “Days away” from home for high-acuity care are rising. Hospitals are desperate to discharge elderly patients, but without adequate SNF (Skilled Nursing Facility) or AL (Assisted Living) beds, the system backs up.

3. The Lag is Real:

When you overlay the US old-age dependency ratio curve against Japan’s, shifting the US data back by roughly 15 years, the lines are nearly identical. We are walking the exact same path, just a decade and a half behind. This suggests that the US will inevitably face the same crises: a collapse of family care capacity, a spike in social hospitalization, and eventually, a forced federal intervention similar to LTCI, whether we like the politics of it or not.

4. The Robotics Mirage:

We love to think technology will save us. “Robots will wipe the asses!” Maybe. But Japan, the world leader in robotics, has struggled to make it work. Adoption rates for care robots are shockingly low. For toileting support devices, the adoption rate is a meager 0.5%. For monitoring and communication, it’s better at 30%, but that doesn’t solve the physical labor problem.

Why? Because humans prefer humans. And robots are expensive. Humanoid robots like “AIREC” cost $67,000 and aren’t practical yet. Tech is a tool, not a savior. The solution in Japan (and eventually in the US) will be human labor, likely imported. Japan is slowly cracking open its immigration doors for caregivers. The US will have to do the same, politics be damned, or the system will collapse.

Part V: Operator Warfare

The “Pure-Play” vs. The Diversified Mess

Not all Senior Housing REITs are created equal. In fact, most of them are managed by people I wouldn’t trust to run a lemonade stand. But a few have figured it out.

Welltower (WELL): The Predator

Welltower has gone “all-in.” They are shifting to a “pure-play rental housing platform for the silver economy”. They aren’t dabbling in medical office buildings (MOBs) as much anymore; they are selling those assets, disposing of $10 billion in assets YTD, to fund senior housing acquisitions.

Their strategy is aggressive and data-driven:

Alignment via RIDEA: They are moving away from Triple-Net (NNN) leases (where the operator pays rent regardless of performance) to RIDEA structures (Senior Housing Operating portfolios). In RIDEA, the REIT shares in the upside. When occupancy goes from 80% to 90% and rents rise 10%, Welltower gets that cash flow directly. This is why they are projecting such massive NOI growth.

Financial Fortress: They have a balance sheet that is the envy of the sector: 2.4x Net Debt/Adjusted EBITDA. This is absurdly low leverage for a REIT, giving them dry powder when everyone else is choking on debt service.

Smart Capital Deployment: Look at the HC-One deal in the UK. They realized a ~14% unlevered IRR on their senior mortgage and equity stake. They are buying portfolios like Barchester (284 communities) with underwritten returns in the low double-digits. They are acting like a private equity firm with a REIT tax structure.

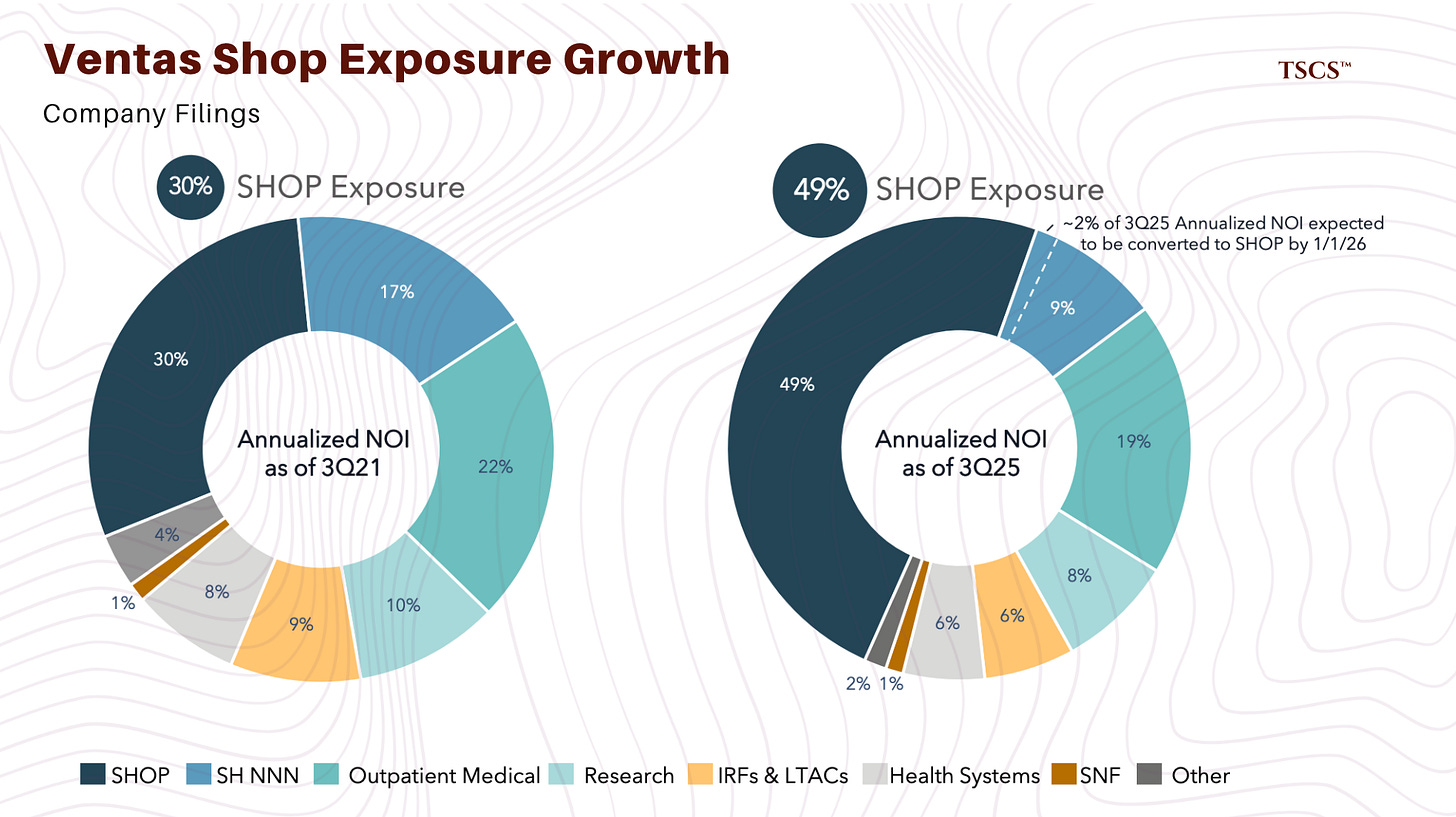

Ventas (VTR): The Fast Follower

Ventas is also pivoting hard to SHOP (Senior Housing Operating Portfolio) growth. The results are validating the strategy: in Q3 2025, they posted 15.9% year-over-year Same-Store Cash NOI growth in their SHOP segment. That is an insane growth number for a real estate asset class.

Their “Right Market, Right Asset, Right Operator” strategy is sound. They closed over $2 billion in investments in 2024, focusing on assets priced below replacement cost. While Welltower feels like the sharper spear tip with its data analytics platform, Ventas is proving that the rising tide lifts the well-positioned boats significantly.

The “Mom and Pop” Wipeout

The real story isn’t just about REITs winning; it’s about small operators losing. Running a senior living facility in 2025 is a regulatory nightmare. You need sophisticated HR to manage staffing mandates. You need tech for electronic health records (EHR). You need scale to buy food and supplies cheaply.

The standalone, single-site operator cannot compete. They are bleeding cash. Welltower and Ventas are circling these distressed assets like sharks. They will buy them, plug them into their operating platform (or hand them to a preferred operator like Brookdale or Oakmont), and instantly improve margins. This is the consolidation endgame.

Part VI: The Home Health Hedge

Is “Aging in Place” the Enemy?

Every time I pitch senior housing, someone asks: “But won’t everyone just stay home? Technology allows aging in place!”

Yes and no. It depends entirely on acuity.

The “Low Acuity” Trap:

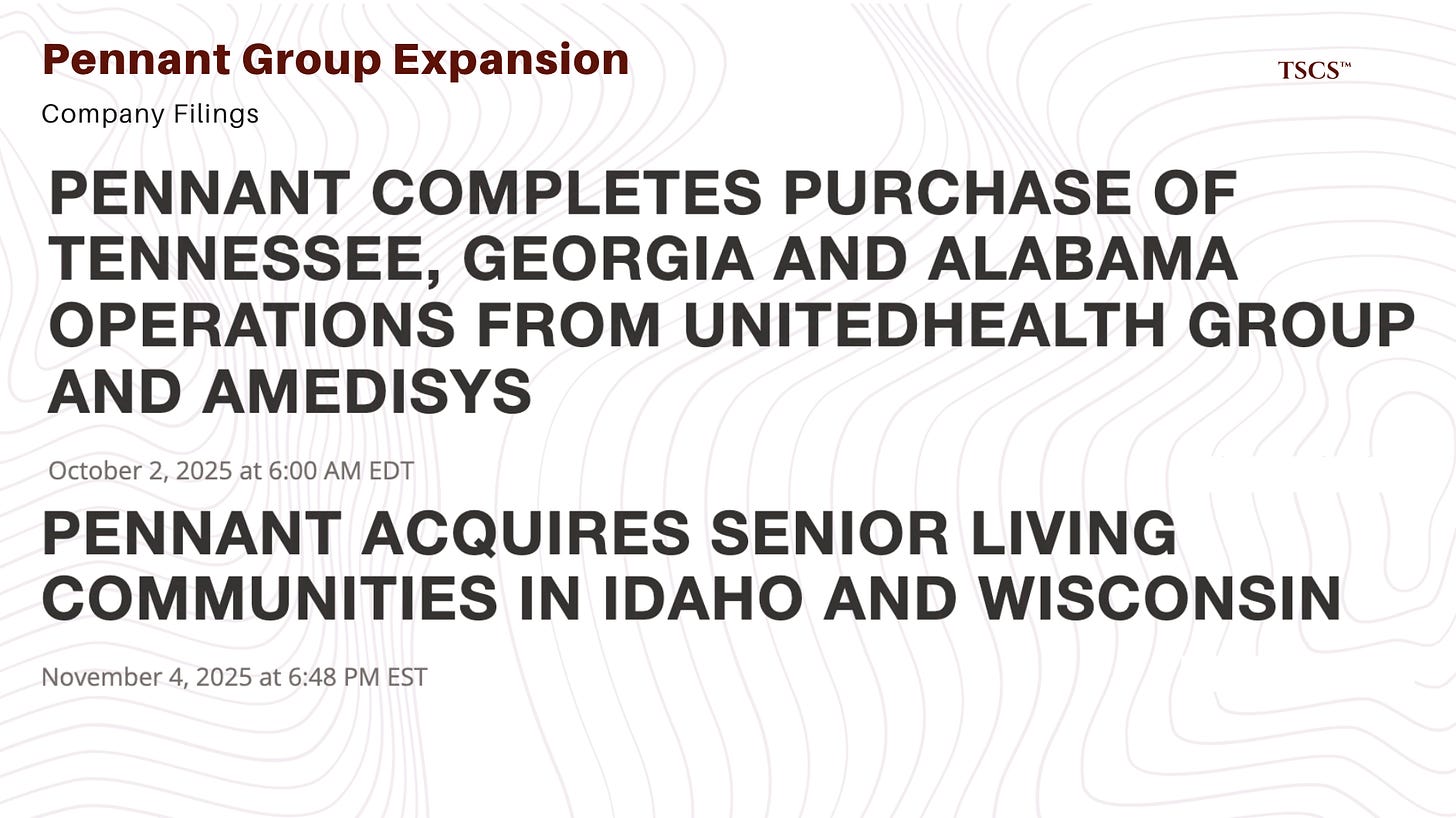

For a healthy 80-year-old, staying home is great. Companies like Pennant Group (PNTG) and Addus HomeCare (ADUS) are killing it in this space. They provide personal care, home health, and hospice. They are acquiring agencies left and right.

Pennant, in particular, has a fascinating model. They acquire small agencies and spin off local leaders, giving them autonomy, “local ownership”. It’s a decentralized model that scales well and aligns incentives. They recently dropped $146.5 million to acquire operations in Tennessee, Georgia, and Alabama. They are betting big on the Southeast.

The “High Acuity” Reality:

But home health has a hard economic ceiling. When dad has dementia, wanders out into the snow at 2 AM, and needs 24/7 supervision, home health becomes mathematically impossible for the middle class.

Consider the economics: 24/7 home care requires 3-4 full-time staff to cover all shifts. At a modest $30/hour (and good luck finding that rate for reliable care), that’s $720/day, or over $21,000/month.

Compare that to a high-end Memory Care facility. Even at a premium price of $8,000-$10,000/month, the facility is less than half the cost of 24/7 home care.

There is a mathematical tipping point where home care becomes too much. Home care scales linearly, you pay by the hour. Facility care is a step function, a flat monthly fee. Once a patient requires more than 8 to 10 hours of daily care, the cost of keeping them at home exceeds the cost of a luxury memory care unit. The economic gravity is undeniable.

So, home health isn’t an existential threat to high-acuity senior housing. It is a funnel. It keeps people home longer (increasing the “acuity creep”), but eventually, they must move to a facility. Pennant and Welltower aren’t enemies; they are servicing different stages of the same decline.

Part VII: The “Value-Add” Playbook

Converting the Ruins

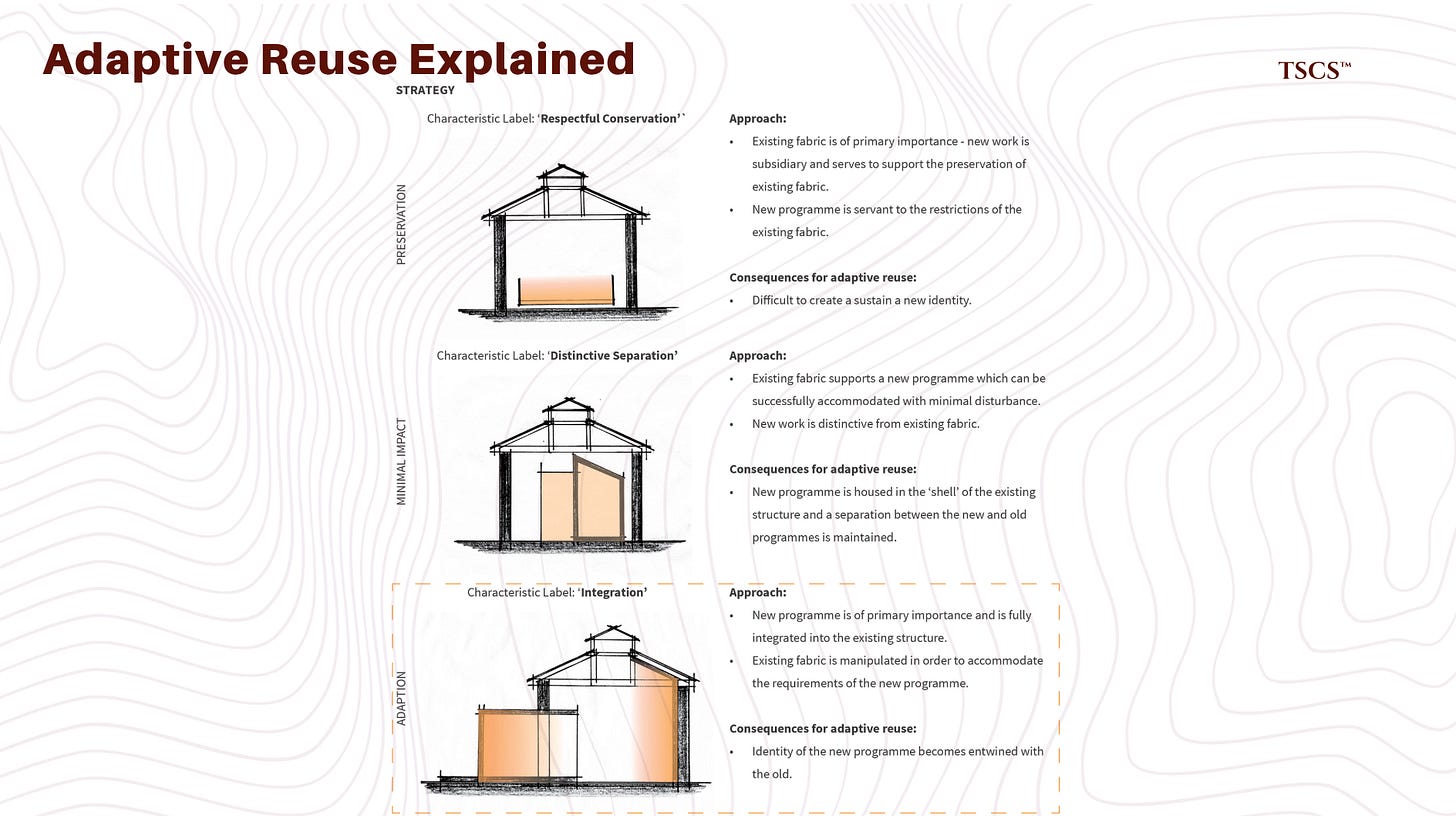

If you can’t build ground-up because costs are too high, how do you add supply? You scavenge. You find the assets that are dead in the water and repurpose them. The most interesting trend in 2024-2025 is Adaptive Reuse, specifically, hotel-to-senior living conversions.

The Logic:

Speed: You can convert a hotel in 12-18 months. Ground-up takes 3-5 years.

Basis: You can buy a failed extended-stay hotel for $100k-$150k/key.

Zoning: Hotels are often already zoned for commercial/residential use. The entitlement fight is easier.

Layout: Extended-stay hotels (Residence Inns, etc.) already have kitchenettes and wide doors. They are 80% of the way to being an Assisted Living unit.

The Examples:

The conversion of a Residence Inn in Long Island into “The Residences at Plainview.” The total cost was approximately $285,000 per unit. Compare that to the ground-up construction cost in Long Island, which would easily exceed $500,000 per unit. That spread is your profit margin.

Another example is The Watermark at Brooklyn Heights, a conversion of the historic Leverich Towers hotel. These projects are complex, but for an opportunistic investor (like Capitol Seniors Housing), it’s a way to bypass the construction cost nightmare and bring product to market now, while the shortage is acute.

However, it’s not a slam dunk. Hotels lack common spaces. You have to blow out walls to create dining halls. You have to upgrade HVAC for infection control. If you buy a crappy motel, you get a crappy senior living facility. Quality control is the risk here. But in a supply-constrained market, even “B” product will stay full.

Part VIII: The Labor Stranglehold

The Achilles Heel

You have likely noticed that this entire thesis (the demographics, the supply gap, the rent growth) has one massive, glaring weakness: Labor.

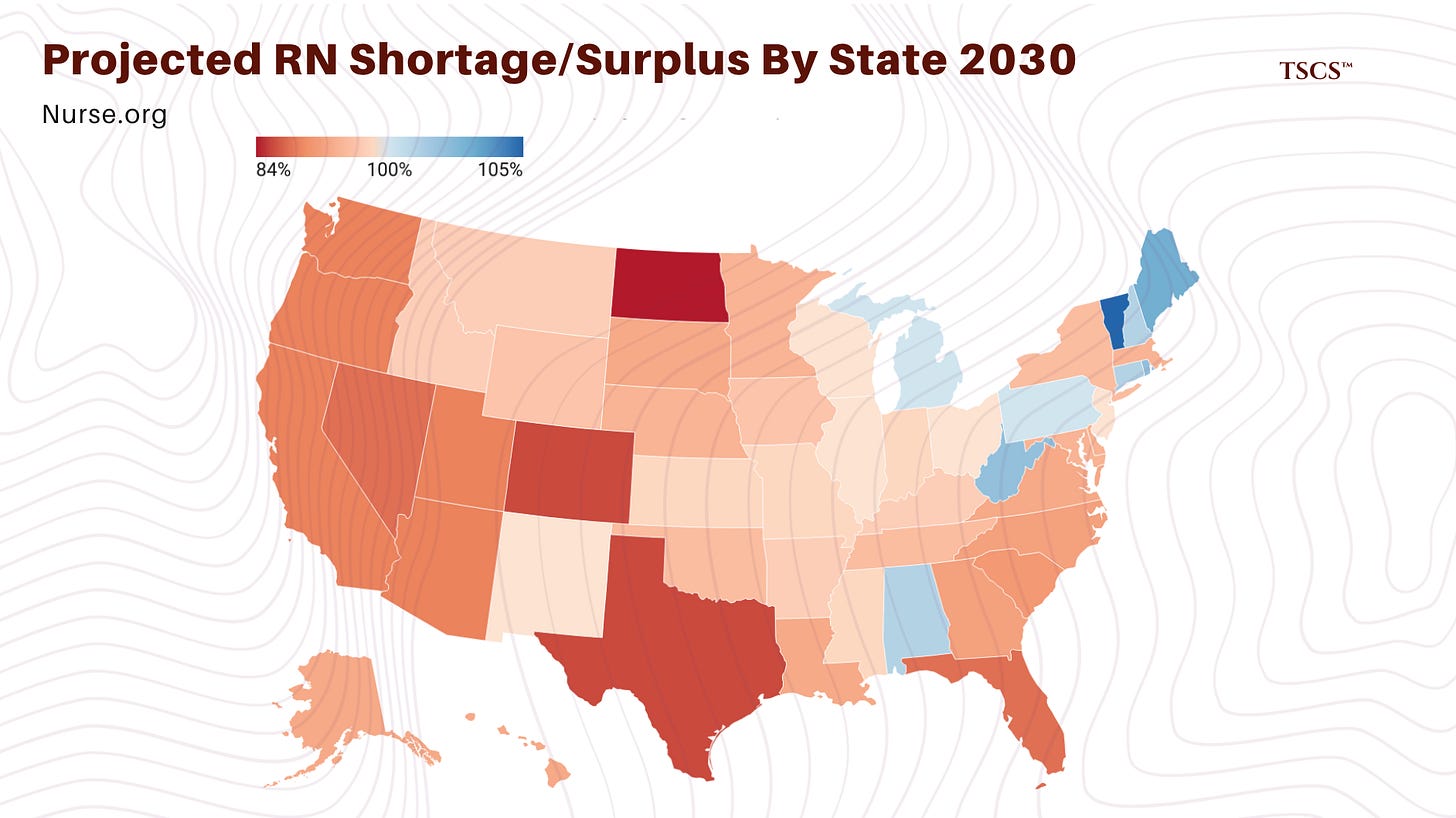

You can build the most beautiful building in the world, but if you don’t have nurses and aides, you can’t open the doors. The CMS staffing mandates are a sledgehammer hanging over the industry. 80% of nursing homes do not meet the 24/7 RN requirement. The industry needs to hire 102,000 new nurses and aides to comply.

Where are they coming from? The magic nurse tree? The labor market is tight, and healthcare wage inflation is structural.

The Cost of Compliance:

The estimated cost to the industry is $6.8 billion per year. This will crush margins for the thin-capitalized operators.

This brings us back to Scale.

Small Operator: Cannot afford to pay agency nurses $80/hour. They get fined. They get banned from new admissions. They go bust.

Large Operator (Welltower/Ventas): Has the balance sheet to absorb the wage hikes. Can invest in training schools. Can lobby for exemptions. Can use technology to optimize scheduling.

The labor crisis accelerates consolidation. It kills the weak and strengthens the strong. It sucks for the margins in the short term, but it clears the field in the long term.

Conclusion: The Asymmetric Bet

We are looking at a “Perfect Storm” in the positive sense for capital deployers who have the stomach for it.

Demand is Inelastic: You can’t delay aging. The 80+ cohort is coming, and they are sicker than ever.

Supply is Broken: The capital cycle has destroyed new inventory creation. The gap between demand and supply is widening every day.

Pricing Power is Returning: Occupancy is hitting 90%, and rents are rising above inflation.

Valuations are Attractive: REITs and private assets are trading below replacement cost.

The Play:

Look at the REITs: Welltower (WELL) is the blue-chip alpha predator. They have the best balance sheet and the most aggressive strategy. Ventas (VTR) is the value play, drafting off the same tailwinds.

Look at the Home Health Aggregators: Pennant (PNTG) is the best operator in the decentralized space, rolling up the fragmented home health market.

Avoid: Generic, ground-up development in tertiary markets. The construction risk is too high.

Watch: The “Hotel Conversion” space for niche opportunities to create supply at a low basis.

The “Great Gray Wave” is here. Most people see it as a societal crisis. The capital cycle analyst sees it as the most obvious wealth transfer opportunity of the decade. Don’t be on the wrong side of the wave.

Disclaimer: The information provided on this Substack is for general informational and educational purposes only, and should not be construed as investment advice. Nothing produced here should be considered a recommendation to buy or sell any particular security.

Banger start to the article and it only gets better.

Very strong piece.